Sector analysis: Industrial

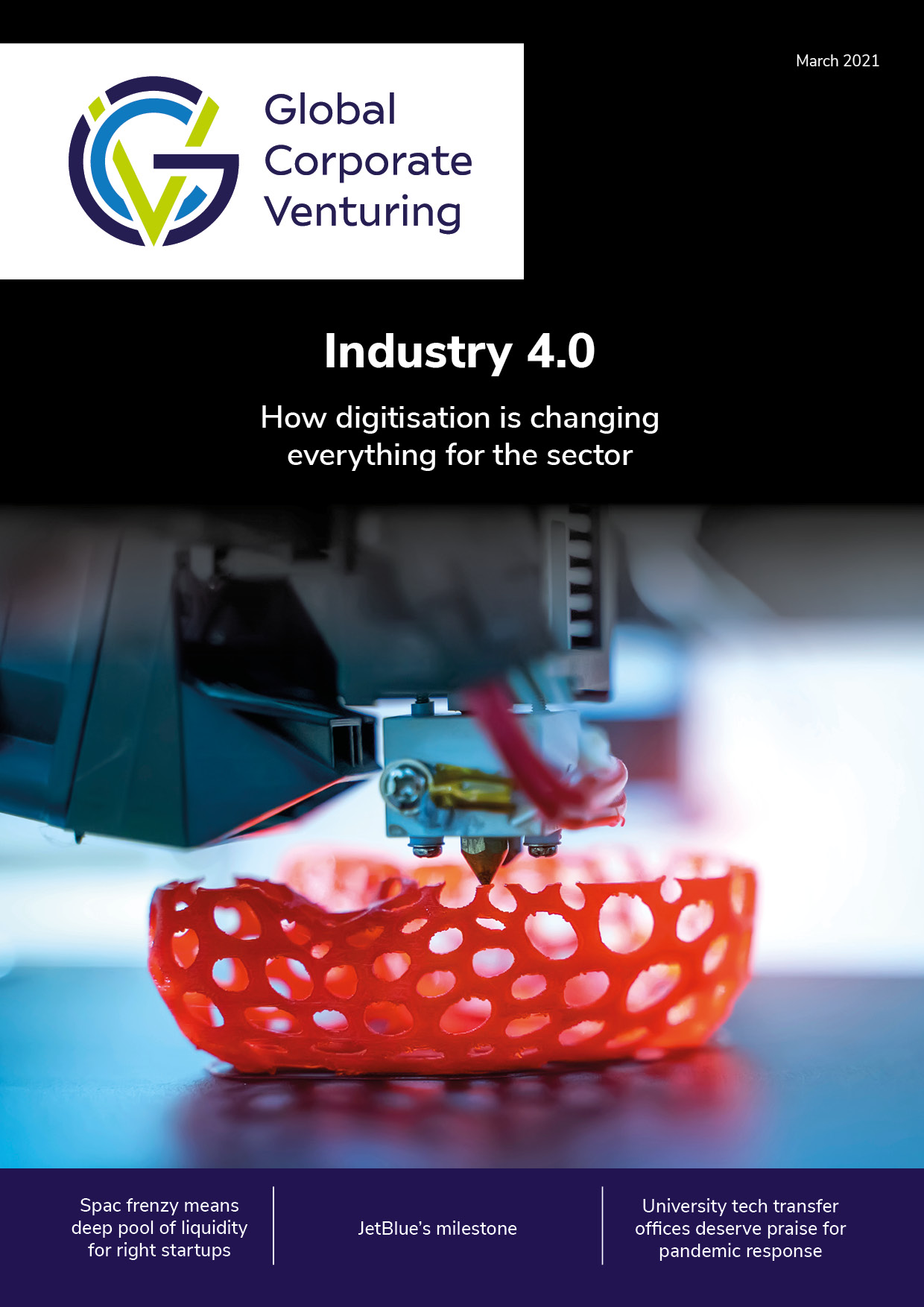

Terms like “industry 4.0”, the “fourth industrial revolution” or the “industrial internet of things” are virtually a must when innovation in the industrial sector is the topic of conversation. These buzzwords are used describe a major shift in the sector, which aims to marry the agility of digital information technology with the power of manufacturing. This blend purports to create more efficiencies, leveraging emerging technologies like artificial intelligence (AI), big data analytics, blockchain and 3D printing.

A major shift in…