Kaloyan Andonov spoke with Tianyi (Tony) Sun, director of corporate venture capital at GC International, about the experience of the relatively young CVC arm of Thailand-based PTT Global Chemical Public Company (PTT GC or GC), its alignment with the strategy of its corporate parent and what it can offer to entrepreneurs it backs

Kaloyan Andonov: First and foremost, please tell us a bit about your corporate parent. GC is a chemical company from Thailand with a global footprint but please tell us also what stirred in its interest in corporate venture capital?

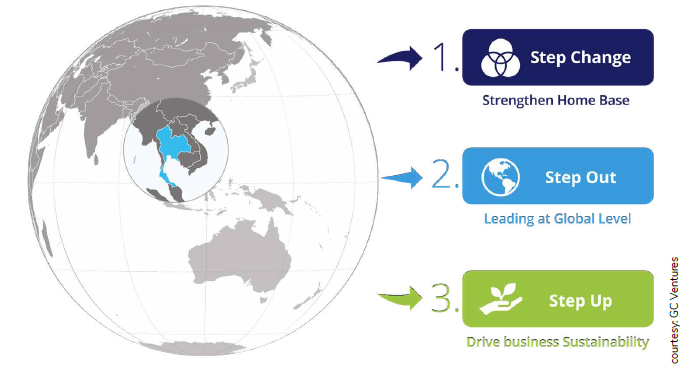

Tianyi (Tony) Sun: PTTGC is a chemical company with $15bn assets and headquarters in Thailand. While it is traditionally a petrochemical company, GC has gradually built portfolio in sustainability like bio-based chemical and has been ranked as world’s number one in Chemical industry by Dow Jones Sustainability Index three years in a row. GC’s interest in CVC goes back to almost 10 years ago. At the time, GC realised the importance of diversifying its businesses, and thus started to execute a multiple-year three-step strategy with emphasis on high value products and sustainability:

- “Step change”, which involves growing and strengthening GC’s core operation and our business in Thailand through partnerships.

- “Step out”, involving international expansion through project development, M&A initiatives, and new collaboration opportunities.

- “Step up”, which is the integration of sustainability into our core business.

In this context, the CVC unit is a key component in the “Step out” strategy. The team was assembled in 2017 and started to actively make investments in 2018. We are tasked to interface with emerging technologies globally and have the mandate to explore ways to engage with opportunities that can bring in new capabilities (technology, market access and business model) to the corporate mothership.

KA: What is GC Ventures’ investment mandate and how is the CVC programme is structured? Do you invest from the corporate balance sheet or outside of it?

TS: We are investing from the corporate balance sheet and we report to the organisation that drives the international expansion of PTTGC. We have four focus areas – advanced materials, biotech and life science, cleantech and industrial digital. Our entry point is typically a series A or series B round. In most cases, we work with companies that are already generating revenue and looking to scale up and develop the next-gen products. We always co-invest with financial VCs and other CVCs to form investment syndicate and support the portfolio companies in the long run. For now, our strategy is to do minority shareholding where we typically request just an observer seat.

KA: How do the four major areas of interest (digital, cleantech, advanced materials and bio and life sciences) align with the overall strategy of the corporate mothership?

TS: We are a strategic VC, and thus we make investment decisions based on both the potential of financial return and potential of strategic synergy. GC has different business units internally that work in all those different functions. The CVC team holds regular brainstorming sessions with them. Based on the need and timeline of business units, we try to narrow down high-level investment mandates into a few specific areas as high priority in the coming year, and we use this to drive our investments and look for specific deals. So, it is a very aligned approach.

KA: What is it that GC Ventures can offer to its portfolio companies that other investors may not be able to? How do you onboard startups and connect them with your business units?

TS: PTT GC is not just one company – it is part of PTT Group, which is the national oil and gas company of Thailand. Within PTT Group, GC has many sister companies so there are a lot of potential resources we can bring to the portfolio. With that in mind, I would say there are three key things we can offer. First, we can provide access to a very diversified group of businesses, ranging from oil and gas through chemical manufacturing, to power and utilities, and to retail and food services. Second, we are a reputable partner to access the Southeast Asia markets with, where the growing population and booming manufacturing sector drive the economy. Third, GC has an extensive range of subsidiaries and a network in both petro-based and bio-based chemicals. These three things can help portfolio companies build up and grow their businesses. For example, the distribution company within our group is actively helping one of our portfolio companies identify customers in Southeast Asia. Before each investment, the CVC team works with business units and the potential portfolio company to brainstorm possible collaboration models. After the investment, as part of our portfolio management, the CVC team continues to serve as the interface between business units and the portfolio companies to make sure that the right expectation is set and a proper collaboration programme can be put in place.

KA: Particularly, in terms of the supply chain issues that are of concern at the moment with the reopening of the global economy. Have there been cases where you have leveraged the supply chain of the mothership to help a startup?

TS: Yes, we are actually in the process of speaking to all portfolio companies trying to understand what kind of challenges they are facing in terms of supply chain and if there is anything we can help with. One portfolio company was looking for local manufacturing resources here in the US to meet their customers requirement of local production, while another was trying to find local feedstock to avoid overseas shipment uncertainty and increasing costs. Our team has been able to build a relationship between them and one of GC’s subsidiaries here in the US, which has access to some of the resources these startups need. The problems have not been fully resolved yet, but that is the kind of help and connection we can provide.

KA: Your investment mandate is broad, geographically speaking, with Thailand and the US being the most strategically important locations. How has that unfolded so far?

TS: In the CVC world, we are still relatively new. Part of our strategy involves investing in funds first to increase our geographic coverage, and once we are comfortable enough, we start to make direct investments. Like you said, we have two teams – I am based in Boston responsible for our activities in North America, and I have my counterpart in Bangkok, overseeing investment activities in Asia and Europe. We started out in North America first and then decided to expand. In North America, we have invested in two funds and six startups. However, as we were in the process of making investments in funds across other geographies, the covid-19 pandemic hit. So, like for almost everyone else, that imposed some limitations on how our team could operate. Our pace indeed slowed down a little bit in 2020, but quickly ramped up back in 2021. For areas outside North America, we have managed to invest in one fund in Europe and one fund in China. Now, as the global economy continues to reopen and we have better understanding of the situation, both teams will continue to execute our strategies more actively in the coming years.

KA: You have invested indirectly in regions like Europe, Canada and China by taking LP stakes in funds like Pangea, Emerald Ventures and the SinoGreen Fund? What has your experience as an LP been like so far?

TS: Our experience working with those funds has been great. It is a true partnership. As we are a strategic CVC, we invest in funds not just because we want the financial returns but also we want to build relationship with them, get into the ecosystem and access the knowledge and know-how they have. To use myself as an example, my background is in material science. I had spent a few years at a consulting firm helping CVCs with market research and tech scouting but I am still rather “green” when it comes to making investments. When we invested in Pangaea Ventures, Pangaea kindly offered to take secondees from GC along with them. I was one of the secondees sent there and got the opportunity to sit with their GPs for two months to learn how deals are done and how to think like a VC. I then brought the knowledge back inhouse so that the entire team can learn from this. Since then, I have been having regular conversations with those seasoned VCs to bounce ideas, refine our investment thesis and seek their advice. Aside from knowledge transfer, other key strategic benefits of working with those funds include access to highly relevant high-quality dealflow and expanding network.

KA: Venture capital is a business that is about people. How many people are there in your team and what is their background?

TS: For the core investment team, we currently have four people in US and three in Thailand. We all share the common passion in working with innovative entrepreneurs. In terms of experience, I think all of our background is a mixture of technology and business – some are trained as technologists and exposed to business through consulting, while others have business or finance background but gained industry and technology knowledge over the years, for example, through experience at GC.

KA: What are the ideal characteristics of a startup that you seek to find in order to invest in it?

TS: Like I said earlier, we are strategic VC, and we make investment decisions based on both the potential for financial return and the potential of strategic synergy. On the potential for financial return, I think it boils down to three points. The first is that the startup needs to follow the global megatrends and have a large addressable market. The second is that its technology can demonstrate good product-market fit. The third is that it must have a good team that can execute. On the potential for strategic synergy, we typically look at how close the startup’s offering is to our business unit’s immediate needs and how the startup’s technology, market, or business model can complement GC’s portfolio in the long run. In practice, when we come across an opportunity, we work with other VCs and CVCs to validate our investment thesis on the financial potential together, and work with business units to define strategic value.

KA: In terms of the mix of skills or attitudes you look to find in founders and leaders of startups, what is the blend that you seek?

TS: We have seen successful entrepreneurs with all kinds of background. I think the common thing about them is that they can keep the fine balance between two things – dedication to the ideas they have and the openness to feedback. They must know what they want to do and be very focused on it but, at the same time, they must also know how to listen and receive feedback, so that other people can really help them grow.

KA: You mentioned that, aside from a trusted financial VC to lead a deal, you also look for deals where other corporates take part. What has your experience been co-investing with other corporates?

TS: For almost all investments we have done so far, there have always been other corporate co-investors in the syndicates. We prefer to have other strategic VC investors like us joining the syndicate from different parts of the supply chain, so that each of us can help the company in their own way. Within the chemical sector, I think CVCs are generally very collaborative because we all benefit by sharing the risk and helping the portfolio companies grow. I have not seen much rivalry, even with corporate venturing arms of companies that would be considered competitors. One example I can give is one of our portfolio company Actnano, which just closed its series B round recently. Actnano develops an innovative protective coating technology for electric components with focus on automotive applications. Among its investors, you can find two financial VCs and six CVCs and all of them are very pleasant to work with. Another example is ESS, which develops a low-cost technology for long-duration energy storage and was recently listed on the New York Stock Exchange. You can also see world’s leading energy and chemical companies in the syndicate supporting the companies together.

KA: How would you describe the overall investment experience of GC Ventures?

TS: Overall, our experience has been very positive. From the CVC team perspective, we are growing the portfolio companies, learning as a team and some companies start to show the potential of demonstrating good financial returns and strategic synergy. From the corporate perspective, the mothership recognises that CVC is a critical function, sees it as a key tool towards innovation and continues to support its activities. From an ecosystem perspective, people start to recognise our people and our names, entrepreneurs start to come to us seeking help for challenges they are facing and we are seeing increasing inbound deals and referrals. I think all of these are very good signals that we are on the right track. I do not want to pretend that everything is perfect. Running a CVC team like ours is just like running a startup. There have been hiccups and there is a lot out there that we do not even know. We are also experiencing some of the growing pains like most CVCs out there. But if we put together what we achieved so far and learned so far in the past four to five years on the personal level, on the team level, and on the corporate level, I think it has been absolutely worth the time and effort.

KA: Finally, I wanted to ask about your view on the Thailand startup ecosystem?

TS: If you take a broader view of Southeast Asia, the economies there are booming along with their populations. There is a lot of innovation in consumer-facing technology and there have been notable deals and exits from there. But if you look at the energy and chemical sector that we operate in, except for Singapore, the innovation density is probably not as high in the region as it is in North America or Europe. This is exactly the reason why CVC arms like us are critical to explore and incubate in GC’s homebase. That said, we have been seeing very positive moves in favour of chemical and energy innovation in the area because promoting innovation in deep tech has been brought forward on many Southeast Asian governments’ agenda in recent years. The private sector is also participating in it. We are seeing increasingly more incentives and programmes from the public and private sector to attract and keep young talent, to bring or develop technology and grow it over there.

Two questions for senior management

We also managed to talk to Andy Ting, head of strategic planning and portfolio management, to whom Sun and the rest of the GC Ventures team report. We found that GC America boasts strong support from senior executives who understand not only the role of the venturing unit within the context of an overall corporate strategy but also the risk and opportunities of venture investing in general.

KA: In your view, what is the strategic value that GC Ventures brings to the business group?

Andy Ting: Corporate venture investment is a key enabler of GC’s Step Out strategy. GC has established a clear target to increase the share of specialty chemicals in its business portfolio. As the share of specialty chemicals business increases, the number of relevant adjacent markets, applications, and technologies also expand. Instead of trying to do all the R&D and application development internally, it is much more efficient to tap into the intelligence and entrepreneurial spirit of the startup ecosystem. Through this network, GC is able to access emerging technologies that could be relevant to its business. At the same time, GC could help select startups in their technology commercialisation efforts through collaboration programmes which is a win-win situation. Collaborating with startups and deploying promising technologies also will be one of the parallel means for GC to pursue its sustainability targets.

KA: How do you view the risks and opportunities in minority stake investments in venture capital deals?

AT: The key benefit of minority stake investments is the ability to build a diversified investment portfolio. With the smaller cheque size associated with minority state, we can efficiently deploy our fund across multiple investments. This is strategically important as it gives the opportunity to be exposed to a wide variety of interesting emerging business sectors and technologies. A diversified investment portfolio also is a well-known tool to mitigate the higher risk in venture investment.

The risk of minority stake is the lack of control and the reduced ability to shape the business direction of a startup. Given the nature of startup businesses which are to prove a new business model, the commercial feasibility of a new technology or a new product, the startup often needs to adjust its business plan which may require changing the business model or targeting a different end-use markets or customers. As a result, the original strategic intent of the investment may no longer be aligned. On one hand, the corporate investor will need to regularly reassess the strategic fit of its investment and make a timely decision. On the other hand, it needs to work closely with other investors to ensure that the startup has the best chance of succeeding, even though the startup’s business plan has changed.