The semiconductor producer completed a nine-figure series C round from investors including SAIC Motor. This is a deal from the semiconductor and chips space, which does not normally see many corporate-backed deals but our data suggest valuations are currently experiencing upward pressure.

China-based semiconductor technology developer Beijing Eswin Technology Group raised a $392m series C round, which was backed by automotive manufacturer SAIC Motor’s Shang Qi Capital subsidiary. The round was co-led by investment bank Citic Securities’ private investment arm, Goldstone Investment, with China Internet Investment Fund, and also featured Legend Capital, the venture capital firm spun off by conglomerate Legend Holdings, among other investors.

Founded in 2016, Eswin is developing integrated chips for use in applications such as artificial intelligence-powered data processing, wireless connectivity, displays and video. In addition to integrated circuits, it provides silicon materials, advanced packaging products as well as packaging and testing services.

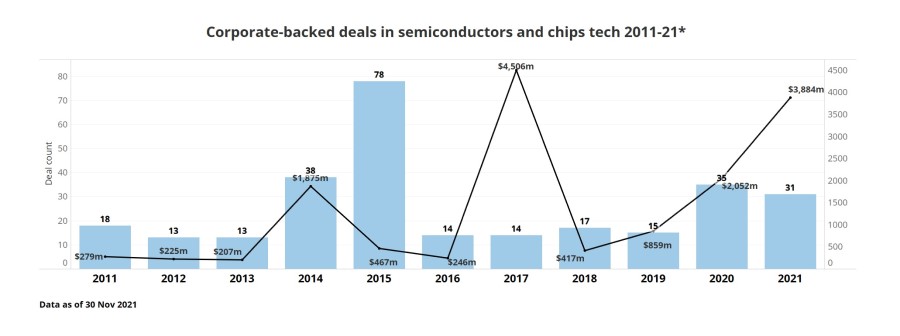

Eswin is part of the semiconductors and chips tech space, which has seen some interest by corporate venture investors over the years, as illustrated by the GCV Analytics bar chart below. As this is a hardware space, where innovation is more difficult to mature, the number of deals per year has been fairly modest during much of the past decades (mostly between 10 to 20 deals), except for 2015, which registered 78 corporate-backed deals in such businesses. In most recent times, when we began hearing about the now well-known shortage of semiconductors after the pandemic broke out, we saw 35 deals in 2020 and 31 by the end of November this year. Notably, the total estimated dollars in those deals nearly doubled from $2.05bn by the end of last year to $3.88bn by the end of November. This suggests not only heightened interest in the semiconductors space, likely in part to due to the shortages, but also significant upward pressure on valuations.