When Global University Venturing published its ground-breaking analysis of more than 60 years of spinouts at University of Oxford in April 2020, all the data we had collected was from a pre-pandemic world. By that point, the institution’s portfolio had collected more than £2.2bn and another $245m in equity financing overall.

Guest after guest on our Talking Tech Transfer podcast noted that the pandemic had led to an increase in activity, a reality subsequently reflected in annual reports. Having analysed Oxford’s longitudinal data just before the pandemic has given GUV a unique opportunity to evaluate how exactly these past 18 months have affected university venturing at a deep level by way of example of one of the world’s oldest and leading research institutions.

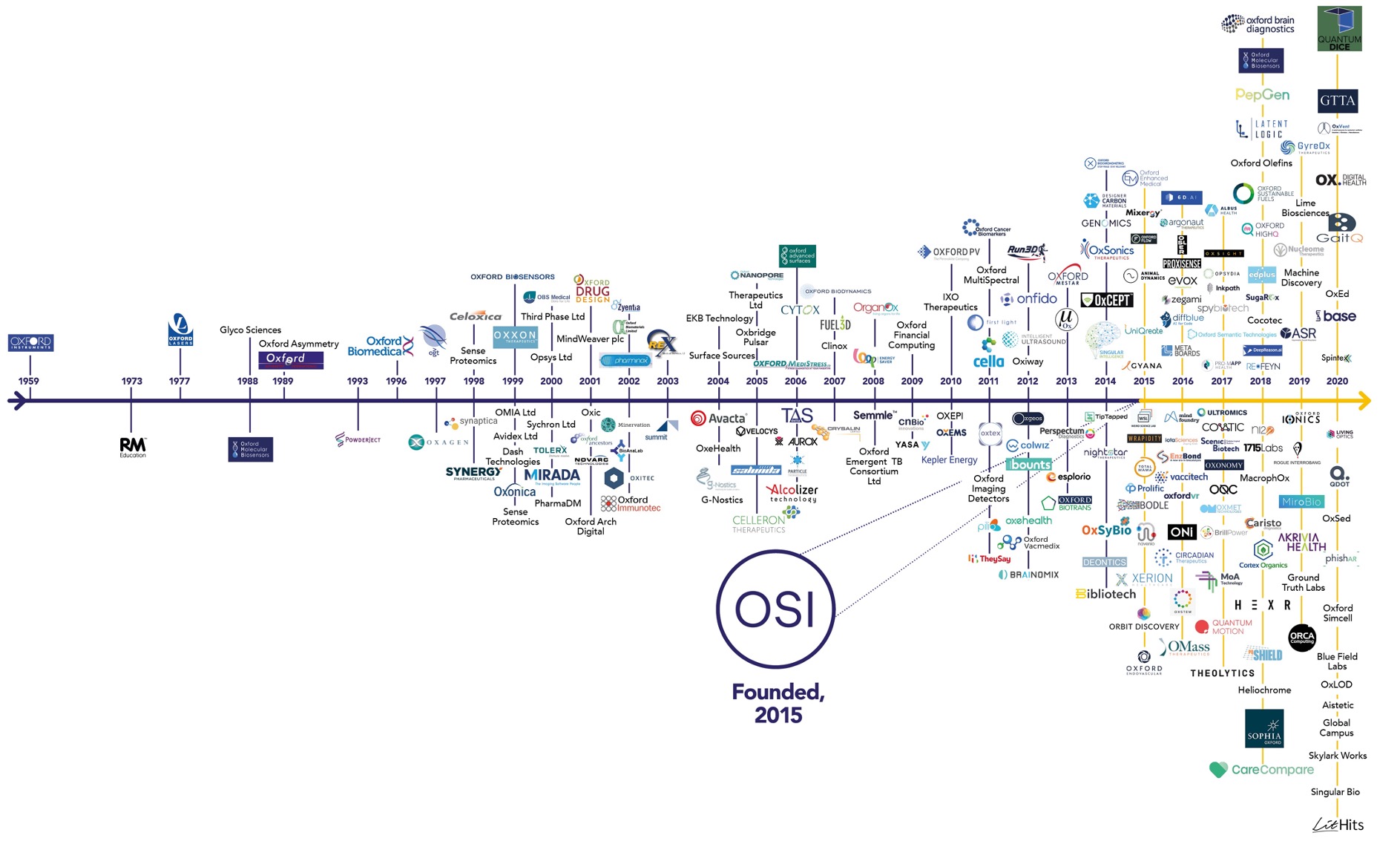

During the 2020 to 2021 fiscal year, the university’s tech transfer subsidiary Oxford University Innovation (OUI) added a record 23 spinouts, 4 startups and 6 social enterprises to its portfolio – with some crossover between these, this meant 31 new additions to OUI’s list of companies for a new total of 275 (including two that remain in stealth and details of which we are not at liberty do disclose).

Around 77.5% of companies remain active today, a slight drop on the 78.5% in our last analysis. A total of 15 companies achieved some form of exit – either an initial public offering, an acquisition or both – before being wound down, so may be reasonably counted as successes. Including these businesses, the survival rate jumps to around 82.8%, again a slight drop on the 83.9% previously.

Across the portfolio, total pre-exit equity capital now stands at more than £2.8bn, plus another $732m and €6.5m. Although it is difficult to account for currency fluctuations, at the current exchange rates this would be a total of more than £3.3bn or $4.6bn.

Notably, the median amount is only £3.3m and the average is £14.8m for the rounds in British pound sterling, which constitute the majority of transactions, or $49m and $72.3m for the rounds in US dollar amounts – of which there were only 10.

But beyond these numbers, Oxford achieved something far more remarkable during the pandemic: the technology of its spinout Vaccitech – which listed on Nasdaq in April 2021 following a $110m IPO – was the foundation for the covid vaccine in partnership with pharmaceutical firm AstraZeneca.

Alexis Dormandy, chief executive of the university’s investment company Oxford Science Enterprises (formerly known as Oxford Sciences Innovation) which had invested in Vaccitech, said: “The fact that 98% of Covax vaccines are the AstraZeneca vaccine is because it really took a university.

“The people at the university deserve huge credit for coming up with a deal with AstraZeneca to give them the technology for free, and also the people in Vaccitech who contributed to giving that for free, which then allowed non-western countries to get access to the vaccine.

“I do not think it would happen if it was not a university venturing arm, because in money versus the good, the money would win.” He added: “It is a reflection on the importance of university venturing and what it can do.”

Another covid-related company was Oxsed, a social venture that was working on a rapid test for the disease. Oxsed launched in June 2020 and only five months later was acquired by Prenetics’ DNAFit Life Sciences subsidiary.

This was not the only notable acquisition that occurred during the pre-vaccine days of the pandemic – epigenetics company Base Genomics, which had raised only $11m in equity funding, was bought by molecular diagnostics business Exact Sciences for $410m in October last year.

Matt Perkins, chief executive of OUI, wrote in the office’s annual report: “Our spinout portfolio not only continues to grow, but to rapidly mature.

“Oxford Nanopore’s £3.4bn IPO is stealing the headlines, while many continue to scale towards their own flotations. Meanwhile, Yasa Motors held a prominent exit of its own with its acquisition by Mercedes Benz.

“As these develop, the overall ecosystem is moving from the gold rush days of the Oxford Boom to a more established community of innovators looking to create a rising tide of impact that raises all boats.

“While OUI’s role in the process remains at that inflection point where research transfers into the wider world, we believe we have a part to play in sustaining the momentum of recent years and using our voice and convening power to help our community thrive.”

That listing of Oxford Nanopore was grabbing headlines for all the right reasons: it marked a phenomenal success for the university and it also became one of the largest initial public offerings of a spinout in the nearly nine years that GUV has been covering the sector.

Woodford proves his worth too late

There is an elephant in the room when it comes to Oxford Nanopore’s flotation: Neil Woodford and his since-collapsed Woodford Investment Management, which also managed the Woodford Patient Capital Trust (now called Schroders UK Public Private Trust).

The listing was so successful, it made commercialisation firm IP Group a whopping £84m on the spot.

Oxford Nanopore was a core holding in Woodford’s flagship Equity Income fund and it could have netted investors hundreds of millions of pounds. However, administrator Link Fund Solutions sold the shares to Acacia Research for a fraction of its IPO valuation a year ago.

The spinout was one of 18 holdings sold for a combined £224m in June 2020. Nanopore’s price was reportedly £98m. Overall, Link Fund Solutions had offered such a cutthroat price that Acacia flipped the majority of the package, some of it within hours, and immediately bagged a profit of £150m.

Nanopore was one of two companies that Acacia held on to and it is a bet that has massively paid off for the patent litigation company.

Indeed, Acacia offloaded £16.4m worth of shares as part of the initial public offering and retained a 4.4% stake worth £149m at the IPO price of £4.25 a share. At the time of writing, its stake is worth £193m.

Is this hindsight enough to claim that Woodford was right all along? The root of the firm’s collapse was an overreliance on illiquid holdings that Woodford was unable to sell on when investors wanted their money back in droves – around £10m per day. Reportedly once worth £10.2bn, the fund was worth just £3.7bn by the time it was suspended in 2019.

The drawn-out process since the collapse has meant that many investors are still waiting for their money today – Link Fund Solutions continues to wind down the fund and is unsure when exactly this will be complete.

Adding to the chaos is the fact that law firm Leigh Day launched legal proceedings against Link Fund Solutions in September 2021 claiming that Link Fund failed to carry out its regulatory duty, as authorised corporate director, to look after the best interests of investors. Crucially, that claim covers both its decision since the fund’s suspension and the run-up to that suspension.

In his first interview since the collapse, Woodford showed himself combative in February this year when he announced his ambition to launch a Jersey-based investment firm – plans that failed. Speaking to the Daily Telegraph, he apologised saying “I am very sorry for what I did wrong. What I was responsible for was two years of underperformance – I was the fund manager, the investment strategy was mine, I owned it and it delivered a period of underperformance.”

However, he stuck to his view that the fund would have been successful and declared that had investors stuck with him they could be “enjoying the fruits of that faith”.

He added: “I cannot be sorry for the things I did not do. I did not make the decision to suspend the fund, I did not make the decision to liquidate the fund. As history will now show, those decisions were incredibly damaging to investors and they were not mine.”

The example of Acacia’s win with Nanopore would agree with Woodford’s claim.

There is an argument to be made that investors may have misunderstood the “patient” part of patient capital (the firm survived only five years). It was never a get-rich-quick scheme. Tom Hockaday, former head of OUI, wrote about Woodford in his compendium on tech transfer, University Technology Transfer: What It Is and How to Do It, and in a subsequent interview with GUV revealed he maintained nothing but respect for him – admitting he had no real sense of what went wrong at the firm.

“I think what Woodford did with patient capital and what he did with supporting the opportunities that brilliant UK science presents to UK business and UK investors was really positive,” he said. “The role he played in getting [Oxford Science Enterprises (OSE)] going as one of the founding investors was really positive. I can talk about the genuine positives of what he did in promoting patient capital, but the wrangling and financial management is just not a world I know.”

Arguably, Woodford’s mistake was not investing in unquoted holdings. That is a model that Nanopore has proved works – and it is a model pursued by others, such as London Stock Exchange-listed IP Group.

Woodford’s mistake was his decision to call the firm’s lead product the Equity Income fund. It created the perception that the fund would invest conservatively in companies that typically pay dividends, but unquoted stocks do not do that.

It is impossible to know whether this was wilful dishonesty, negligence or Woodford genuinely believed he was doing right by his investors, because he so passionately believed in university research commercialisation – he was, after all, a strong supporter of IP Group and one of the people who made OSE happen. But the result remains the same – investors were exposed to a risk profile that the fund name hid from them.

Is Nanopore’s listing vindication for Woodford’s vision? Yes. It is just a shame for everyone that he went about it all the wrong way.

OSE’s journey has only just begun

Oxford Science Enterprises is going about it all the right way. To date, the investment firm has raised £613m and invested around £360m of that, bringing another £600m from external investors into the portfolio. OSE itself is now worth more than £1bn after its creation led to an explosion in the number of spinouts coming out of Oxford.

Steadfastly pursuing its mission of putting impact over money, OSE reinvests proceeds and as of this year even donates 2% of its shareholding from each successful company back to the originating university department. If there is anyone else out there who does this, they have not advertised it – which seems unlikely and so this almost definitely qualifies as a unique aspect.

Dormandy joined from venture capital firm Atomico in January this year, taking over from interim CEO Jim Wilkinson who returned to his original post as chief financial officer. Dormandy immediately went to work of putting his mark on the organisation and established a group looking into how well, or not, OSE was doing on diversity and inclusion.

He said: “The way I describe it is we need to be an organisation that we will be proud of in 10 years’ time, not one we could have got away with 10 years ago.”

Describing the initiative, he noted: “We did a survey internally, there were bits we were good at and others we were not so good at. We have done quite a lot of work and we still have a lot more to do, but one of the things I am most proud of is that, without trying at all and being totally meritocratic, five of my seven direct reports are women. There was no conscious effort to do that.

“As it happens, the whole of the life sciences team are women, again by accident. But clearly it is a much bigger issue than just women, we probably have further work to do on the Black, Asian and minority ethnic demographic – I would not say we are bad, we are probably market average but I am not sure that is a benchmark to aim for.”

OSE has now rolled out a survey to its 55 largest companies to get the big picture and start benchmarking. Dormandy added: “We will pay for and support initiatives to try and push that all in the right direction. So, we take it extremely seriously and, like anybody, if they say they are winning that battle they are deluding themselves. Everyone is at an early stage, but we are definitely on it and take it seriously.”

Dormandy already has a noteworthy take on fostering diversity. He continued: “The question for me is not: do I encourage [spinouts] to have diverse leadership? If I ever see a longlist of people I am interviewing and it is not diverse, I ask: what are we doing? I do not think it is so much about encouraging people, I regard it as a moral minimum and a commercial minimum.

“And as I say, the fact that we have a lot of women work in our company has nothing to do with actively trying to reach people. When we look at a list we say, does that list look like a representation of the population – if it does not, then it is the wrong list.”

OSE’s success leads to an obvious question: should there be more university venturing funds? “In general, it is a good idea,” Dormandy explained. “The biggest issue is the people. This is a professional industry and if they can be done well with good people, there is a huge opportunity there. If it is done as a slight afterthought – thinking we should be a bit more entrepreneurial, how do we spin a few things up – it is not that they will do any damage, except that it might set things back by them not working out. Better to do it well early.

“If you asked me what it would be like in five years’ time, yes, they will be spinning up in other places. And if you ask me in 10 years’ time, there will be an industry that is probably literally 20 times the size it is now.”

Dormandy is not shy about doubling down on that vision. Joking that he had never read anywhere that an American accent was needed to build a Microsoft or Intel, he added: “There are three things that need to happen. We need to have the capability to build these businesses, not just spin them out.

“We need to have billions in cash, not tens of millions, to build these industries around them. And the last bit we need is the attitude to go after it, because there is a mindset about: what does success look like?”

It will not necessarily be a software company. It may be something as unusual as Refeyn, which Dormandy highlighted as a portfolio success he was particularly proud of. Refeyn has developed mass photometry technology – essentially, it uses light to measure the weight of molecules.

“I first met them before I joined Oxford Science Enterprises – I was introduced to the founder four years ago,” Dormandy recalled. “I trained as a doctor, but when a professor who is using light to measure the weight of things is talking to you about the detail… I was definitely struggling to keep up.”

“I had absolutely no idea what the commercial model was going to be,” he admitted. “What they do is essentially the same as a mass spectrometer, but they do it for $50,000 – a fifth of the price of others.”

The technology is so transformative, Refeyn is struggling to keep up with orders and is beating every milestone they could have. But that is not the amazing part – researchers have been writing to say the throughput of their labs had gone up fivefold since installing Refeyn’s benchtop machines, because people no longer had to queue to get access to one big machine.

“The democratisation of that technology is a massively important thing,” Dormandy declared. “The reason I love it is it has very strong, unique science that nobody else has and it appeals to me that I did not see it when I first met them, which is a lesson to all of us. You need to try harder and have a bit more imagination because that is part of the job here.”

The fact that Dormandy missed the opportunity initially was emblematic of the system, he pondered: “It would not have been funded by VCs, because the work of getting that science out into a business, there is probably two years of just doing that and there was not an investible business.”

The importance of OSE therefore can hardly be overstated. If the UK is to emerge as a powerhouse for innovation following the tumultuous years of a post-Brexit, post-pandemic world still ahead of us, university venturing will be a crucial component. It is important the government understands this – not just this leadership but all subsequent ones.

Some notes about this data:

- The date formed refers to the date provided by University of Oxford as the date on which the company was spun out, not when it was incorporated with Companies House. The incorporation dates are usually a few months before the completion of the spinout process, but in some cases differ by several years.

- The total funding has been rounded. It includes the equity declared by the companies in their most recent annual accounts, by University of Oxford to GUV and press releases by the spinouts themselves. They are correct, to the best of our knowledge, as of September 2021. The figures do not include any non-dilutive grants, debt financing or bank loans. Some companies have disclosed they raised money, but not yet how much – in these cases we elected to either leave the field blank or display the confirmed funding only.

- Defunct companies have not filed any accounts for their most recent financial year or have an active notice in place by Companies House to be struck off and thereby be dissolved.

- PharmaDM is the only company whose status could not be ascertained, although there are no records in Belgium’s official register and its software is now distributed directly by KU Leuven. It seems safe to assume the company has been wound down.

- Startups are companies that have gone through OUI’s incubator only, they do not include startups from the wider university community.

- At the request of OUI, the following list does not include spinouts in stealth mode.

| Spinout | Formed | Type | Active | Exit | Technology | Funding |

| OxCarbon | September 2021 | Social venture | Yes | Commercial carbon offset services | ||

| OxCCU | August 2021 | Spinout | Yes | Conversion of CO2 into sustainable aviation fuel | ||

| Sandymount Therapeutics | August 2021 | Spinout | Yes | |||

| EndLyz Therapeutics | July 2021 | Spinout | Yes | Treatments for Parkinson’s disease | $3.3m | |

| Amber Therapeutics | June 2021 | Spinout | Yes | Bioelectronic platform initially focused on treating urinary incontinence | ||

| LiliumX | May 2021 | Spinout | Yes | Protein technology platform to facilitate scalable discovery of first-in-class bispecific biologics | $125,000 | |

| OxVax | March 2021 | Spinout | Yes | Off-the-shelf vaccines for solid tumours | ||

| Oxford Green Innotech | March 2021 | Spinout | Yes | Carbon-free transformation of ammonia waste into hydrogen | ||

| Vaxine | March 2021 | Startup | Yes | Supporting medical personnel in the deployment of the covid vaccine | ||

| Viscera Technologies | February 2021 | Startup | Yes | Predictive diagnostics technology initially focused on a test for helicobacter pylori | £35,000 | |

| Ujji | February 2021 | Startup | Yes | Gamified life coaching app | ||

| Aisentia | February 2021 | Spinout | Yes | Machine learning and AI to reconstruct CT angiograms using non-CT images | ||

| Hydregen | February 2021 | Spinout | Yes | Enzyme catalysis using hydrogen gas to recycle the NADH co-factor, reducing waste and lowering costs | £120,000 | |

| Hare Analytics | February 2021 | Spinout | Dormant | Behaviour-based analytics for business-to-consumer applications | £10,000 | |

| Salience Labs | February 2021 | Spinout | Yes | Photon-based computing; joint spinout with University of Münster | ||

| Curacode | February 2021 | Spinout | Yes | Laser-printed high-security, low cost authentication labels | £30,000 | |

| Orbit RRI | January 2021 | Social venture | Yes | Promoting esponsible research and innovation in information and communications technology; joint company with De Montfort University | ||

| Augmented Intelligence Labs | January 2021 | Spinout | Yes | Analysis and decision support systems for marketing research; first spinout out Saïd Business School | ||

| Kleidox Therapeutics | December 2020 | Spinout | Yes | Working with marketing insights companies to develop their marketing products | ||

| Skylark Works | November 2020 | Social venture | Yes | Social purpose-led consultancy | ||

| Singula Bio | November 2020 | Spinout | Yes | Neoantigen-based cell therapies for patients with solid tumours | ||

| GTT Analytics | November 2020 | Spinout | Yes | International maritime logistics simulations | ||

| Quantum Dice | November 2020 | Spinout | Yes | Self-certified quantum random number generator | ||

| Global Campus | October 2020 | Social venture | Yes | Sustainable, integrated and inter-university learning opportunities | ||

| LitHits | October 2020 | Spinout | Yes | Mobile app to encourage book reading | ||

| Aistetic | October 2020 | Spinout | Yes | Tailored clothing e-commerce app using computer vision and deep learning to generate 3D models of customers | ||

| Carnot | September 2020 | Startup | Yes | Ultra-efficient ceramic engines | £273,000 | |

| OxLOD | September 2020 | Social venture | Yes | Bringing the tools developed for heritage to the health data management | ||

| OxVent | September 2020 | Social venture | Yes | Ventilator designed to support covid patients in ICUs | £203,000 | |

| OXDH | August 2020 | Spinout | Yes | IVF and maternity health data platforms and telemedicine service | ||

| Open Clinical | August 2020 | Social venture | Yes | Open source and open access innovation in healthcare knowledge | ||

| Oxford Simcell | August 2020 | Spinout | Yes | Biosensors for food safety testing, incorporated in the UK but focused on China | ||

| Blue Field Labs | August 2020 | Spinout | Yes | Expertise and knowledge regarding data privacy, ethics, data security and public policy in connection with technology use | ||

| Global Health Research Accelerator CIC | July 2020 | Social venture | Yes | Digital platform for knowledge sharing | ||

| PhishAR | July 2020 | Spinout | Yes | Cybersecurity technology to thwart phishing attempts | ||

| Dark Blue Therapeutics | July 2020 | Spinout | Yes | Co-founded by OUI, Oxford Science Enterprises, Evotec, BMS and University of Oxford to spin out successful Lab282 oncology projects | ||

| Base Genomics | June 2020 | Spinout | Yes | Acquired by Exact Sciences for $410m in October 2020, now incorporated as Exact Sciences Innovation | Epigenetics company advancing technology to sequence DNA methylation developed at Oxford’s Ludwig Institute for Cancer Research branch | $11m |

| CareerShe | June 2020 | Startup | Yes | Helping students aged 5 to 25 to learn about the world of work and guide them in major life decisions | ||

| Deep Edit | June 2020 | Startup | Yes | Software-based photo enhancer for professional photographers | ||

| Oxsed | June 2020 | Social venture | Yes | Acquired by Prenetics’ DNAFit Life Sciences subsidiary in November 2020 | Focused on developing a rapid covid-19 test, joint company of University of Oxford and Oxford Suzhou Centre for Advanced Research | £249,000 |

| OxEd | April 2020 | Spinout | Dormant | Platform to standardise assessments of language, reading and arithmetic skills in children | £100 | |

| Bloomd | April 2020 | Startup | Yes | Question and answer platform connecting elderly citizens to younger users | £40,000 | |

| GaitQ | March 2020 | Spinout | Yes | Wearable device that analyses the walking gait of Parkinson’s patients | £625,000 | |

| Qdot Technology | April 2020 | Spinout | Yes | Engineering solutions for thermal problems such as those occurring in fusion reactors | ||

| Living Optics | January 2020 | Spinout | Yes | 3D laser spectrometer and single shot hyperspectral imaging | £5m | |

| Spintex Engineering | January 2020 | Spinout | Yes | Scalable manufacturing process for spinning spider silk | £306,000 | |

| Ivy Farms | December 2019 | Spinout | Yes | Lab-grown meat | £6.4m | |

| Orca Computing | December 2019 | Spinout | Yes | Quantum computing technology | £2.9m | |

| Ground Truth Labs | December 2019 | Spinout | Yes | Digital pathology annotation tool | £50,000 | |

| Infinitum Education | November 2019 | Startup | Yes | Artificial intelligence-powered, gamified teaching | ||

| Collegia Partners | November 2019 | Startup | Yes | Pension fund management for SMEs | £246,000 | |

| Global Malaria Vaccines | September 2019 | Spinout | Yes | Germany-based holding company to receive EU funding on malaria vaccine development at the university | ||

| Nucleome Therapeutics | July 2019 | Spinout | Yes | Drug development using the non-coding part of the human genome | £5.2m | |

| Lime Biosciences | July 2019 | Spinout | Yes | DNA assembly | ||

| Gyreox | July 2019 | Spinout | Yes | Design and rapid generation of libraries of molecules for previously undruggable targets | £835,000 | |

| Machine Discovery | May 2019 | Spinout | Yes | Optimisation codes for several verticals, beginning with nuclear fusion processes | £100,000 | |

| Cristal Health (dba Akriva Health) | May 2019 | Spinout | Yes | Software for the submission, de-identification and sharing of mental health patient records | £3m | |

| Oxford Ionics | April 2019 | Spinout | Yes | Ion traps based quantum computing | £180,000 | |

| MiroBio | April 2019 | Spinout | Yes | Therapeutic antibodies for treatment of inflamation of cancer | £31m | |

| Rogue Interrobang | March 2019 | Social venture | Dormant | Strategy gaming and consultancy | £100 | |

| Oxford Immune Algorithmics | April 2019 | Startup | Yes | Portable blood monitoring device, backup app and database | £5.3m | |

| Asymmetric Suzuki Reactions | March 2019 | Spinout | Yes | Working with pharmaceutical and agrochemical companies to synthesise molecules | £65,000 | |

| Greater Change | March 2019 | Startup | Yes | Fundraising for homeless people | ||

| Oxford Brain Diagnostics | April 2019 | Spinout | Yes | Software for differential diagnosis of cognitive diseases | £2.2m | |

| CareCompare Services | December 2018 | Startup | Yes | App that connects patients and families with care providers | ||

| Oxstem Beta | December 2018 | Startup | No | In liquidation as of May 2021 | Therapies to stimulate formation of new beta cells in the pancreas to restore functional beta cells in people with diabetes | £1,500 |

| Oxstem Immuno | December 2018 | Spinout | No | In liquidation as of May 2021 | Therapies to induce tissue repair for chronic wounds and a range of inflammatory conditions | £1,500 |

| Cortex Organics | December 2018 | Spinout | Yes | Scalable producton of cannabidiol | £15,000 | |

| Sophia Oxford UK | November 2018 | Social venture | Dormant | Non-profit accrediting businesses that bring their workforce out of multidimensional poverty | ||

| Macrophox | October 2018 | Spinout | No | In liquidation as of March 2021 | Cancer cell therapy company | £3.3m |

| Ni2o | October 2018 | Spinout | Yes | Brain implant to treat a variety of diseases | ||

| Hello Display Materials | September 2018 | Spinout | Yes | Light-emitting diodes using perovskite technology; joint spinout with University of Cambridge | £796,500 | |

| Handsup Technologies | August 2018 | Spinout | Yes | AI-based learning support applications; rebranded from Edtopia in May 2021 | £705,000 | |

| Oxford Molecular Biosensors | August 2018 | Spinout | Yes | Bacterial biosensors for detection and quantification of environmental contamination | ||

| PQShield | July 2018 | Spinout | Yes | Quantum computing cypersecurity | £4.5m | |

| Caristo Diagnostics | July 2018 | Spinout | Yes | Biomarker to detect coronary heart disease | £2m | |

| 1715 Labs | July 2018 | Spinout | Yes | Commercialising Zooniverse technology, which powers a citizen science portal | £600,000 | |

| HEXR | June 2018 | Spinout | Yes | 3D-printed personalised helmets | £4.4m | |

| Refeyn | June 2018 | Spinout | Yes | Single molecule mass spectrometer | £4.3m | |

| Oxford HighQ | June 2018 | Spinout | Yes | Sensor technology based on optical microcavities used in scientific instruments and chemical sensors | £2.1m | |

| Oxford Olefins | March 2018 | Spinout | No | Dissolved in June 2019 | Developing novel catalyst process and route to high value internal olefins | |

| SugarOx | March 2018 | Spinout | Yes | Crop stimulant | ||

| PepGen | March 2018 | Spinout | Yes | Drug delivery platform technology | $157.5m | |

| Odqa Renewable Energy Technologies | February 2018 | Spinout | Yes | Geothermal technologies | £775,500 | |

| Latent Logic | February 2018 | Spinout | Yes | Acquired by Waymo in December 2019, now incorporated as Waymo UK | Machine learning technology for autonomous vehicles and traffic modeling | £2.2m |

| DeepReason.ai | January 2018 | Spinout | Yes | Fast and intelligent reasoning using public or private datasets | ||

| PalaeoPi | January 2018 | Spinout | Yes | Low cost three dimensional imagine of museum artifacts | ||

| Oxford Sustainable Fuels | January 2018 | Spinout | Yes | Catalyst production and processes for upgrading pyrolysis oil to high octane gasoline | £1m | |

| VeriVin | December 2017 | Startup | Yes | Through-barrier Raman spectrometer to identify and classify complex liquids in sealed containers | £300,000 | |

| Theolytics | December 2017 | Spinout | Yes | Developing libraries of synthetic oncolytic viruses, with an initial focus on myeloma | £5m | |

| BreatheOx | November 2017 | Spinout | Yes | Development of asthma monitoring system | ||

| Brill Power | November 2017 | Spinout | Yes | Electical and software controls for lithium ion battery storage | £3.3m | |

| 6D.ai | October 2017 | Spinout | Defunct | Acquired by Niantic in March 2020, application for company dissolution filed in September 2021 | AR/VR platform technology for the software industry | £2.2m |

| MOA Technology | October 2017 | Spinout | Yes | Screening and discovery of herbicides | £8.3m | |

| Opsydia | September 2017 | Spinout | Yes | Laser fabrication in diamond structures | £1.9m | |

| Quantum Motion Technologies | August 2017 | Spinout | Yes | Silicon-based quantum computer | £9.5m | |

| Alloyed | July 2017 | Spinout | Yes | Alloy by design; rebranded from Oxmet in October 2020 | £22.7m | |

| InkPath | July 2017 | Spinout | Yes | Career development software platform | £1.1m | |

| Ufonia | July 2017 | Startup | Yes | Smart voice assistant for healthcare | ||

| Oxtractor | July 2017 | Startup | Yes | Artificial intelligence for social media marketing | ||

| Oxford Quantum Circuits | June 2017 | Spinout | Yes | Super conductors for quantum computers | £2m | |

| Cycle.Land | June 2017 | Startup | Yes | Bike sharing scheme | £552,000 | |

| Ultromics | May 2017 | Spinout | Yes | Automated detection of cardiovascular diseases | $59.1m | |

| Scenic Biotech | March 2017 | Spinout | Yes | Cell sequencing technology platform | €6.5m | |

| Oxford Semantic Technologies | March 2017 | Spinout | Yes | Machine learning technology to run complex queries on disparate data sources | £4.1m | |

| Fungry | March 2017 | Startup | No | Dissolved in May 2019 | Food purchasing and delivery platform | |

| SpyBiotech | March 2017 | Spinout | Yes | Platform for vaccine candidate development | $39m | |

| ProMapp | March 2017 | Spinout | Yes | Acquired by Nintex in July 2018 | Health outcomes | £150,000 |

| Oxonomy | February 2017 | Spinout | No | Dissolved in September 2020 | Maritime trade and transport simulation | |

| Covatic | January 2017 | Spinout | Yes | Personalisation engine built for the BBC | £2.9m | |

| SunReign | December 2016 | Startup | Yes | Marketplace for solar energy | £30,000 | |

| Metaboards | December 2016 | Spinout | Yes | Ubiquitous wireless power and data using metamaterials | £5.2m | |

| Oxford VR | December 2016 | Spinout | Yes | VR software to help treat phobias | £14.3m | |

| Oxstem Cardio | November 2016 | Spinout | No | In liquidation as of May 2021 | Regenerative medicines for age-related cardiovascular diseases | |

| Enzbond | November 2016 | Spinout | Yes | Software to predict enzyme function | £1.7m | |

| Proxisense | October 2016 | Spinout | Yes | Blade tip timing instrumentation | £3.2m | |

| Circadian Therapeutics | September 2016 | Spinout | Yes | Therapeutics and diagnostics for the treatment of sleep and circadian rhythm disruption | £6.4m | |

| Iota Sciences | September 2016 | Spinout | Yes | Microfluidics technology | £9m | |

| Flying Fish Research | August 2016 | Startup | No | Dissolved in December 2018 | Market research analysis | |

| Oxstem Ocular | August 2016 | Spinout | No | In liquidation as of May 2021 | Regenerative medicines for age-related diseases | £2.4m |

| Oxstem Neuro | August 2016 | Spinout | No | In liquidation as of May 2021 | Regenerative medicines for age-related diseases | £3.6m |

| Osler Diagnostics | June 2016 | Spinout | Yes | Technology to follow levels of analytes in biological liquids | £69.4m | |

| OxSight | June 2016 | Spinout | Yes | Glasses to assist the visually impaired | £7.3m | |

| SwitchThat | May 2016 | Startup | Yes | Boiler monitoring app | ||

| Oxford NanoImaging | May 2016 | Spinout | Yes | Super-resolution microscopes | £26.5m | |

| Oxstem Oncology | May 2016 | Spinout | No | In liquidation as of May 2021 | Regenerative medicines for age-related diseases | £3.6m |

| Oxstem | May 2016 | Spinout | Yes | Regenerative medicines for age-related diseases | £17.5m | |

| Newton Labs | May 2016 | Startup | Yes | Dissolved in the UK in September 2018 but incorporated in the US, where it continues to operate, in March 2018 | Cloud-based tools for recruitment | $400,000 |

| Evox Therapeutics | April 2016 | Spinout | Yes | Biotherapeutics for a range of severe diseases | £114.7m | |

| Argonaut Therapeutics | April 2016 | Spinout | Yes | Precision medicine for cancer | £5.2m | |

| Omass Therapeutics | March 2016 | Spinout | Yes | Mass Spectrometry | £42.5m | |

| Vaccitech | March 2016 | Spinout | Yes | Listed on Nasdaq in April 2021 following a $110m IPO | Vaccine development | $216.4m |

| Diffblue | March 2016 | Spinout | Yes | Software code validation | £18.9m | |

| Mind Foundry | February 2016 | Spinout | Yes | Big data analytics | £14.8m | |

| Zegami | January 2016 | Spinout | Yes | Software, data query and visualisation tools | £4m | |

| Oxford Endovascular | December 2015 | Spinout | Yes | Flow-diverter for the treatment of intracranial aneurysms | £12m | |

| Navenio | December 2015 | Spinout | Yes | GPS-free navigation | £20.2m | |

| T-Cypher Bio | November 2015 | Spinout | Yes | Drug discovery platform; rebranded from Orbit Discovery in November 2020 | £14.1m | |

| Bodle Technologies | November 2015 | Spinout | Yes | Display technology using ultra-thin films | £8.8m | |

| Sonosine | October 2015 | Spinout | Yes | Electromagnetic acoustic imaging; rebranded from Oxford Enhanced Medical in January 2021 | £2m | |

| Oxford Flow | September 2015 | Spinout | Yes | Pressure flow regulator | £13.3m | |

| Gyana | September 2015 | Startup | Yes | AI-based data science software | £4.9m | |

| Xerion Healthcare | August 2015 | Spinout | Yes | Nanoparticle-augmented radiotherapy technology | £3.5m | |

| iOx Therapeutics | July 2015 | Spinout | Yes | Cancer therapeutics | £3.2m | |

| Total Mama | April 2015 | Startup | Yes | Healthcare service for women before, during and after pregnancy | £50,400 | |

| Evershelf | April 2015 | Startup | No | Dissolved in September 2020 | Cataloguing software for CDs, DVDs and vinyl | |

| Mixergy | April 2015 | Spinout | Yes | Smart water boiler | £5.5m | |

| Animal Dynamics | April 2015 | Spinout | Yes | Biology-inspired design of military drones | £7.7m | |

| UniQreate | March 2015 | Startup | Dormant | Adaptive and self-learning data extraction | ||

| Prolific Academic | March 2015 | Startup | Yes | Subsidiary of US-based Prolific Technologies | Participant recruitment for online surveys | £937,500 |

| Wrapidity | February 2015 | Spinout | No | Acquired by Meltwater in February 2017 and dissolved in March 2020 | Web data extraction | |

| Weird Science | January 2015 | Startup | Yes | VR/AR tools for STEM subjects | ||

| Singular Intelligence | December 2014 | Startup | Yes | AI-based decision automation for retail and consumer goods | £237,000 | |

| BibliU | December 2014 | Startup | Yes | Online textbook platform | £12m | |

| PNLP | December 2014 | Startup | Yes | Sports insights sourced through social media | ||

| Oxbotica | October 2014 | Spinout | Yes | Autonomous vehicle software | £65.6m | |

| Deontics | August 2014 | Spinout | Yes | Evidence-based clinical decisions | £2.8m | |

| QXR Research Co A2 | July 2014 | Startup | Defunct | Originally known as Oxford Biochronometrics, defunct as of January 2020 | Digital fraud protection | |

| Starticles | June 2014 | Startup | No | Dissolved in January 2016 | Knowledge showcasing platform | |

| OxSyBio | April 2014 | Spinout | Yes | Tissue engineering | £11m | |

| Designer Carbon Materials | April 2014 | Spinout | Yes | Nanomaterials for applications including energy harvesting and biosensors | £252,000 | |

| Edspire | March 2014 | Startup | No | Dissolved in January 2017 | Online learning resources search engine | |

| Genomics | March 2014 | Spinout | Yes | Genome analytics | £66m | |

| OxCept | January 2014 | Spinout | No | Dissolved in August 2017 | Cybersecurity | £580,000 |

| OxSonics | January 2014 | Spinout | Yes | Ultrasound medical device | £28.8m | |

| Nightstar Therapeutics | January 2014 | Spinout | Yes | Listed on Nasdaq in October 2017 following a $75m IPO, acquired by Biogen in March 2019 for $877m | Gene therapy for rare, inherited diseases | $95.5m |

| Oxford Mestar | December 2013 | Spinout | Yes | Translational and regenerative medicine | £2.1m | |

| MuOx | November 2013 | Spinout | Dormant | Acquired by Summit Therapeutics in November 2013, licensing agreement with OUI terminated in March 2019 | Treatment for Duchenne muscular dystrophy | |

| Oxford Biotrans | September 2013 | Spinout | Yes | Specialty chemistry | £7m | |

| Okurso Social Technologies | June 2013 | Startup | No | Dissolved in September 2015 | Lead generation by tapping into web and social media | |

| Perspectum | April 2013 | Spinout | Yes | Filed for a $75m IPO in July 2021 but withdrew in August 2021 | Medical imaging for liver diease | £48.3m |

| Esplorio | January 2013 | Startup | Yes | Travel diary app | £643,000 | |

| Run3D | December 2012 | Spinout | Yes | 3D motion analysis | £480,000 | |

| Brainomix | December 2012 | Startup | Yes | Medical imaging software to analyse CT scans of stroke patients | £9.7m | |

| OxiWay | November 2012 | Startup | Yes | Recruitment software to scale the hiring process and remove unconscious bias | £464,000 | |

| Onfido | October 2012 | Startup | Yes | AI-based identity verification | £152m | |

| Oxford Vacmedix | September 2012 | Spinout | Yes | Cancer vaccine development | £9.5m | |

| OxeHealth | August 2012 | Spinout | Yes | Medical device to detect pulse and breathing rate remotely | £29.5m | |

| Intelligent Ultrasound | July 2012 | Spinout | Yes | Acquired by Medaphor in September 2017 for £3.6m, Medaphor changed its name to Intelligent Ultrasound Group in January 2019 | Software to improve medical ultrasound imaging | £2.6m |

| Active Inspiration Technologies (dba Fuell) | July 2012 | Startup | No | In liquidation as of March 2020 | Digital health platform for employees | £2.1m |

| Colwiz | May 2012 | Startup | Yes | Acquired by Taylor & Francis Group in May 2017 | Research management, collaboration and productivity platform | £1.5m |

| Oxgeos | March 2012 | Startup | Yes | Geo-social games, community and advertising platform | ||

| TheySay | December 2011 | Startup | Yes | Acquired by Aptean in January 2018 | Deep learning platform to detect a user’s sentiment | £2.3m |

| Oxford Cancer Biomarkers | December 2011 | Spinout | Yes | Colorectal cancer biomarker tests | £11.3m | |

| Pilio | November 2011 | Startup | Yes | Energy management software | ||

| Oxford Imaging Detectors | October 2011 | Spinout | No | Dissolved in October 2018 | Electronic microscopes | £250,000 |

| Oxford MultiSpectral | September 2011 | Spinout | Yes | Multispectral digital scanners | £988,000 | |

| Oxtex | July 2011 | Spinout | No | Dissolved in February 2021 | Self-inflating tissue expanders based on hydrogel | £6.8m |

| First Light Fusion | July 2011 | Spinout | Yes | Fusion energy | £44.2m | |

| Cella Energy | January 2011 | Spinout | No | Dissolved in March 2016 | Hydrogen storage technology | £2.7m |

| Oxford PV | November 2010 | Spinout | Yes | Solar cell technology | £108.4m | |

| Ixo Therapeutics | November 2010 | Spinout | No | Dissolved in April 2018 | Immunotherapy | £150,000 |

| Kepler Energy | October 2010 | Spinout | Yes | Tidal turbine energy production | £250,000 | |

| OxEms | June 2010 | Spinout | Yes | The company filed documents as recently as July 2021, but has not updated its website since 2015 and there appears to be no discernible business activity | Electromagnetic tags for underground utility network monitoring | £2m |

| Oxepi | February 2010 | Spinout | No | Dissolved in September 2012 | Epigenetics | £431,000 |

| Yasa | August 2009 | Spinout | Yes | Acquired by Mercedes-Benz for an undisclosed amount in July 2021, concurrently spun out Evolito which will develop the technology for aerospace applications | Electric motors and generators | £49.3m |

| CN Bio-innovations | July 2009 | Spinout | Yes | Microbioreactor technology to improve drug discovery | £19.9m | |

| Oxford Financial Computing | March 2009 | Spinout | No | Dissolved in February 2012 | Algorithms for financial apps | |

| Organox | November 2008 | Spinout | Yes | Organ recovery for transplantation | £28.4m | |

| Maple Tree Energy | November 2008 | Spinout | Yes | Now incorporated as Trust Power, doing business as Loop Energy Saver | Smart energy meter platform | £6.9m |

| Oxford Emergent TB Consortium | July 2008 | Spinout | No | Dissolved in July 2015 | Tuberculosis vaccine developer | £4m |

| Semmle | March 2008 | Spinout | Yes | Acquired by GitHub in September 2019, now incorporated as GitHub Software UK | Software engineering analytics platform | £7.7m |

| Crysalin | June 2007 | Spinout | Yes | Crystal structure determination | £4.5m | |

| Oxford BioDynamics | June 2007 | Spinout | Yes | Listed on Aim in December 2016, raising £20m in its IPO | Chromosome fingerprinting | £15.7m |

| Clinox | June 2007 | Spinout | No | Dissolved in August 2013 | Development, conducting and analysis of early-stage clinical trials in oncology | |

| Fuel 3D Technologies | February 2007 | Spinout | Yes | Handheld 3D scanner | £34.1m | |

| Alcolizer Technology UK | November 2006 | Spinout | Yes | Drug testing | £2.8m | |

| Cytox | October 2006 | Spinout | Yes | Alzheimer’s diagnostic | £12.9m | |

| Oxford Advanced Surfaces | September 2006 | Spinout | Yes | Advanced coatings for polymers | £4.7m | |

| Aurox | July 2006 | Spinout | Yes | Microscopy | ||

| Particle Therapeutics | June 2006 | Spinout | Yes | Needle-less injection | £1.6m | |

| Oxford Medistress | April 2006 | Spinout | Yes | Stress diagnostic | £2.2m | |

| TDeltaS | March 2006 | Spinout | Yes | Diet biochemistry | £15m | |

| Velocys | December 2005 | Spinout | Yes | Incorporated as Oxford Catalysts Group, acquired Velocys in November 2008 and listed on Aim | Catalysts for gas-to-liquid and liquid hydrogen | £1.5m |

| Celleron Therapeutics | November 2005 | Spinout | Yes | Cancer therapeutics | £12.1m | |

| Oxbridge Pulsar Sources | September 2005 | Spinout | Yes | Secure communications | £25,000 | |

| Salunda | June 2005 | Spinout | Yes | Industrial solid state sensors | £9.6m | |

| Oxford Nanopore Technologies | May 2005 | Spinout | Yes | Listed on LSE in September 2021 following £350m IPO | Lab-on-a-chip | £805m |

| EKB Technology | December 2004 | Spinout | No | Dissolved in July 2012 | Bioprocessing to produce and recover chemicals in a single step | £375,000 |

| Surface Therapeutics | November 2004 | Spinout | No | Acquired by Serentis in October 2007, Serentis was dissolved in December 2011 | Treatments for inflammatory epithelial diseases | £1.5m |

| G-Nostics | June 2004 | Spinout | No | Dissolved in May 2012 | Anti-smoking diagnostics | £250,000 |

| Avacta | June 2004 | Spinout | Yes | Breath analysis | £396,000 | |

| Oxford Consultants for Social Inclusion | August 2003 | Spinout | Yes | Data analytics for socio-economic research | £40,000 | |

| Riotech Pharmaceuticals | July 2003 | Spinout | Yes | Hepatitis drug development | £1.3m | |

| ReOx | May 2003 | Spinout | Yes | Drugs controlling the activity of hypoxia inducible factor | £2m | |

| Summit Therapeutics | February 2003 | Spinout | Yes | Listed on Nasdaq in 2015 following $34m IPO | Chemical genomics | £24.1m |

| BioAnaLab | November 2002 | Spinout | No | Acquired by Millipore in January 2009, Millipore itself bought by Merck Group in 2010, before BioAnaLab was dissolved in August 2013 | Biopharmaceutical testing | £1m |

| Oxford Risk Research and Analysis | November 2002 | Spinout | Yes | Risk analysis | £470,000 | |

| Oxford Immunotec | October 2002 | Spinout | Yes | Listed on Nasdaq in 2013 following $74m IPO, sold its US laboratory services to Quest for $170m in 2018 | T cell measurement technology, including a test to diagnose latent tuberculosis infection and disease | £66.2m |

| Oxitec | August 2002 | Spinout | Yes | Acquired by Intrexon for $160m in August 2015 | Environmentally-friendly insect pest control | £28.7m |

| Glycoform | August 2002 | Spinout | No | Dissolved in April 2012 | Glycosolation technology | £5.8m |

| Zyentia | May 2002 | Spinout | No | Dissolved in March 2010 | Modification of proteins | £2.9m |

| Oxford Biomaterials | March 2002 | Spinout | Yes | Biomimetic spinning of fibres | £490,000 | |

| Minervation | February 2002 | Spinout | Yes | Healthcare consultancy | £16,000 | |

| Pharminox | January 2002 | Spinout | No | Dissolved in April 2019 | Anti-cancer drugs | £6.1m |

| Oxford Drug Design | December 2001 | Spinout | Yes | Computer-aided drug discovery | £7.5m | |

| NaturalMotion | November 2001 | Spinout | Yes | Acquired by Zynga for $527m in February 2014 | Interactive character animation | £19.3m |

| Oxford Archdigital | June 2001 | Spinout | No | Dissolved in June 2009 | Development of archaelogical-based IT applications | £150,000 |

| Novarc | April 2001 | Spinout | No | Dissolved in March 2006 | Automotive components | £1.5m |

| Oxford Ancestors | April 2001 | Spinout | Yes | Genetic genealogy | ||

| Oxford Bee Company | March 2001 | Spinout | No | Dissolved in September 2008 | Pollination | £335,000 |

| OxLoc | March 2001 | Spinout | No | Dissolved in March 2010 | Tracking devices | £2.8m |

| PharmaDM | December 2000 | Spinout | Unknown | Also incorporated research from University of Aberystwyth and KU Leuven, the latter now maintains and distributes PharmaDM’s software. There are no records for PharmaDM in Belgium’s official company register. | Drug design software | £400,000 |

| TolerRx | December 2000 | Spinout | No | Dissolved in October 2011 | T cell therapies for autoimmune diseases, diabetes and cancer | $150m |

| Oxford Biosensors | August 2000 | Spinout | No | Dissolved after entering administration in June 2009 | Biosensors | £9.7m |

| Mirada Solutions | June 2000 | Spinout | Yes | Acquired by CTI Molecular Imaging for $22m in 2003, in turn acquired by Siemens in 2005, before Mirada CEO led a buyout in 2008 and formed Mirada Medical | Medical imaging software | £200,000 (Mirada Solutions); £10.5m (Mirada Medical) |

| OBS Medical | May 2000 | Spinout | Yes | Vigilance monitoring systems | £26.9m | |

| MindWeavers | April 2000 | Spinout | No | Dissolved in September 2014 | Sensory and motor training technology | £935,000 |

| Sychron | January 2000 | Spinout | No | Dissolved in 2005 | Software to develop policy-driven data centre management solutions | |

| ThirdPhase | January 2000 | Spinout | Yes | Merged with CMED Group in 2005 and rebranded to CMED Technology | Clinical trials management | £613,000 |

| Omia | December 1999 | Spinout | No | Merged with Oxiva in 2001 to become Mirada Solutions, acquired by CTI Molecular Imaging in 2003, in turn acquired by Siemens Medical in 2005 | Image analysis for measuring heart motion | |

| AuC Sensing | August 1999 | Spinout | No | Dissolved in November 2008 | Sensor development | £15,000 |

| Oxonica | August 1999 | Spinout | Yes | Listed on Aim in July 2005, raising £7.1m in its IPO, delisted in August 2009 and re-registered as a limited company in February 2011 | Nanotechnology for UV protection, security and biodiagnostics | £5.1m |

| Dash Technologies | June 1999 | Spinout | No | Merged with Celoxica (then Embedded Solutions) in 2000, Dash became dormant in 2007 and was dissolved in May 2010 | Parallel hardware and software design | £500,000 |

| Oxxon Therapeutics | June 1999 | Spinout | Dormant | Acquired by Oxford Biomedica in 2007 for £16m, dormant since 2008 | Immunotherapies for chronic infectious diseases and cancer | £21m |

| Avidex | March 1999 | Spinout | No | Acquired by Medigene for €50m in September 2006, Medigene subsequently spun out Immunocore and Adaptimmune to commercialise different aspects of Avidex in 2008. Avidex was dissolved in December 2012. Adaptimmune completed a $175m IPO in May 2015, followed by Immunocore’s $258m IPO in February 2021. | T cell receptor technology | £33.1m |

| Sense Proteomics | November 1998 | Spinout | No | Acquired by Oxford Gene Technology in 2009, in turn acquired by Symex in 2017 | Autoantibody biomarkers for cancer and autoimmune diseases | £4.2m |

| Celoxica | November 1998 | Spinout | Yes | Ultra-low latency data access for electronic trading | £28.2m | |

| Promic | June 1998 | Spinout | No | Acquired by Biota for £6.4m in 2009, dissolved in October 2015 | Antibiotics | £21.4m |

| Synaptica | March 1998 | Spinout | No | Dissolved in August 2021 | Neurodegenerative diseases | £6m |

| Opsys | February 1998 | Spinout | No | Acquired by Cambridge Display Technology in 2002, in turn acquired by Sumitomo Chemical in 2007, before Opsys was dissolved in August 2013 | Light-emitting materials | £17.4m |

| Synergy Pharmaceuticals | 1998 | Spinout | No | Listed on Nasdaq in 2011 before being saved out of bankruptcy by Bausch Health Companies in a $195m deal in March 2019 | Treatments for gastrointestinal diseases | |

| Oxford Gene Technology | July 1997 | Spinout | Yes | Acquired by Symex in 2017 | DNA technology | |

| Oxagen | April 1997 | Spinout | Yes | Treatments for asthma and chronic allergic and inflammatory conditions | £98.6m | |

| Oxford Biomedica | August 1996 | Spinout | Yes | Listed on Aim in December 1996 following an £11m IPO, before listing on LSE in 2001 | Gene and cell therapies for conditions with a high unmet clinical need, such as ocular and central nervous system disorders | £4.5m |

| PowderJect Pharmaceuticals | October 1994 | Spinout | No | Listed on LSE in 1997, acquired by Chiron Pharmaceuticals for £542m in 2003, in turn acquired by Novartis in 2006 before Chiron was liquidated in June 2014 | Needle-less injection | £3.7m |

| Oxford Asymmetry | April 1992 | Spinout | Yes | Listed on LSE in 1998 before merger with Evotec in 2000 to form Evotec OAI, rebranded to Evotec (UK) in 2005 | Outsourcing for pharmaceutical services | £5.5m |

| Oxford Molecular | August 1989 | Spinout | No | Dissolved in January 2016 | Chemical information management | £28.8m |

| Oxford GlycoSciences | September 1988 | Spinout | No | Listed on LSE following a £30.8m IPO in 1998, before being acquired by Celltech for £101m in 2003, in turn acquired by UCB in 2004 | Biopharmaceutical research and development services | £11.2m |

| Continuum (Entertainment) | October 1986 | Spinout | Yes | Operation of historical sites | ||

| Oxford Lasers | October 1977 | Spinout | Yes | Laser micro-machining tools and high-speed imaging systems | £285,000 | |

| RM | November 1973 | Spinout | Yes | Listed on London Stock Exchange in 1994 | Educational IT services | £4.5m |

| Oxford Instruments | April 1958 | Spinout | Yes | Listed on London Stock Exchange in 1983 | Analytical and superconductivity instruments | £153,000 |

Thierry Heles

Thierry Heles is editor-at-large of Global University Venturing and Global Corporate Venturing, and host of the Beyond the Breakthrough podcast.