Just 249 investments were announced in the last three months of 2022 but the year was still the second-best on record in almost every category.

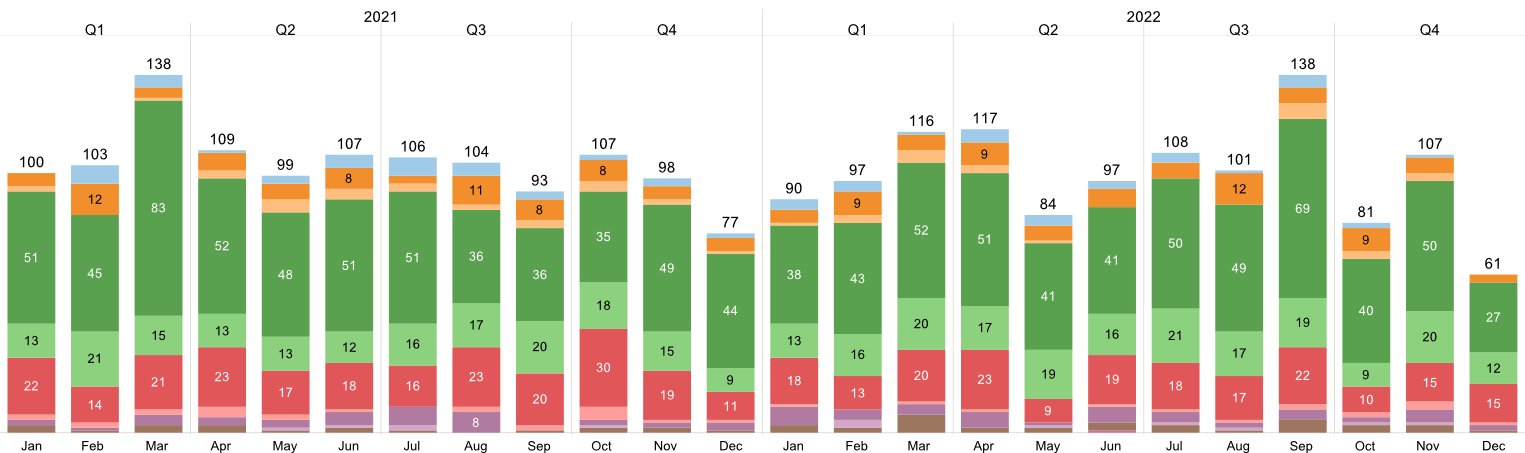

It may seem counter-intuitive to call a 3.5% drop in the number of deals a cause for celebration, but it is in a year that saw venture capital investments overall drop by 25%. A total of 1,197 deals were tracked by GUV in 2022, just 44 fewer than the 1,241 in 2021.

It is worth noting that 2022 was still the second-best year in terms of dealflow since GUV began tracking the sector a decade ago.

Investments

There was a marked slowdown in the final quarter of the year when 249 deals were closed. The drop was most pronounced in December, a month that is typically quieter thanks to the Christmas holidays — even in 2021, there were only 282 in the final quarter, including 77 in December — but this time announcements essentially stopped by December 23 and did not pick up again until early January (which did, however, bring large rounds such as the $140m series C round for University of Oxford’s autonomous vehicle software developer Oxbotica).

November was a strong performer, with 107 deals that were actually an increase year-on-year and above average for 2022. It is also worth noting that September 2022 matched the best month in 2021, March, so this is not a tale of fewer and fewer deals as the year progressed.

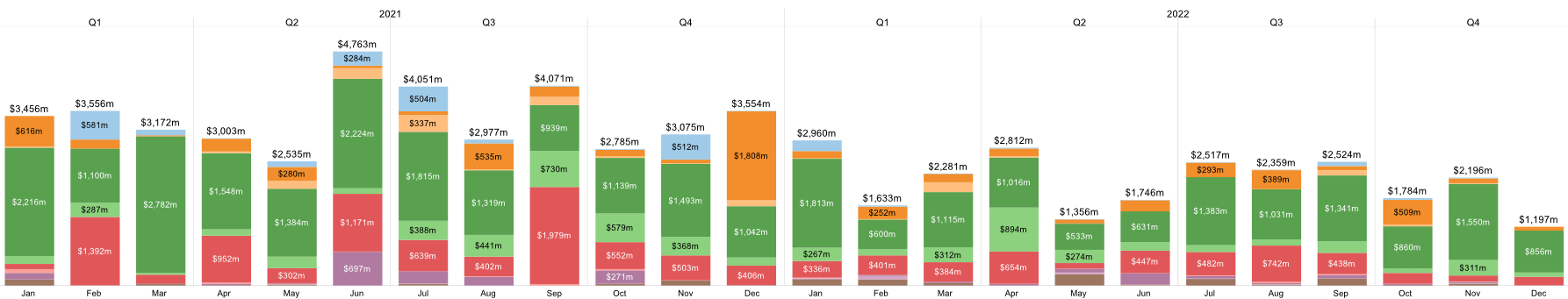

The situation is direr — and more on par with startups overall — when looking at the amount of cash that was put into spinouts, particularly in the fourth quarter: just $5.17bn was invested across the 249 deals. That’s a massive 45% drop year-on-year but hardly surprising given the overall state of venture capital.

And year-on-year, spinouts actually fared slightly better than startups, raising $25.37bn in 2022, down from $41bn in 2021. In other words, a drop of 38% versus the 42% fall in capital invested in all startups.

The decline was most marked in the final quarter of 2022, which saw a 45% drop in the amount of capital invested but that was roughly equal to Q2, which saw a 42.6% drop year-on-year. It was a 32.5% drop for Q1 and a 33.3% difference for Q3.

The relative percentages of round sizes remained surprisingly stable year-on-year and the shift to smaller rounds was not as pronounced as one might expect: 52% of rounds raised in 2022 were worth up to $10m, compared with 49% in 2021, while rounds worth between $10m and $99m made up 43% in 2022 (41% in 2021), and rounds worth more than $100m accounted for 6% in 2022 (10% in 2021).

It is obviously a concern that less VC money is available, but spinouts have proven that investors continue to be happy to back true innovation now that the craze around overvalued, unsustainable businesses like instant grocery delivery services has died down.

And here’s one more positive note: the amount of capital raised by spinouts in 2022 was also the second-most on record.

Monthly investments in spinouts

The biggest winners

Although it is hardly surprising that out of the 10 largest rounds in 2022, seven involved US-based companies, it is interesting that the other three were based in mainland Europe. It challenges to some degree the notion that the UK is the powerhouse and that the EU is lagging behind.

Long-time readers will know that ETH Zurich produces more spinouts than any institution even in the golden triangle in the UK, but this top 10 shows that the Swiss institution’s portfolio can also attract serious capital (and make mainstream headlines): in April, carbon capture technology producer Climeworks raised $646m in a round co-led by Partners Group and GIC, also featuring Baillie Gifford, Carbon Removal Partners, Global Founders Capital, M&G, BigPoint Holding and private investor John Doerr.

TU Munich has reason to celebrate too as it cements its position as one of the most important and successful clusters in Europe: two of its companies, Celonis and Personio, raised nine-figure sums last year.

| Company | Institution | Country | Round | Sector | Size |

|---|---|---|---|---|---|

| Climeworks | ETH Zurich | Switzerland | Undisclosed | Industrial | $646m |

| Form Energy | Massachusetts Institute of Technology | US | E | Energy | $450m |

| Celonis | TU Munich | Germany | D | IT | $400m |

| SeatGeek | Stanford University | US | E | IT | $228m |

| Delfi Diagnostics | Johns Hopkins University | US | B | Health | $225m |

| Orna Therapeutics | Massachusetts Institute of Technology | US | B | Health | $221m |

| Arsenal Biosciences | Parker Institute for Cancer Immunotherapy | US | B | Health | $220m |

| Personio | TU Munich | Germany | E | Services | $200m |

| Cleerly | Cornell University | US | C | Health | $192m |

| Retro Biosciences | Gladstone Institutes | US | Undisclosed | Health | $180m |

Exits

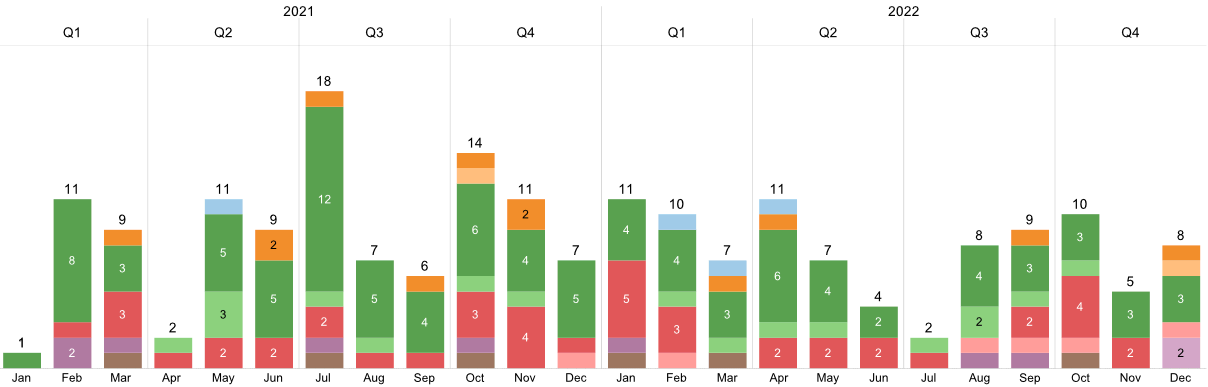

With the dearth of initial public offerings and the SPAC craze long behind us, it’s expected that the number of exits would be down year-on-year: from 106 in 2021 to 92 in 2022. Despite that 13% drop, our red thread re-appears: 2022 was the second-best on record.

And while some may decry the lack of spinouts going public of late, it is heartening that there remains a healthy appetite for spinouts among corporations and that interest remained steady throughout the year notwithstanding the lull in June and July.

That’s the good news.

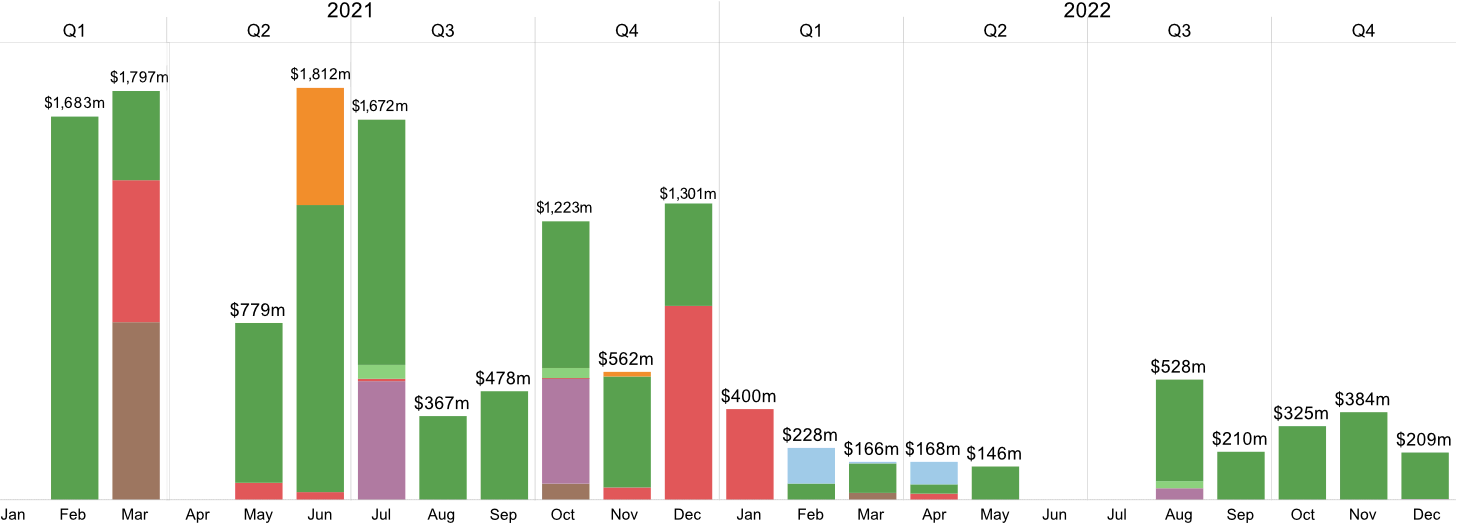

The bad news is that, in terms of money spent on spinouts, 2022 was one of the worst — only 2014 and 2016 had seen less cash made. Just $2.76bn was disclosed and the top 10 largest exits made up nearly 61.8% of that with $1.7bn.

True, many acquisition agreements never disclose the terms. But it’s not far-fetched to assume that those undisclosed amounts wouldn’t shift the needle much, certainly not enough to get close to the $11.67bn generated in 2021.

Monthly exits of spinouts

The UK fared better this time thanks to University of Oxford scoring several wins: two of its portfolio companies, MiroBio and DJS Antibodies, were acquired for nine-figure sums: $405m paid by Gilead Sciences for the former and $255m paid by AbbVie for the latter (though policymakers in Westminster might not be that excited). And the lone initial public offering in the table also went to an Oxford spinout: Pepgen went public in a $108m offering on Nasdaq in May and its shares are trading above its IPO price at $16.77 as of the time of publication (again, one might suspect Westminster would’ve been happier about a listing on the London Stock Exchange).

Oncology company Carisma Therapeutics also went public, but it did so in a more unusual way: through a merger with Nasdaq-listed Seren Bio, a cancer therapy developer and not a special purpose acquisition company. The deal gave the combined entity access to $180m of capital.

Of note too is the fact that a majority of the largest exits happened outside the US, with the Netherlands and the UK both appealing to buyers. Perhaps this isn’t a case of buyers moving to a specific country so much as it is about moving away from the US.

| Company | Institution | Country | Type | Sector | Size |

|---|---|---|---|---|---|

| MiroBio | University of Oxford | UK | Acquisition | Health | $405m |

| Neogene Therapeutics | Netherlands Cancer Institute | Netherlands | Acquisition | Health | $320m |

| DJS Antibodies | University of Oxford | UK | Acquisition | Health | $255m |

| Carisma Therapeutics | University of Pennsylvania | US | Merger | Health | $180m |

| Surgical Innovation Associates | Northwestern University | US | Acquisition | Health | $140m |

| Pepgen | University of Oxford | UK | IPO | Health | $108m |

| Mayht | TU Delft | Netherlands | Acquisition | Consumer | $100m |

| Villaris Therapeutics | University of Massachusetts | US | Acquisition | Health | $70m |

| ACT Genomics | Kyoto University | Taiwan | Acquisition | Health | $65m |

| Purigen Biosystems | Stanford University | US | Acquisition | Health | $64m |

Below you can find links to other parts in our 2022 retrospective, with insights from thought leaders such as Stanford University’s Karin Immergluck, Monash Innovation’s Alastair Hick and UM6P Ventures’ Yasser Biaz.

And for an even more in-depth analysis, keep an eye out next week for our groundbreaking 10-year longitudinal analysis. Spoiler: it’s been a really good decade to have been in the tech transfer business.