The dollar value of energy venture deals that corporates took part in fell 63% in the second quarter.

Oil and gas companies appear to be in a retreat when it comes to investing, with a 63% decrease in the dollar value of the deals they took part in in the second quarter, compared to the same period last year.

Moreover, one of the oil and gas majors, Total, has retreated from corporate venture investing entirely. France-based TotalEnergies closed its $400m corporate venture capital unit and sold its portfolio to venture capital firm Aster.

To counterbalance the departure of TotalEnergies, there were three new energy-related funds created, including a $150m energy transition fund launched by TDK Ventures, a $100m fund launched by Innopower, the Thai energy technology company, and a $9.1m fund formed by LX Holdings, part of Korea’s LG Group. Still, the collective firepower of these new units will not match what was lost with the

departure of Total.

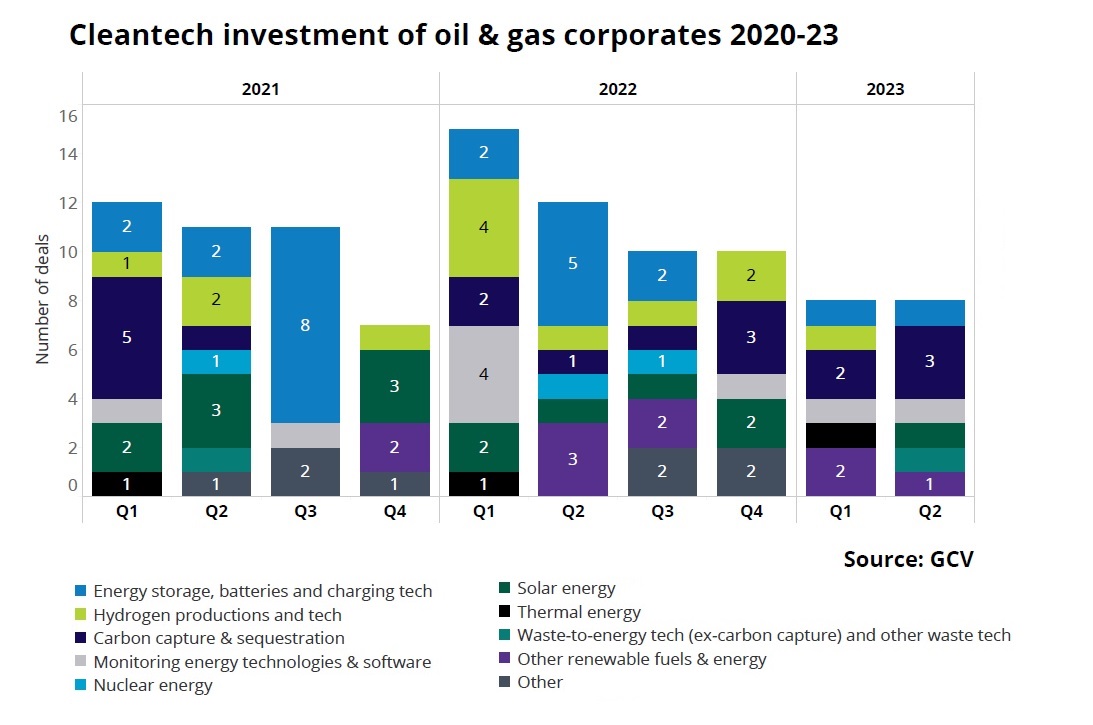

Cleantech themes such as carbon capture and storage and the transition to electric mobility still dominate in terms of the deals being done, and energy companies appear to be happy to take positions all the way along the value chain in these areas. One of the biggest deals of the past quarter was the $195m series B funding round for KoBold Metals, a US company using AI and geoscience to find new sources of the lithium, cobolt, copper and nickel needed to make batteries.

Deal trends

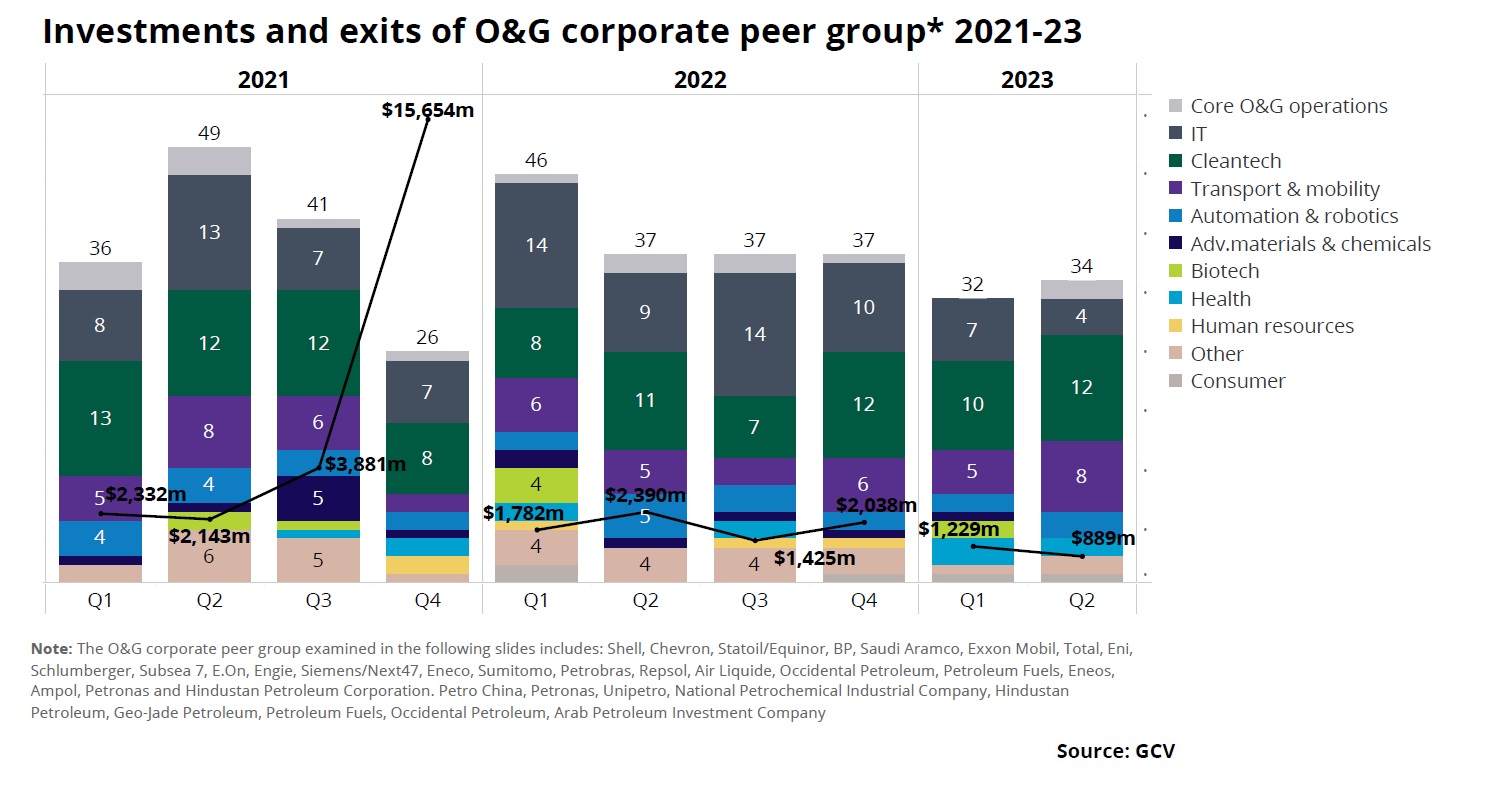

Oil and gas corporate venturers backed 34 startup rounds in the second quarter of 2023, down from 37 deals from the same period in 2022. The total estimated dollar value of those deals stood at $889m, down 63% from the estimated $2.39bn deal value of Q2 2022, when energy markets were buoyant, with crude prices reaching over $100 per barrel.

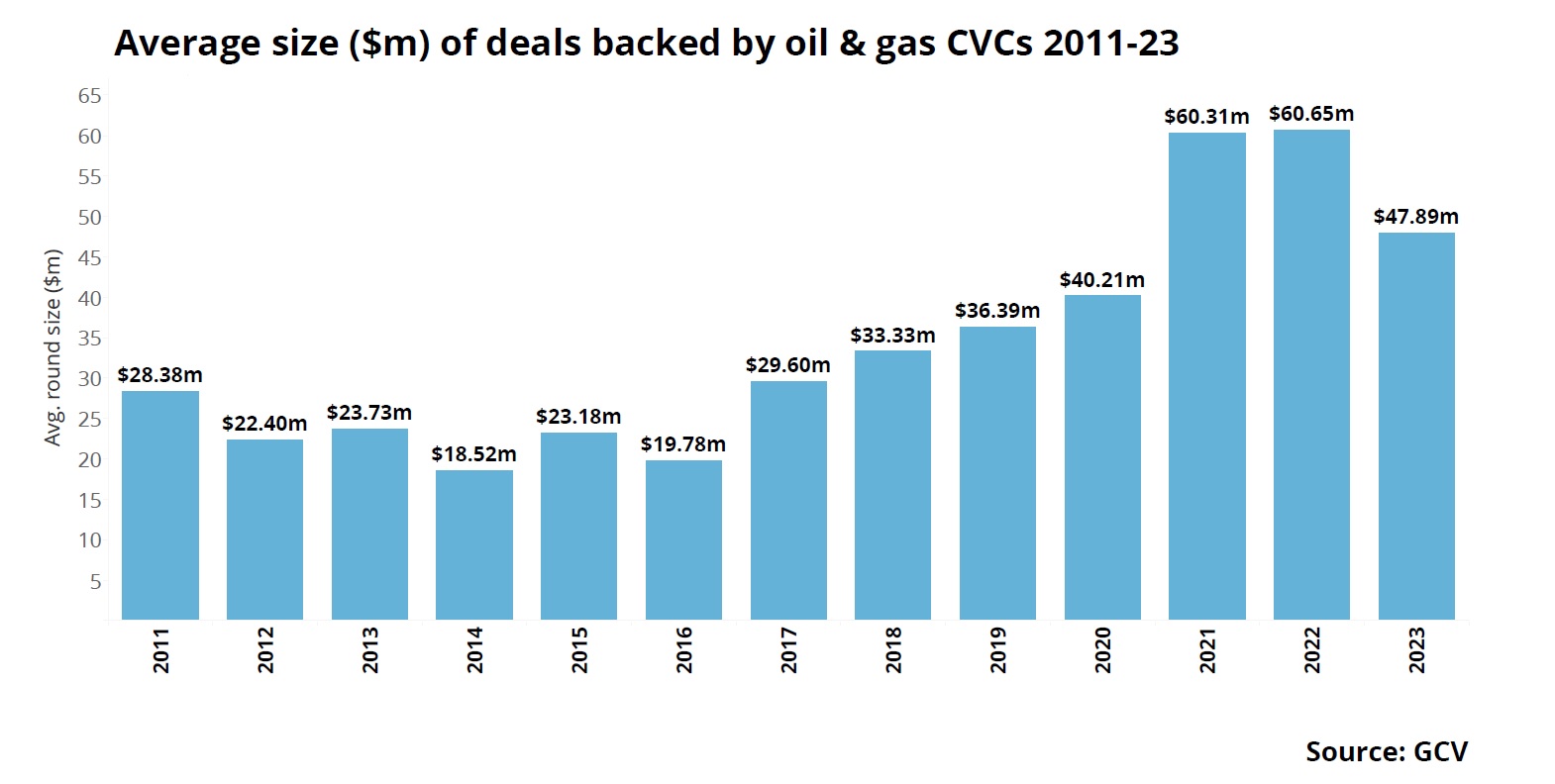

The average size of deals that oil and gas corporate venturing units participated in was $47.89m in H1 2023. This figure is lower compared with the average for all of 2022 ($60.65m), suggesting the energy sector is seeing a correction. Deal sizes are still above the levels seen before 2021.

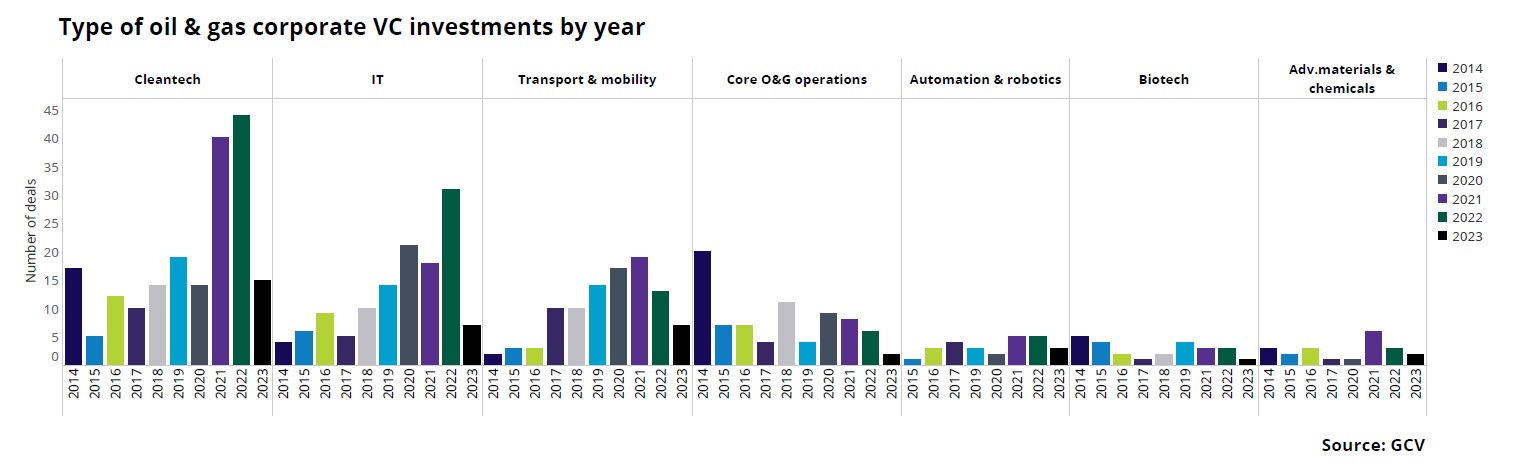

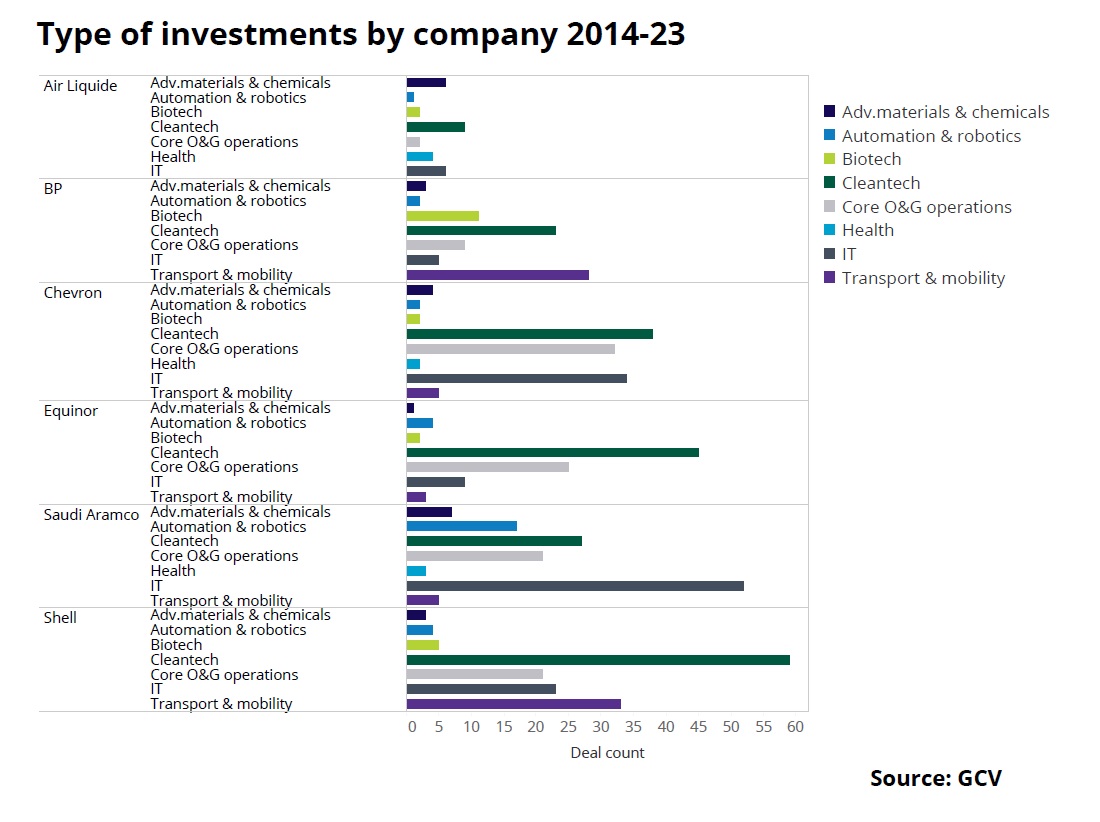

On sector-by-sector basis, the number of deals in cleantech, IT, transport and mobility as well as oil and gas technologies have continued to dominate in 2023.

Shell, Equinor and Chevron have taken the lead in cleantech investments since 2014. Saudi Aramco and Chevron lead on investments in IT technologies, whereas Shell, BP and Chevron invested the most in transport and mobility startups.

Over the years corporate venture investors have consistently shifted to non-core areas, primarily IT, cleantech and transport and mobility. Such non-core businesses are the most disruptive to the core business of oil and gas companies.

Energy storage, carbon capture and monitoring tools were among of the most popular clean investments in the second quarter of 2023, reflecting the race to decarbonise heavy industry in developed economies across the globe.

Crude outlook still positive

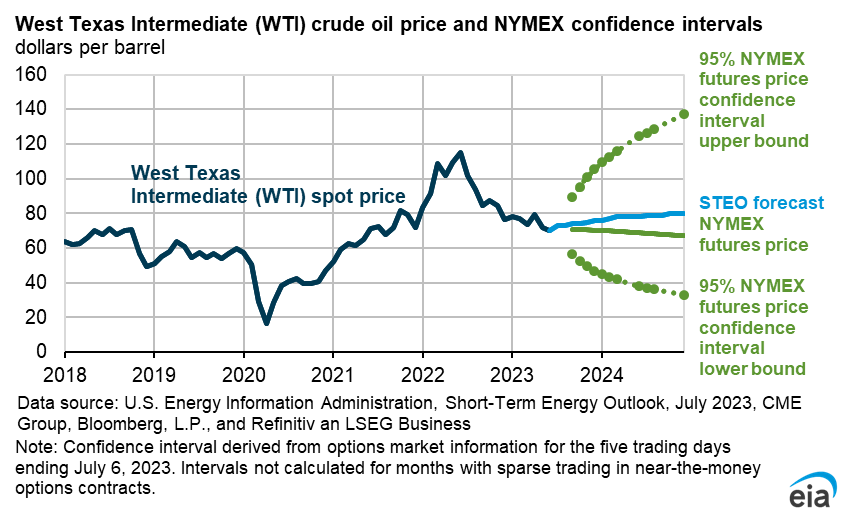

Crude oil prices have been obstinately depressed in most recent times despite successive announcements of production cuts by OPEC member countries. Saudi Arabia in early June 2023 that it would unilaterally cut production by 1 million barrels per day in July. The new OPEC+ 2024 output targets now are set at 40.46 million b/d. Saudi Arabia then announced further cuts in July, as did Russia.

Yet, crude prices have not really moved much since then, with the WTI prices staying relatively range-bound between $70-$75 a barrel. This lack of short-term reaction by markets has been somewhat puzzling to all.

Saudi Aramco chief executive Amin Nasser attributed it to recessionary fears and economic headwinds, while remaining optimistic for the second half of 2023 and 2024, in a recent interview for CNBC. The International Energy Agency (IEA) in its Short-Term Energy Outlook (STEO) also expects higher crude prices in 2023 and 2024, forecasting higher oil consumption and discounting the ongoing output cuts by major petroleum producing countries.

The IAE has not revised much its average price forecast since the previous quarter, expecting WTI prices to rise to the mid-$80s per barrel range into 2024. It also expects the WTI to remain priced at roughly $5 discount to Brent.

Higher or stable oil prices are positive for corporate venturing in the space because more capital will potentially be available for VC and innovation investing.

Gas price unpredictable for now

Natural gas prices remain geopolitically sensitive as Russia’s war against Ukraine continues. The EU has been cautious in building up gas storage reserves, and set a target to reach. 90% full gas storage by November this year, a target it is likely to hit early.

With stockpiles plentiful, price movements will dependent largely on winter weather the Northern hemisphere. A mild winter in Europe could slash natural gas prices to half today’s levels, say analysts from Morgan Stanley, cited by oilprice.com. A colder-than-average winter, on the other hand spike prices higher.