Backed by JPMorgan Chase, Honeywell, Amgen, Mitsui & Co, Quantinuum is working both on quantum hardware and software — and is now one of the biggest players in the field.

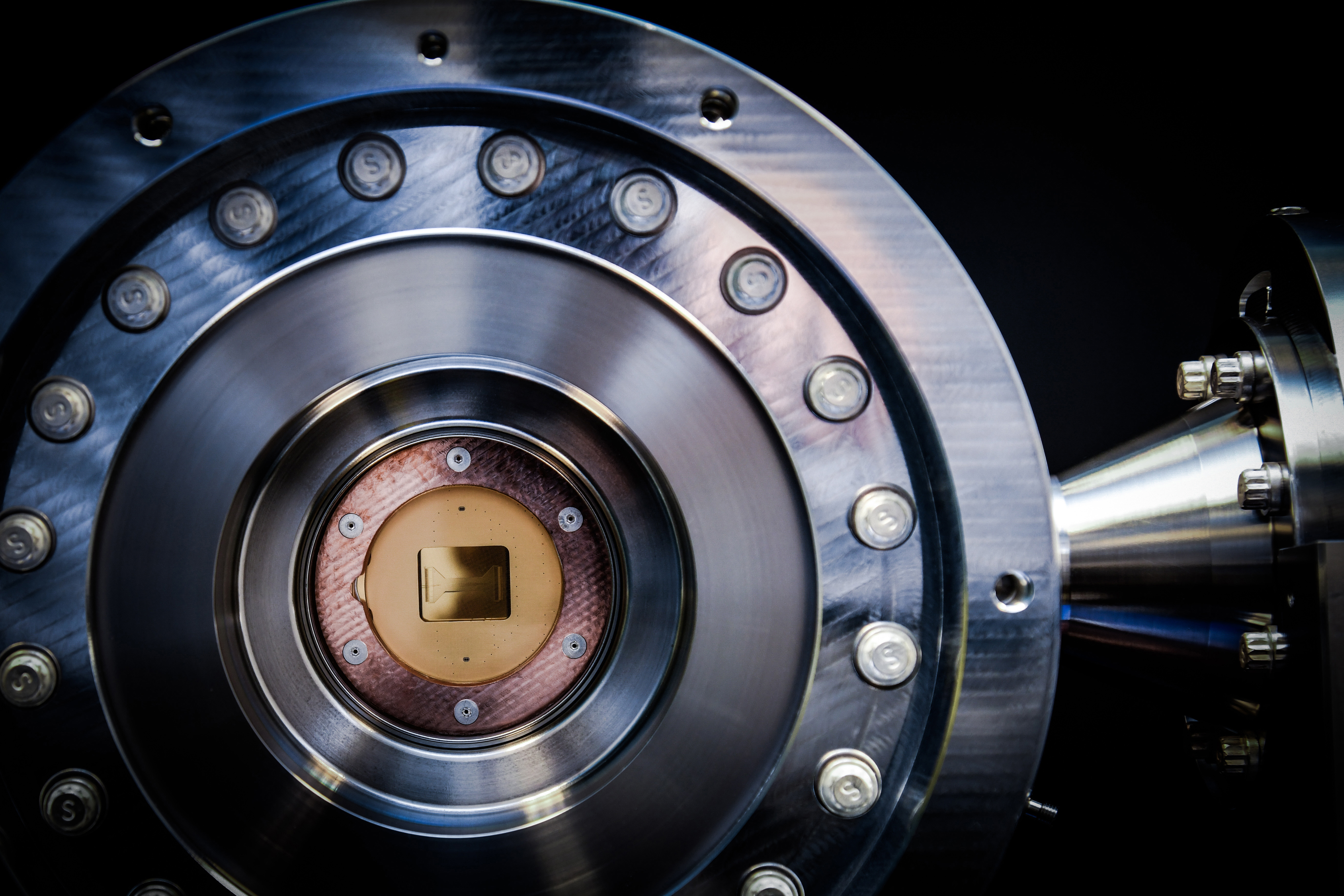

Close-up of Quantinuum’s trapped-ion quantum computer. Photo courtesy of Quantinuum.

Quantinuum raised $300m in funding this week in the latest sign that corporate investors are backing ever-larger rounds for quantum computing startups. The US-based quantum software and hardware company attracted a roster of big corporate backers including JPMorgan Chase, which anchored the round, and conglomerate Honeywell, biotech Amgen and diversified group Mitsui & Co.

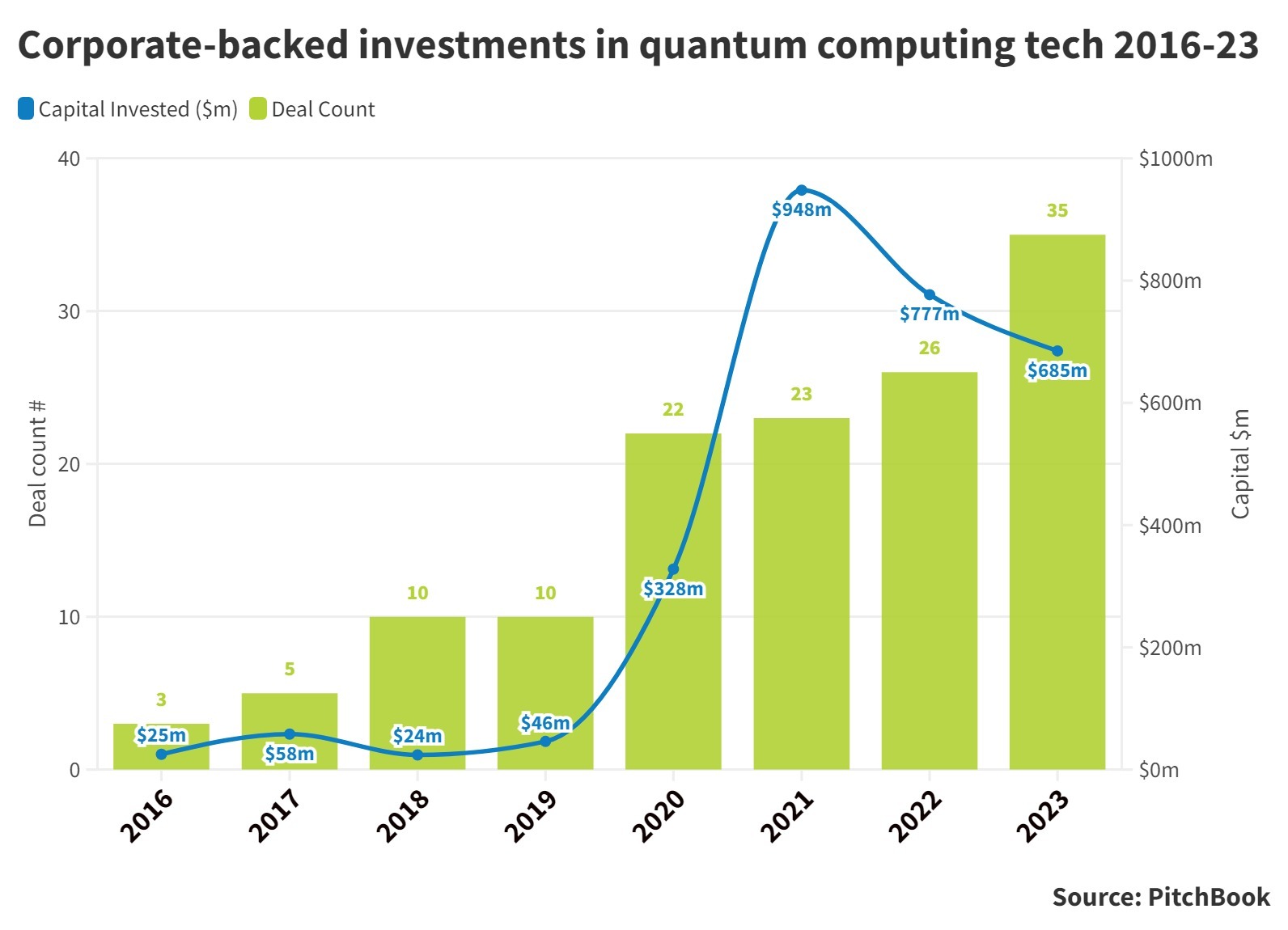

Corporate VCs have become more comfortable with big bets in quantum in recent years: they contributed to 35 deals in 2023 that amounted to $685m, according to Pitchbook, although that is down from a peak of $948m across 21 deals in 2021 when PsiQuantum was responsible for nearly half of the 2021 in a Microsoft-backed $450m series D.

Quantinuum needed to raise significant capital — most quantum computing developers fall into the software or hardware category but Quantinuum is trying to do both. The company has now nearly doubled its capital to $625m.

Quantum computing remains an incredibly tough nut to crack — although a growing number of university spinouts are trying to solve its myriad challenges — and Quantinuum hasn’t just amassed significant equity, it has also built a global workforce of nearly 500 staff, including more than 370 scientists and engineers, across the US (where it’s headquartered in the small city of Broomfield, Colorado), Europe (including its original home base in Cambridge) and Japan. Japan is fast building itself into a quantum leader, with UK university spinout Oxford Quantum Circuits also recently opening offices in the country.

Quantinuum has built a three-continent-spanning presence partly because it is the product of a merger between Honeywell Quantum Solutions and Cambridge Quantum Computing in 2021.

Honeywell Quantum Solutions was focused on hardware — specifically, a trapped-ion quantum computer — while Cambridge Quantum Computing was working on software (one of its key areas of focus was cybersecurity). Honeywell injected $270m into Quantinuum at the time of the merger in the form of a convertible note, and owned a majority stake of 54% (it’s not provided an updated figure, but said in the latest announcement it “remains the company’s majority shareholder”).

Quantinuum’s investors also include IBM Ventures, the corporate venturing arm of IBM which itself is a key player in quantum computing and which invested an undisclosed amount in 2022 as part of a strategic partnership agreement.

JPMorgan Chase, too, has an ongoing partnership with Quantinuum that actually predates the merger: the bank was one of the first experimental users of Quantinuum’s processor technology, called H-series, and today also uses Quantinuum’s software development kit, TKET. This makes sense: quantum computing poses a serious threat to cybersecurity and industries like financial services because it could easily break current encryption standards. A key reason that encryption works is that it would take classic computers — even supercomputers — potentially billions of years to break keys using brute force, while a quantum computer could, in theory, drastically reduce that to a timeframe worth exploiting for a hostile actor.

On the software side, Quantinuum’s offering includes Quantum Origin — quantum computing-hardened encryption keys that are expected to offer protection from quantum computers breaking classic encryption. Users range from defence and transport company Thales to virtual private network operator PureVPN.

Quantinuum has also developed a quantum computational chemistry platform called Inquanto — targeting pharmaceutical firms, automotive companies and battery materials developers. Quantinuum is even getting in on the AI action: its Lambeq software library focuses on quantum natural language processing — in simple terms, it allows a user to write a sentence to generate a quantum circuit — and the company expects this to become increasingly important as AI platforms scale.

Crucially, the software is hardware agnostic: you don’t have to use Quantinuum’s H-series processors (TKET and Lambeq can even be installed for free by anyone so inclined). And in turn, the processors can run software from other quantum computing companies. All of this might seem an unusual decision in our age of walled gardens and vendor lock-ins (just think how Apple doesn’t let you run macOS on a third-party computer or refuses to make iMessage for Android phones), but it is an ingenious move. Microsoft became the dominant player on PCs by letting any manufacturer install the operating system and Android became the dominant mobile phone platform by being open source.

Whether the gamble will pay off for Quantinuum remains to be seen — the company is racing others to build the first universal fault-tolerant quantum computer (while potentially powerful, quantum computers are also highly prone to errors and that’s a problem nobody has solved yet). But this latest funding round sets the business up with the capital and human resources to make it one of the biggest players in the field.

Rajeeb Hazra, who became chief executive of Quantinuum a year ago, is optimistic following the $300m investment: “The confidence in our business demonstrated through this investment by our longstanding strategic partners and industry leaders is a clear indication of the value we will continue to create with the world’s highest performing quantum computers, groundbreaking middleware to accelerate the developer ecosystem and innovative application software to revolutionise fields like cryptography, computational chemistry and AI.”

Thierry Heles

Thierry Heles is editor-at-large of Global University Venturing and Global Corporate Venturing, and host of the Beyond the Breakthrough podcast.