More corporate investors choose to invest in academic research. But it requires much different skills to investing in later-stage startups.

For an increasing number of corporates, the high risk and effort of investing in university spinouts is a gamble worth taking.

Funding in this area of pre-seed investing, the earliest stage of startup financing, is typically provided by university technology transfer offices, specialist venture capital funds, founders’ friends, supporters and family members. But corporates, which traditionally back later-stage startups, are increasingly seeing value in academic research that is not yet commercially proven.

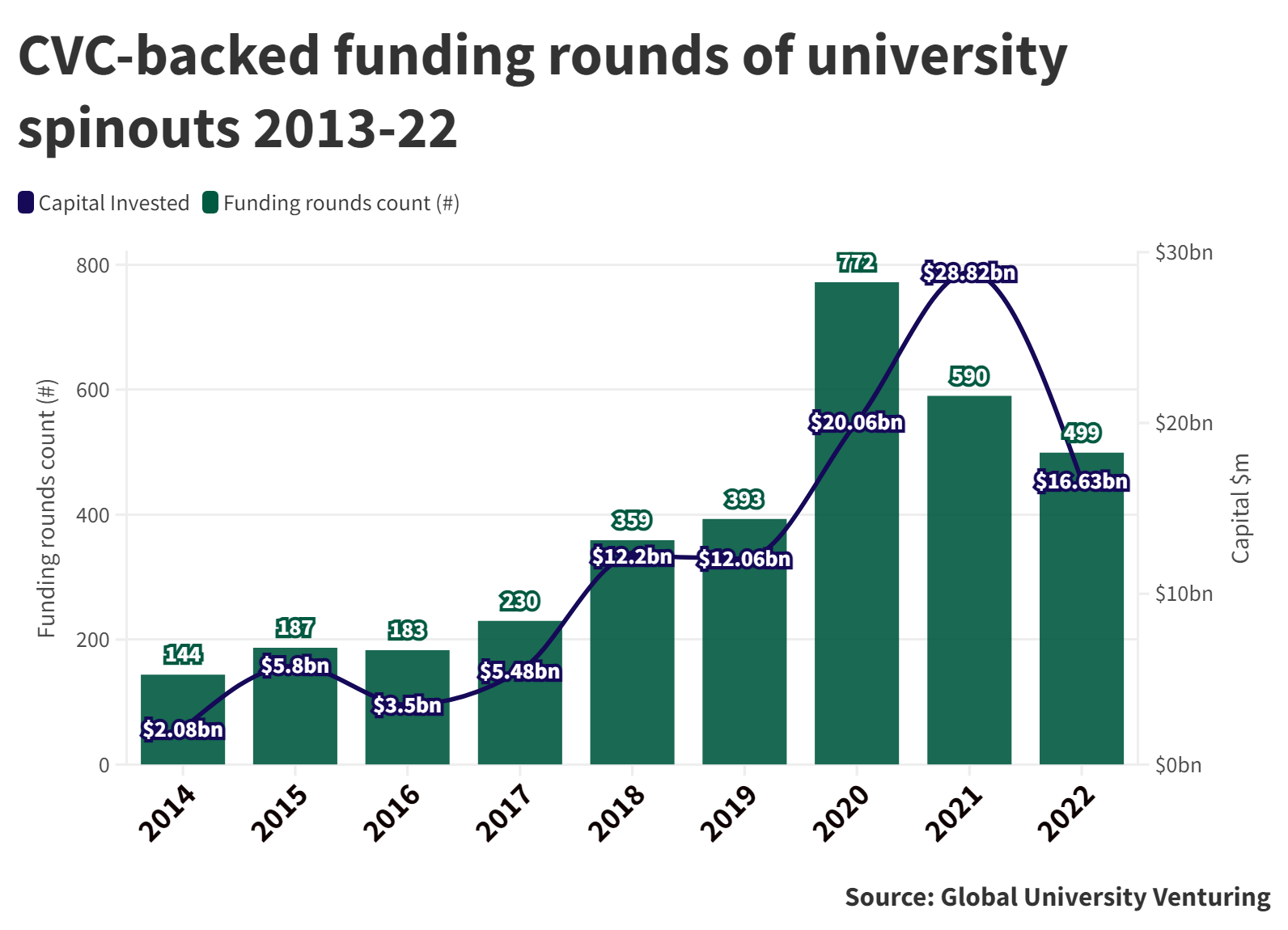

Corporates invested a record $28.3bn in university spinouts in 2021, according to Global Corporate Venturing data. That fell to $16.6bn in 2022, the most recent data available, but still well above the previous several years.

For some, the potential financial return of investing early in academic science makes the effort involved in building a company from scratch worth it. “When we go in and take that risk early, we obtain a substantial ownership, and therefore, in the long term, the risk is rewarded,” says Søren Møller, managing partner of Novo Seeds, the early-stage investment arm of Novo Holdings, owned by Danish charitable organisation Novo Nordisk Foundation.

Novo Seeds invests for financial return in life science technologies, but it co-invests with corporate venture funds with a more strategic interest in university spinouts. Corporates are “important players in seeding companies because they are willing to take risk to develop ideas that are in their corporate interests. They are important and knowledgeable contributors as we build new companies,” says Møller.

READ MORE ON UNIVERSITY SPINOUTS:

Other pre-seed investors also welcome corporate investors. Gregor Haidl, principal of High-Tech Gründerfonds, a German public-private investment fund that has corporate partners, says corporate investors can “accelerate the learning of the university spinout team” by showing how the academic research can have commercial applications.

Corporates benefit from investing early in spinouts because they have the opportunity to shape a product from the beginning according to their needs. “It is so early that founders are still defining the product. If you are already on board as a corporate, you can tailor the product much more to your needs,” says Haidl.

Investing so early in a spinout is very different to later-stage dealmaking. Investors are essentially helping to build companies from the very beginning. This requires teams with different skills to those committing capital to later stage startups.

Here are tips for making a success of investing in university spinouts:

1. Build a local reputation as an investor.

Investing in university spinouts is like building your own ventures. You need build a reputation as an early-stage investor and invest locally.

Novo Seeds builds biotech companies out of either academic science or from spinouts that originate from pharmaceutical companies. The companies it builds have a strong tie to the local Scandinavian ecosystem and to Denmark, where Novo Holdings is based, because the team “works with them every day to get the company off the ground,” says Møller.

Novo Seeds has built a reputation for building companies out of academic research, which means it is often approached by entrepreneurs who have an idea for a new company. Other times, the Novo Seeds team will have an idea for a new company and will proactively look for the science and technology to build that venture. “Oftentimes we need to find it in different places. There is not one academic group that has the solution to everything, so we put it together from inventors from different areas,” says Møller.

2. Nurture relationships with repeat founders rather than with specific universities.

Spinout investors say they tend to work with repeat founders as their experience in setting up companies is more valuable than ties to a specific university.

For MS&AD Ventures, the corporate venture arm of the Japanese insurer, investing in a university spinout team is more important than the academic institution. “We care less about exactly which university it is from,” says Tiffine Wang, partner at MS&AD Ventures. “We feel that, at the end of the day, it’s always about the team. If it’s a university spinout, it needs to come from a very well-trusted person.”

High-Tech Gründerfonds works with a variety of different European universities and research institutes to source deals. But it prefers partnering with professors who are seasoned founders, especially as they can sort out terms governing intellectual property quickly. “There are some professors who really like fostering a good spinout culture and get things sorted with the IP terms,” says Haidl.

3. Make sure you have a big fund.

Building companies from academic science takes a lot of resources. It is only investment firms like Novo Seeds, which has an annual investment budget of $200m, that have the financial strength and manpower to take this on. The team of 30 does a lot of work scrutinising data to predict if a company is going to succeed or not.

Its team consists of people with an understanding of science and people who understand the venture market. “You need a complex mix of science background, operational understanding of drug discovery, expertise and understanding of the market,” says Møller.

It even has its own “seed lab” where it tests out the science that underpins an idea for a new company. Two-thirds of the approximate 170 companies in its portfolio stem from academic science.

Investing at such an early stage means you need a big fund to do all the follow-on financings that a spinout requires to reach later stage rounds. “You need to preserve a good ownership stake in the successful companies that you build. That is how you make money,” says Møller. “If you are a small seed fund and you don’t have follow-on capabilities, it’s more challenging to make money.”

4. There are no standard terms for spinout IP, which can slow investment.

The lack of standard terms for intellectual property ownership rights for academic research can slow investment, and the time it takes to sort out IP rights varies across universities. “It can sometimes take, and I am not joking, several months or even a year to get the spinout terms sorted,” says Haidl, of his experience working with European universities.

“You go to other institutes, and they have standard terms that are VC investing compatible and the entire process takes a fraction of the time. There is a very big difference depending on the institutes and universities. There is no Europe-wide standard, unfortunately.”

5. Strong intellectual property is more important than commercial success.

With early technologies and so-called moonshots, where the commercial viability of technology cannot be proven for a long time, having a valuable IP and a strong team should take priority. “Valuable IP is more important to us because, if you have really long shots and it will take you a long time to get to market, strong IPs are a necessity because you can keep up with the competition as nobody can copy you in the end,” says Haidl.

Having a strong IP also helps the company secure an exit valuation. “Even if companies don’t perform well on the commercial side, you can still achieve a decent exit valuation based on the team and their IP. If you don’t have a valuable IP, it’s much harder to sell the company if it doesn’t work well on the commercial side.”