From geothermal energy and mining tech to subterranean delivery systems, here are some of the most exciting startups focusing on what's underground.

Earth’s underground regions remain relatively unexplored, but are becoming increasingly important commercially, with geothermal energy, for example, a potentially bountiful source of renewable power that is still mostly untapped. Mining technology is also becoming more prominent as rare earth minerals make up a crucial part of more and more electronic products, and underground space could prove a more efficient way of building out infrastructure.

Technological development is making it increasingly possible to tap into previously unreachable subterranean regions. Here are some of the most exciting startups to emerge recently in this area, from the creator of the first ever geothermal energy panel and the developer of a system that uses electricity to break down rocks to a company that wants to build city-wide underground delivery networks.

Sage Geosystems

Houston, USA

Founded: 2020

Funding to date: $41m+

Although several countries, most notably Indonesia, Iceland and Kenya, source a significant amount of their power from geothermal energy, those countries tend to be the ones situated in volcanic regions where heat and water are both close to the earth’s surface.

Sage Geosystems believes that represents only 2% of the overall geothermal energy resource. The company has adapted oil and gas exploration technology to create artificial reservoirs underground, using pressurised water to create the steam necessary for energy. The company has also netted a Pentagon contract to develop an underground energy storage system for renewable power.

Geothermal project developer Ignis H2 Energy and sister company Geolog International supplied an undisclosed amount of investmentfor Sage in late 2022 before Chesapeake Energy Corporation led a $17m series A round disclosed in February this year. That was increased to $41m shortly afterwards according to a regulatory filing.

Enerdrape

Ecublens, Switzerland

Founded: 2019

Funding to date: $2.7m

Enerdrape, a spinout from the Swiss Institute of Technology of Lausanne, is also working on technology that would expand the sources of geothermal energy. It has created what it claims is the world’s first geothermal panel technology, which is being piloted in a project shortly set to be deployed in the town of Aigle.

The system is modular and prefabricated and is designed to be installed in existing subsurface infrastructure like tunnels or parking garages. In theory, they could capture shallow geothermal energy that is then used to heat or cool the buildings above, without the need for drilling or boring.

Most of Enerdrape’s earlier financing came from grants, in addition to a $170,000 convertible note from Venture Kick. Its first full funding round was closed in January this year, as Swiss energy utility Romande Energie joined investment firm Après-demain to provide $1.5m in seed capital for the startup.

Eden

Somerville, USA

Founded: 2017

Funding to date: $22.7m

Eden is developing technology it calls Electrical Reservoir Stimulation, which uses electricity to break underground rocks. The company says the technique has the potential to cut water consumption and carbon emissions from drilling, while simultaneously reducing the earthquake risks from fracking.

The system could be used to secure geothermal and hydrogen energy as well as for rock-based carbon storage and mining. Eden claims its technology can halve the energy needed for breaking up rocks by creating micro fractures before they are dug up, meaning they can be broken down more easily.

Petroleum drilling contractor Helmerich & Payne and TechEnergy Ventures, the investment arm of oil and gas producer Tecpetrol, co-led Eden’s $12m seed round last October with help from mining group Anglo American. The rest of its funding had come from grants, most notably from the National Science Foundation. Another US government institution, the Department of Energy, has put up $1.4m for a pilot geologic hydrogen project in the Middle Eastern country of Oman.

Rigid Robotics

Vancouver, Canada

Founded: 2013

Funding to date: N/A

Rigid Robotics may have been around for over a decade but it’s a pioneer in the use of artificial intelligence in the mining industry, having developed an industrial internet-of-things system that combines AI with advanced data analytics from sensors in mining equipment.

The company’s platform can host several mining software applications and is intended to be the bridge between them, meaning it could automate the loading process in mines. But in a more immediate sense, it can track the performance of vehicle operators and maintenance for machinery as well as analysing conditions for drilling or blast engineers before they go to work on an area.

Rigid has not revealed any funding details thus far, but University of British Columbia’s entrepreneurship@UBC venture incubator counts it as a portfolio company. It appointed seasoned mining executive Ryan Hawes as CEO last month, with founding chief executive Mehran Motamed moving to a joint president and chief technology officer role.

RockMass Technologies

Toronto, Canada

Founded: 2016

Funding to date: $2.8m+

RockMass has also developed mining analytics technology based on research at Queen’s University, in Ontario, Canada. It provides detailed ongoing geological data to help industrial and mining customers optimise digging models and increase efficiency.

The tech allows users to access geological mapping through a handheld lidar device called the RockMass Eon (left), a system the startup says is up to nine times faster than manual mapping techniques. It has been utilised by geotechnical software producer Rocscience and engineering consulting firm Golder.

SOSV and BDC Capital were joined by angel investors from Maple Leaf Angels and the Creative Destruction Lab in the company’s $2m seed round in 2020. Its co-founders, Shelby Yee and Matthew Gubasta, have both been part of Forbes’ 30 Under 30 for manufacturing and industry list.

HyperTunnel

Basingstoke, UK

Founded: 2018

Funding to date: N/A

HyperTunnel is looking to bring together a range of technologies from mining, surveying, boring and 3D printing in an innovative tunnelling system it believes could be both faster and cheaper than existing methods, which date back to the 19th century.

The company combines AI and swarm robotics, which are fed through a grid of pipes to carve chambers in the ground and install access points while supplying survey data that can be used to form a digital twin of the planned tunnel. Essentially, it builds a 3D-printed structure in the ground that forms the basis of the structure.

HyperTunnel’s strategic partners include Network Rail, which operates the UK’s rail infrastructure, and it has received grant funding from the UK government to build an underpass at the Global Centre of Rail Excellence in Wales this year.

TerraStor

Fort Worth, USA

Founded: 2021

Funding to date: N/A

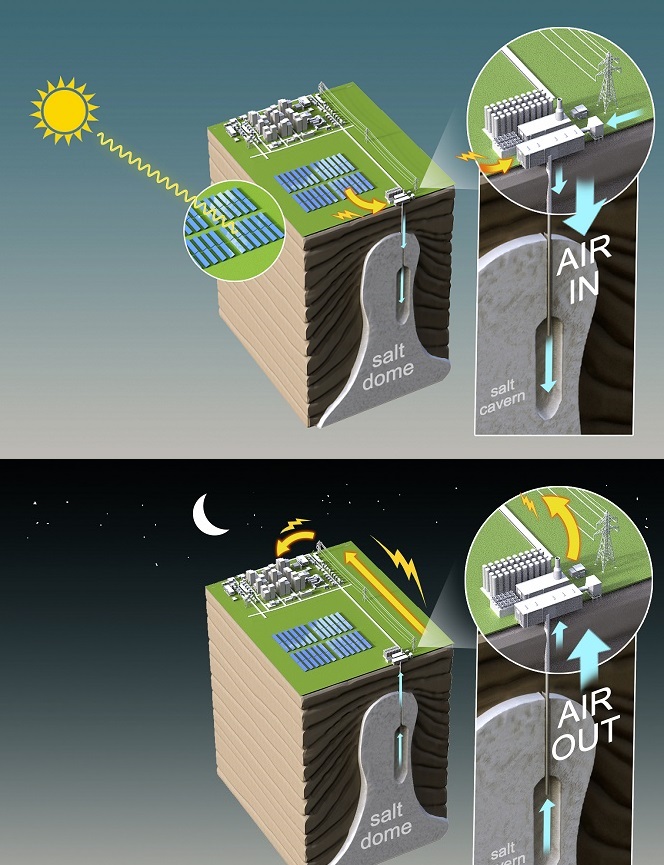

TerraStor is working on grid-scale energy storage infrastructure that would house energy in underground caverns like the ones created by salt domes, a process where salt or other minerals move into underlying rock.

The advanced compressed air energy storage plants would use a large electric compressor to push highly pressurised air into a storage cavern until it is needed (diagram left).

The caverns are expected to be able to store energy from eight hours to a full day and would offer over 100 MW in output.

The company has yet to announce a full-scale funding round but it passed through the Startupbootcamp Australia accelerator in 2022. It was incubated by Harvard University’s Harvard Innovation Labs.

Delta g

Birmingham, UK

Founded: 2023

Funding to date: $2.6m

Spun out of University of Birmingham last year, Delta g is looking to build what it describes as ‘Google Maps for the underground space,’ made possible by its portable gravity gradient sensors, which have been designed to accurately detect buried features.

Delta g’s sensors use quantum technology to detect underground features by their gravitational profile. They are intended to map complex underground locations quickly and accurately without requiring excavation and are unaffected by vibrational noise, hypothetically reducing the disruption caused by road repairs.

The startup emerged with $2m from a pre-seed round led by Science Creates Ventures and backed by Quantum Exponential Group, Newable Ventures, Bristol Private Equity Club and various angel investors, with the UK government’s Innovate UK agency adding a $600,000 grant.

Pipedream Labs

Austin, USA

Founded: 2020

Funding to date: $15m

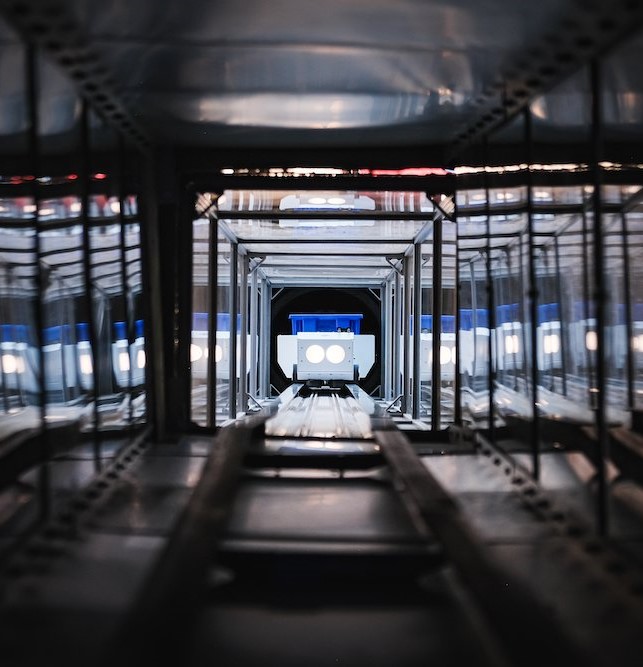

Pipedream Labs developing an underground network for deliveries, a model it calls hyperlogistics.

The network would consist of subterranean tunnels three to six feet under cities, linked by automated pick-up points, where an electrically powered vehicle can send goods back and forth. It could hypothetically be used to for food and last-mile ecommerce delivery and a pilot project is currently underway in the suburbs of Atlanta.

Pipedream graduated from Techstars in 2021 and closed $1.6m in seed funding the following year. Starship Ventures then led a $13m series A round in April 2024 that also featured Cortado Ventures and Myelin Ventures. It plans to choose a city for the first iteration of its large-scale delivery network later this year.

READ MORE:

8 bioengineering startups to watch

11 data centre energy startups to watch