Venture capital has poured into the cleantech sector over the past couple of years. Concerns are growing that startups may not be able to scale into viable companies that generate expected returns.

Pradeep Tagare remembers the last cleantech boom and bust cycle when venture capital piled into the sector in the heady investment years between 2006 and 2009. The bubble burst in the years immediately afterwards, as recession dried up follow-on investment and renewables struggled to compete with falling oil and gas prices.

The head of corporate venture investing at National Grid Partners, the venture arm of the UK-based utility, is worried the industry could be heading into a similar boom and bust cycle. The past two years have seen what some argue is an oversupply of capital coming into the sector. The question now is whether the industry can generate returns from all that capital.

“There is real capital that has been deployed into projects that are viable; but, at the same time, these startups have to evolve into viable companies. In some areas, most of these projects are at pilot stage. Can they scale to really solve the problem? That is the trillion-dollar question,” says Tagare.

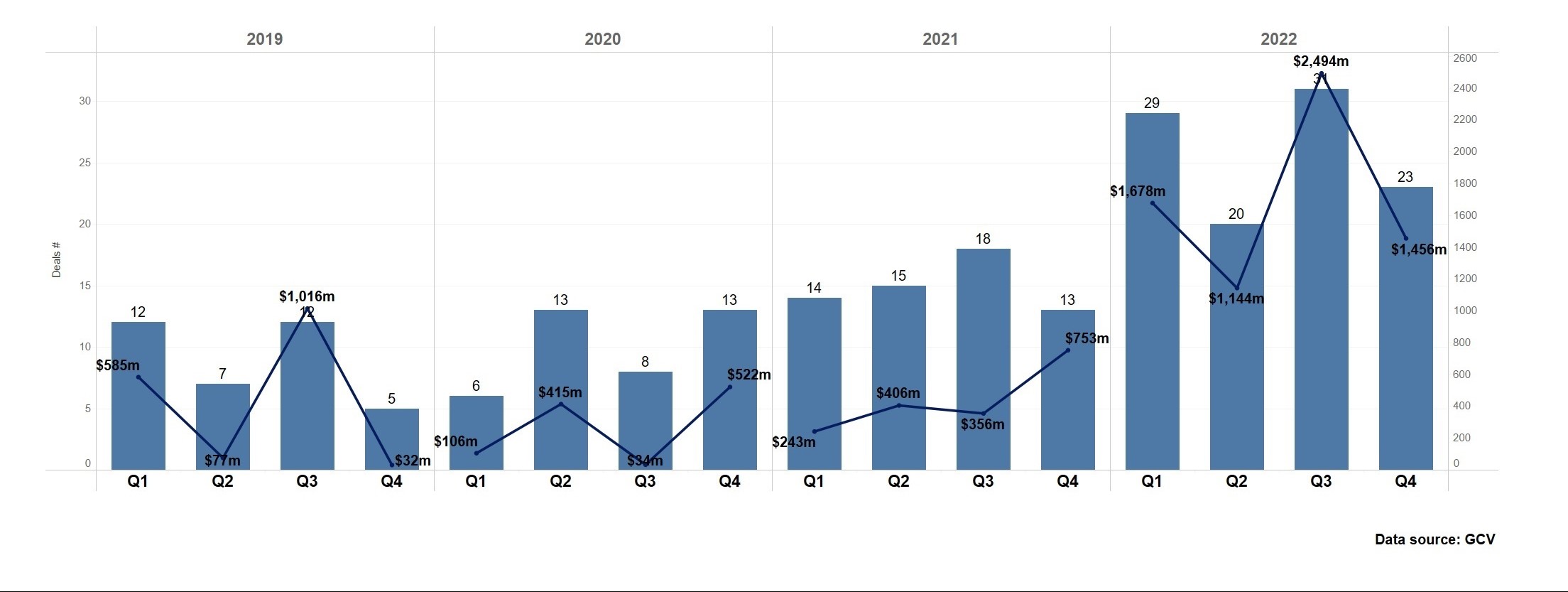

Cleantech has had a good year. Together with gaming it has outperformed other sectors for receiving corporate funding in the second half of 2022. But climate technologies require a lot of investment and time to reach commercial scale, much longer than the three to five years that venture capitalists expect from software startups.

It was impatience and lack of long-term vision that burned startups in the last cleantech boom and bust cycle. Investors didn’t keep investing in projects that take years to come to fruition.

Stiff competition for deals

An influx of new financial investors and impact funds has driven up the valuations of cleantech companies over the past two to three years, making it harder for corporate investors to participate in deals.

“All of these are high capex items,” says Aruna Subramanian, managing director, SABIC Ventures, the corporate venture arm of the Saudi chemical manufacturer. “They have long development cycles. We will spend four years and tens of millions building pilot plants without generating any value. They will take a long time and you don’t know if they will be successful or not.”

Now fears of a global economic downturn are growing, with parts of Europe already technically in a recession. As interest rates rise, growth equity capital which is needed to fund large clean energy infrastructure is expected to dissipate, leading to the delay of projects.

An upside is that valuations of tech companies have come down, making it a good time to invest. Roee Furman, managing director of Doral Energy-Tech Ventures, the corporate venture arm of the Israeli renewable energy company, says it is “great timing” for investments, but he does worry about the funding of clean energy projects that will require long-term investment.

“What might get tricky are capital-intensive deeptech businesses that will need greater support from growth equity funds. When they need growth equity capital, they will not necessarily have numbers to show yet,” says Furman.

War in Ukraine changes everything

What will keep attracting investment to the cleantech sector in the coming year is the energy crisis resulting from Russia’s invasion of Ukraine. European policymakers have taken steps to accelerate investments in renewables and carbon-free energy sources, so that Europe becomes less dependent on Russian imports of fossil fuels. Carbon reduction goals have also spurred innovation.

“Decarbonisation as a theme got real in 2022,” says Tagare. “We were pleasantly surprised the industry focused on decarbonisation. For a lot of net zero plans that were announced four to five years ago the question was: is anyone going to act on them. We were surprised that there were a number of technologies that not only got funded but started doing pilot projects.”

Decarbonisation as a theme got real in 2022

Pradeep Tagare, head of corporate investing, National Grid Partners

This focus on decarbonisation is likely to continue in 2023, particularly given the large amount of government support for clean energy. The US passed its largest ever climate bill, the Inflation Reduction Act (IRA), in August 2022. The legislation provides $369bn in green subsidies and grants for climate and clean energy tech.

“We are excited about the IRA and the dollars it will pump into the ecosystem,” says Tagare. “It will lead to a lot of innovation in energy storage. We will see a lot of investments in utility-scale storage and cheaper storage.”

Cleantech sectors that are expected to receive continued investment in 2023 include:

Hydrogen

The popularity of hydrogen investments in 2022 is expected to continue and even ramp up this year. Johann Boukhors, managing director of Engie Ventures, the venture subsidiary of the French utility, says his unit will continue to invest more in green hydrogen as well as biogas and biomethane in 2023. “A new value chain [for green hydrogen] is being set up that didn’t even exist until two years ago,” says Boukhors.

Tagare says building a hydrogen economy is a “multi-decade investment opportunity given the sheer size of what is required.” Innovations in hydrogen production, transportation and its end use are required.

As a natural gas utility, National Grid Partners is interested in using hydrogen to reduce the carbon impact of its gas network. One approach is mixing hydrogen with natural gas, so that it can flow through pipelines. Another approach is generating hydrogen at the point of consumption. “We look at companies that enable large-scale production of hydrogen at cost parity,” says Tagare.

Long-duration energy storage

As more renewable energy is brought onto the electricity grid, storage systems that can help balance their intermittency are increasingly vital. Investors are looking at innovations in energy storage that have a range of up to 16 hours. This would allow for a grid that could potentially rely 24/7 on renewable energy.

Lithium-ion is most commonly used for storing renewable energy, but a global shortage and the negative environmental impact of mining the material means startups are working on alternatives. Sodium-ion and iron-air batteries are two technologies that are likely to receive investment this year.

Virtual power plants

With increasing amounts of renewable energy coming onto the electricity system, it is becoming increasingly complex to integrate all of these decentralised sources of energy. Machine-learning modules are being developed that automatically figure out when to turn renewable sources on and off. The AI systems can learn over time which resources can be optimised and when the grid needs to dip into the virtual power plant.

National Grid Partners sees virtual power plants as a continued source of investment in 2023. “A virtual power plant can reach out to all these renewable resources in real time. This is an example of decentralisation and digitisation where digitisation is really required for decentralisation to work,” says Tagare.