December issue editorial by James Mawson, editor in chief, Global Corporate Venturing

It feels a privileged position to read the insights of some of the smartest investors about the technologies and trends that shaped their deals this year.

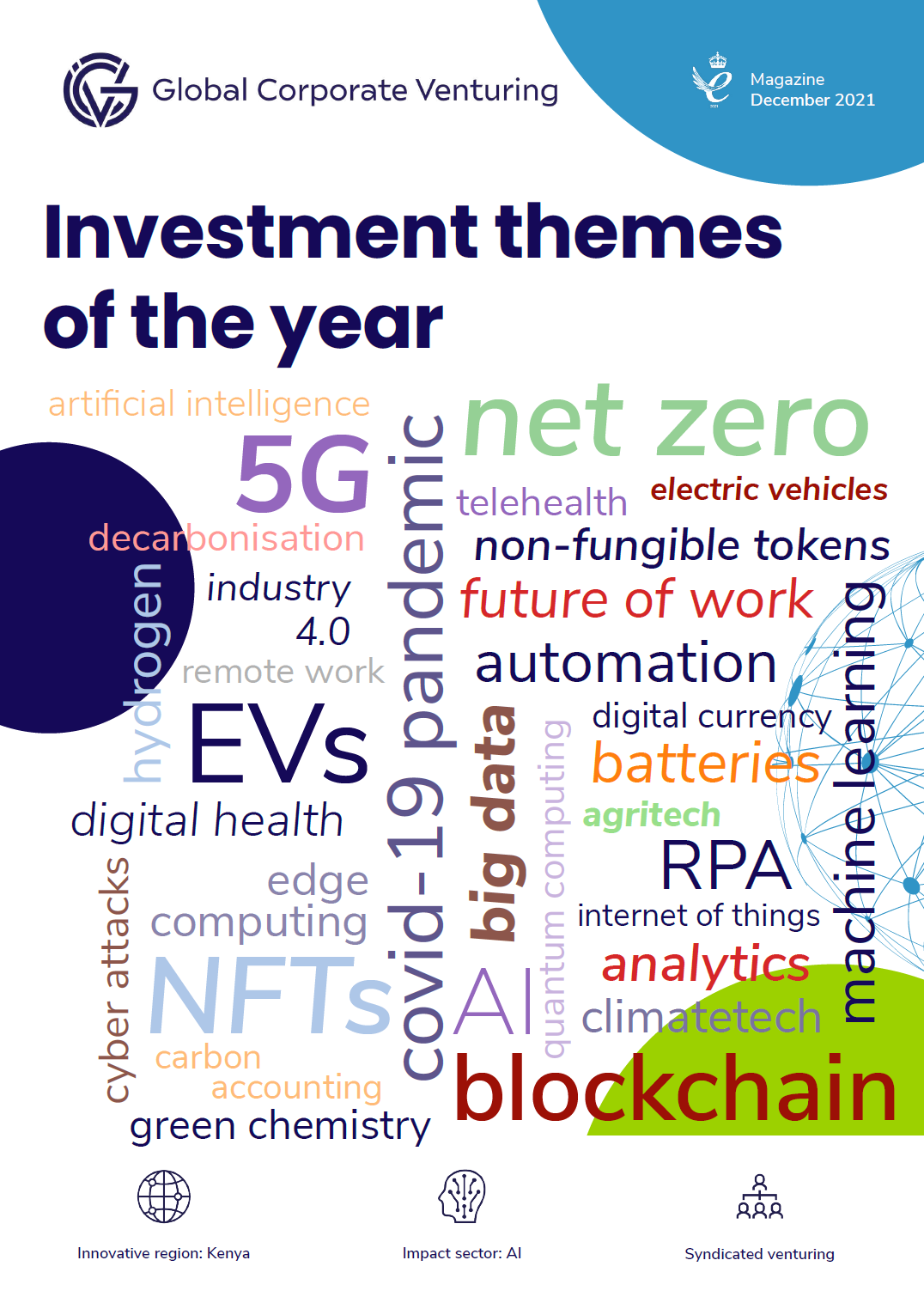

The annual survey for the World of Corporate Venturing report to be published in February at the GCVI Summit is a snapshot in time. The extract of insights published here reflects a diversity of focus areas and interest from 2021’s tech areas that is impressive. Crossovers from between sectors and technologies will create unexpected disruption.

The insights, however, reflect the longer-term trends of disruption and digitalisation forming over many decades.

Artificial intelligence as an idea using computer chips has been around for decades but the leap to deep learning on neural computer networks a decade ago and then transformers on pre-trained, large data sets five years ago has opened up the scale and power to tackle creative tasks, such as plausible-looking text and speech.

The same is true in energy. Decades of research into nuclear fusion seemed to lead nowhere. Now, startups, such as Helion Energy, General Fusion, Tokamak, Commonwealth Fusion and TAE, are raising hundreds of millions of dollars on the hope they can deliver net electricity production, while there is renewed attention on smaller fission reactors.

In communication, the promise and power of 5G has opened up the internet of things and edge computing decades after the first generation of mobile phones were used by Wall Street traders.

The internet is also morphing into web3 for a more decentralised control of information and combine with virtual and augmented reality, blockchain, non-fungible tokens and cryptocurrencies to offer new ways to network, invest and finance innovation.

The power of technology and innovation is reshaping our world, both inside and out. In healthcare, from messenger RNA’s first experiments in the late 1980s to development of vaccines targeting the covid-19 virus has been both decades and days in the making.

Green chemistry, synthetic biology, quantum computing are fruits from centuries of research into the fundamental sciences. The researchers are revealing their mysteries and entrepreneurs are turning the breakthroughs into businesses corporations can buy, partner and learn from. Everywhere and everything is undergoing change but certain memes are recurring.

The world’s attention this year has seemed increasingly on the implications of a pandemic and climate change. CEOs, governments and society are looking at innovation as a strategic necessity, which is good. Global Corporate Venturing has through the pandemic set up and run the global sector councils to help these CVCs look across the value chains for the important issues and by cross-pollinating the ideas create new opportunities.

The best-run, financed and supported corporate venturing units will have the greatest opportunity to seize and use the tech and ideas. The GCV Institute was set up for these CVCs’ professional development and their parent companies for success. Forming out of nearly a decade’s research through in-real life academies, the GCV Institute also builds on decades of applied insights from the Bell Mason Group (BMG) consultancy run by Heidi Mason and Liz Arrington (who were both also co-authors with me on the book Corporate Venturing: A Survival Guide).

I am, therefore, delighted to welcome Liz as the new head of the GCV Institute after the past year’s scaling up and development for hundreds of corporate venturers and their business unit and C-suite executives. Increasingly, the institute enables CVCs to benchmark themselves to peers and help the alumni share a common language and network to syndicate ideas and deals using the GCV Connect powered by Proseeder platform.

The industry is facing renewed competition for the best and most disruptive ideas and enhanced professional development to maximise its advantages and minimise obvious flaws will help all in the innovation capital ecosystem.

This year is ending on a high in this regard despite the obvious health concerns from the ongoing pandemic and other issues of inequality thrown up by the widening gulf between those who can use or benefit from the innovations and those who are unable to access their fruits.

Next month’s outlook issue will look at how any technology, however good its potential, relies on the intentions and abilities of those wielding it and how societies attempt to control them.