Chevron led a $100m round, backed also by a group of other corporates, raised by the carbon capture specialist.

UK-based carbon capture technology developer Carbon Clean received $150m in a series C funding round, led by oil and gas producer Chevron – through its Chevron Technology Ventures unit – to help decarbonise heavy industry. The company counts several other corporates among its previous backers, including cement producer Cemex, conglomerate Marubeni, insurance provider Axa, electronics manufacturer Samsung, gas producer TC Energy, insurance company Axa, water and waste management company Veolia as well as oil and gas majors Saudi Aramco and Equinor. Most of them joined Chevron for this latest round.

Founded in 2009, Carbon Capture has developed a point source carbon capture technology, capturing emissions directly from the source, intended to facilitate the cost-effective separation of CO2 from emissions from industrial and gas facilities. The company aims to achieve gigatonne-scale carbon capture capacity around the world by the mid-2030s. Carbon Clean currently provides technology to several industries including cement, steel, refineries, biogas and energy-from-waste.

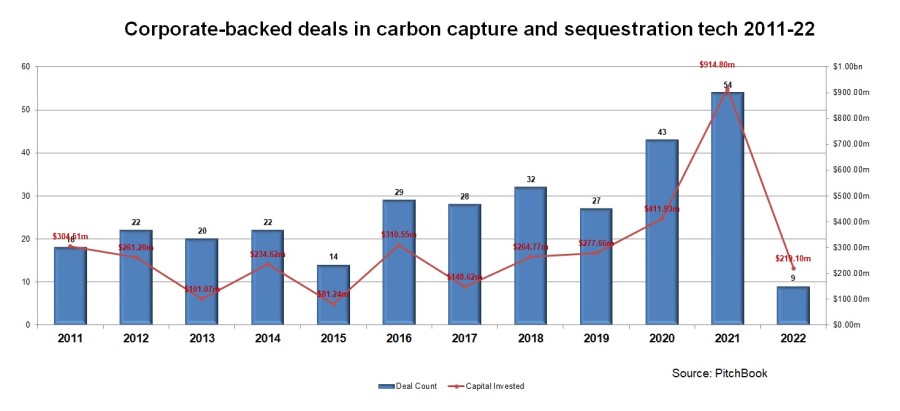

The company is part of the broader carbon capture and sequestration tech space which has attracted the attention of corporate venture investors, as illustrated by the graph below summarising data from PitchBook. In the past two years, there has been a record level of corporate-backed deals in this area, along with record levels of total estimated dollar value in them, reaching $914m by the end of 2021. The interest in such technologies is not surprising in the context of low carbon future and net zero goals by the middle of the century and the need of heavy industries to neutralise their carbon footprint.