Labour shortages and the ability to accelerate robot programming with genAI will breathe new life into the sector in 2024 say investors.

Photo courtesy of Pexels

Robotics startups have always had high failure rates due to high engineering costs and 2023 saw, among other things, the demise of Karakuri, a robotic chef company that announced its collapse in August 2023 due to a lack of funding. Former pizza-robot company Zume, which had been backed by SoftBank, went into liquidation, German cobot arm-maker Franka Emika filed for insolvency and Dutch agricultural robot maker Honest AgTech was declared bankrupt.

But on the whole, investors are positive about the future of robotics. The arrival of generative artificial intelligence has the potential to accelerate the programming of robots dramatically, says Kazuhiko Chuman, general manager of KDDI Open Innovation Fund, the investment arm of Japanese telecoms company KDDI.

“The process of perceiving the surroundings based on a robot’s camera input, predicting movement direction, deciding how to move the robot, and operating the robot was divided into four separate functions. The processing after the camera input was traditionally designed by human programmers,” he says.

“However, with generative AI taking over the programming tasks, we anticipate a dramatic acceleration in the evolution of speed with which these processes can be improved.”

More forecasts for 2024

- Transport in 2024: investors eye pick-up in startup deals after a stalled year

- Logistics in 2024: Labour shortages and climate to drive investment

- Energy in 2024: Plenty of funding rounds but few exits, say energy investors

- Fintech in 2024: investors eye payments, interest rates and a shift to emerging markets

Soroush Karimzadeh, the chief executive and co-founder of Novarc Technologies, agrees that excitement around generative AI is leading to more investments in the hardware sector. “The vast amount of capital is still at the seed or series A level, as there has been an influx of start-ups in the robotics industry spurred by the development of AI-based robots,” he says.

A global shift

Beyond this, the industry is also seeing a shift in where robotics developments take place, with countries such as the US and Canada becoming increasingly involved in the production side, Karimzadeh says.

“Canada and the US have historically been an end-user market for robotic technology and automation systems. The North American region has lagged behind Europe in innovation and Asia in the production of these technologies for industrial applications. Over the last few years, this trend has begun to shift,” says Karimzadeh.

Tensions with China, which is shifting hardware production back to the US, coupled with a growing need for automation are pushing the transition.

“More industries need to automate their manufacturing processes to be competitive, address labour shortages and manage supply chain challenges,” Karimzadeh says.

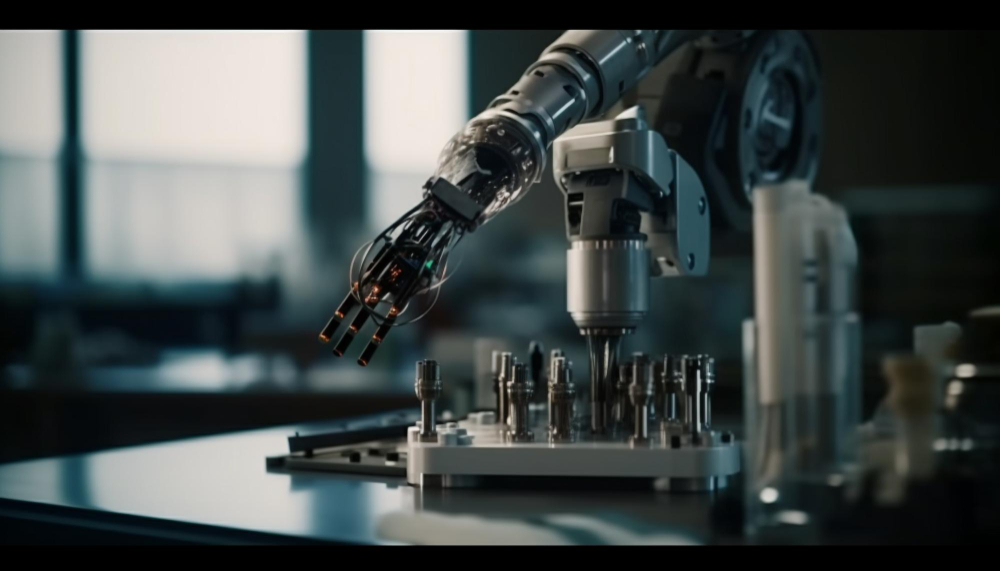

Novarc Technologies is a Canada-based automation company that specialises in welding cobots for small pressure vessels such as air tanks. In September 2023, the startup raised $20m in a series A round with Caterpillar Venture Capital, the corporate venture arm of US-based engineering equipment manufacturer Caterpillar leading the round.

Winning Caterpillar as a corporate was a major win for Novarc, says Karimzadeh. “Despite challenging market conditions, we have been successful in attracting investors, specifically the latest investment by Caterpillar Ventures. Attracting investors has been made easier by the fact that our user case model is easily understood.”

“There remains strong interest in companies like Novarc with significant revenue in robotics space that provides the manufacturing industry with a collaborative robot that increases productivity and enhances weld quality allowing fabricators to remain competitive in key infrastructure bids,” Karimzadeh says.

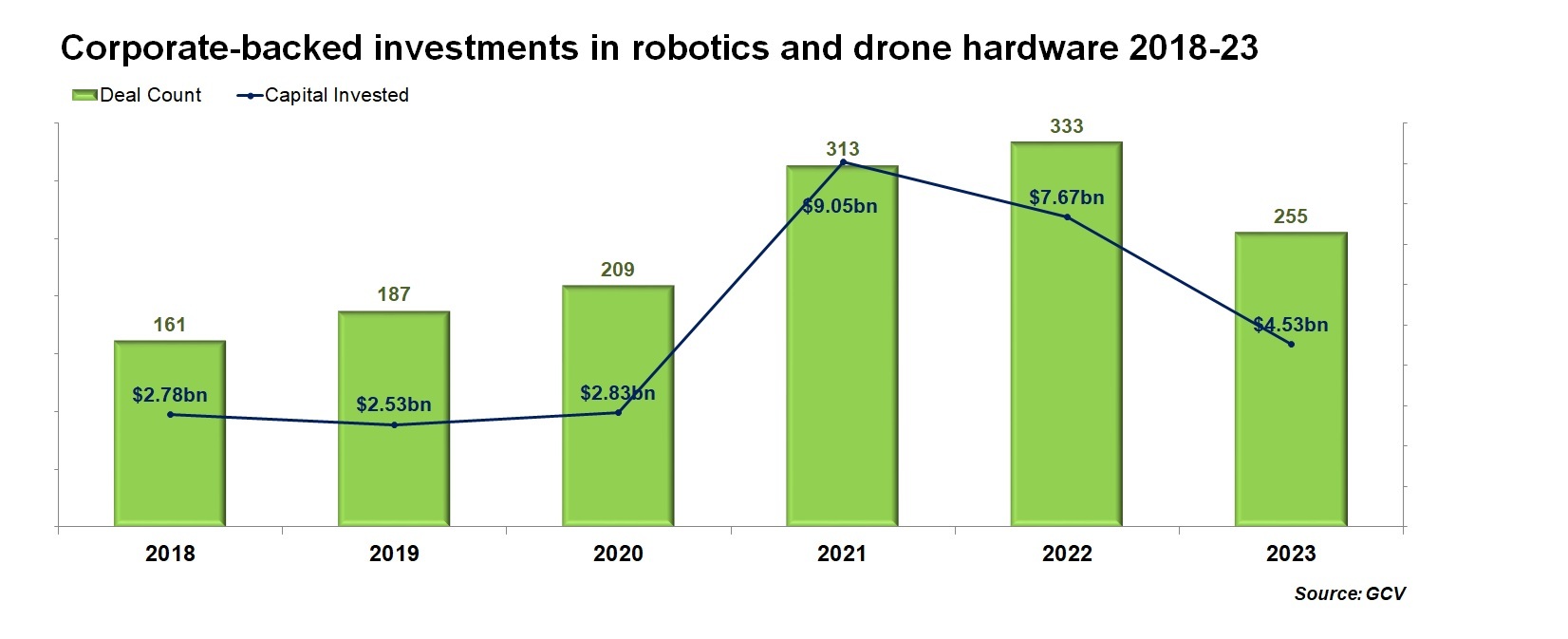

Investment down from 2021 highs

Corporate investment in robotics startups has halved from a high of $9bn in 2021.

“Compared to 2021, when the pandemic heightened expectations for automation in operations, the post-Covid normalised world has seen a trend of decreasing overall investment amounts,” says Chuman.

However, taking a broader view, $4.53m in investment in 2023 is still significantly higher than 2020 levels.

KDDI has been one of the most active investors in the robotics sector in 2023, with four robotics investments this year. “In February, we invested in Lebo Robotics, which develops inspection and repair robots for wind turbines. In March, we invested in Yogo Robot, which offers multifunctional delivery robots capable of handling multiple applications with a single unit. In May, we invested in GITAI Japan, which is developing general-purpose robots for space operations,” says Chuman.

In July 2023, the company also invested in Telexistence, a developer of remote control and AI robots. Chuman says that the need for robotic assistance in Japan has meant that the market is attractive for investors.

“The ongoing need for companies to address issues related to the supply chain due to population decline and aging in Japan, as well as labour shortages, combined with the rising global interest in generative AI, means that this sector remains an important area for investors,” he says.

Robotics companies are becoming more adept at showing how they can save customers money and operating costs, says Chuman.

“Our investee robotics company Telexistence, originally known for its human-operated remote robotics technology, pivoted to specialise in automating restocking operations for convenience stores, leading to significant contract wins,” he says. Showing how the robots could replace specific operational tasks positions Telexistence well to scale up.

Surgical robots

Another robotics investor to watch is Intuitive Ventures, the venture capital firm of US-based medical devices manufacturer Intuitive Surgical.

Intuitive Ventures raised a second, $150m fund in 2023, which will allow it to expand investment activities, says Murielle Thinard McLane, the newly appointed managing partner.

“Fund II will allow us to further scale our impactful investment approach, and accelerate the creation of innovative minimally invasive care solutions,” she says.

“In August, we had the privilege of supporting Capstan Medical as they launched out of stealth with an oversubscribed $31.4 million series B round. This Intuitive Ventures portfolio company is transforming the treatment of structural heart disease via endovascular robotics,” she says.

Other notable medical robotics startups that are featured in Intuitive Ventures’ portfolio include Neocis, a Florida-headquartered company that develops assisted dental implant surgery robots. Neocis raised $40m in additional funding in 2022 bringing its total investment to $160m.

McLean expects more healthcare systems will begin to adopt surgical robotics in the coming year. “More healthcare systems around the world are embracing surgical robotics, and generally adopting new technologies that will make it easier to detect disease earlier, champion the power of the consumer/patient in the delivery of precisely targeted personalised therapeutics, and harness rich data that will collectively improve outcomes across the patient care continuum,” she says.

Legal challenges to dominate in 2024?

Chuman says the robotics sector will see more scrutiny in 2024 around safe practice. “Privacy and surveillance concerns arise as advanced monitoring capabilities may lead to infringements on individual privacy. The issue of liability for autonomous robots is also pressing, with accountability for accidents and damages becoming less clear. On the employment front, automation could exacerbate social inequalities and economic disparities due to job displacement,” he says.

“In military applications, the use of autonomous weapon systems could fundamentally change the nature of warfare and increase risks to non-combatants. Considering these ethical concerns, corporations and investors must collaborate with technology developers and policymakers to make informed investment decisions and to support the growth of their investee startups,” he says.

Labour shortages to push growth

There is expected to be a shortage of 314,000 welders in the US in 2024, pushing a need for welding services like Novarc’s, says Karimzadeh. “I anticipate there will be increased consolidation and IP acquisition within the robotics sector as new infrastructure laws in the US will drive up the need for welding services,” he says. “The industry will need to implement welding automation systems. There will be more development in AI which will enable more intelligent robot deployments.”

There will be an opportunity for new software to be developed for these robots. “Taking the welding industry as an example: welding robots only provide the hardware; they lack the welding logic and cognition to provide a fully packaged solution for welding applications. The next step forward is an autonomous and adaptive welding solution that uses artificial intelligence and computer vision. This wave of robotic welding can address the shortage of highly skilled welders and dramatically improve pipe weld quality.”