The US's $369bn climate legislation, the Inflation Reduction Act (IRA), promises to put the US at the forefront of the clean energy transition, but the act has its limitations.

Even though it is a US company, solar thermal energy startup GlassPoint has historically run most of its projects outside the US in places like Saudi Arabia and Oman, where the sunny climate creates ideal conditions for its solar plants that produce heat for industrial processes.

But the US’s Inflation Reduction Act (IRA), a landmark bill passed in August 2022 to encourage renewable energy development, has made the economics of developing projects in the US considerably more attractive.

“With the IRA we saw there was an economic incentive to do more in the US. So, we have been investing more in business development there,” says CEO Rod MacGregor.

Despite its name, the Inflation Reduction Act is mostly a very large package – $369bn – of tax incentives to support renewable energy manufacturing and production in the US. Its generous provisions cover a range of sectors, including hydrogen, electric vehicles, residential energy efficiency, carbon capture and storage, solar and wind generation.

The tax incentives are so large that it has created concerns among European policymakers that it will pull investment away from its own cleantech sector.

Anecdotally, it appears that some startups are being drawn to the US as a direct result of the tax credits on offer.

“A lot more entrepreneurs want to come to the US,” says Raghuram Madabushi, director of National Grid Partners, the corporate VC arm of UK-based utility National Grid.

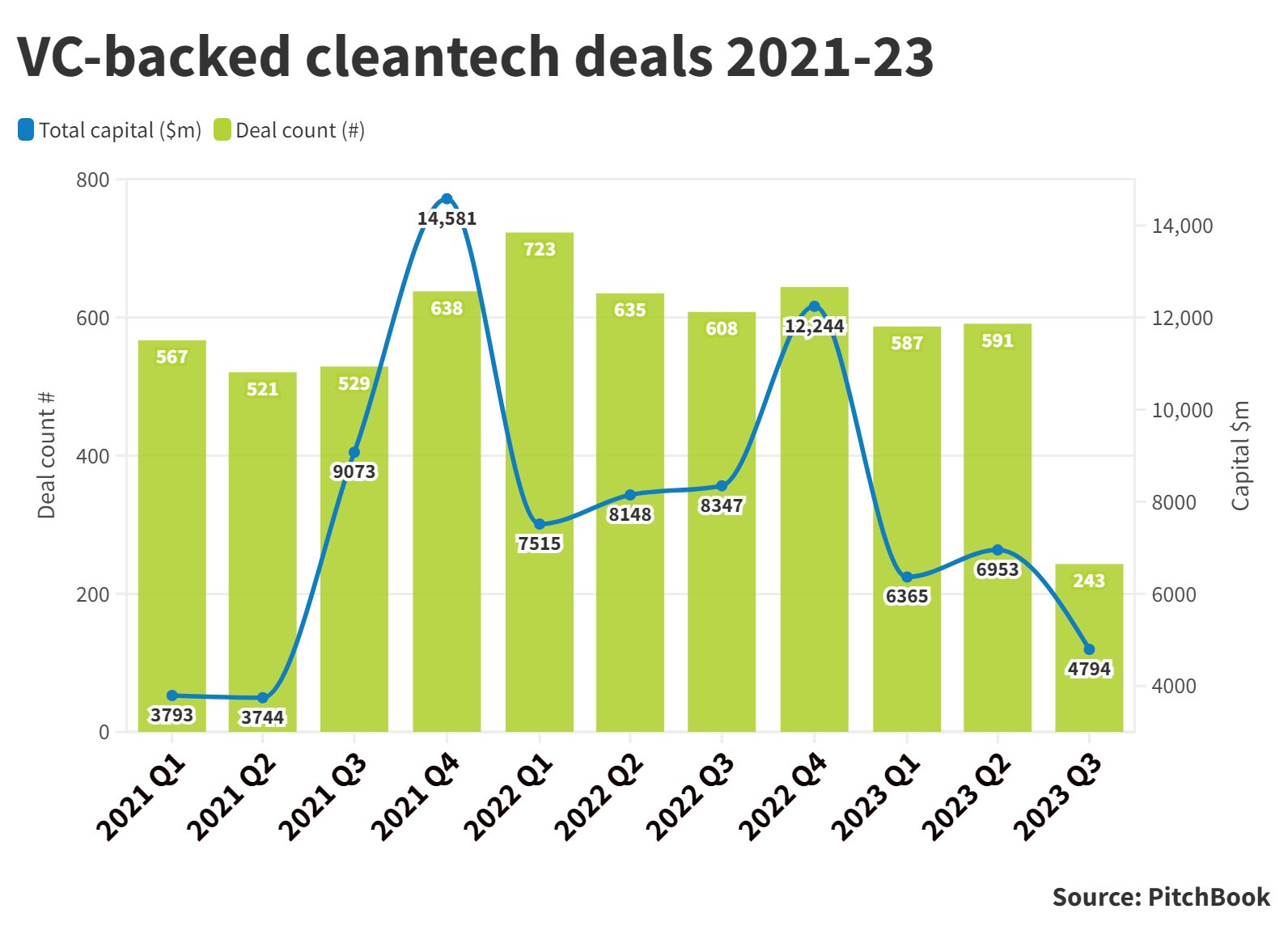

But, one year since it was passed, has the legislation shifted cleantech investment away from Europe and other parts of the world to the US? Data pulled by Global Corporate Venturing suggest the picture is nuanced.

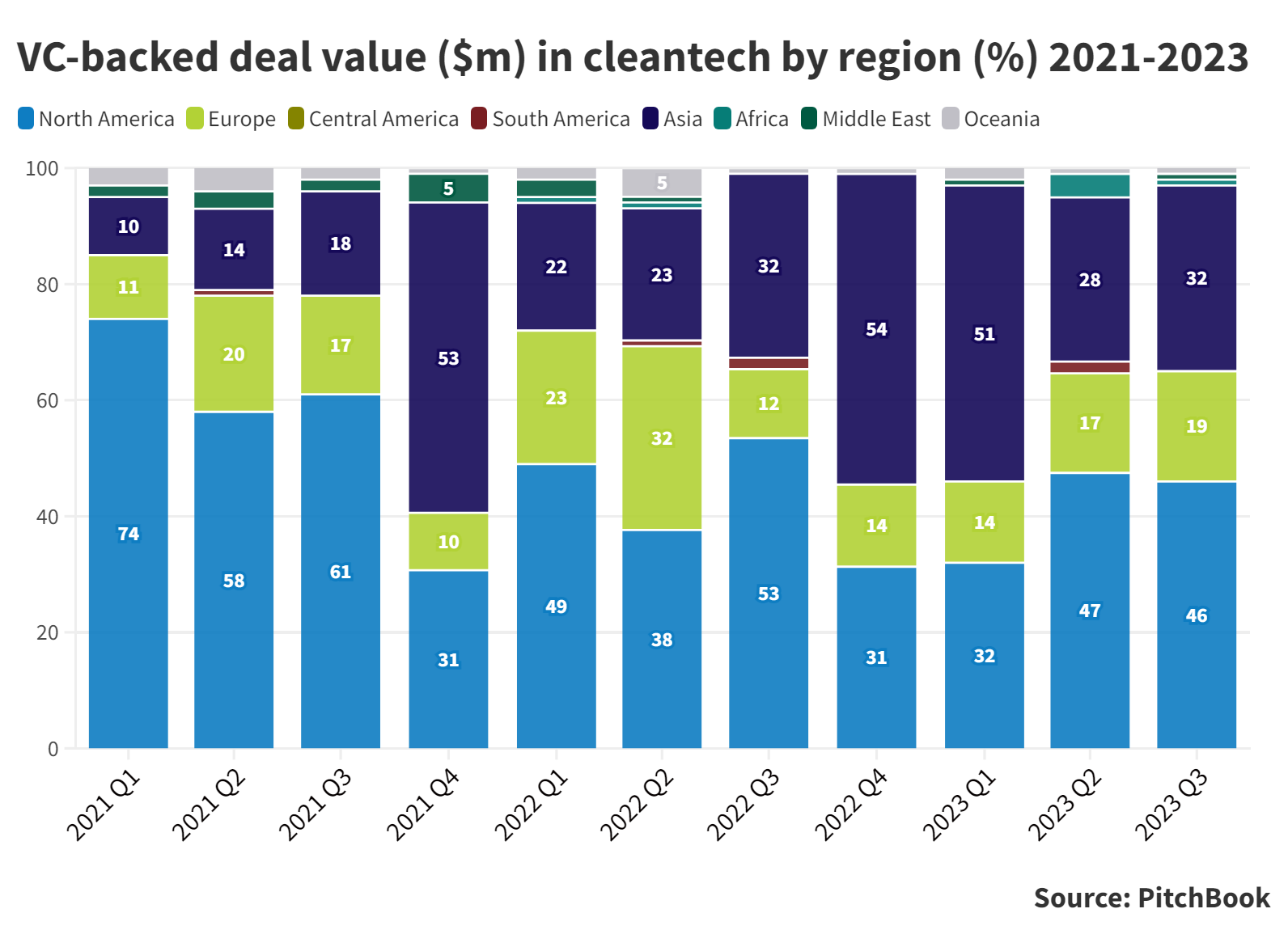

Immediately after the passage of the Inflation Reduction Act, there was a clear increase in the value of VC-backed cleantech deals in the US and a decline in Europe. In the third quarter of 2022, shortly after the passage of the Inflation Reduction Act, the US accounted for 53% of total VC-backed deal value in cleantech, a jump of 15 percentage points from the previous quarter. Europe represented 12% of the total value in the third quarter of 2022, a drop of 20 percentage points from the quarter when the legislation was passed.

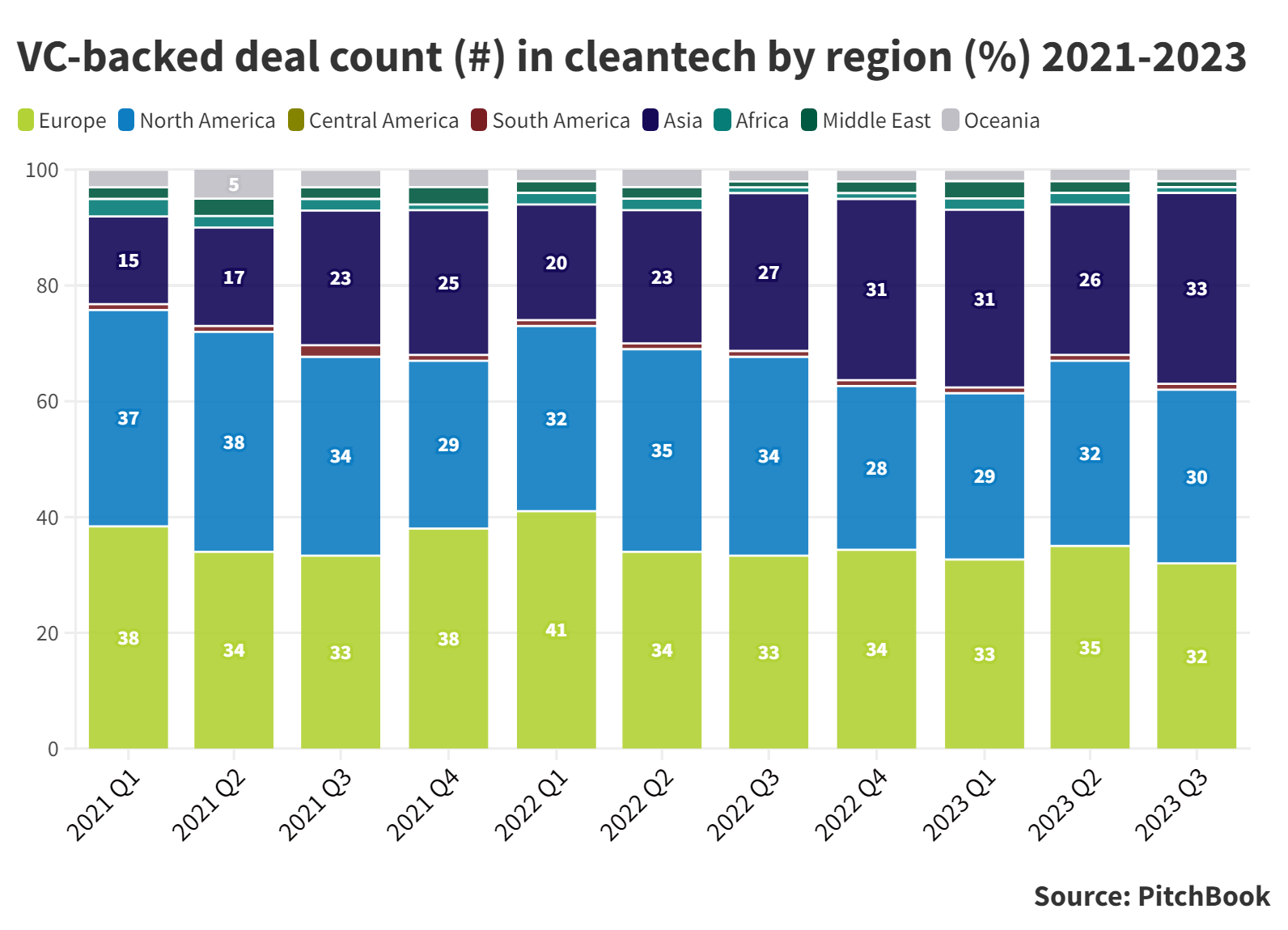

But the US already accounted for a higher proportion of total deal value in cleantech than other parts of the world in certain quarters before the Inflation Reduction Act was signed into law (see chart above). And the number of VC-backed cleantech deals by region has stayed fairly steady before and after the passage of the legislation.

MacGregor’s company has not yet done a project in the US as a direct result of the IRA, but he is seeing increased interest from end users of renewable energy that pose an increased opportunity for companies like his. One large corporate in the US is about to put a request for proposals for a decarbonisation project, he says, that would not have happened without the incentives of the Inflation Reduction Act.

“You are seeing suppliers like us being attracted [by the IRA] but also end users,” says MacGregor.

Holes in the legislation

For all the hype around the legislation, suppliers point out holes in the drafting of the act that create uncertainties for industry.

The solar thermal technology that GlassPoint has developed, for example, is not eligible for the IRA’s tax credits from 2025 because of a change in the legislation that excludes technologies that do not produce renewable electricity. The startup’s plants produce carbon-free heat rather than electricity for industry. Industrial process heat is used in a wide range of manufacturing, from refining bauxite into aluminium to making canned foods. It accounts for more energy use and a large portion of global greenhouse emissions than the electricity market.

“We are in discussions with various parties to see if we can get that clarified,” says MacGregor. “There are a number of technical corrections coming in.”

Transmission infrastructure is also not adequately addressed in the legislation. Madabushi at National Grid Partners argues regional transmission capacity has to double or even triple to meet carbon reduction targets. While a lot of VC money chases end-market decarbonisation, such as the electrification of transport and decarbonising of heavy industry, these assets will be not be able to connect to the grid without transmission upgrades.

“In the past year we have been leaning into hydrogen investments and other asset-heavy investments”

Raghuram Madabushi, director of National Grid Partners

But the legislation has prompted the venture unit to focus on clean energy sectors that it wouldn’t have considered before. Hydrogen is one of those industries. National Grid owns natural gas pipelines in the US that can be retrofitted for hydrogen.

“We started out less asset centric, more software centric given the venture-scale needs. But our decarb strategy has evolved. In the past year we have been leaning into hydrogen investments and other asset-heavy investments,” says Madabushi.

The large size and scope of the US legislation has left policymakers and industry wondering what impact it will have on Europe, traditionally a frontrunner in cleantech. It will not stop venture units like National Grid Partners from investing in Europe, says Madabushi.

He points out that in many areas of clean energy, Europe is far ahead of the US. Large traditional industries in Europe have been transitioning towards cleaner energy much sooner than in the US. Germany has a more mature solar industry, for example. Electric vehicle adoption is much higher in the Nordics than in the US.

“There are lots of learnings,” says Madabushi about European countries’ earlier adoption of clean energy. “The pain points have been faced earlier. But the startups are having more traction in the US than in Europe because of capital. It is an interesting dynamic.”

Others argue Europe still has a long way to go to meet decarbonisation targets, which will require continued investments. The European Commission passed its own clean energy law, the European Green Deal, in 2020, which sets taxation policies designed to reduce greenhouse gas emissions at least 55% below 1990 levels by 2030.

“Any renewable investors can’t afford not to be in the US now.”

Rod MacGregor, CEO of GlassPoint

While the IRA will make the US an attractive place for cleantech investment, the rest of the word, in particular Europe, will need such investments to cope with domestic demand, says Johann Boukhors, managing director of Engie Ventures, the CVC arm of the French utility, in an email. He adds the IRA has not yet caused a change in direction of his unit’s investment strategy.

GlassPoint CEO MacGregor says the company will continue to invest outside of the US. He sees the IRA as an “incremental opportunity – something else we can do as opposed of instead of what we can do”.

The pressure that the IRA places on other countries to boost their own clean energy policies is positive, says MacGregor. “It will be healthy for renewable energy because governments will act. Over time it will even out, and everyone will support their own industries over time.”

But he adds: “Any renewable investors can’t afford not to be in the US now.”