How you set up effective performance metrics for teams whose outcomes are a combination of tangible and intangible effects, is often as much about influence and learning, as it is about revenue.

Measuring performance is one of the most challenging areas of running a corporate venturing programme, and one of subjects we are most frequently asked about by participants on GCV Institute courses. How do you set up effective performance metrics for teams whose outcomes are a combination of tangible and intangible effects, often as much about influence and learning as they are about dollars of revenue?

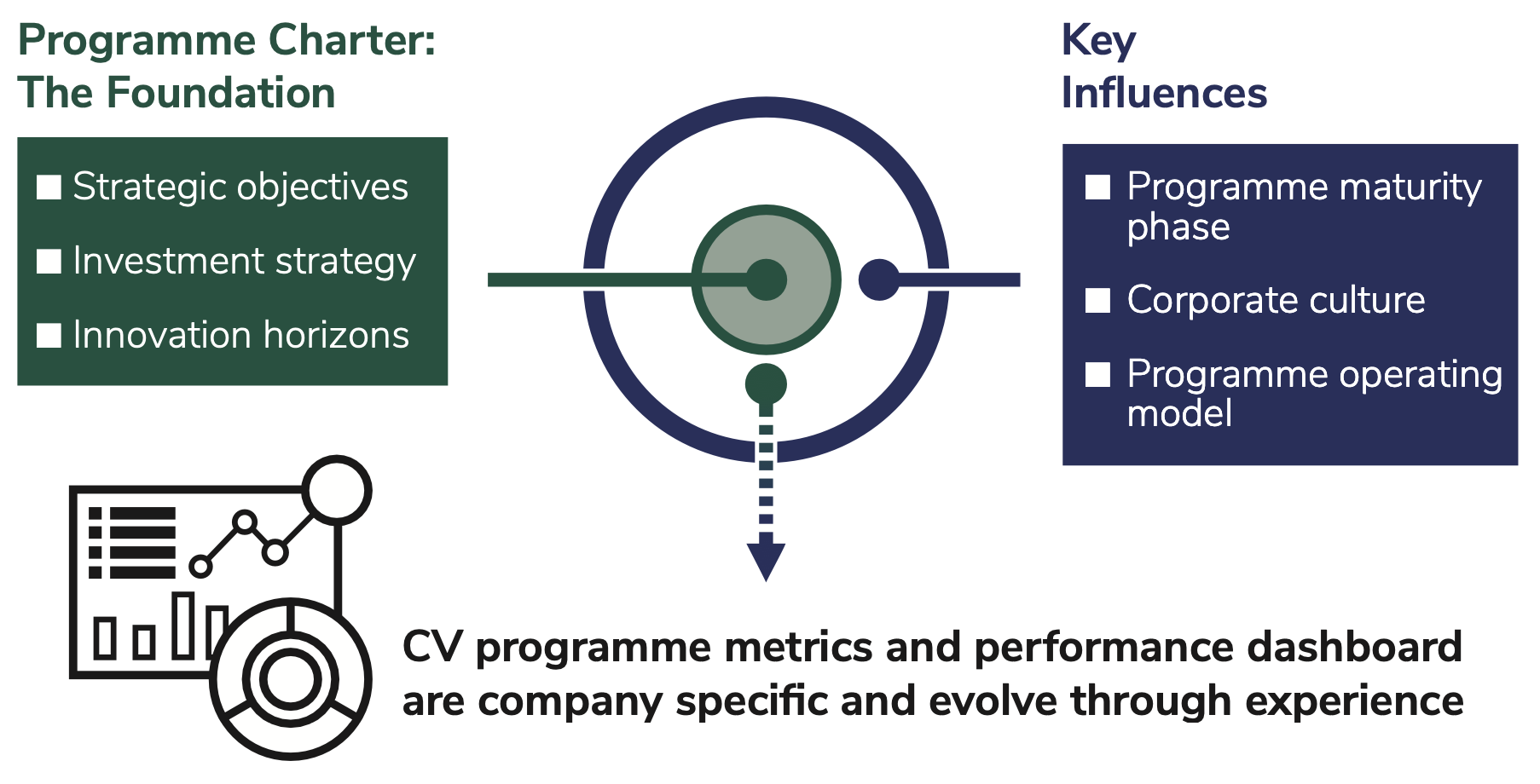

There is no one size fits all when it comes to the definition of performance metrics for a corporate venturing programme. CVC programme performance metrics and dashboards will be company-specific and will evolve over time with experience.

But there is a methodology to follow that can help develop a performance framework that fits a CVC’s particular needs :

Programme charter – Metrics will look very different for a corporate venture team focused on near term internal technology adoption than for external ecosystem development, new business creation or future of explorations.

Programme maturity phase – Startup phase is all about hitting operational milestones in establishing a credible strategic investment platform. Expansion phase is showing momentum/proof of strategy and readiness to scale. Resiliency phase is demonstrating a measurable drumbeat of wins and impact, from both internal and external stakeholder perspectives.

Programme operating model is related to charter and maturity phase and influences performance priorities

- While all CVC programmes are strategic, increasingly many are being designed with the objective that financial returns should cover the cost of the strategic investment platform. The more mature and independent the programme, the greater will be the expectation of superior financial results.

- CVC teams that are driven by the needs of parent company business units are likely to prioritize and measure key performance indicatiors (KPIs) related to engagement between the portfolio companies and the parent corporation. For many of them this is the starting point for demonstrating value with early wins.

- Thesis-driven teams typically have earned the trust of the corporate leadership to act as a guide to future business trends and new business. They can find it hard quantify short term strategic results in terms of time and dollars and easier to point to anecdotal evidence of wins and impact on parent strategic direction.

- Financially-driven teams still need to demonstrate strategic impact and relevance, or they will not survive. CVC financial returns are too small move the needle for the corporation’s overall results.

Financial Performance

For majority of this year’s Touchstone survey respondents, competitive financial returns are seen as table stakes for CVC programme survival, with two-thirds targeting at least VC-level portfolio performance. An increasing number of programmes are employing a chief operating officer or dedicated finance team to manage portfolio reporting. Standard VC metrics such as internal rate of return (IRR) and total value to paid in (TVPI) are now the language of financial performance for most CVCs, with 79% using IRR and 73% looking at TVPI. Some groups also look at achieving ‘evergreen status’ – where returns allow group to be self-funding — within five to seven years.

Strategic performance

Measuring strategic performance remains the holy grail for CVC programmes. There’s seldom a simple answer because charters, objectives, investment strategies and the culture and sector of the parent company vary so much — not to mention the stage of the CVC programme. It’s always a balance between what the CVC team would like to be able to communicate to key parent stakeholders and what it can easily track.

It can be helpful to think through how corporate priorities, CVC investment strategy, and portfolio management processes should be aligned to measure the programme’s strategic impact.

Charter

The CVC programme charter ideally is as concrete as possible, documenting shared understanding between parent management and CVC unit.

- Why does the programme exist? Why is it important to the parent strategically (growth, competitiveness, transformation)?

- How are CVC programme objectives reflected in investment and portfolio strategy (balance of strategic focus areas, theses, innovation horizons/lead time to value)?

- What is the appropriate mix of financial and strategic performance goals and metrics?

Investment

Strategic considerations are a key component of the CVC investment process, although the way they are defined and assessed may vary significantly.

- What strategic rationales are included in standard investment committee pitches?

- Are there standard approaches for describing and quantifying key strategic goals?

- Are the corporate venture business development team and potential business unit collaborators included in investment decisions?

- Are pre-investment strategic assumptions tracked after the investment?

Portfolio development and management

It’s in the best interest of the CVC team to proactively define the framework for assessing the programme’s strategic performance, but they should ensure this reflects culture of the parent company. Think about:

- What performance metrics resonate with the parent and what can be efficiently tracked by the CVC team.? This could include activity KPIs, such as the percentage of portfolio engagement with parent, the number of proofs of concept, meetings, reports and events as well as quantitative business impact metrics such as time and money and also anecdotal success stories.

- What is the right mix of strategic insights, commercial impact, and softer measures (brand, culture change, DE&I…) for a scorecard?

- Are both the CVC team and parent ‘partners’ incentivised to drive portfolio strategic value delivery (end-to-end investing)?

Communicating Performance

Ultimately, effective performance communication is about managing parent expectations by delivering results within the ‘corporate patience cycle’ and speaking the language of the parent. Is the parent corporation highly quantitative and reliant on statistics? Is it important to demonstrate contribution to innovation branding, customer satisfaction, or societal impact. Are there hot buttons to avoid?

The key thing is for the CVC programme to take the lead — it’s much more challenging if you allow metrics to be defined for you by people who don’t understand how corporate venturing works.