- News & Analysis

- Home

- Global Corporate Venturing

- Global University Venturing

- Latest News

- Publications

- Podcast

- The CVC Funding Round Database

- The CVC Directory

- Video

- Subscribe

- Newsletters

- Events

By Kaolyan Andonov

Dollar value of funding rounds increases

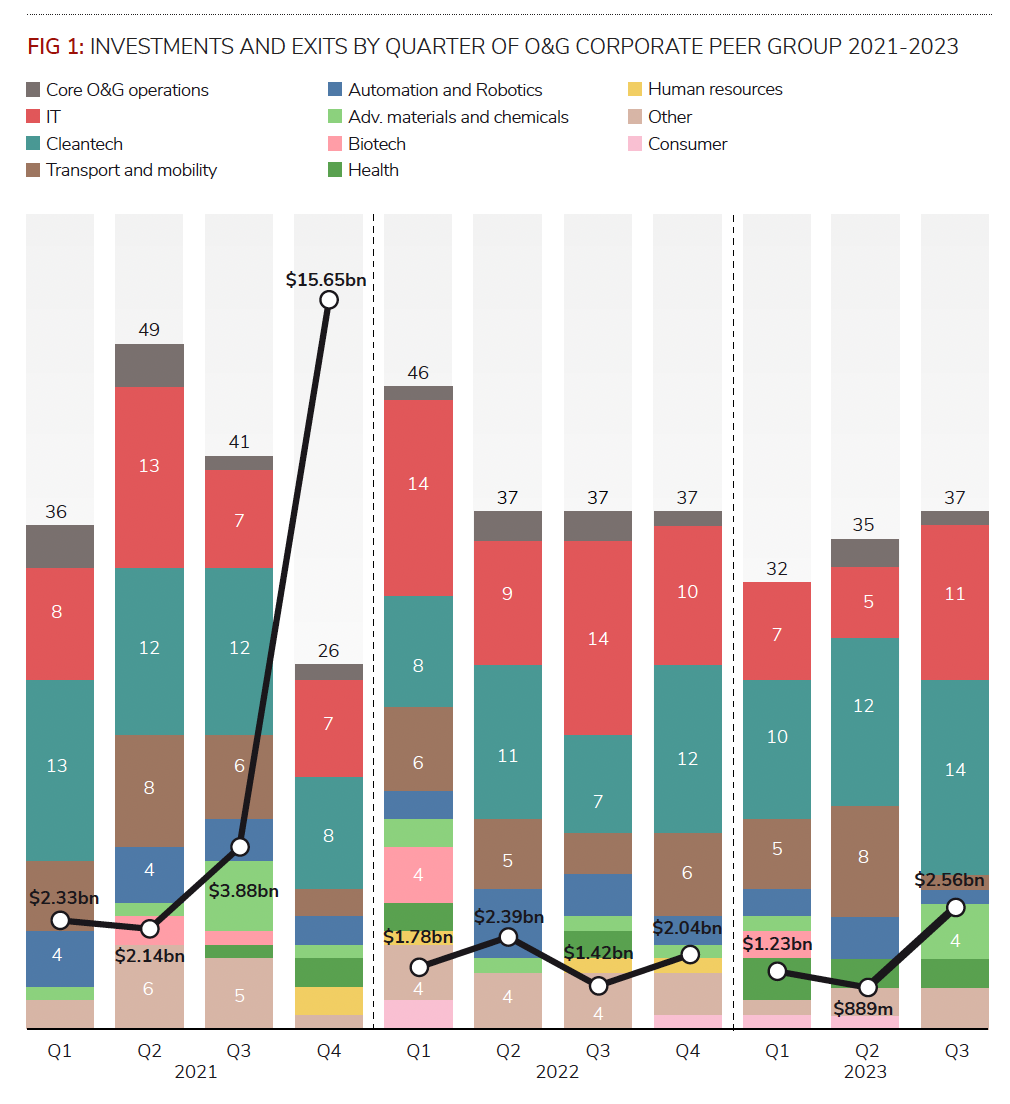

In Q3 2023, the oil and gas peer group backed the same number of startups as it did a year earlier, but the estimated dollar value of those deals rose sharply. The willingness to back bigger deals comes against the backdrop of rising crude oil prices, as supply is constricted but demand is growing.

The investment arms of oil and gas companies backed the same number of startup funding rounds in the third quarter of 2023 as they had in the same period in 2022 – 37. But the total estimated dollar value of those deals rose by 80% from $1.42bn last year to $2.56bn in Q3 2023.

This is the highest quarterly cumulative deal valuation seen since 2021.

A handful of large deals, the biggest two of which were backed by Saudi Aramco’s investment units, helped lift the average deal size. Aramco Ventures backed the $262m series C round raised by US-based metal tech developer Boston Metal. Meanwhile, Prosperity7 Ventures, the other investment arm of Saudi Aramco, backed the quarter’s second-biggest funding round, the $175m series C raised by networking technology company Nile Secure.

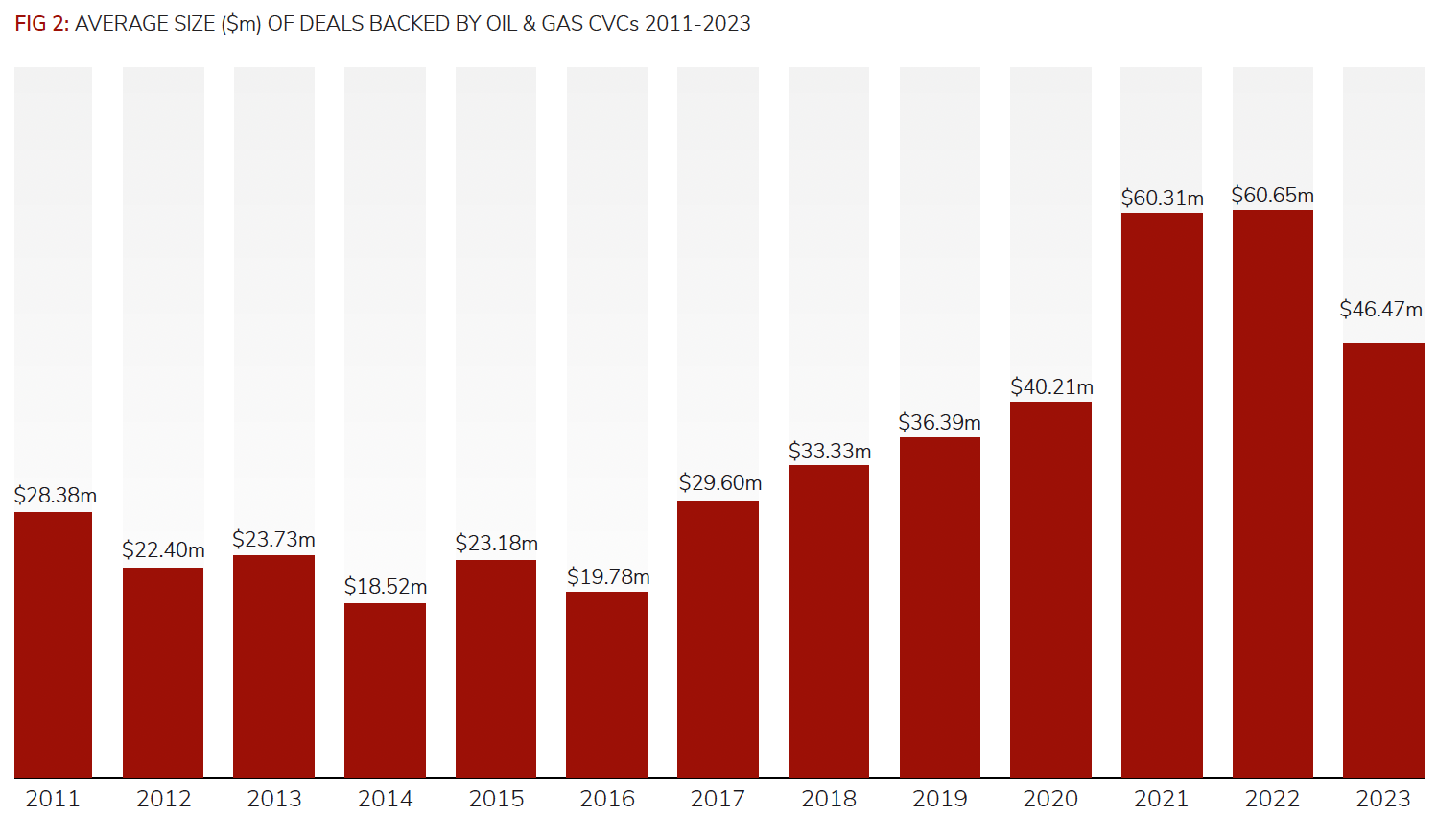

The average size of deals that oil and gas corporate venturing units participated in for the first nine months of 2023 – $46.47m – is still down compared with 2022, when it stood at $60.65m.

The VC industry has seen a correction across the board over the past 18 months, fuelled by factors such as the collapse of the Silicon Valley Bank, as well as macroeconomic factors such as inflation, the rising cost of living and

volatility in commodity prices. It is too early to discern if the recent increase. in total dollar means that the period of

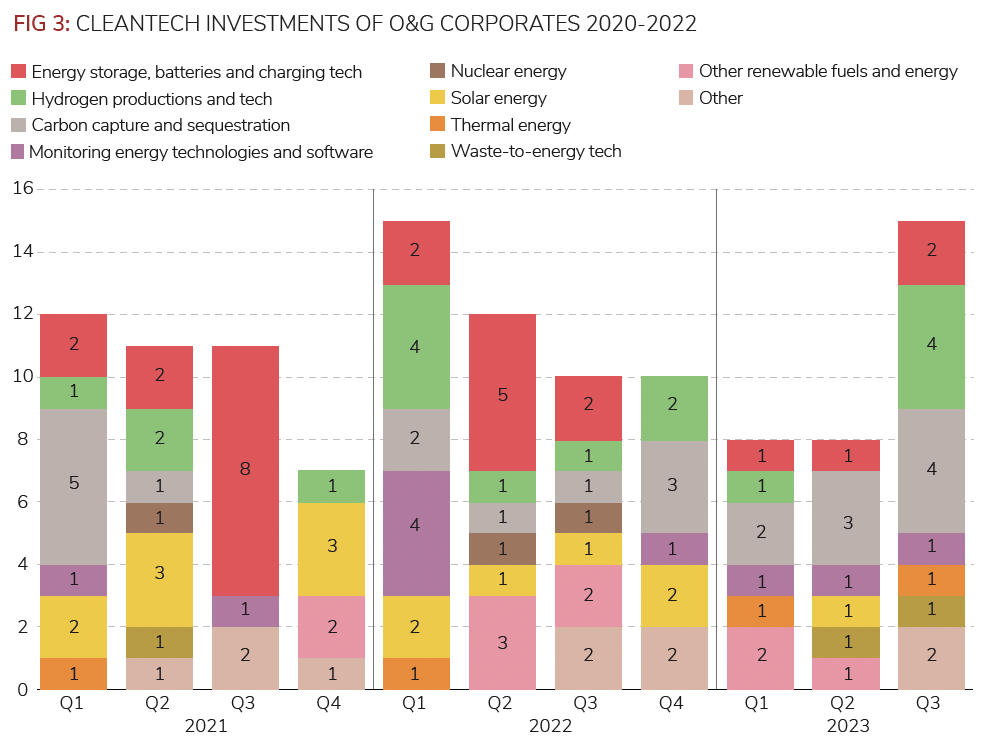

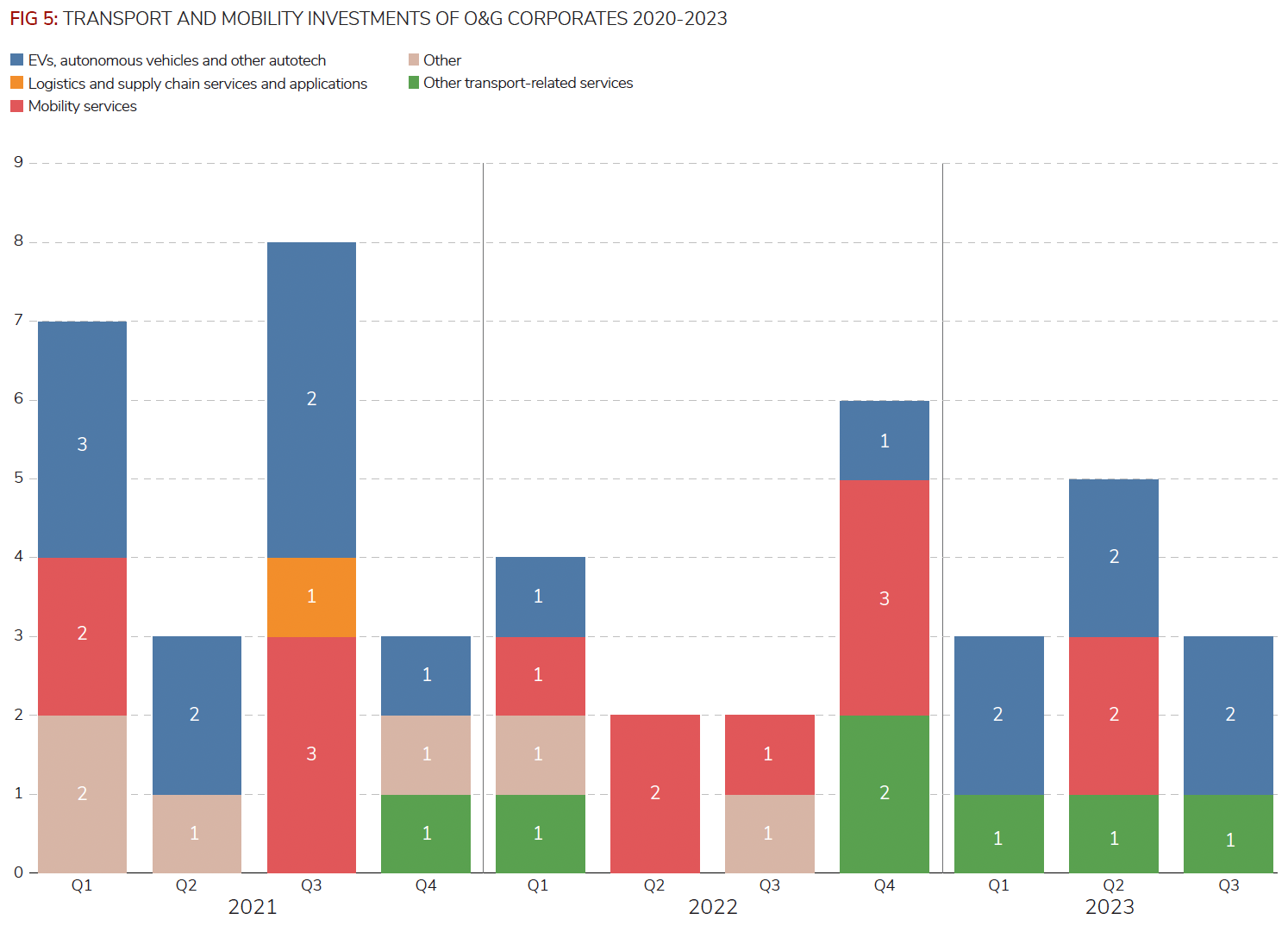

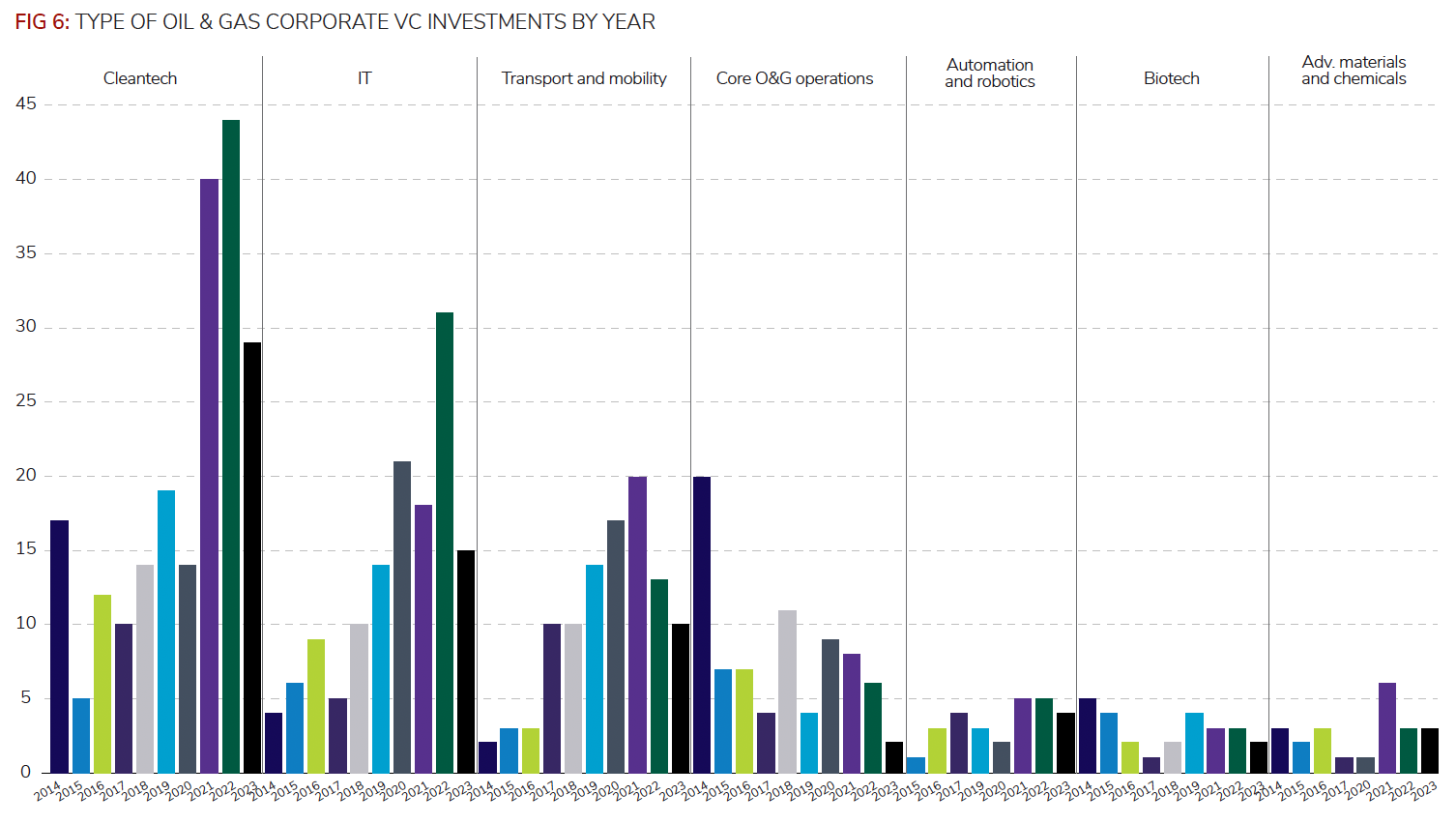

correction is ending.On a sector-by-sector basis, the number of deals in cleantech, IT, transport and mobility, as well as oil and gas technologies, have continued to dominate throughout 2023 so far. Shell, Equinor and Chevron have taken the lead in cleantech investments since 2014. Saudi Aramco and Chevron led on investments in IT technologies, whereas Shell, BP and Chevron invested the most in transport and mobility startups.

Over time, corporate venture investors have consistently shifted to non- core areas, primarily IT, cleantech and transport and mobility. Businesses in these areas are the most likely to disrupt the core business of oil and gas companies. Energy storage, carbon capture and hydrogen were among the most popular cleantech investments in

the third quarter of 2023, continuing to reflect the push to decarbonise heavy industry across the globe.Crude prices rising

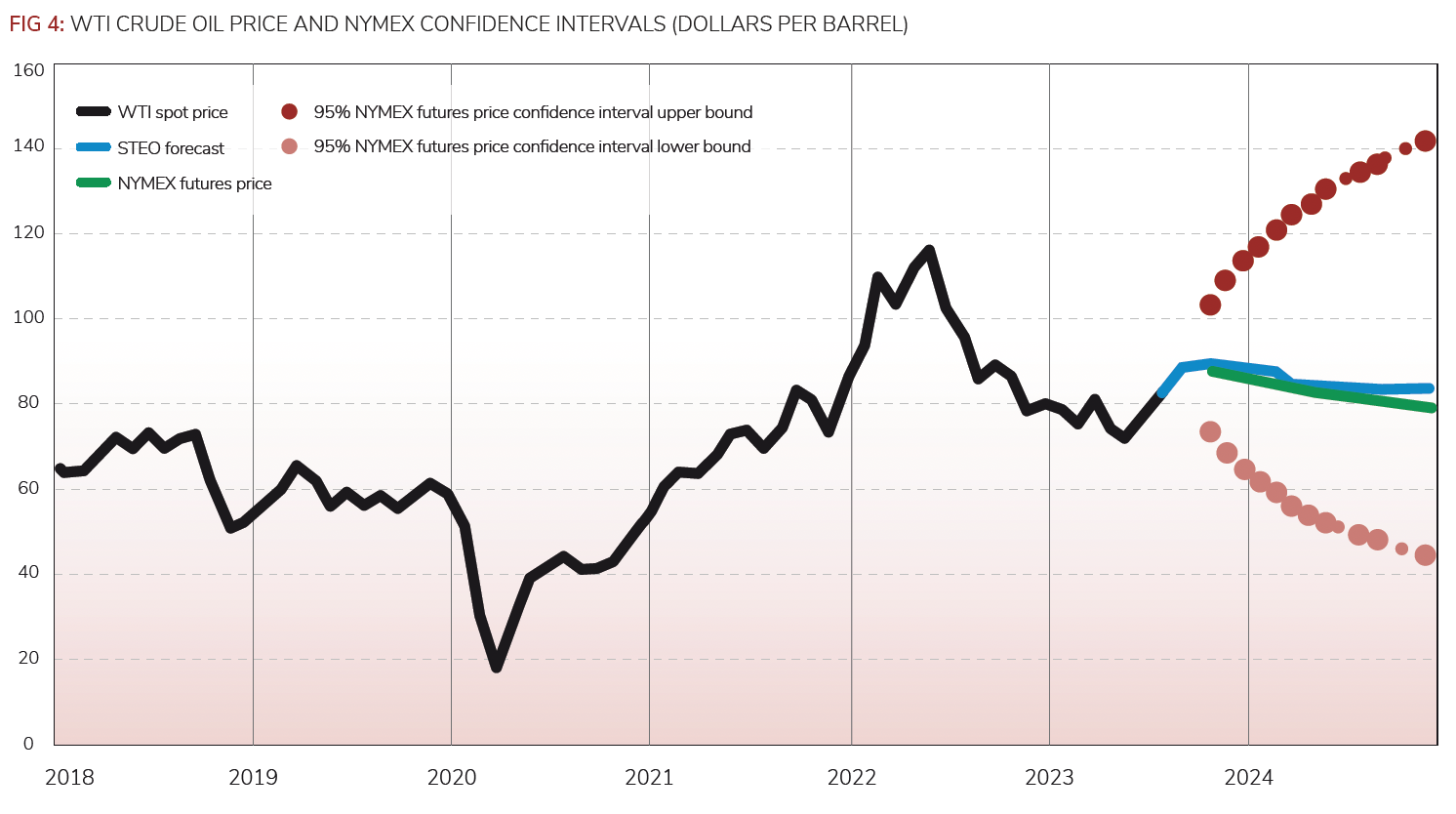

Crude prices are not bound in as narrow a range as they were in the first half of the year. They now appear to reflect mounting pressures on the supply side.

OPEC member countries have vowed to continue reducing output voluntarily throughout much of this year, with Saudi Arabia and Russia’s output reductions being widely publicised. Yet, crude prices did not budge, with the WTI benchmark staying between $70-$75 a barrel until recently, when it broke out above $80 level.

Benchmark oil prices are ultimately determined by global supply and demand for crude. In Q3 2023 and beyond, the International Energy Agency (IEA) is expecting world consumption of liquid fuels to exceed global production. In fact, the EIA expects oil demand to surge to an all-time record high of 102 million barrels per day on average by the end of this year.

Aside from concerted actions by OPEC, geopolitics and macroeconomic factors have also taken their toll. Some oil-producing countries, such as Libya, Iran and Venezuela, are effectively taken out of the world market, as they are either subject to sanctions, or are in a period of civil unrest. The war in Ukraine has also made it impossible for Russia to sell its oil and gas (at least directly) to many developed countries.

Demand remains strong

Some analysts expected demand to weaken in 2023 due to recessionary pressures across much of the developed world. That has not transpired and, far from weakening, oil demand has been growing. Demand for oil by China, the world’s second-largest consumer, is expected to grow 6% to 15.82 million barrels per day, up 50,000 barrels from the August forecast.

The IEA in its Short-Term Energy Outlook expects the WTI spot price to average between $80 and $90 per barrel for the rest of 2023 and through 2024, forecasting higher oil consumption, higher fuel liquid production and discounting the ongoing output cuts by major producing countries.

The IEA is, however, also forecasting that global oil inventories are likely to decline by the end of the year, which would add upward pressure to oil prices in the coming months. In fact, its Brend spot price forecast averages $93 per barrel.

Higher or stable oil prices are positive for corporate venturing in the space because more capital will potentially be available for VC and innovation investing.

Healthcare | Human microbiome

Publications | Reports | GCV

Long and short-term bets investors should make on sustainable aviation fuelAlgae, alcohol and electrofuels all have potential for creating sustainable aviation fuel — but which ones are winning backing from industry?

Has the IRA made the US a magnet for cleantech investment?The US's $369bn climate legislation, the Inflation Reduction Act (IRA), promises to put the US at the forefront of the clean energy transition, but the act has its limitations.

Energy companies could be climate tech’s “innovation angels”— but aren’t stepping upnergy companies can be astute investors in climate-related deeptech startups. Unfortunately they are slowing their investment pace.

Seven university spinouts with game-changing green grid technologySustainable energy means a more efficient grid and better storage. These breakthrough spinouts have ideas on how to do it.

Read the full report on your tablet or device.Download PDFAbout us

GCV provides the global corporate venturing community and their ecosystem partners with the information, insights and access needed to drive impactful open innovation. Across our three services - News & Analysis, Community & Events, and the GCV Institute - we create a network-rich environment for global innovation and capital to meet and thrive. At the heart of our community sits the GCV Leadership Society, providing privileged access to all our services and resources.

Navigation

test reg

test regLogin

Not yet subscribed?

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.Accept Read MorePrivacy & Cookies PolicyPrivacy Overview

This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience.Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.