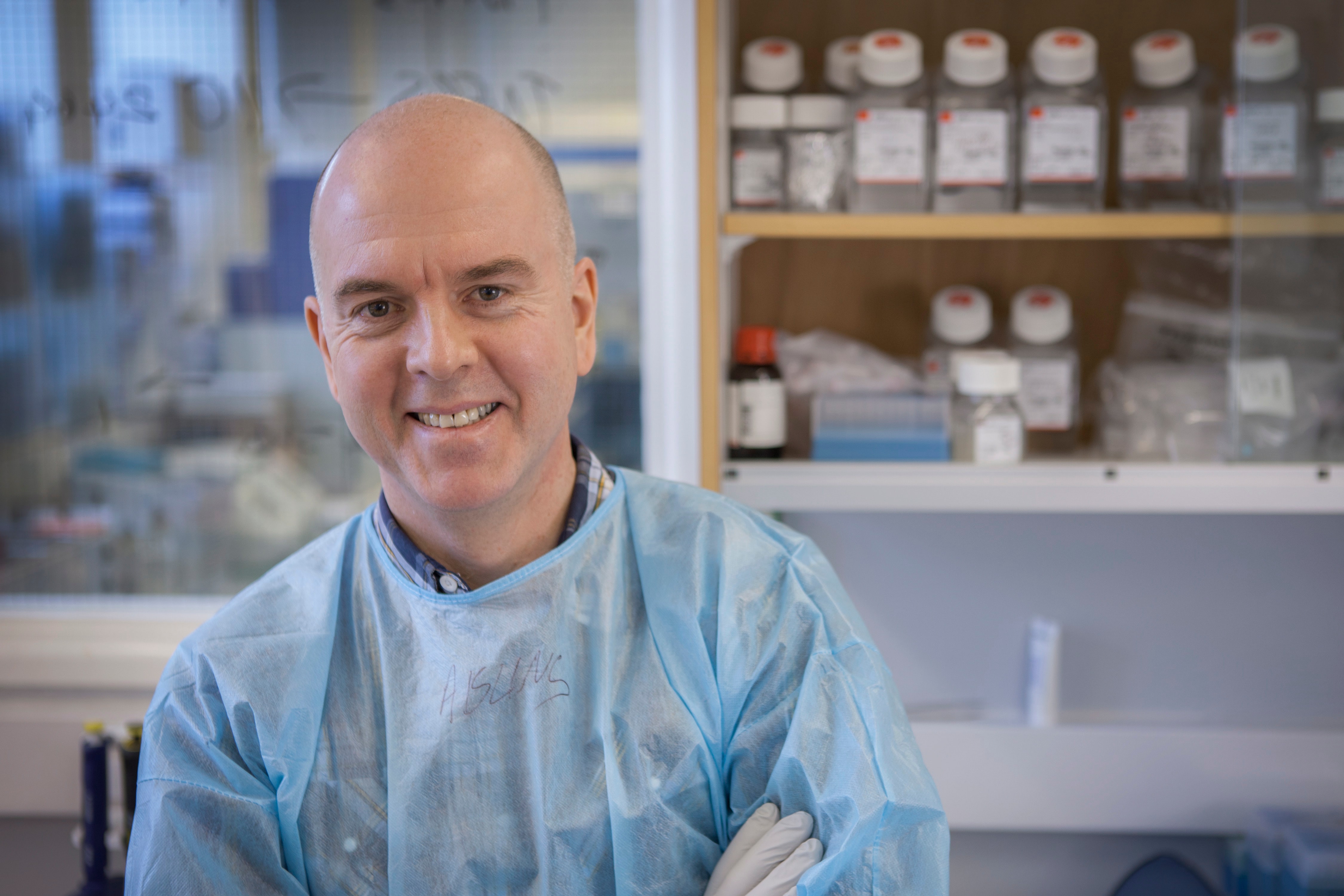

CEO Jeremy Salt talks to Global University Venturing about how the University of Plymouth spinout is working to prevent zoonotic diseases such as Ebola and covid.

There are, in the UK alone, more than 30 indigenous zoonoses – diseases transmissible from vertebrate animals to humans – ranging from anthrax to Lyme disease. Worldwide, there are more than 200 types, according to the World Health Organization, and they make up a significant percentage of all newly identified infectious diseases as well as several existing ones.

Some zoonoses have a large direct economic impact beyond the human health implications. In the UK, more than 27,000 cows were slaughtered in 2020 due to bovine tuberculosis and the costs for controlling the disease run at around £100m ($130m).

Others have caused epidemics in the past, such as Ebola, which was responsible for more than 11,300 deaths over the course of 2014 to 2016 – a large proportion of the suspected and confirmed more than 28,600 cases.

Of course, the most severe zoonosis in living memory has been the covid-19 pandemic, caused by the severe acute respiratory syndrome coronavirus 2 (Sars-CoV-2). As of mid-March 2022, there have been more than 464 million cases worldwide and more than 6 million deaths. The need for a vaccine was acute, and thankfully spinouts Moderna, BioNTech (through its partnership with Pfizer) and Vaccitech (through University of Oxford’s deal with AstraZeneca) all had technologies that were able to target the spike protein.

While quick to develop and deploy, the approaches had a significant drawback: as the virus mutated, the creation of booster shots became necessary and all three vaccines now require three shots to remain as effective as possible.

The Vaccine Group (TVG), a spinout of University of Plymouth, is working on a best-in-class vaccine. TVG’s technology revolves around a herpes virus-based animal vaccine platform that it primarily uses to protect animals against infectious diseases rather than wait until they have arrived in humans.

Jeremy Salt, chief executive of TVG, told Global University Venturing that the major difference between its vaccine and commercially available ones was that it particularly targeted the T cell response. “Because of the way that the herpes virus replicates normally, and the vector that we have, we can generate very strong T cell responses,” Salt noted. “We have seen a lot of variation in the spike protein over the time that all of the epidemiological sequencing has been done. It is inherent in T cells epitopes that they do not tend to vary as much as the B cell targets on the surface of the virus.”

He elaborated: “From the outset, our approach was to make use of that particular attribute of the vaccine – targeting less variable T cell epitopes – and we then incorporated other proteins, which were not constrained by being the target of the anti-spike antibody. We were able to include two other proteins from the virus. We hope that this would then be a useful vaccine against a wider range of variants.”

This plan of attack has been off to a promising start. TVG approached Pirbright Institute, focused on infectious diseases in animal farms, to look at T cell responses in a pig model. It “might sound odd”, Salt acknowledged, but pigs “are a nice correlative in terms of their immune response”.

The model showed that TVG’s vaccine not only induced very strong responses against the novel coronavirus but also against the original strain that had been responsible for the Sars outbreak in 2002.

“Obviously, we do not need a vaccine for Sars-CoV-1,” Salt acknowledged, “but the extrapolation is if we can protect against Sars-CoV-2 and as distant a relation as Sars-CoV-1, it is not unreasonable to expect that anything in between those two, and on the other side, is going to be covered.”

TVG has discussed the data with the UK Medicines and Healthcare Products Regulatory Agency, who were “extremely helpful” and is now using internal funding to generate the additional data needed to be able to move into phase 1 trials.

Once TVG reaches that point, it will need a strategic partner as it does not have the resources in-house. But rather than this being an issue, it is one of TVG’s strengths. The spinout is a relatively small business, yet it has a huge network through the two-decades-long work of its scientific founder and chief scientific officer Michael Jarvis.

Jarvis, with the support of University of Plymouth’s tech transfer office and commercialisation firm Frontier IP, incorporated TVG in 2017 and the spinout continues to collaborate with the university as Jarvis maintains a joint appointment – he is an associate professor in virology and immunology.

The spinout’s initial work was built around a collaborative grant involving partners from Europe and the US, such as the Defense Advanced Research Projects Agency (commonly known as Darpa) to look at the possibility of intervening in the reservoir host of a zoonotic infection and trying to reduce the risk of spillover into human populations. A big part of that project involved the development of software to be able to model the potential impact of such spillovers.

Since then, TVG has undertaken research into vaccines for Lassa fever, Ebola, bovine tuberculosis, E. coli mastitis, African swine fever and streptococcus suis. The development of a vaccine for the latter is jointly funded by the British and Chinese governments. Streptococcus suis occurs in pig livestock and a vaccine would additionally enable a reduced antibiotic use to combat antimicrobial resistance.

Some projects were supported through BactiVac, a Research Council-funded organisation that awards small amounts of pump priming in the context of bacterial vaccines. It was a “slight diversion” from zoonotic diseases but “the common element was the issue of antimicrobial use”, Salt explained.

Moving forward, TVG expected to increase its focus on high-impact animal diseases but would continue to pursue vaccines for zoonotic diseases, Salt revealed. “The actual amount of work on zoonotic diseases may remain the same, but the overall size of the company will increase. We are looking now at diseases such as porcine reproductive and respiratory syndrome and developing a vaccine with protection against a broader range of strains. This high-impact swine disease is one of the key global issues in terms of loss of productivity in the pig industry, and that project is being done with commercial partners; we are lining up a route to market straight away.”

Strategic partnerships were a key component of TVG’s business model, Salt stressed. The spinout developed vaccines to either proof of principle or proof of concept stage and then licensed them out, he elaborated. “With grants, we have not necessarily started with a commercial partner every time, so there has not always been a defined route to market.

“The flexibility that it gives us is that it is a relatively limited capital investment to be able to demonstrate proof of principle. The other advantage is it creates a better opportunity for us to find a range of partners later on, rather than tying ourselves to a single partner who may decide ultimately for their own reasons that they do not want to continue with a product. It also gives us a chance to work on a range of diseases.”

There were disadvantages to this model, Salt admitted. “We are tied into a royalty model. There may be ways of generating more income if we owned and developed the products, but that would be a huge step for a startup like us. The model we have is appropriate for where we are.

“We will slowly evolve to get to a slightly later point in development, but what we are very keen to do with the diseases which we see as key for animal health, rather than in zoonotic diseases, is to find a partner early on who will commit.”

He added: “The advantage for us in these partnerships is that animal health companies have huge capability to determine where potential markets are. Whereas when we are tied into grant funding, the targets are within the scope and control of the grant-awarding body, not necessarily the commercial market.”

The plan to go slightly further down the development track stemmed from Salt’s prior expertise gained in business development. He explained: “I have a very clear view of what companies see as the components of a proof of concept. Often scientists believe they have a product earlier than the company might. Where I would like to take us is to potentially immediately transfer the technology into a facility that could, in theory, go into regulatory-type pivotal studies. In other words, if we can get a little bit further, we would have more knowledge of how our constructs perform at something useful to manufacturers.”

It was a goal that TVG was looking to finance through its next investment round, Salt said, but even in the medium term, he did not see the company going beyond that stage. Speaking of money, Salt added that he had been positively impressed with innovation agency Innovate UK: “They seem very well organised, motivated and have been extremely helpful in trying to find other sources of money for us.”

The government support had generally been favourable to grow a company like TVG, he continued. The country was “well organised on the various vaccine networks, both on the animal health and human health sides”.

Notably, vaccinology was a relatively recent area that only emerged over the past 10 to 15 years, he noted. “Previously there was microbiology, immunology, virology, molecular biology… Gradually people have come to accept that vaccinology per se might sound very applied – therefore, why would any basic researchers want to get involved – but the British government has done a good job at backing this concept that vaccinology needs its own investment. To encourage people to work on vaccines and look at the specifics of translational research has been really useful.

“How do we do that translation? It comes in multiple ways. It can be encouraging SMEs to get involved in early-stage projects. It can be allowing companies to be part of these collaborations and giving them money. That funding is now available to companies like TVG helps to put some flesh on the bones of that idea that was built up through the vaccine networks. People are also prepared to put money into the applied sciences, on top of merely the basic research. Then, there are the Vaccine Manufacturing and Innovation Centre at Oxford and the Future Vaccine Manufacturing Research Hub at Imperial College London.”

Such a well-rounded ecosystem was a crucial aspect of emergency responsiveness, Salt argued. “Unless there is a commercial partner, it is very difficult to make the transition from bench scale to manufacturing – it is not usually done in one jump. Even groups like TVG, which are slightly more informed about commercialisation processes than the average university, cannot take technology and put it straight into high-volume manufacturing.”

This was where actors such as the aforementioned Pirbright Institute came in, Salt explained. It announced last year plans to establish an animal vaccine facility partly funded by the UK Foreign, Commonwealth and Development Office and the Bill & Melinda Gates Foundation.

“This is physical infrastructure that allows the flow through from the research base into the scale that you need to be able to transfer into manufacturing,” Salt stressed. “It is tangible and that takes time.”

None of this was a response to the covid pandemic, Salt said pointing to the Jenner Institute at University of Oxford which was established in 2005 and produced the foundational research enabling the AstraZeneca vaccine. “The ability of the scientists to create that construct so quickly and the competency and confidence that the regulators had to be able to dramatically change their processes is not instantaneous. It has been built up over years and a lot of it on government grant money.”

Existing facilities were motivated by a desire to be prepared for disease X – a term officially adopted by the WHO in 2018 as a placeholder for a hypothetical, unknown pathogen that could cause an epidemic – but they “are not overnight successes”, Salt said. Having such facilities available in quiet times for companies like TVG was very helpful, he maintained.

Challenges remained, he lamented. As TVG moved closer to a phase 1 trial for its covid vaccine, the amount of available public funding had been reduced because the acute need was gone. Notwithstanding this, he added, “what we are left with is a huge amount of interest in vaccinology and the infrastructure. We feel it is relatively urgent that we are continuing this three-pronged approach effectively – pursuing government outside any grant cycle, making applications where there is a reasonably short turnaround and talking to our own investors about the possibility of funding this next step.”

There was not, however, any “large missing chunk” left in the UK’s public ecosystem after decades of strategic investments and an evolution of university thinking on research commercialisation, Salt celebrated. “The disappointing bit for me is not a government issue,” he said. “It is the limitation on the number of private companies who ultimately have the capacity to go ahead and develop products and market them on a global scale. As somebody who has been involved in this industry for most of my career, it seems that companies have moved away from the UK. We have AstraZeneca and GlaxoSmithKline, but there is a feeling that there used to be a wider range of choices and it is a little bit narrow today.”

Salt was unable to offer insights into why big corporations had chosen to leave or foregone a UK base. For TVG, the tax environment was favourable to collect investment, he declared, but he was not clear whether it was a lack of support or a disincentive that caused companies like Zoetis, his former employer, to leave.

Ultimately, it did not matter to TVG, he claimed. “Europe and the world are accessible to us. But from the UK economy point of view, it is slightly disappointing that we do not have any of that.”

Perhaps the most crucial part of the UK ecosystem for TVG was Frontier IP, without which “we would not be sitting here,” Salt underlined. While the university did a good job supporting Jarvis with the technology development, protecting the initial IP and encouraging him, their expertise ultimately did not lie in running a business. “On a day-to-day basis, Frontier IP give us operational support and that knowhow makes it far easier for a spinout like this to be set up.”

He continued: “The key thing in addition to operational support is strategy. Where we are going as an organisation, being able to build up the business plan with the financial modelling that is available within Frontier IP, and the networking with potential investors is crucial.”

The importance of private funding was not just about money, he said. “It is the breadth of what we can work on. If we were continually applying for grants, our direction would be dictated by what the grant funders are prepared to consider. With our shareholders, we have a chance to persuade them our vision is going to give them a good return on their investment. It is ultimately for them. It has freed us up by having these contacts and Frontier IP giving us access to these investors.”

That vision for TVG’s future would involve it exploring the utility of its technology in other areas, Salt revealed. Specifically, the spinout planned to look into companion animals and using its platform as a gene delivery for functional proteins.

Salt had joined TVG because he was attracted to this stage of company development and size, and because it gave him the opportunity to apply the knowledge accumulated sitting on the other side of the table. “It seemed to be a good time to build on the data and trying to add to it, maximise its potential uses and expand the business,” Salt reminisced. “It was attractive to look at a technology, have a chance to influence where it might go and ultimately build the company into a money-making venture.”

He concluded: “It was nice to think something may come of all of this.”

It may be early days still for TVG, but with the leadership of Salt and the expertise of Frontier IP behind the spinout, there can hardly be any doubt that something will, indeed, come of this.

– This article was updated on March 22 to remove a reference to rabies that could have been misread as the disease posing a danger to humans, when it only exists in a small number of wild bats according to the NHS, and to correct the spelling of Zoetis. We apologise for the confusion.

Thierry Heles

Thierry Heles is editor-at-large of Global University Venturing and Global Corporate Venturing, and host of the Beyond the Breakthrough podcast.