Microorganisms are increasingly being harnessed to create everything from cleaner fuels to flavourings, dyes and chemicals, part of a growing interest in reengineering existing biological processes for new purposes.

In a sense, humankind has been putting microorganisms to work since the ancient Sumerians started brewing beer some 6000 years ago, or when we first began to use yeast to leaven bread. But today, our new-found ability to edit the DNA of microorganisms means they can be tweaked to produce everything from speciality chemicals to food proteins.

Synthetic biology, or the re-engineering of biological systems, is an umbrella term for a vast number of technologies — from cell and gene therapies that can combat diseases like cancer, to developing new mRNA-based vaccines against Covid, to growing cultured meat in a lab. Some of the healthcare benefits are relatively well-publicised and have dominated media headlines. But there are other uses that are less well-known, from agriculture to new materials development.

For this report, we have looked at these more nascent uses, excluding the more mature areas such as cell and gene therapies and plant-based protein production.

This market still tends to be somewhat modest in size — depending on definition — but is seen as having high growth potential.

One report from Brainy Insights estimates the size of the synthetic biology market to have been worth nearly $12bn in 2022 and expects it to grow to nearly $56bn by 2030. It attributes this tremendous growth potential to scientific breakthroughs and innovation which have made it possible to apply biology to so many areas.

Similarly, according to a report by BCC Research, the synthetic biology world market was forecast to increase from an estimated $9.5bn in 2021 to $33.2bn by 2026, at a compound annual growth rate (CAGR) of 28.4%.

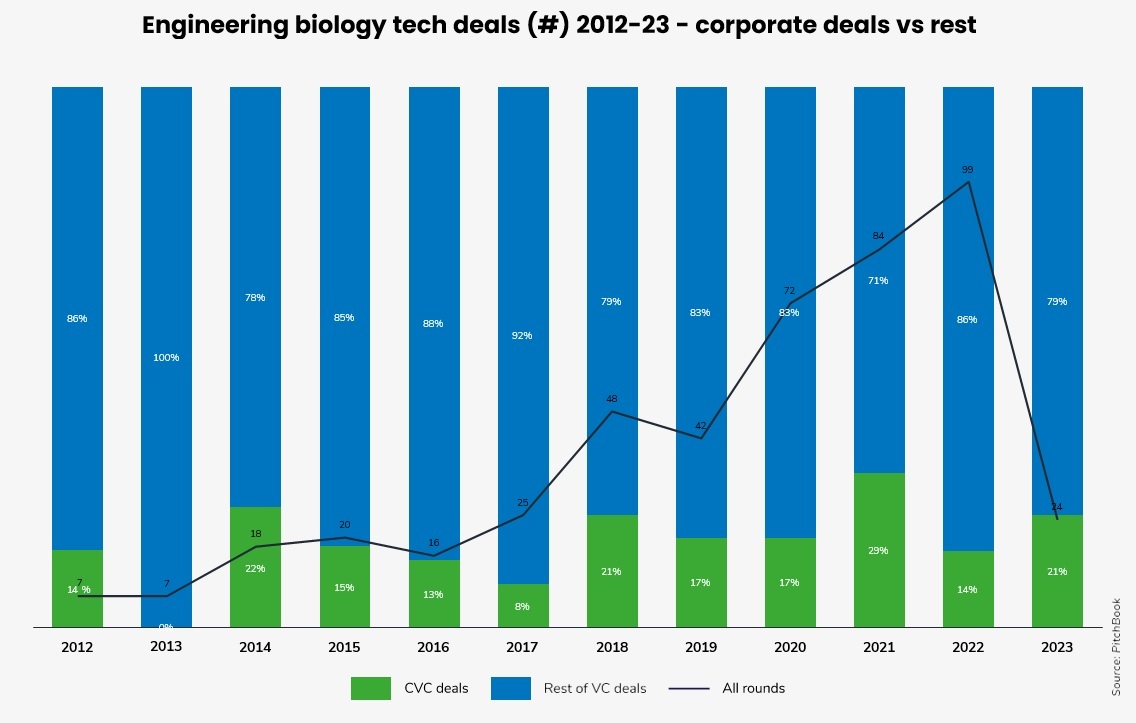

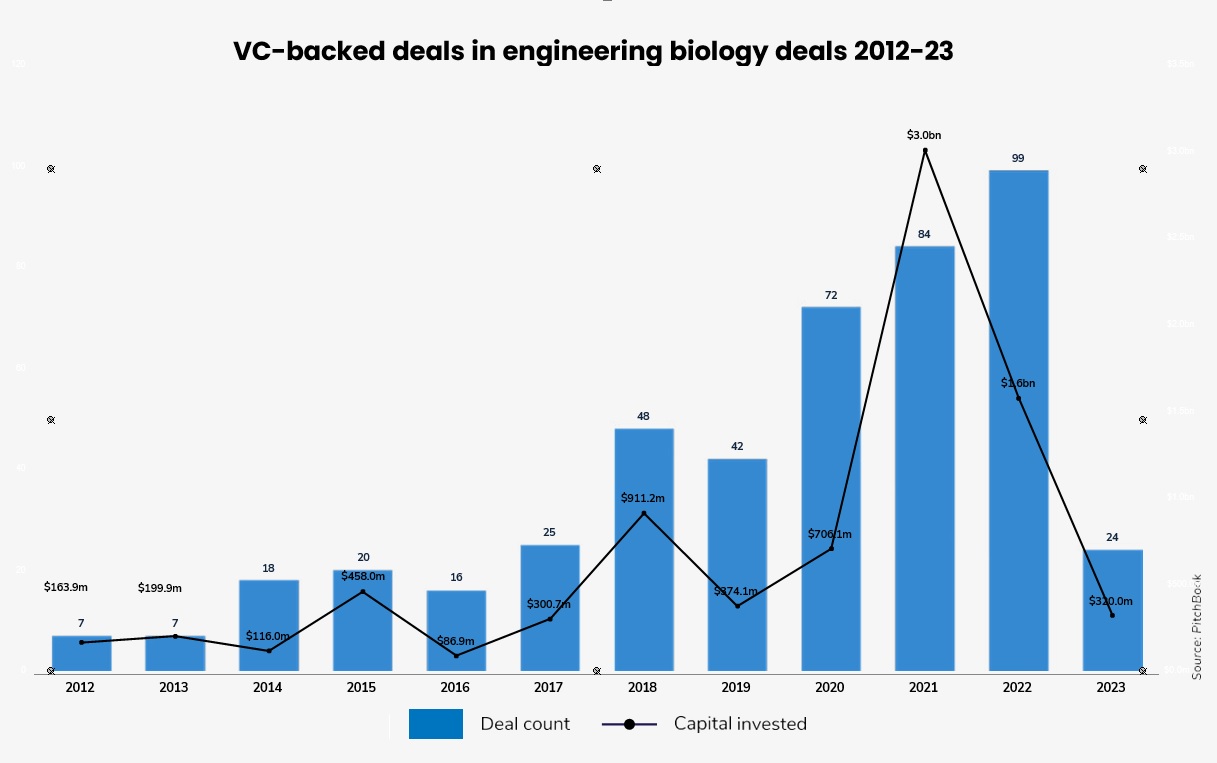

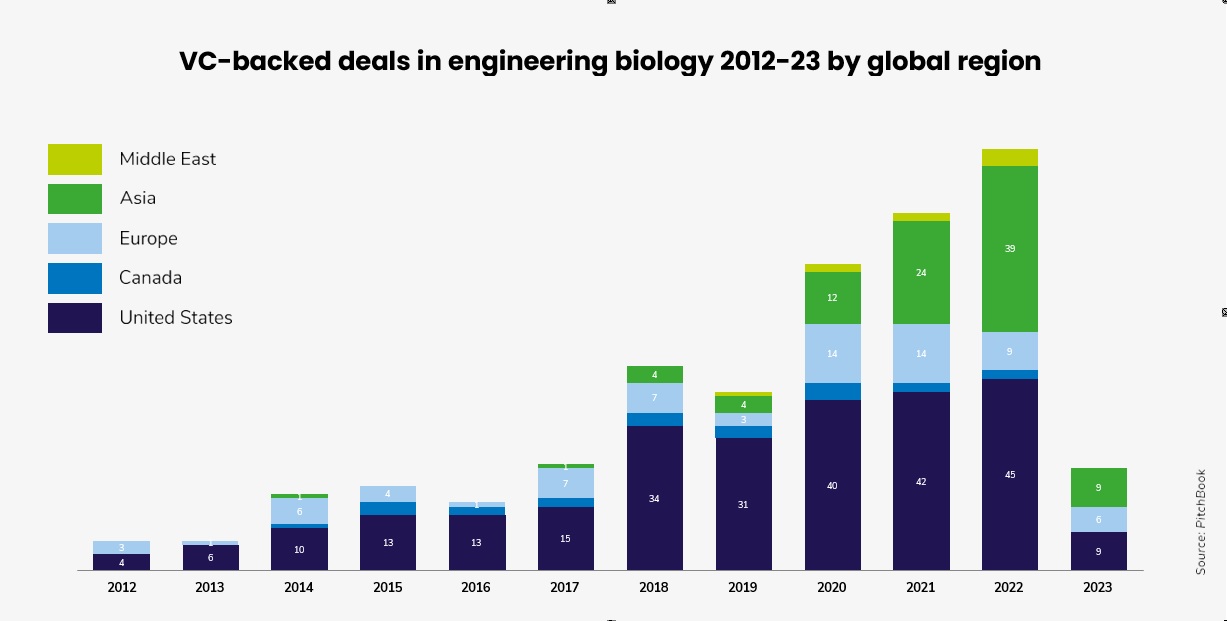

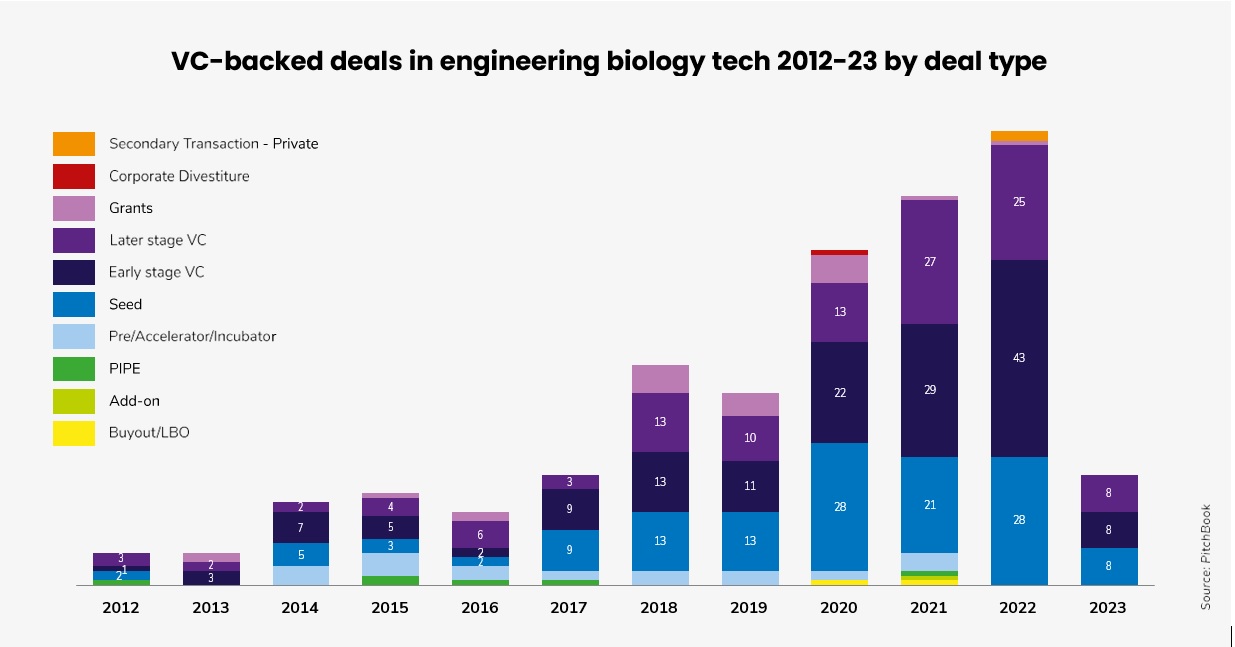

Our narrowly defined area of synthetic biology (excluding food and alternative protein applications) only really began to take off with venture capital investors in 2018-19, according to PitchBook’s data. Corporate-backed deals have remained a relatively modest portion of those deals – oscillating between 15% and 30%.

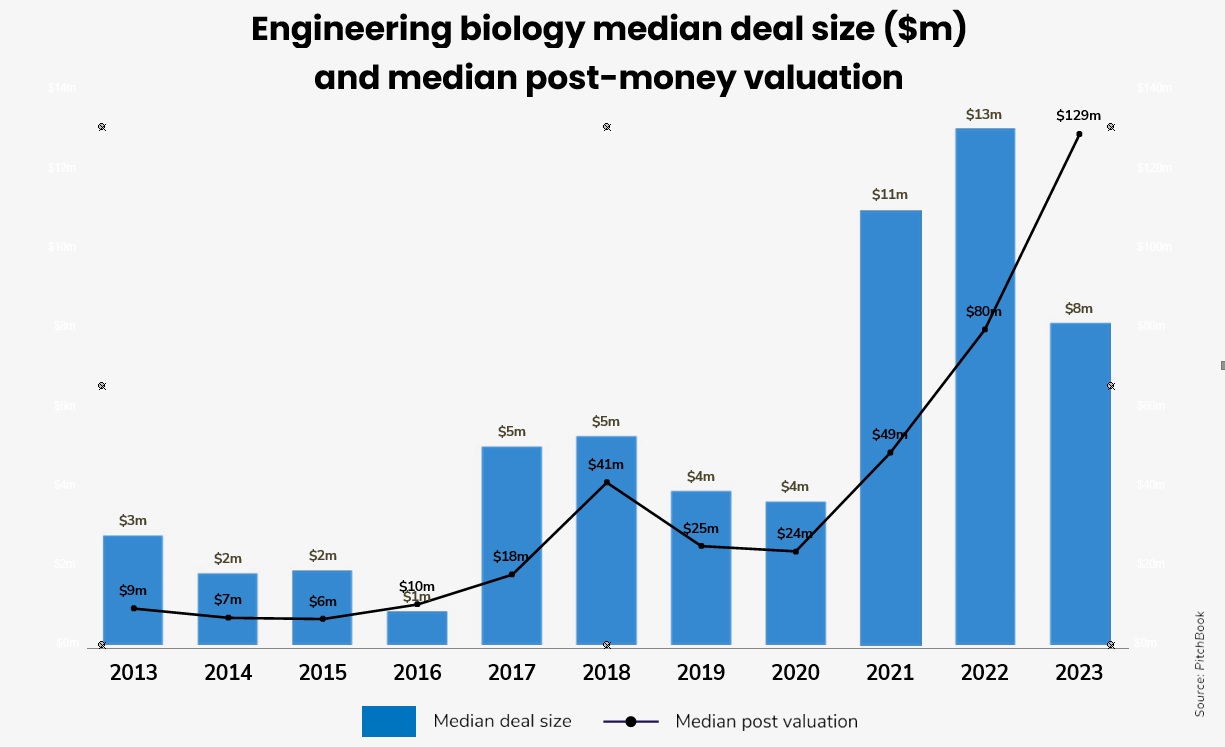

Median deal sizes and median post-money valuations have remained fairly modest. Most deals have been at a seed and early stage. However, those figures have been growing, evidencing its high growth potential perceived by investors.

Geographically speaking, the US and Asia have been the primary regions where engineering biology VC deals have taken place and much less so Europe.

Biotechnology and medicine

Gene editing and so-called “designer babies” have been some of the most talked about breakthroughs on the healthcare side. This has come with some controversy, such as in the last of the He Jiankui affair in China in 2018, where the first genome-edited HIV-resistant babies were brought to life. At the same time, Car-T cell therapy, where a patient’s own cells can be used to combat cancer, are giving hope to many.

But there are a number of other ways that healthcare is using engineered biology.

A great case in point is sitagliptin, sold under the brand name Januvia, a drug commercialised by Merck and used for treating type 2 diabetes. In simple terms this drug increases the secretion of insulin and supresses the releases of glucagon, which drives glucose levels to normal, according to Nature magazine and Wikipedia.

Xiylo, a University of Bristol spinout, similarly discovered a molecule that binds only to glucose, and turned that into a “smart insulin” company, helping diabetics. It was acquired by Novo Nordaisk in 2018.

Agriculture and food

Synthetic biology in the agriculture and food market is expected to witness significant growth in the coming years – from an estimated $3.2bn in 2020 to $14.12bn by 2025, at a CAGR of 34.56% during that period, according to a report by BIS Research. Driving factors behind this expected growth include the growing need for global food security, heightened consumer awareness of the importance of nutrition and greater investments in research.

Potential applications in agtech and foodtech range from crop yield management and development of disease and pest- resistant crops to the improvement of soil health, optimisation of food processing as well as enhancing food nutritional value and food safety.

There are many promising startups in this space. California- based Pivot Bio, for example, is developing a microbial solution that replaces nitrogen fertilisers. It has received backing from several corporate VCs including Tekfen Ventures, Bunge Ventures and Leaps by Bayer, according to PitchBook.

Similarly, Colorado-based DMC Biotechnologies develops bio-based chemicals designed for low-cost, sustainable transformation of multiple product markets. The company is backed by Solvay Ventures, the venturing arm of chemical producer Solvay, according to PitchBook.

Material advances

Engineering biology is also making strides in materials that could be greener and more sustainable. A case in point would be an application of synthetic biology to the textiles and apparel industry. It is all about living organisms with the potential to become bio-fabrics.

Big global clothing brands have a sustainability and emissions problem when it comes to synthetic fabrics. Artificial leather is made from petroleum derivatives and needs harsh chemical treatment to make it feel and look like real leather, as a blog post on Cleantech.com explains.

The post identifies several startups (Modern Meadow, Provenance Biofabrics and VitroLabs) that specialise in making bioleather, without animals being involved. Modern Meadow makes such leather from yeast-expressed collagen, the primary component of skin, and claims to do it at costs on par with traditional leather. Provenance Biofabrics similarly uses collagen to create leather.

Another interesting application is the harvesting of spider silk. Also known as super silk, protein fibre spun by spiders is five times stronger than steel and more elastic and waterproof. It is, however, very difficult to farm and mass-produce. As the CleanTech.com blog post notes, today genetically engineered hosts (e.g. yeasts, silkworms and goats) can be used to get spider silk. Two companies specialise in this – Bolt Threads, which works with yeast, and Japan-based Spiber which uses E.coli.

Bio-engineered materials can go beyond fabrics and textiles. According to Nature magazine, hyaline films are made from diamine monomers produced by engineered organisms that were optimised using a suite of robotics to build millions of strains in parallel. Such films are clear, flexible and robust to make them suitable for flexible electronic devices like wearables.

Stumbling blocks

The engineering and synthetic biology sector faces some challenges in scaling. While nature may have developed enviable chemistry, bio solutions are not always easy to harvest on a large enough scale to be commercially viable.

As a piece by the Manhattan Institute declared, “despite decades of hype, as well as years of mandates and subsidies, biofuels have never made a significant dent in our need for oil.”

According to IEA data, bioenergy is the largest source of renewable energy globally, accounting for 55% of renewable energy, but only 6% of global energy supply.

The time horizon required for these technologies to mature and in some cases obtain regulatory approvals, are also a challenge for VC and PE investors.

In the case of environmentally sustainable materials, the biggest economic hurdle may be inability to price-compete with commodities like oil and gas or conventional chemicals.

Thus, engineering biology has a long and bumpy way ahead but its disruptive potential is large enough for investors to take an interest.