Payments is an area fintech investors we've spoken to see as ripe for a shake up. They're also watching for an AI crash and the direction of interest rates.

Last year was a turbulent one for financial technology, as even the most celebrated startups were forced to cut valuations to raise money. Subsectors like Web3 and buy now, pay later services particularly suffered.

But 2024 is expected to bring several factors into focus. Payments is an area many investors believe is ripe for a shake up. They are watching the direction of interest rates anxiously – this is pivotal for the health of fintech investment in general, and those with crypto investments will be watching which way the next US president takes regulation. There is also mounting worry abut the AI hype bubble popping before fintech startups have even figured out the most promising uses of the technology.

More forecasts for 2024

- Transport in 2024: investors eye pick-up in startup deals after a stalled year

- Logistics in 2024: Labour shortages and climate to drive investment

- Energy in 2024: Plenty of funding rounds but few exits, say energy investors

Three fintech investors spoke to Global Corporate Venturing about their expectations for 2024: Joerg Landsch, who runs corporate VC for Deutsche Bank; Andreas Nemeth, the founding partner of insurance firm Uniqa’s fintech-leaning investment arm; and Manuel Silva Martinez, who has headed venture firm Mouro Capital since it was spun off from banking group Santander.

First up, how was 2023 for you? Were there any surprises?

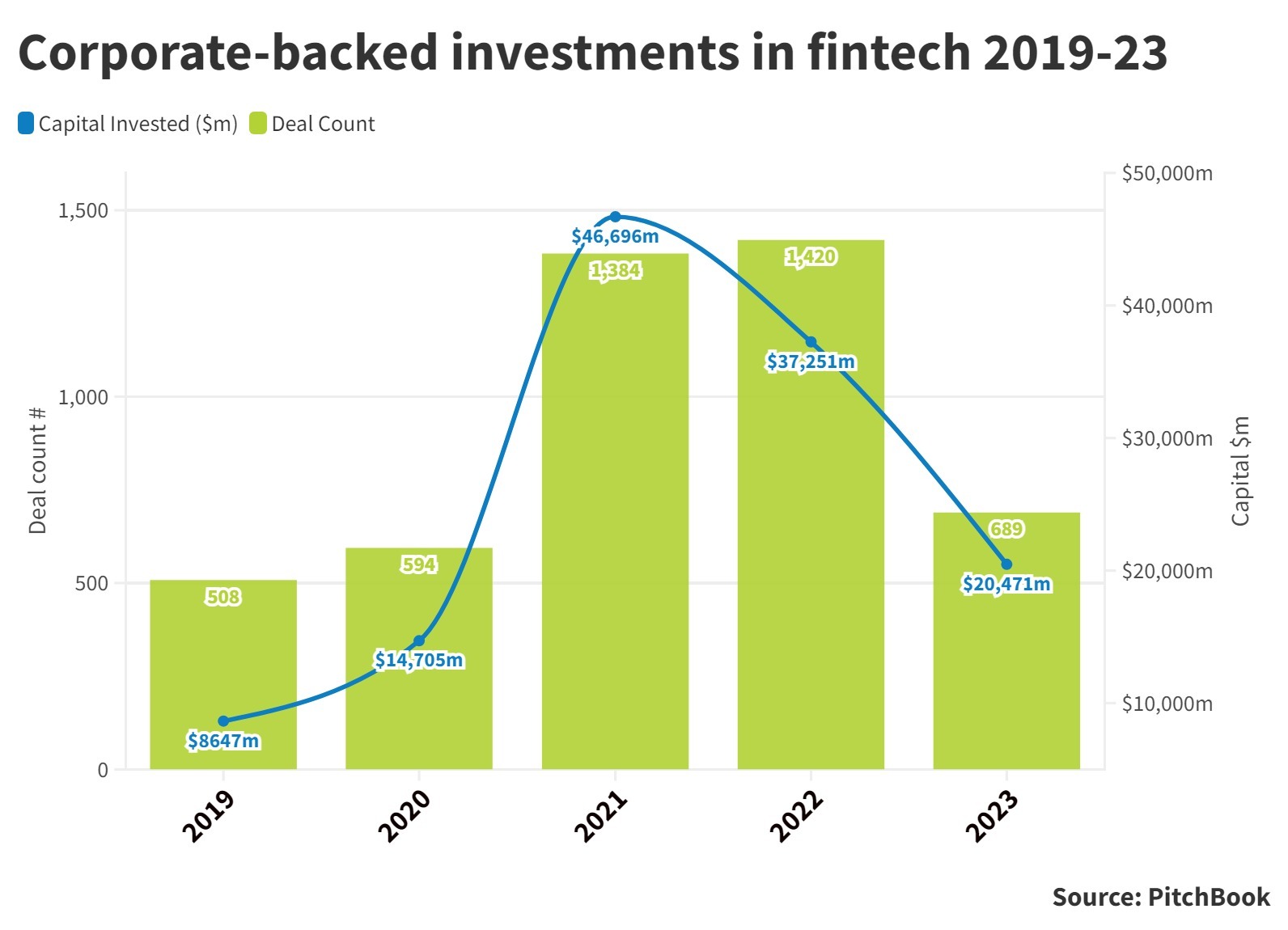

Landsch: The venture capital landscape has, by and large, evolved as anticipated, stabilising around the levels observed in 2019 in terms of transaction volume and deal count. However, the accelerated surge in the field of artificial intelligence was somewhat unexpected, both in terms of its scale and rapid pace of advancement.

Silva Martinez: I was expecting a pretty slow year with a lot of work to be done along with second guessing, making sure things are stable and on track and teams were delivering.

That was in line with expectations, the other part that was to be expected was rationalisation about everything: how you spend your money and resources, how you think about your teams, etc. The big question mark – and it’s still a question mark – is how soon are we going to see changes in the market that would indicate a good outlook for next year?

“We can see some silver lining – maybe not in 2023 but 2024.”

Andreas Nemeth, Uniqa Ventures

Nemeth: I think it turned out better than expected when it came to volumes and deal activity, and we’ve seen some gradual improvement throughout the year. If you look at the numbers in global deal activity you can see an upward trend already. Q2 and Q3 were slightly better than Q1, so we can see some silver lining – maybe not in 2023 but 2024.

We slowed our deployment speed in 2023, we did much less in terms of deals than the year before because we’re still waiting for the market to finally consolidate with a wider reduction in valuations. But we don’t consider that a crash, just a mean reversion now valuations are coming back to pre-covid levels.

Fintech valuations have seen a big reset from 2020 and 2021. Do they have further to fall in 2024?

Landsch (right): Early-stage funding, particularly in seed and pre-seed financing, has demonstrated remarkable valuation robustness, and I anticipate this trend will persist and valuations to remain on current healthy levels.

Conversely, later-stage companies, having secured substantial funding in peak bull market and experienced a market softening, are unlikely to witness a resurgence to previous highs in 2024.

It seems reasonable to expect that current valuation levels will establish themselves as the new normal, shaping the landscape for both current and future standards.

Nemeth: It varies as to whether the startups are still growing and profitable. Everybody is looking for startups that are cash flow-positive or at least close to that, and which are still showing decent growth.

“Before it was okay if startups were growing 80% while making losses. Nowadays, we’d rather see companies maybe growing 30% with a 10% revenue margin.”

When you’re applying The Rule of 40, maybe before it was okay if they were growing 80% while making losses. Nowadays, we’d rather see companies maybe growing 30% with a 10% revenue margin. They will definitely receive higher valuations, whereas startups without a clear path to profitability might not get any funding at all.

We’re probably now at a level that’s at the lower end of the valuation range, so that might improve. But I don’t think it will revert to the range we were seeing a year or two ago. There is a new normal, and that is the longer-term average.

Silva Martinez: The good assets will be in demand and spared from any further backlash, whereas the ones that don’t meet those conditions will still suffer. In 2020 and 2021, the market was treating everybody the same way no matter how good or bad you were. You went out to market and you got money, the valuation did not dramatically change whether you were a good asset or only so-so. That ‘same goes for everybody’ mentality will really see bifurcation next year.

But the reason founders are building what they’re building, especially at early stage, has to do with longer and more fundamental trends. So, ultimately, if you believe in those trends that is really what should drive longer-term valuations.

Generative AI has been on everyone’s lips this year. How much is it influencing your investments?

Silva Martinez (left): We certainly think there are a number of killer use cases still to be developed. It’s still not clear what [the really big changes] are going to be and we’re on the lookout for some of those trends next year.

The servicing side and the way customers interact with their financial institutions will certainly be reassessed under the lens of these new technologies.

There is definitely a valuation concern because the space is very hot. I don’t think it’s talked about enough but the larger concern I would have is that the obsolescence of some of those companies is much faster than venture cycles.

So, as much as you may find that hidden gem company that’s doing something amazing, and you want to invest in those guys, the question is how you project the validity of what that company is doing seven or nine years down the line. How do you assess the longevity of this company in that timeframe?

Landsch: I anticipate a heightened emphasis on distinguishing AI as a feature versus AI as a product. In my perspective, the latter constitutes the cornerstone for the success of AI companies.

I can foresee a surge in momentum in areas such as responsible AI, encompassing aspects of risk and governance. This signifies an evolving landscape where the ethical and strategic dimensions of AI play an increasingly prominent role.

Nemeth: Speech recognition and image recognition combined with pattern analysis and learning networks is definitely a game changer in many industries. Financial services is one of the very big areas, and insurance is one of the industries that will be most affected by AI.

And we are already seeing use cases that are really changing a lot of things. We invested in a startup three and a half years ago that does generative AI and AI-based automation for insurance. They now process hundreds of thousands of claims and will process 1.5 billion claims annually. It’s not just hype, there is already significant impact from the technology in financial services and insurance, though we are probably at the top of Gartner’s Hype Cycle, so I would expect some Valley of Disillusion in the next couple of years.

Moving on to exits, how long until the IPO market reopens? And is the M&A market strong enough to compensate?

Nemeth: There is a very strong M&A market and we are seeing a lot of strategic buyouts there, seizing the opportunity of lower valuations. There is still a lot of demand for digitisation and digital solutions that corporates have failed to build themselves and are now trying to catch up by acquiring startups to acquire digital capabilities.

I don’t expect the IPO market to really open up in early 2024, maybe towards the end of the year. Political uncertainty in the US might still be a concern, and with so much uncertainty in the world I think people are reluctant to deploy money and keep liquidity.

I would expect it to only reopen in 2025 but there is a very long deal pipeline, so it can be dangerous if companies go public and fail. That might send out some further shockwaves, so I think it’s actually good that some of them have pulled back and postponed their IPOs.

Landsch: I anticipate a positive trajectory for the IPO market, with the IPO channel softly reopening and gaining prominence as an exit strategy. Despite this positive development, I envisage that the M&A exit route will continue to be dominant, especially for enterprise tech companies.

Silva Martinez: There is certainly a lot of consolidation in the market, which is perhaps a different kind of exit. It’s not necessarily a bad thing but it is maybe pushing your exit horizon a few years down the line.

“There’s a preference for smaller transactions with a strong acquihire component to them.”

Manuel Silva Martinez, Mouro Capital

In terms of exits that return cash or something similar to investors, I think next year will still be quite slow, and I don’t think the M&A market will necessarily compensate for a lot of that. When I talk to some of the large buyers in fintech, the impression I have is that there’s still a slight preference for smaller transactions with a strong acquihire component to them, where the buyer is maybe getting the potentially good asset of a team a little bit on the cheap. Large acquisitions of fully developed assets less so.

I feel with the IPO market, it might become more of a regional thing. We’re seeing IPOs in the Middle East, where there is liquidity but also probably a strong push from regulators and local authorities to make sure the market reactivates. We’ll see what happens in the US, but obviously the availability of money there is greater than in the rest of the world.

AI aside, what will be the big growth for fintech in 2024?

Silva Martinez: I think we haven’t seen enough innovation in payments for a long time, I’d love to see more things in the payments space. Obviously, a lot of the largely funded companies are in that space, but there needs to be a new breakthrough in payments I can be excited about.

There are probably a number of new industries being formed at the intersection of financial services and some other industries, like the supply chain and how goods and services are delivered – that’s really interesting.

I’m still very much on the lookout for business models in the ESG space with fintech models that are interesting. We haven’t seen much there but we think things are brewing. It’s kind of a new market, but entrepreneurs are building because they need to find new, future sources of revenue where they can innovate.

Landsch: I hold an optimistic view regarding AI as a product, cybersecurity and ESG for 2024.

Nemeth (right): Payments is evergreen and there is a lot of discussion about the dependency, especially in Europe, on US card companies. I think the theme of a new sovereignty in terms of payments – in Europe, the Middle East, Asia – might become another hot spot.

Card-to-card payment is a theme that could emerge as a hot topic which is disrupting the traditional card industry. And it’s an infrastructure topic; fintech infrastructure is a very defensible play so that’s why it is probably a big theme.

Regtech is also an area we shouldn’t forget about, with more regulation coming not only in crypto but in general. One of the main drivers of regulation is ESG discussion and I think that will very much affect fintech in general.

Last but not least, I would expect a lot of activity in emerging markets and less fintech activity in the US and Europe for most of 2024. I think US investors are still pretty conservative and pretty concerned about the whole market, which is why I expect investors will look more to emerging markets.

What economic or geopolitical factors will impact fintech in 2024?

Landsch: Setting aside any unforeseen macroeconomic shocks such as wars, I believe the trajectory of interest rates in major regions will wield a considerable influence on the fintech landscape in 2024. Whether we will witness a decline of interest rates remains one of the pivotal questions shaping that landscape for the year.

Moreover, any political policy changes related to fintech, in light for example of upcoming elections in several core markets including the US, will have an impact for fintech in 2024 onwards.

Nemeth: There is still geopolitical tension, and elections in the US coming up, so there are a lot of macroeconomic issues at play at the moment, which fintech is affected by along with the other verticals.

We have some crypto investments too, so we’re looking at what’s going on in the US with regulation. There are different forces at play. Some expect, if Trump gets elected, that crypto regulation will be less strong, whereas the current administration is definitely pushing for more regulation.

I think the subverticals of fintech, like payment and alternative lending, are still being affected by high interest rates. For most of the last two years we’ve stayed away from anything that is asset heavy or has a lot of lending exposure.

Silva Martinez: Increased regulation will open up new areas for opportunity but at the same time may stress some startups that have not taken regulation seriously. The cost-of-living crisis and potential recession will propel innovations around areas like consumption, savings and planning.

Geopolitical turmoil will create awareness and innovation around new types of risks – supply chain, geopolitical, cybersecurity and so on – all of which are large markets in the making. Lastly, the end of interest rate hikes and a potential reduction in rates may put some stress on some of the business models that have benefited from it, like deposit taking, but also create a new opportunity for tech-enabled lenders.

Finally, what are your personal resolutions for 2024?

Nemeth: We are always reminding ourselves of the basics of the business. For us, it was hard for us to stay away from many deals in the past. Withstanding FOMO is a capability people have to learn, and the more experienced you become as an investor the more you are able to see the patterns that lead to this exuberance.

Silva Martinez: We’ve spent the last 18 to 24 months firefighting, helping our companies to stabilise. One of my personal resolutions is to think about how we go back to building and being positive, bringing positive energy into a company’s culture and creating an inflection point where you can say ‘tough times are behind us, we’re doing well, let’s go back to being positive and back to that spirit of entrepreneurship that is positive overall’.

And then, to be a bit more geographically curious as an investor. There has been an expansion of money into smaller ecosystems and there has been a tremendously positive change in places like Eastern Europe, Latin America, North Africa and the Gulf countries. Keeping that geographic curiosity in these markets, where things may not have been happening a few years ago but are now happening in very interesting manners.

Landsch: Taking on a more prominent role in advocating for the positive transformation of Europe amid prevailing negativity, optimising board meeting efficiency, reducing my chocolate consumption, and having good quality time with my family and three children.