Parent company representation on startup and portfolio company boards is an essential element of the corporate innovation industry - but who holds these seats?

Corporate investment is often a delicate balance — on the one hand trying to collaborate and get startups working with the parent company, and on the other not letting the big corporation smother the startup.

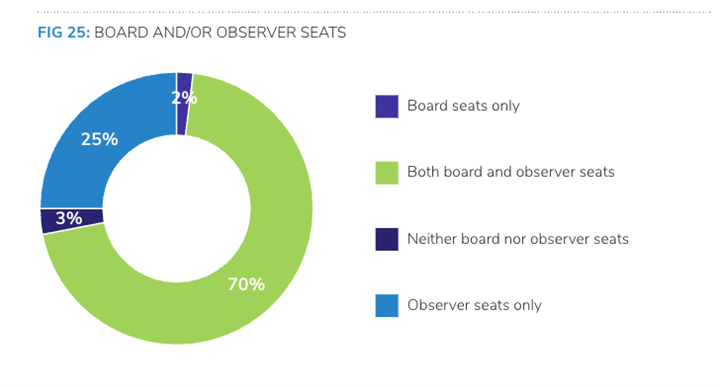

Nowhere is this balance more carefully played out than in deciding who will take board seats at the startup. Almost all corporate investors want to have some kind of board representation, either as a board member or as a board observer, according to our GCV Keystone annual survey last year.

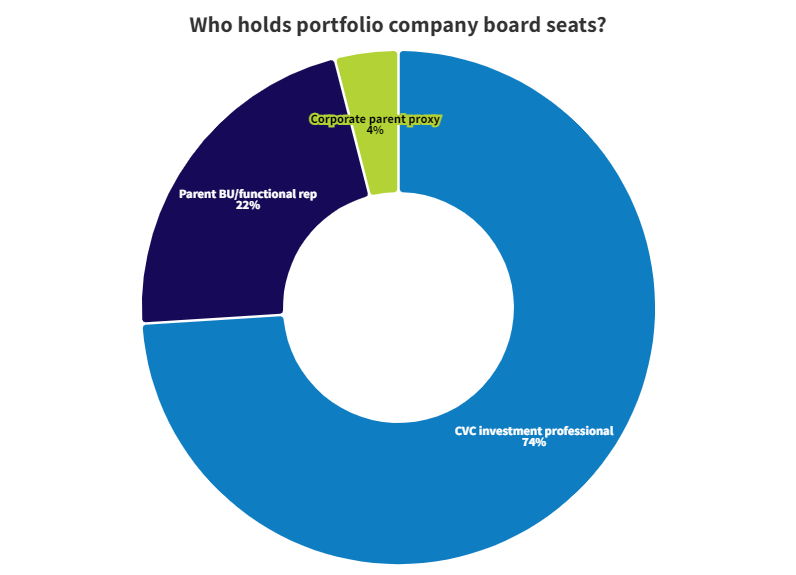

But the big question is who should hold that board seat. Should it be someone from the investment unit, or someone from the parent corporation.

According to our LinkedIn poll, some 74% of CVCs prefer a CVC investment professional to take that seat. Less than a quarter would opt for a parent business unit or functional representative.

It is a sign that investors and parent companies are conscious of the need to create something of a buffer between the corporate and the startup.

Startups can be harmed by the perception that they are too much under the control of an investing corporation. Having a parent corporation representative on the board can also be awkward when it comes to decisions about working with competitors or fielding M&A approaches from them.

The fact that a clear majority of CVC investors operate in a way that puts an “air gap” into the relationship shows a maturity in handling the balance of this complex relationship.

Don’t forget to complete this years GCV Keystone Annual Survey to get a free copy of the World of Corporate Venturing 2024.