Digital banking platform operator Nu Holdings priced its IPO at the top of its range in New York, representing the first Brazil-originated flotation in three months.

Brazil-based Nu Holdings, owner of neobank Nubank which counts internet company Tencent and conglomerate Berkshire Hathaway among its backers, raised $2.6bn in an initial public offering priced at the top of its range. Nu issued 289 million shares on the New York Stock Exchange at $9 per share. Nu had initially intended to raise as much as $3.18bn before decreasing its range from $10 to $11 per share to between $8 and $9 apiece. Berkshire Hathaway, conglomerate led by famed value investor Warren Buffett, has reportedly acquired 10% of the new shares. The company also issued depositary receipts on São Paulo’s B3 stock exchange in a concurrent offering. The listing came at a time when Brazil’s IPO activities have decreased significantly, with no companies having gone public on São Paulo’s B3 stock exchange since September this year.

Founded in 2013, Nubank has developed a digital banking app that provides services including bank accounts as well as debit and credit cards with competitive fees. It is the largest independent digital bank in the world, with more than 48 million users across Brazil, Mexico and Colombia.

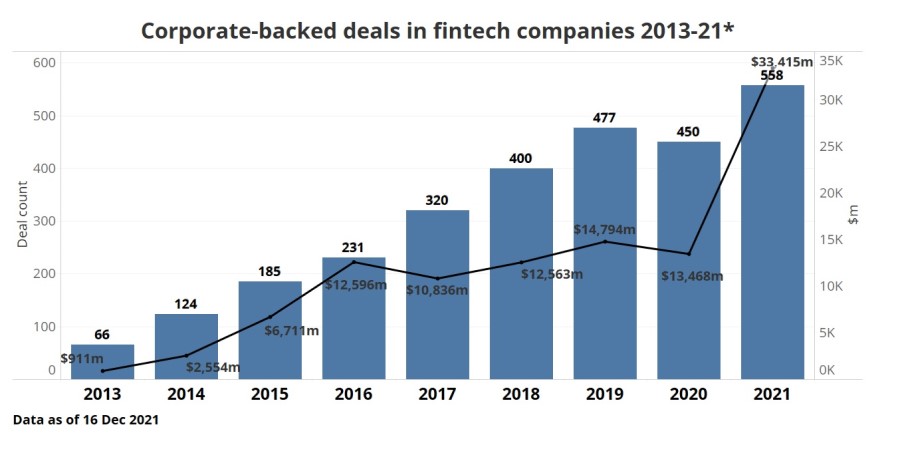

Nu Holdings forms part of the broader fintech space, which has seen much growth and interest from corporate venture investors, as our GCV Analytics chart below illustrates. Both the number of corporate-backed deals in emerging fintech enterprises and the total estimated dollars have skyrocketed over the past decade, growing from 66 deals and an estimated $911m in 2013 to 558 rounds and $33.41bn in estimated committed total capital by mid-December 2021. It is only natural that promising enterprises coming from this space would be going public like NuHoldings in what happens to be (still) an impressive bull market.