The number of corporate-backed funding rounds continued to decline in Q3, but September saw a sharp jump in the value of deals. Large deals are back, too.

Highlights:

- – Deals continued to drop in Q3 (-34% year-on-year) but September figures increased in deal volume relative to previous months and even more so in deal value (up to $16bn);

- – CVC deals declined less than overall VC deals (-34% in deal count and -20% in dollar value for CVC vs a fall of -39% in deal count and -35% in dollar value for VC);

- – The shift to earlier-stage deals continues, but we saw a bit of a rebound in large deals ($100m+);

- – Exit numbers on par with last year’s levels, with three of the top five above $1bn;

- – 60% of corporates that invested in 2022 have so far returned to do another deal in 2023;

- – Corporate-backed fundraising still depressed with just 139 new funding initiatives so far this year.

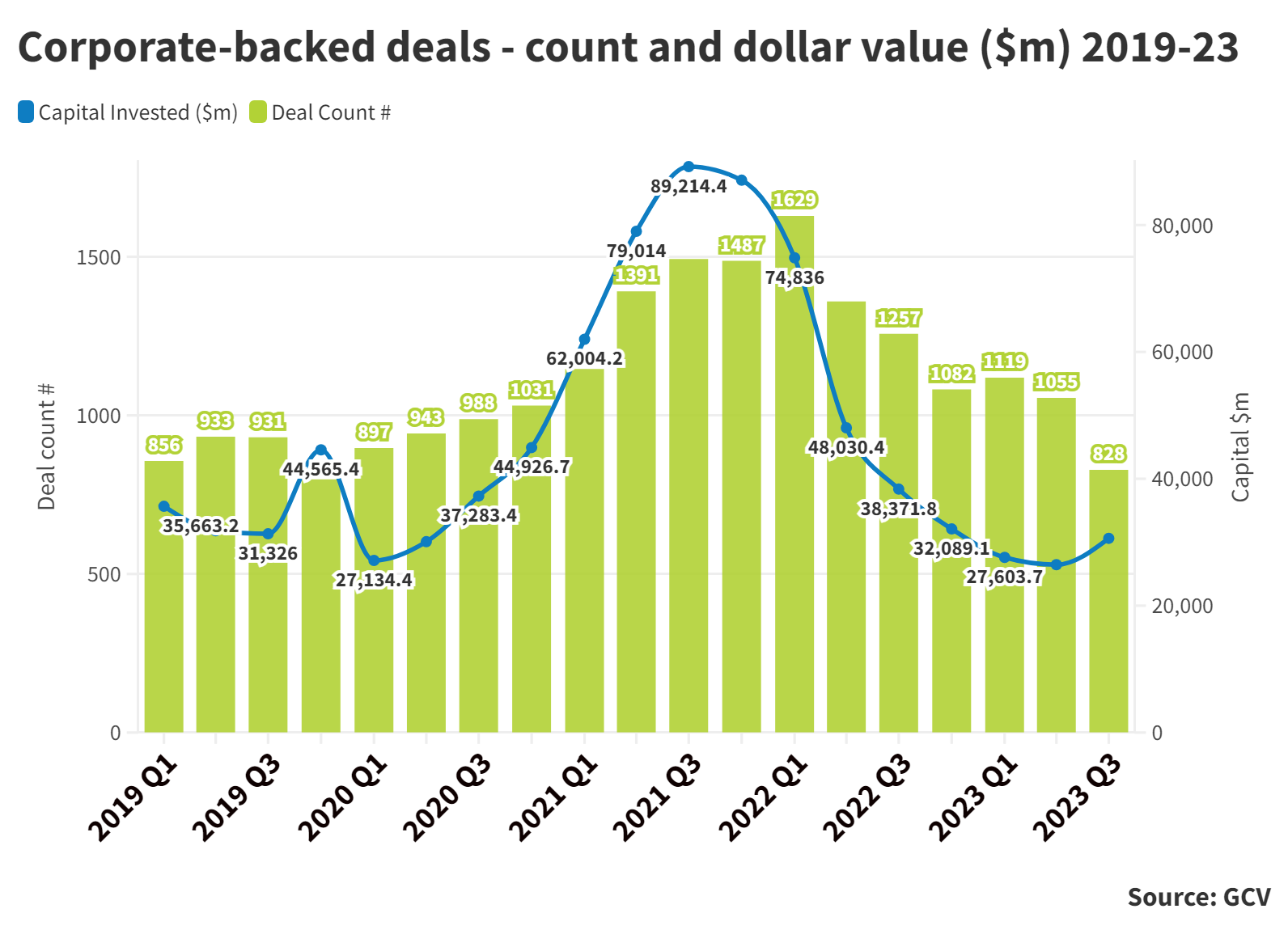

Corporate investors backed a total of 828 funding rounds in the third quarter of 2023, with an estimate cumulative dollar value of $30.62bn. This is a 34% decline from the 1,257 funding rounds that corporate investors backed in Q3 last year and 20% down in dollar terms from the $38.37bn in that period.

It is the lowest quarterly total since the beginning of 2019.

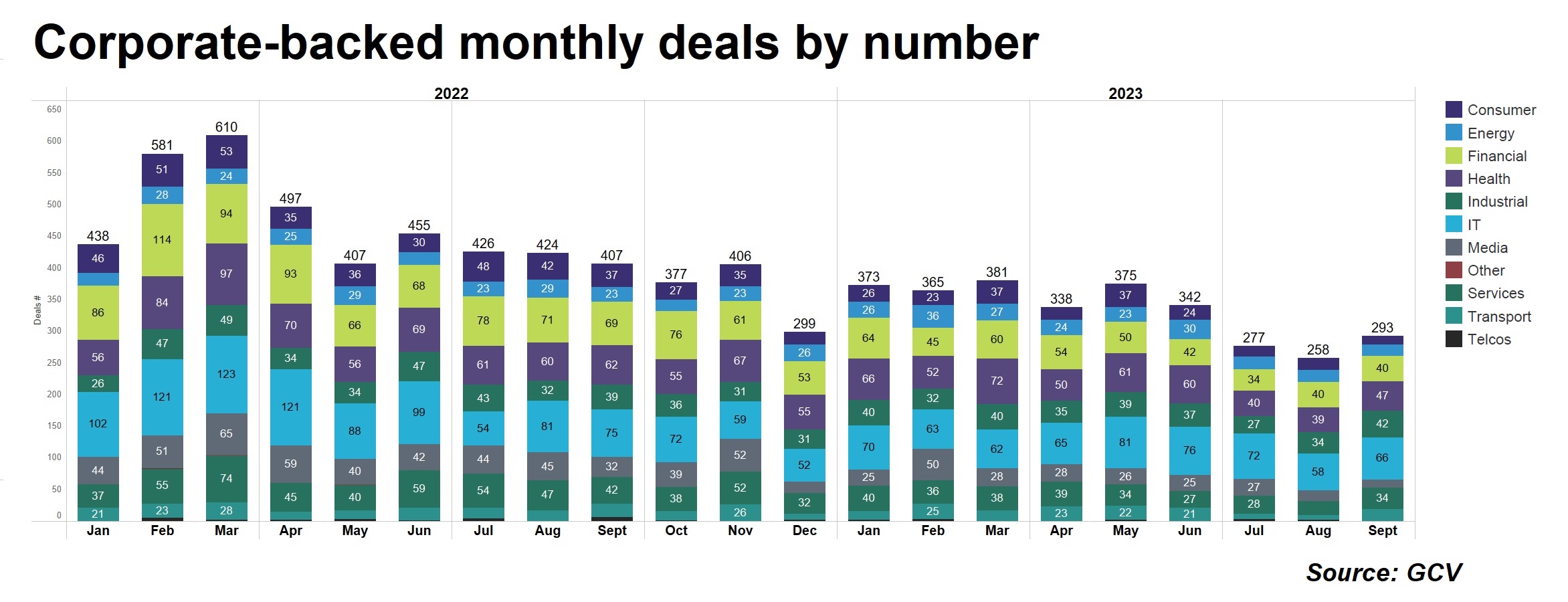

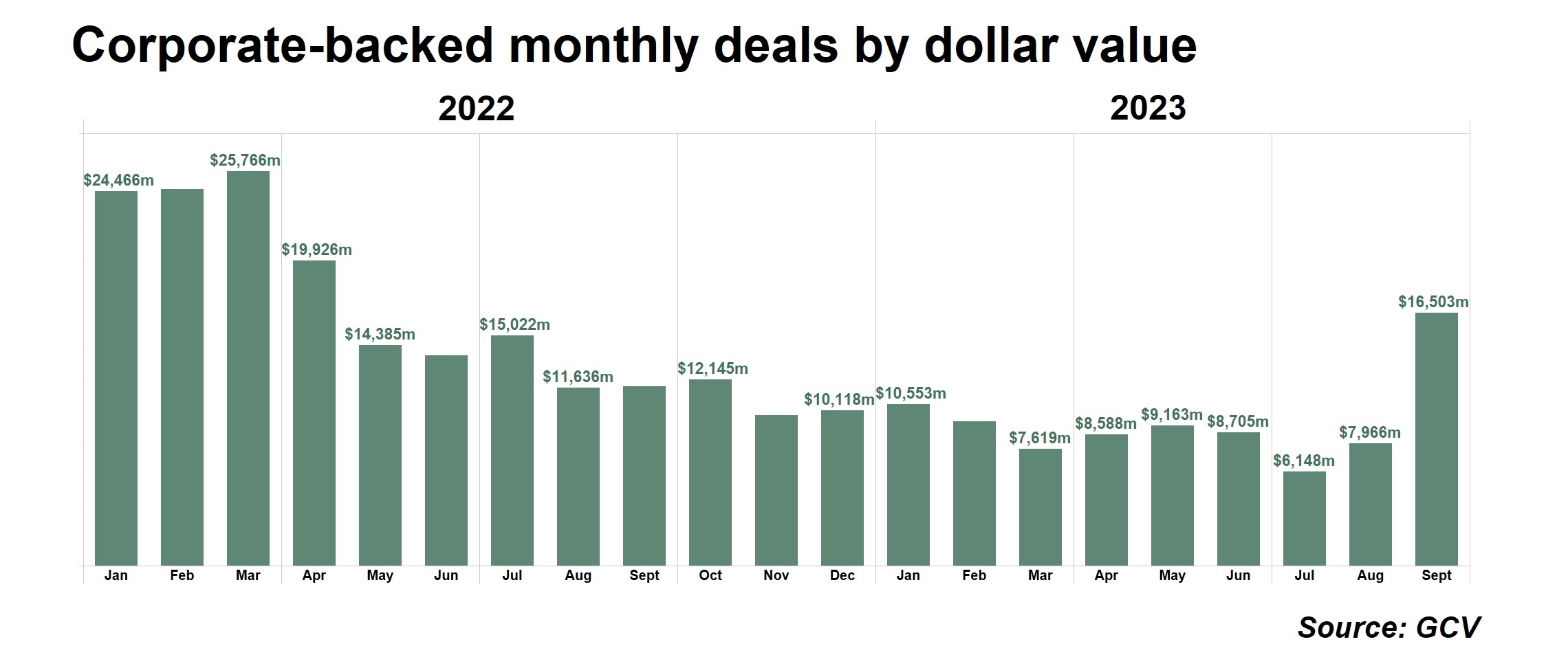

On a monthly basis, however, there were some signs of recovery in September. There was a small rebound in the number of corporate-backed deals (293) compared to the very slow summer months (277 rounds in July and 258 in August).

More importantly, the value of the deals the corporate investors took part in in September jumped sharply, to $16.5bn. Five funding rounds in the quarter were for more than $1bn, and four of those took place in September.

CVC deals decline but less sharply than VC

In the first nine months of 2023, we recorded just 3,002 funding rounds involving corporate venturers, a 29% decline from the 4,245 rounds recorded over the same period last year. The estimated total dollar value of those deals stood at $116.76bn, down 28% from the $161.23bn recorded over the first nine months of 2022.

The third quarter was a continuation of a gradual decline. The deal count is little more than half of the peak quarter – Q1 2022, which registered 1,629 rounds. The dollar value is also a fraction of what quarterly estimated values were back in 2021. In fact, one must go to 2019 and the pre-pandemic period to find comparable numbers.

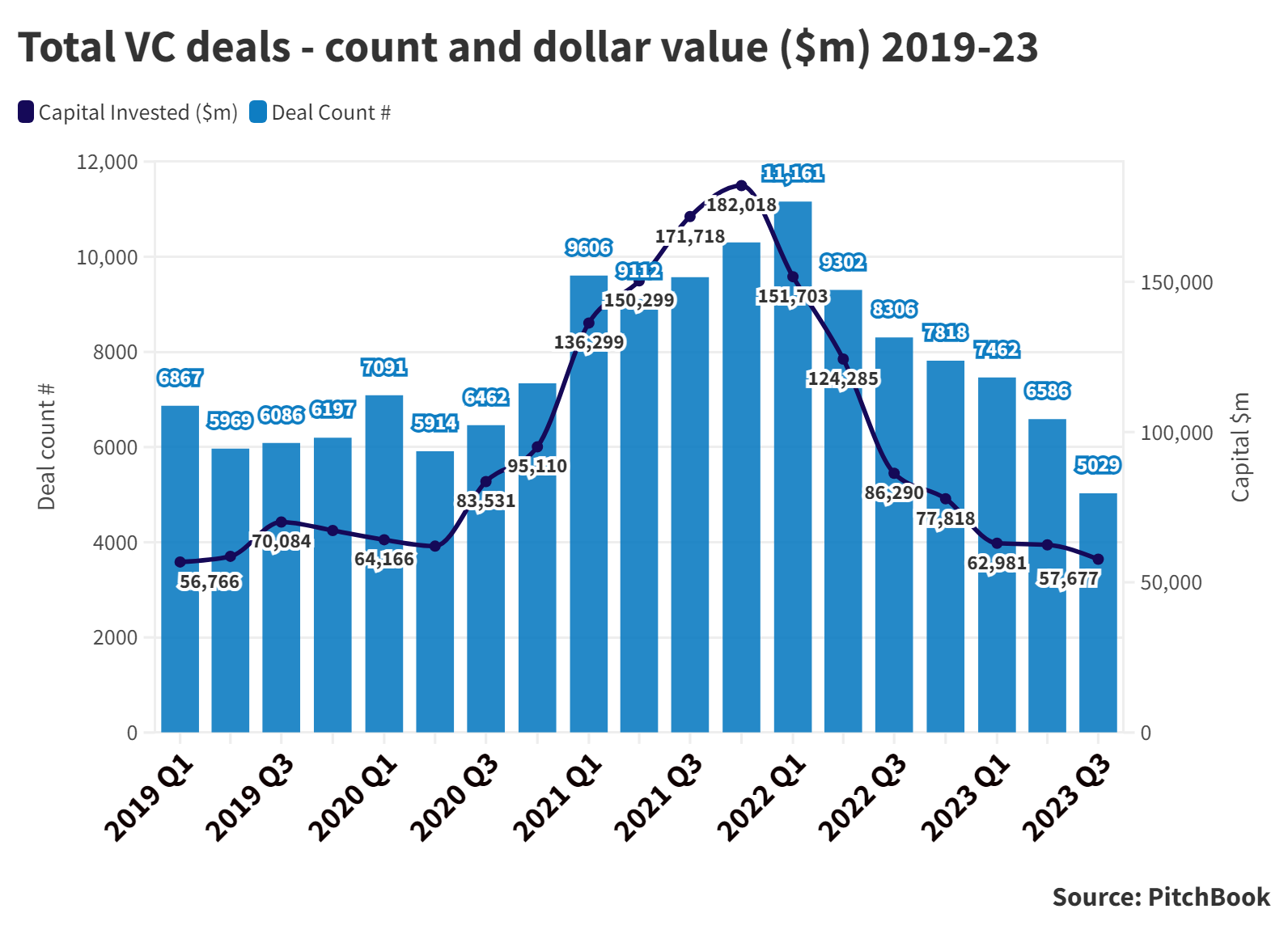

The decline in the overall VC market, however, was even more pronounced. PitchBook counted a total of 5,029 VC-backed rounds in Q3 and total dollar value was estimated at $57.68bn. This was down 39% in terms of deal count (8,306) and 33% in dollar value terms ($86.29bn) from same quarter last year.

According to PitchBook’s data, there were 19,077 VC investments around the globe in the first nine months of 2023, down 34% from 28,769 deals over same period of 2022.

In total dollar terms, the drop in the VC market was also notable. PitchBook recorded $183.1bn of total capital in the first three quarters this year, down 49% from the $362.28bn during the same months of 2022.

Shift to smaller and earlier deals

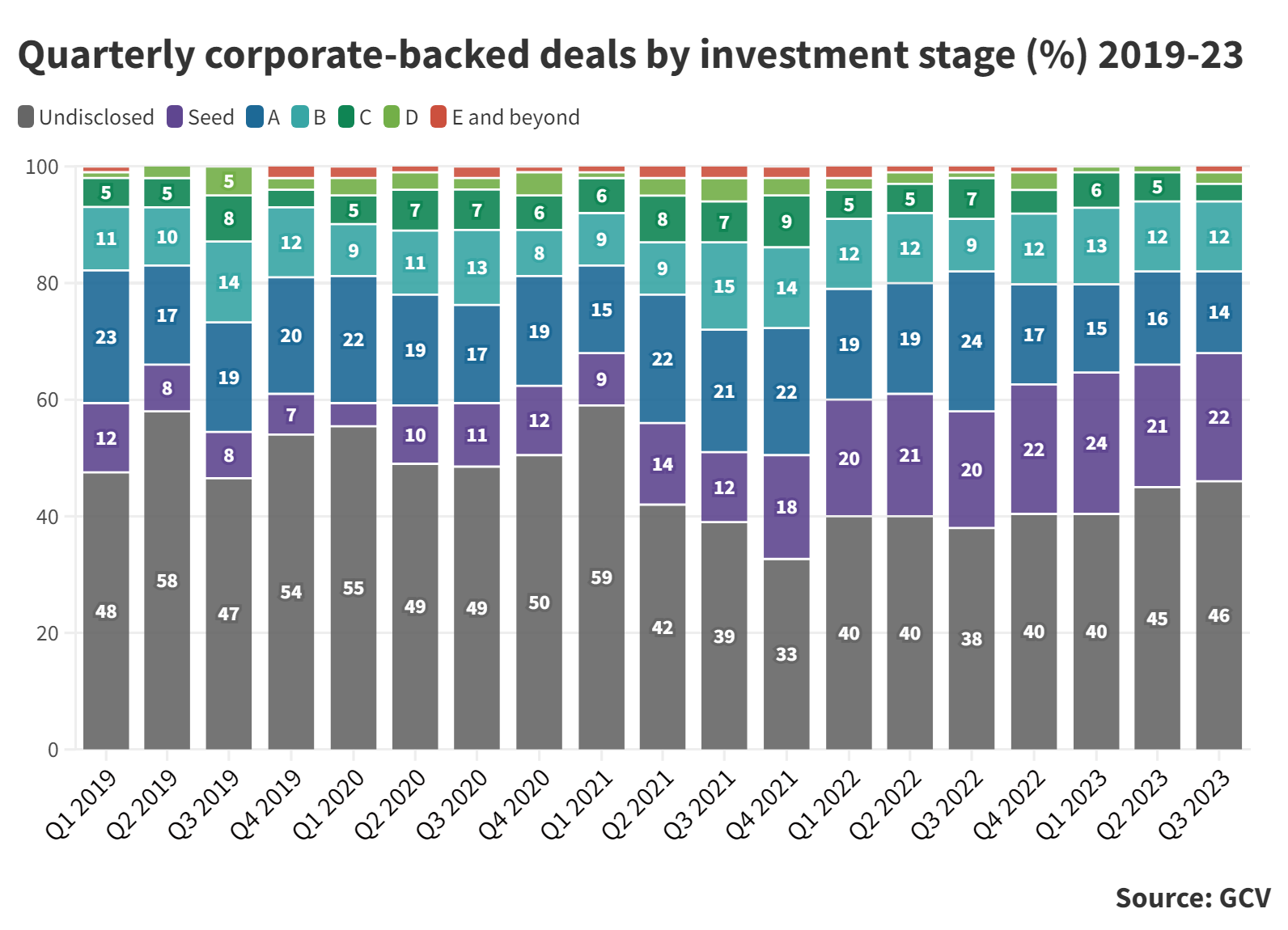

We have continued to see a trend towards corporate investing in early-stage deals. Seed funding rounds made up between 22% and 24% of all the corporate-backed startup funding rounds we counted in the first nine months of the year. That compares with between 7% and 12% of deals back in 2019. The growth of seed stage funding rounds began last year but only seems to have strengthened in 2023.

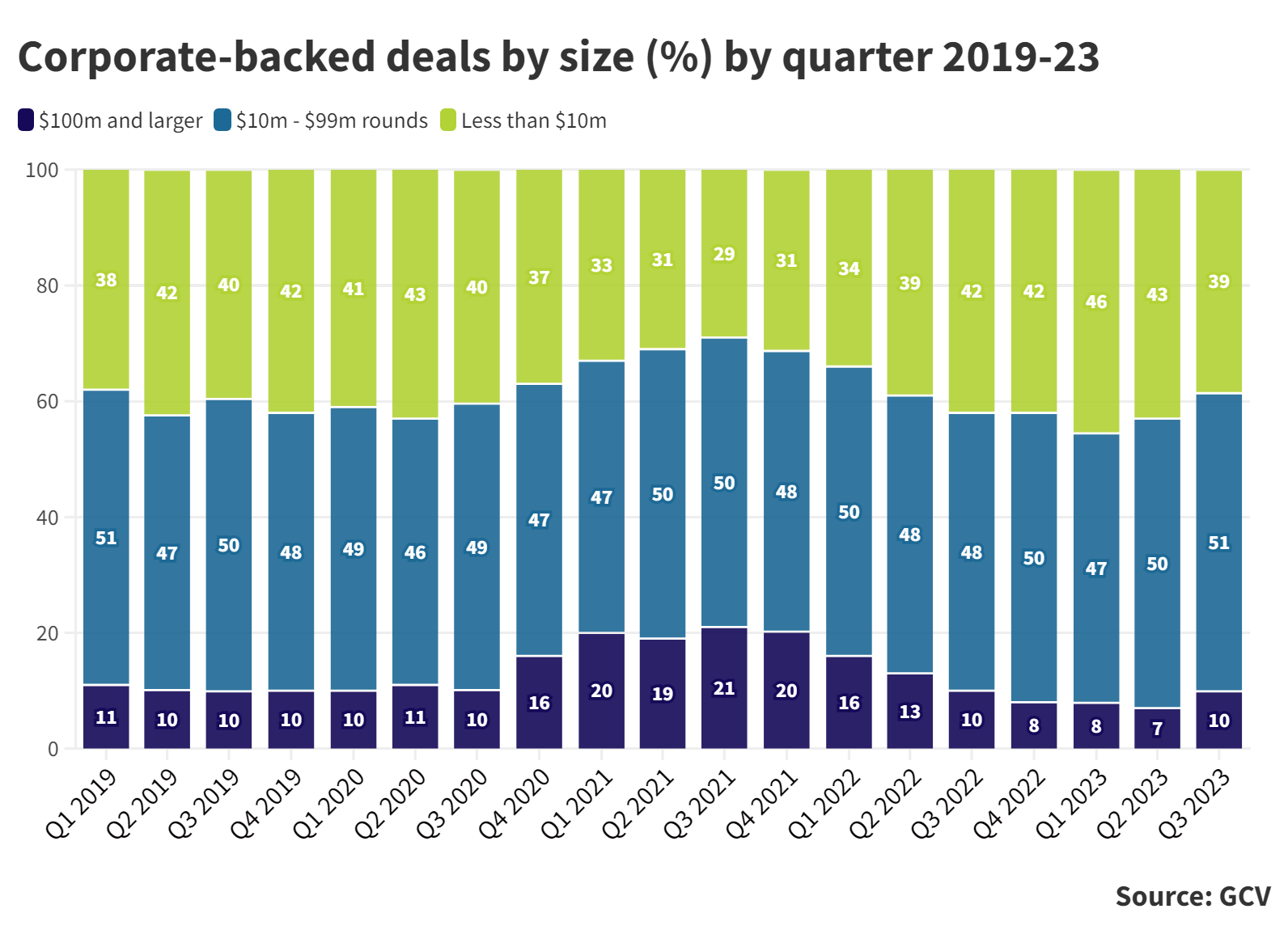

In general, corporate investors have been migrating to smaller deals over the two years. The relative share of large deals, above $100m in size, continued shrinking until Q2 2023 to just 7% of total deals. These have been giving way to small ones ($10m or less) that now constitute an estimated 43% of corporate deals with disclosed size by Q2.

This trend may have begun to potentially reverse in Q3. The share of large deals bounced back to 10% in Q3 at the expense of smaller deals whose share dropped to 39%. It is too early to say if this is a trend but the rebound has definitely been notable. In fact, we happened to report a week with two billion-dollar rounds for the first time since the boom of 2021.

Corporate investors remain committed

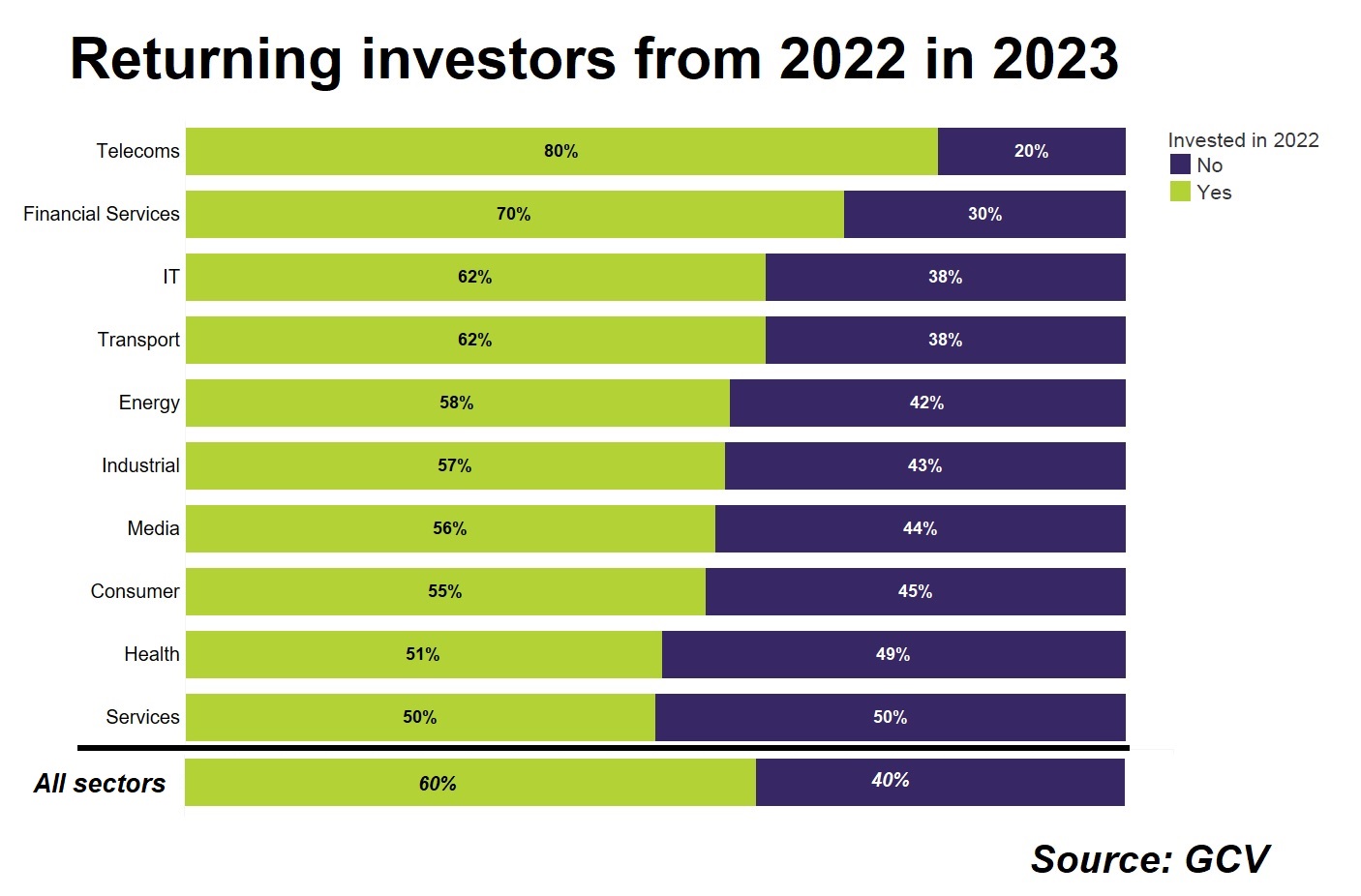

Historically there has always been a question over whether corporate investors will remain active during downcycles. So far, we continue to see many corporate investors remaining steady. Roughly six out of every 10 (60%) of those that participated in at least one minority stake round last year returned as investors in 2023 so far.

In some sectors, the proportion of returning investors is actually higher – telecoms (80%), financial services (70%), IT (62%) and transport (63%). This indicator can be considered a reasonable proxy of the longer-term commitment of corporate investors to venture investing.

Other trends

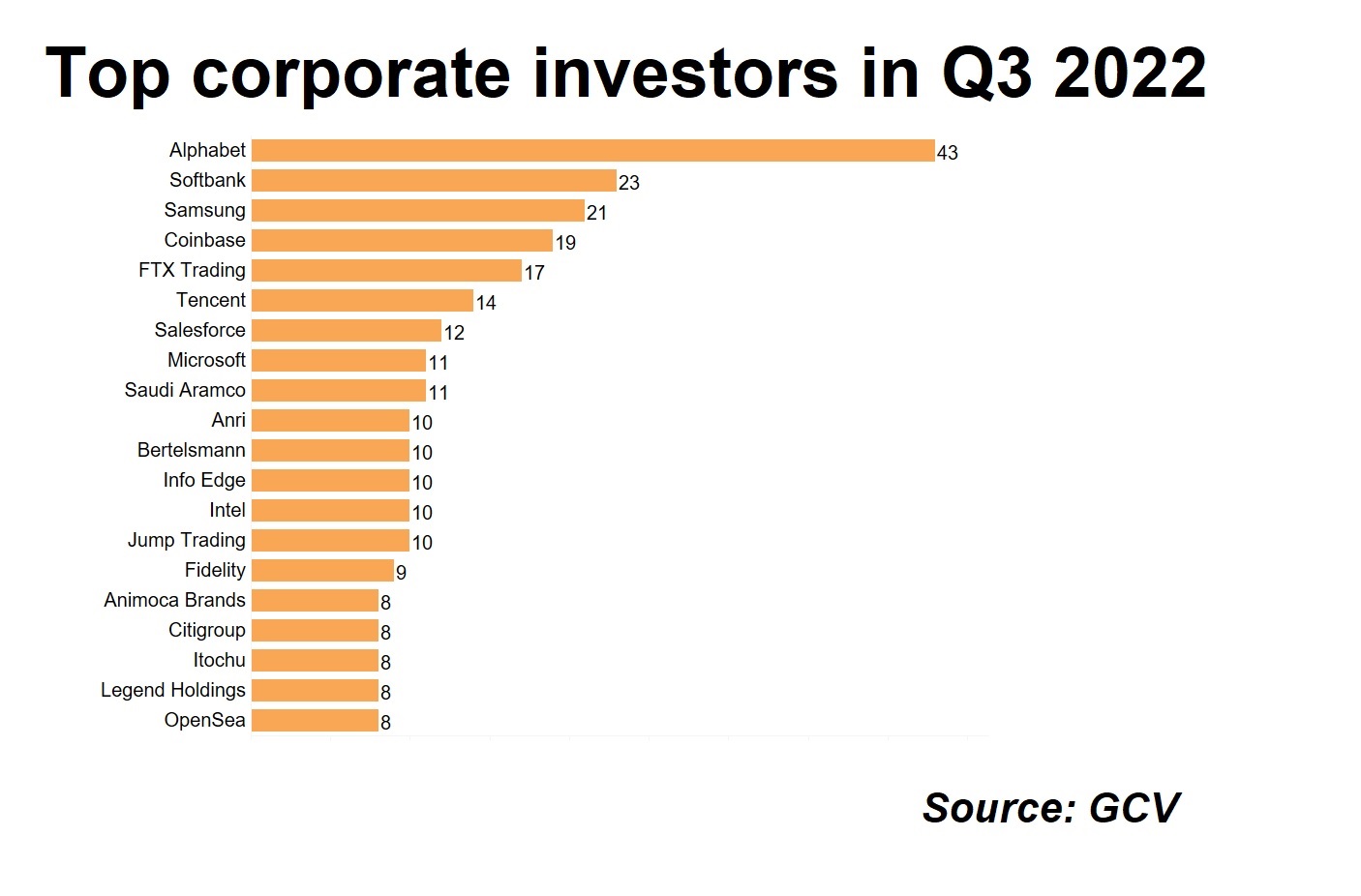

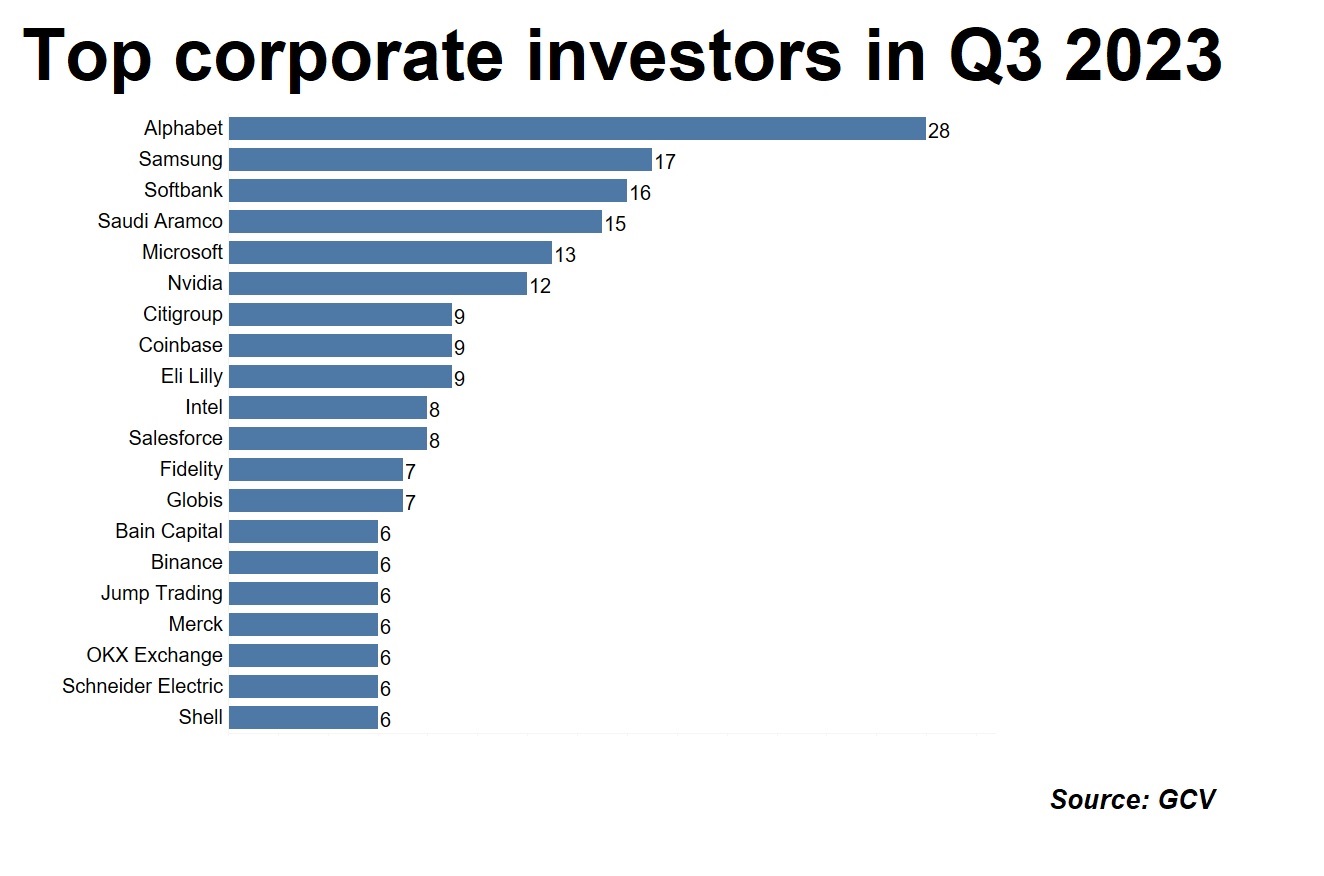

The list of the most active corporate investors has also shifted. While most units have slowed their pace of investing from last year, some have cut back more than others.

SoftBank had already ceded its place as the most prolific corporate investor to Google in 2022, but fell a further notch down in last quarter, with electronics and chipmaker Samsung taking second place. Samsung’s venturing arms have been investing in anything from AI platforms and tech (AI21 Labs, Tenstorrent, Inworld AI, Irreverent Labs) through to oncology and other therapeutics (Fore Biotherapeutics, Bold, Affect Therapeutics) to green hydrogen and carbon capture (Verdagy, CarbonCure), among others.

Oil major Saudi Aramco has also become a more active investor, with increased deal making from its two venturing arms – Aramco Ventures and Prosperity7 Ventures.

Read more here about recent oil and gas sector trends.

A few notable names have dropped off the list of top investors, including Tencent, Citigroup and Bertelsmann. We have seen some new arrivals among the most-active cohort, including Nvidia, which has been riding the wave of AI-enthusiasm for some time now, as well as some digital assets trading platforms like OKX Exchange and Jump Trading.

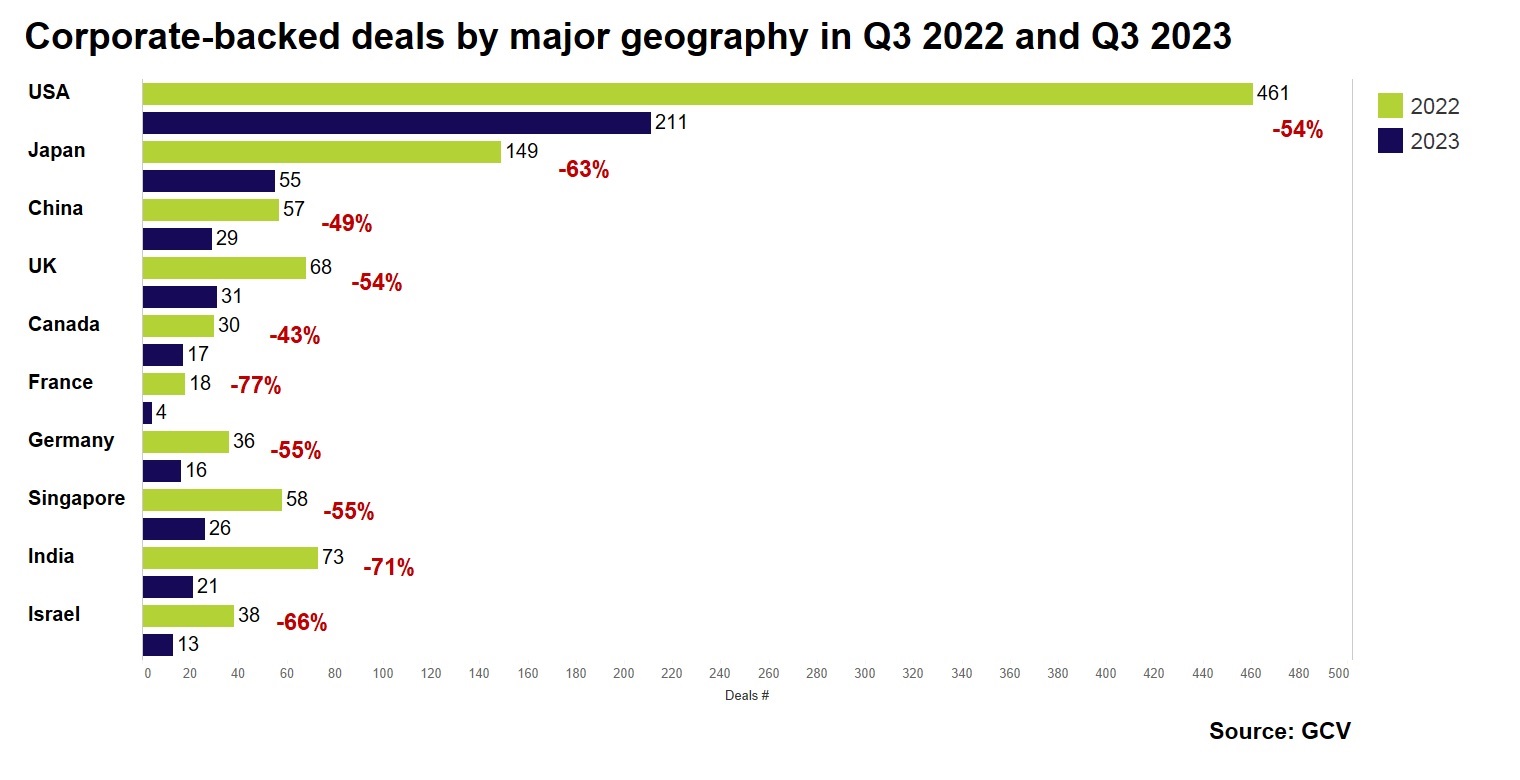

Every geography sees decline

Corporate investment numbers in France, India, Israel and Japan, have seen the biggest falls when compared to the same quarter last year, whereas Canada, China and the US have seen somewhat less of a decline.

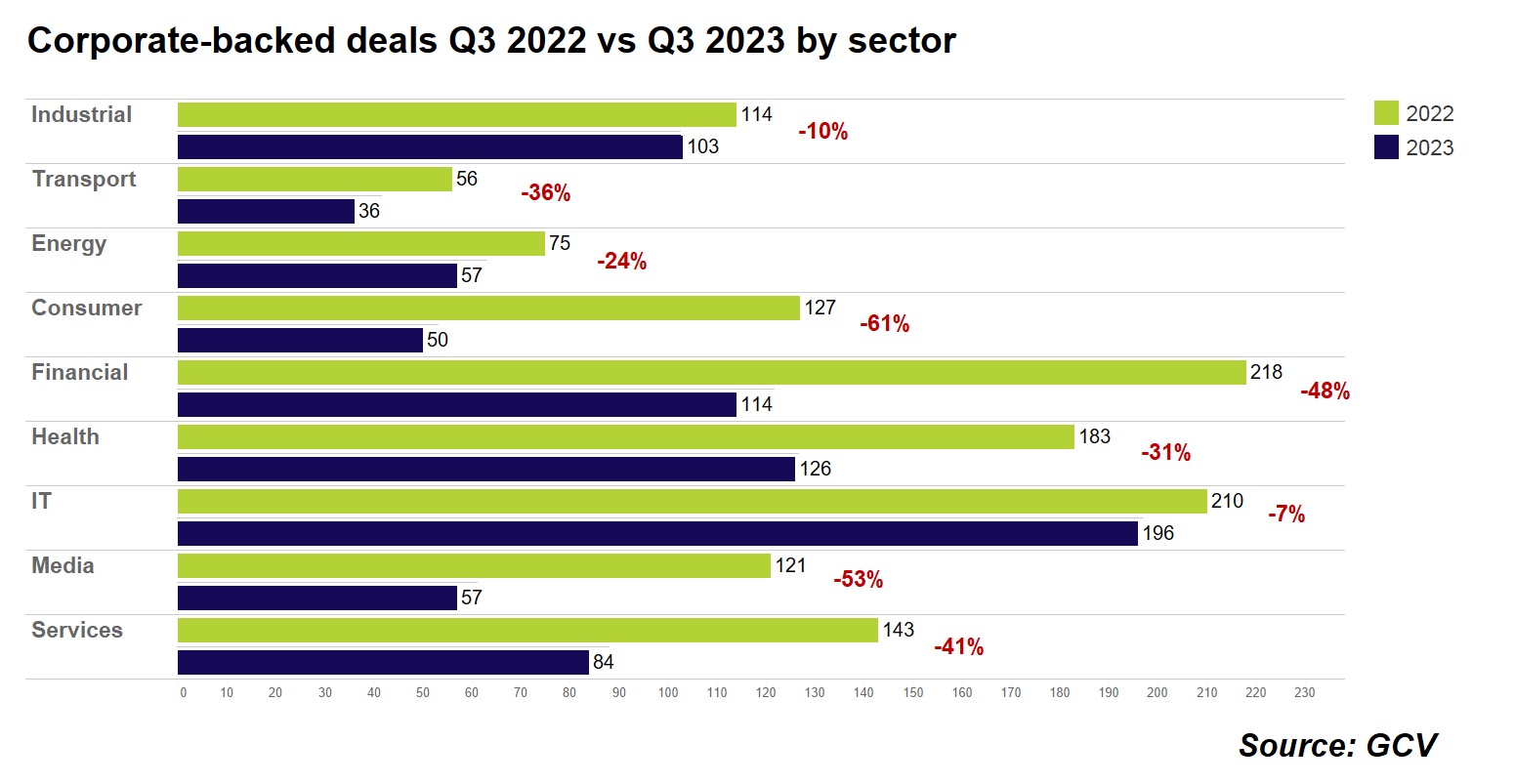

All sectors saw a fall in deal numbers in Q3, compared with the same quarter last year. However, some like IT (-7%), industrial (-10%) and energy (-24%) have seen a smaller fall than sectors like media (-53%), financial (-48%) and services (-41%).

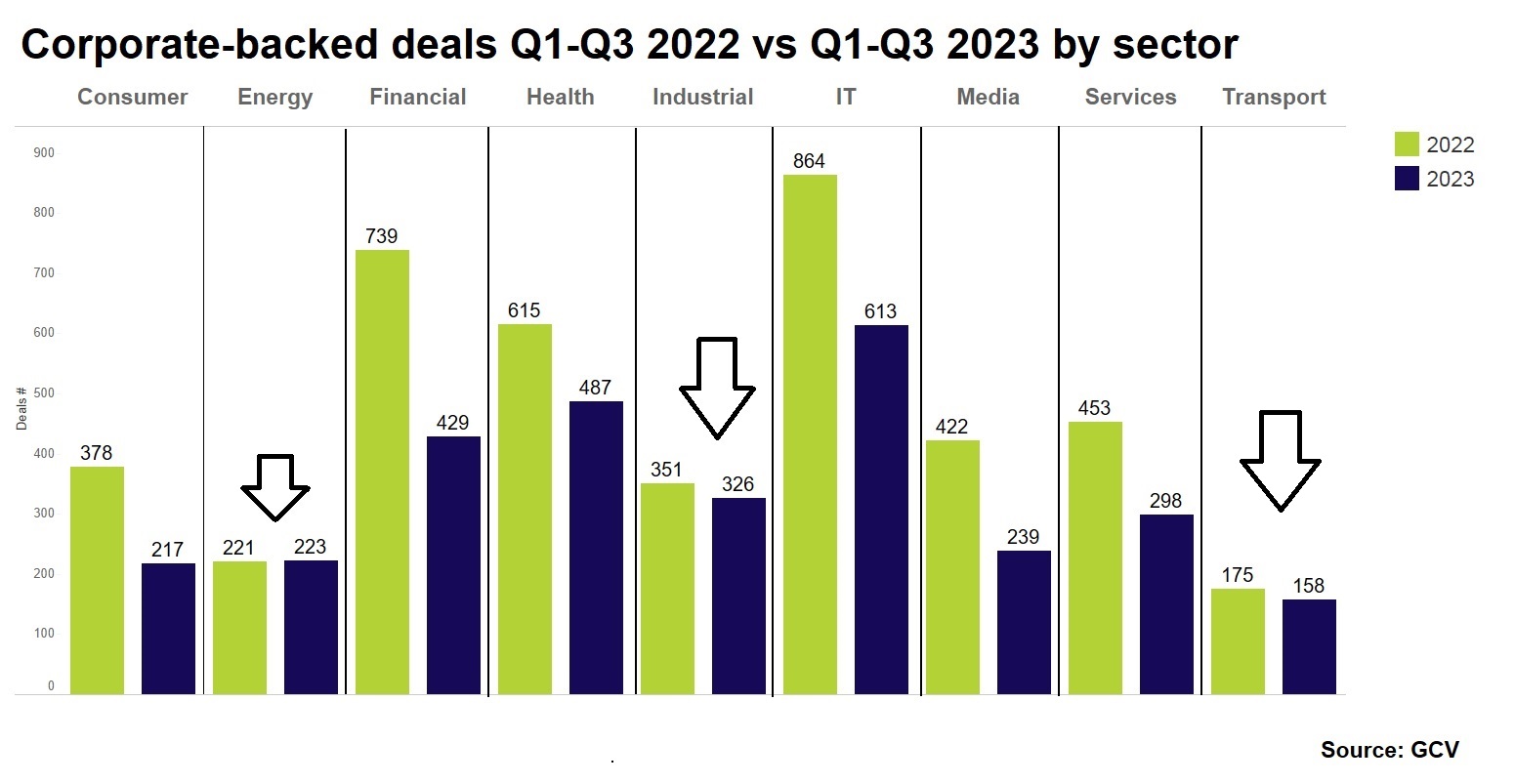

Comparing the first nine months this year with last year it is the industrial, energy and transport sectors which have had the most stable volume of deals.

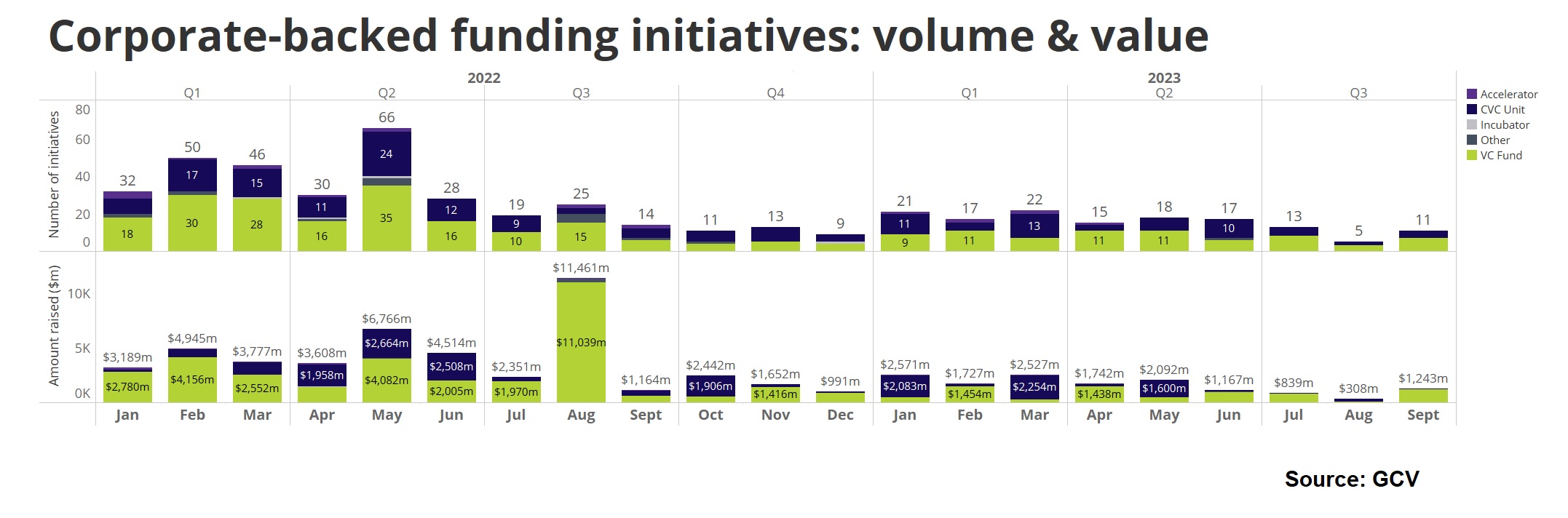

Fewer new funds being created

There are fewer new funds, accelerators, incubators and other funding initiatives being set up 2023 than we saw in 2022. We’ve recorded 139 such initiatives announced so far this year, not even half of the 310 registered in the first nine months of 2022. We reported only a total of 29 such initiatives throughout Q3, a far cry from the 58 of the same quarter last year.

Key corporate-backed startup funding rounds

The five largest corporate-backed funding rounds in Q3 2023 stood above $1bn. They encompassed trendy technologies spanning from AI and ADAS systems to semiconductors and hydrogen and cleantech.

Chinese chipmaker GTA Semiconductors raised CNY13.5bn ($1.8bn) from a deal featuring Huada Semiconductor. GTA Semiconductors develops and manufactures semiconductor chips designed for applications in industrial control, automotive, power and the energy sectors. Its semiconductor chips include power devices, power management components and sensor chips.

Swedish hydrogen tech developer H2 Green Steel raised €1.5bn ($1.6bn) in a Series B2 round led by Altor Equity Partners which featured corporates Hitachi Energy, Wallenberg and Schindler, among other investors. The company provides a fully integrated, digitised, and automated greenfield steel plant by bringing together raw materials, renewable energy, local expertise and artificial intelligence, enabling clients to have access to fossil-free steel. The funds will be used for the establishment and development of H2 Green Steel’s large-scale green steel mill in Boden.

US-based AI systems developer Anthropic received $1.25bn from a $4bn round backed by Amazon. Anthropic will reportedly receive the remainder at a later date. The funds will be used to accelerate the development of the company’s future foundation models and make them widely accessible to AWS customers. Reportedly, this could potentially value the company between $20bn and $30bn. Anthropic runs AI safety & research company intended to build reliable, interpretable and steerable large-scale artificial intelligence systems.

US sustainable battery recycling tech developer Redwood Materials Developer raised nearly $1bn in a series D round, featuring the Microsoft Climate Fund and Caterpillar Ventures, among other investors. The company’s technology recycles and processes scrap from battery cell production and consumer electronics like cell phone batteries, laptop computers, power tools, power banks, scooters and electric bicycles. The fresh funding will be used to continue building capacity.

Chinese intelligence devices and systems maker Rox Motor raised $1bn in venture funding from textile manufacturer Weiqiao Pioneering Group. The funding will be used for vehicle development, one-stop die casting technology and smart manufacturing factory project. Rox Motors has developed intelligence device and systems designed for new energy vehicles, including three-electric technology, intelligent cockpit, intelligent driving and other solutions.

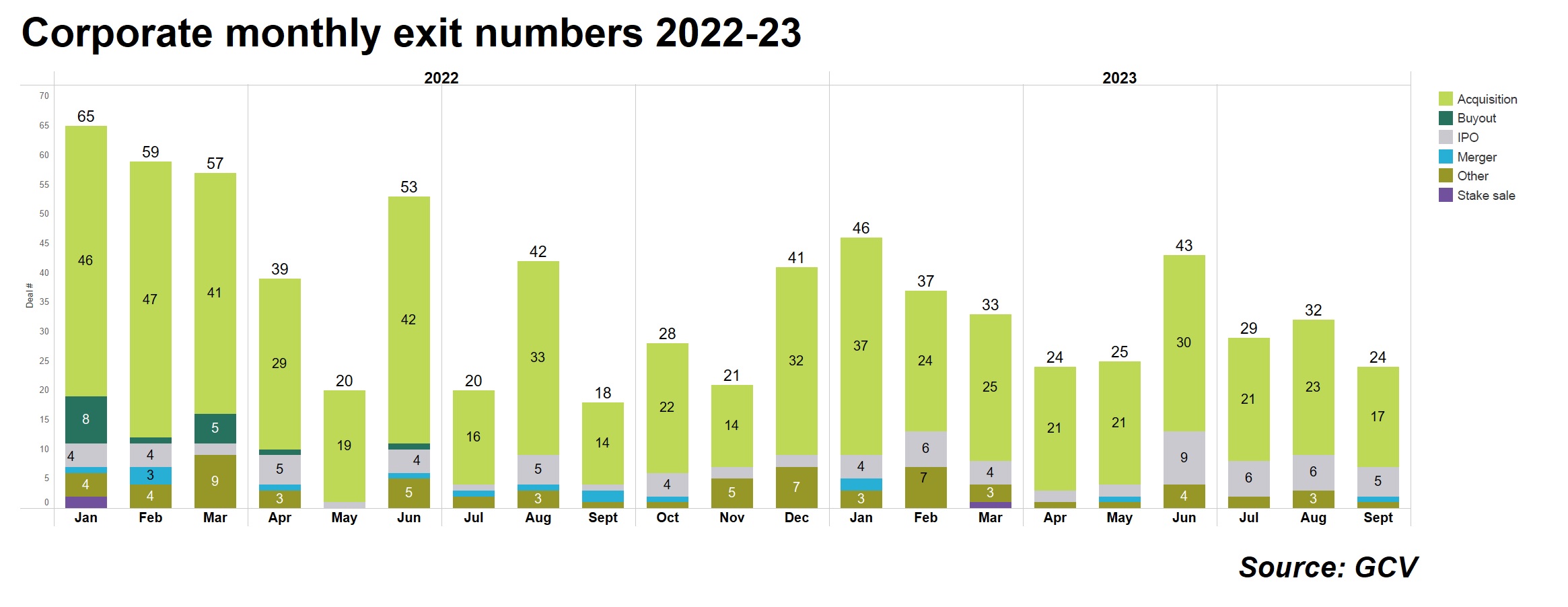

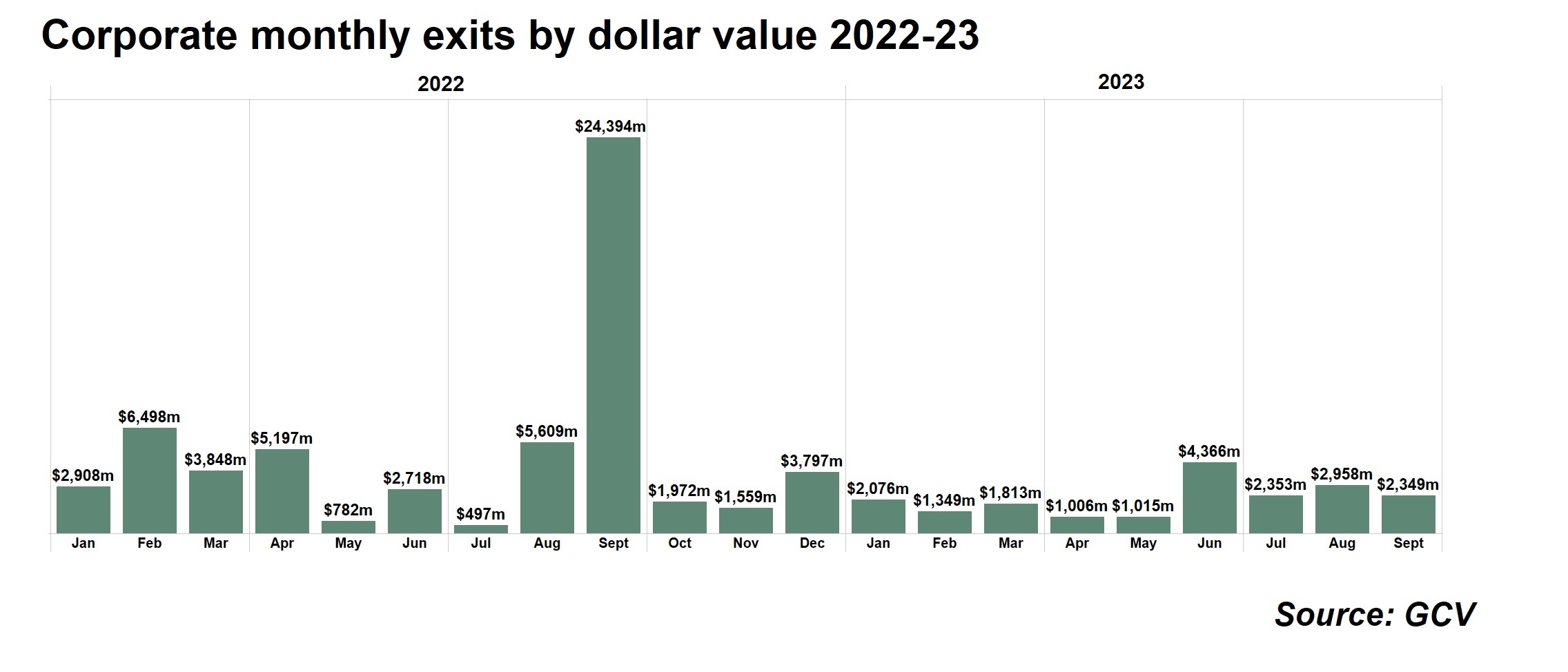

Exits reverting to the mean

In the last quarterly overview, we noted the surprising spike in exits number in June. That spike, however, was not sustained through the summer months, with figures reverting back to the mean in July-September. However, in dollar terms at least, exits held up a little better, standing above $2bn in each month of Q3.

Nonetheless, there are some signs of recovery in the exit market. We counted 85 exits in Q3 this year (29 in July, 32 in August and 24 in September), slightly higher than in the same period last year (83 in total, of which 20 in July, 41 in August and 16 in September). Three of the biggest exits were acquisitions sized above the $1bn mark — fish skin-derived cellular therapy developer Kerecis, carbon capture tech developer Carbon Engineering and metabolic condition-focused therapy developer Inversago.

Reasons to believe in a potential recovery of M&A and public markets are somewhat mixed. Major stock indexes in the US have for the most held up this year, while some European indexes have hit all-time highs or are near them. US private equity firms recorded recorded weaker exits in Q3 but fundraising has fared better than expected, with new private equity commitments tracking down just 12% from record-breaking 2022, said a recent PitchBook report.

Kerecis, an Iceland-based manufacturer of therapeutic products, was acquired by Coloplast for $1.3bn. Kercis counted insurance provider Vatryggingafelag Islands among its previous backers. The company’s therapeutic products aim to speed up the healing of human wounds and repair tissue damage. They contain Omega3 fatty acids extracted from fish skin to reconstruct tissue damage such as burns and other wounds, hernia repair, and breast reconstruction.

Carbon capture technology maker Carbon Engineering reached a definitive agreement to be acquired by its previous backer Occidental Petroleum for $1.1bn, giving an exit to a number of corporates including aircraft maker Airbus, airline Air Canada, mining company BHP and oil and gas major Chevron. Carbon Engineering is a Canadian provider of clean energy services, employing direct air capture technology to capture and store carbon dioxide from the atmosphere or convert it into ultra-low carbon synthetic fuels.

Also in Canada, Inversago Pharma – a developer of drug therapies for metabolic and fibrotic disorders, agreed to be acquired by Novo Nordisk for $1.075bn. Previous backers of the company scoring an exit include pharmaceutical firms Amgen and FPWR. Inversago’s medicinal drugs are developed by using peripherally-restricted cannabinoid receptor agonists of type 1 and are used to cure non-alcoholic fatty liver disease and obesity.

US e-commerce portal Instacart raised $660m in its IPO on the Nasdaq stock exchange under the ticker symbol of CART in September. The company counts American Express and Comcast among its previous backers. A total of 22,000,000 shares were sold at $30 per share, valuing the company at $8.3bn. Maplebear, the holding company of Instacart, is a diversified technology business that operates a technology solution that enables connections and transactions among retailers, advertisers and shoppers in the US and Canada.

Chinese Ant Group took another partial exit from its holdings in India’s payment processing service provider Paytm, selling a 10.3% stake to private investor Vijay Shekhar Sharma for $628m. After the acquisition, Sharma will reportedly own a 19.42% stake in the company. The company counts among its backers not only the Ant Financial group but also Alibaba and Intel Capital. Previously, Alibaba Capital Partners had sold a 6.3% stake in the company. The company will not receive any proceeds from the offering.