Quarterly data: Q3 2021

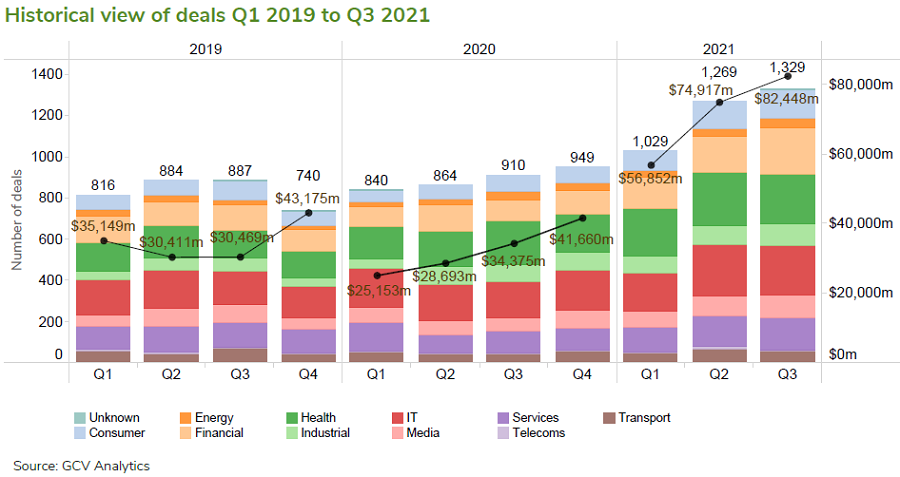

At the end of the third quarter last year, most of us were still in shock from the covid-19 pandemic and coming out of the first nearly worldwide lockdown. Despite the pandemic, we have since seen much upward momentum that both public and private markets have enjoyed as a result of massive monetary intervention on part of central banks. This is what has been taking place and the third quarter of 2021 seems to be yet another page in this bullish story.

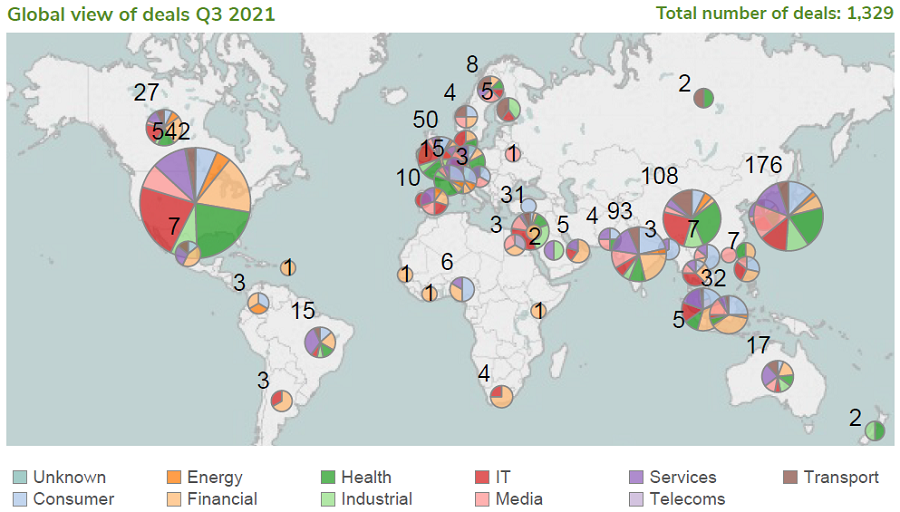

GCV Analytics tracked 1,329 funding rounds involving corporate venturers during the third quarter of this year, representing a 46% surge above the 910 rounds recorded in Q3 2020. The estimated total investment dollars stood at $82.45bn, up nearly 140% from the $34.38bn recorded during the same period last year. The US hosted the largest number of funding rounds (542), while Japan came in second with 176 deals, and China third with 108 deals.

When comparing Q3 2021 with the previous quarter, there was a 5% increase in the deal count, from the 1,269 in Q2 this year. Estimated total investment also went up by 10% from $74.91bn.

If we look at the results on a year-on-year basis, we see that by the end of the third quarter, 2021 has already surpassed the entire 2020 in number of corporate-backed deals – a total of 3,627 deals tracked by the end of September this year versus 3,563 by December 2020. The same is true, even more so, for the total estimated dollars in those rounds, which stood at $214.2bn by the end of September versus the $129.88bn by the end of last year, representing a 65% increase.

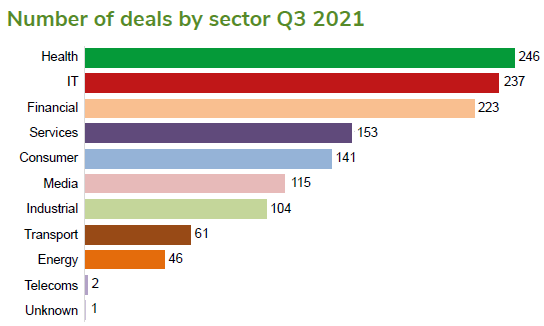

Emerging enterprises from the health, IT and fintech sectors proved the most attractive for corporate venturers, accounting for more than 220 deals each. The top funding rounds by size, however, were raised by companies from a variety of sectors.

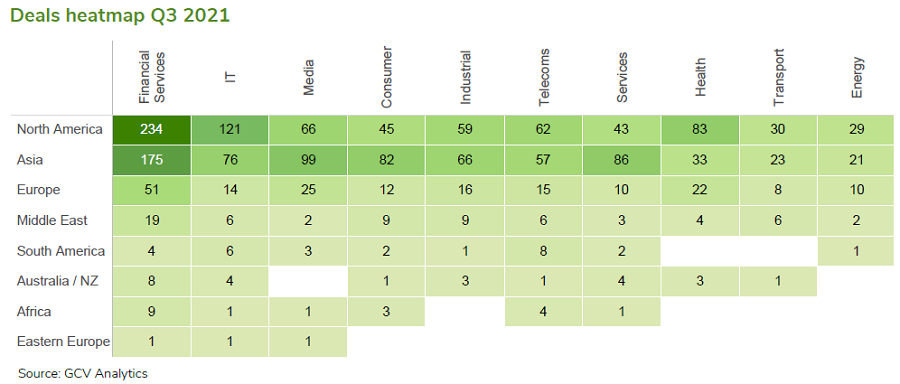

The most active corporate investors, in turn, came from the financial services, IT, media and consumer sectors, as shown on the deal heatmap.

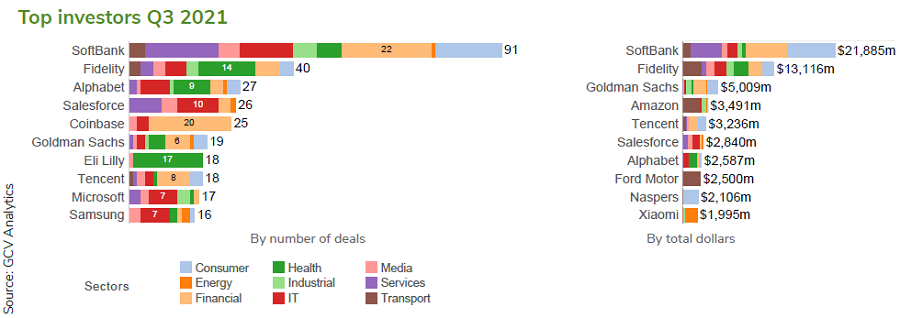

The leading investors by number of deals were diversified telecoms and internet conglomerate SoftBank, financial services firm Fidelity, internet conglomerate Alphabet and cloud enterprise software provider Salesforce. The list of corporate venturers involved in the largest deals by size was headed also by SoftBank, Fidelity and financial services firm Goldman Sachs.

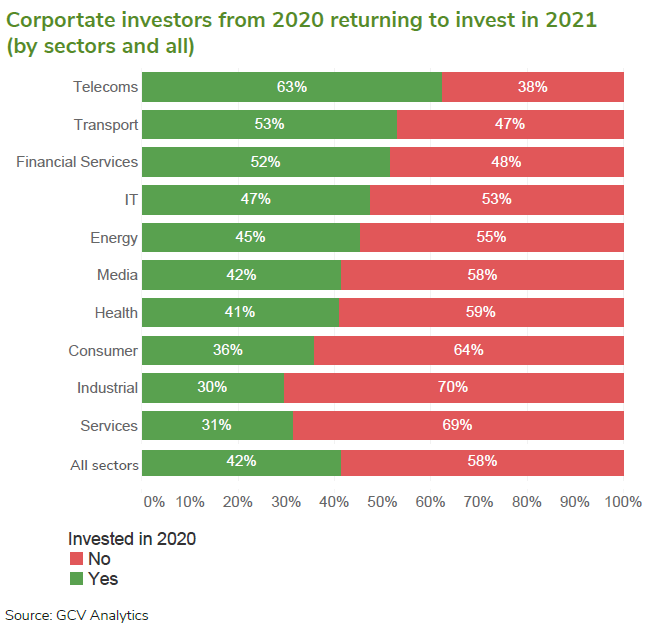

Our data also suggest that, overall, roughly four out of every 10 corporate investors (42%) that had participated in at least one minority stake round last year have already returned as investors during the three quarters of 2021 so far. In some sectors, notably, the proportion of returning investors is actually higher – energy (45%), IT (47%), financial services (52%), transport (62%) and telecoms (63%).

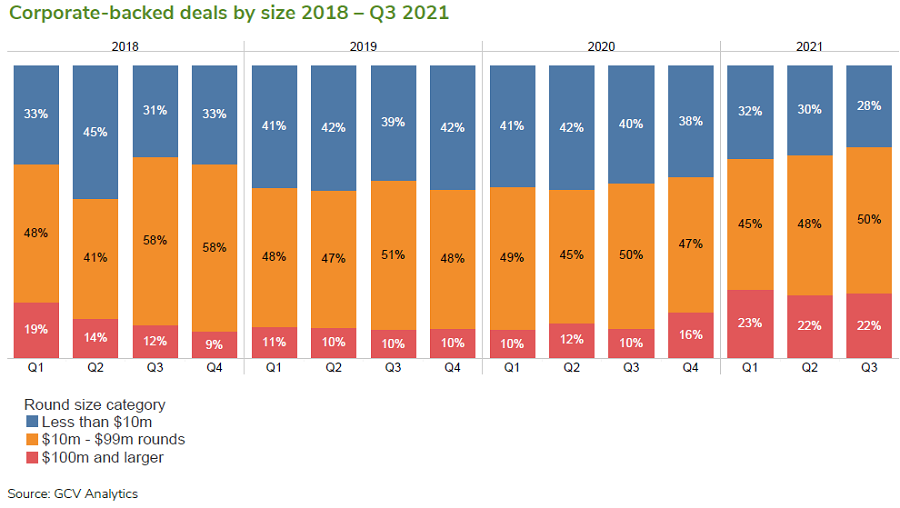

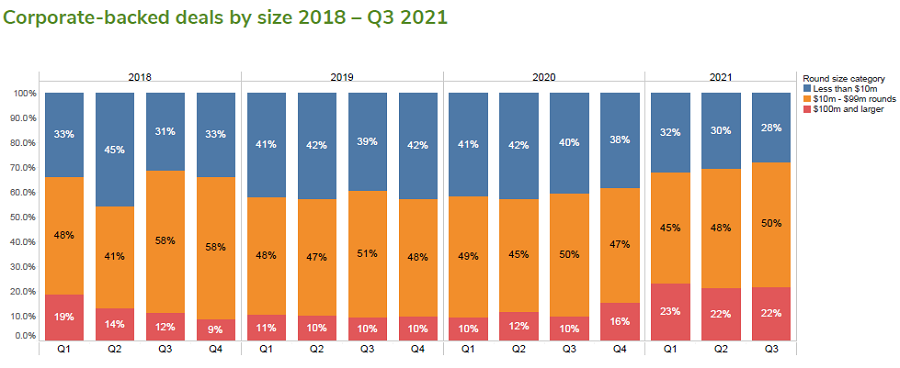

Another interesting indicator to look at are the relative proportions of small (>$10m), medium ($11–$99m) and large (>$100m) deals. As the following graph illustrates, in all quarters of 2021, the relative share of large deals, above $100m in size, increased significantly versus the previous year and stood at about 22%. This implies that valuations of more and more corporate-backed companies are surging and reaching unicorn status.

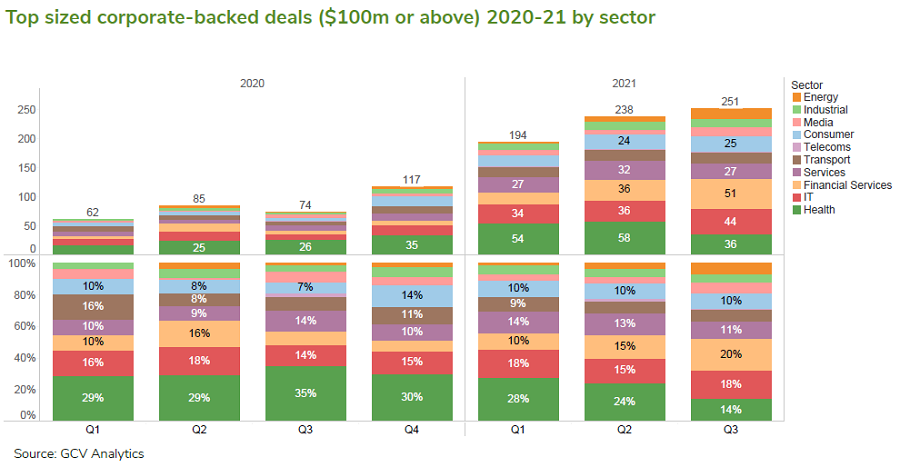

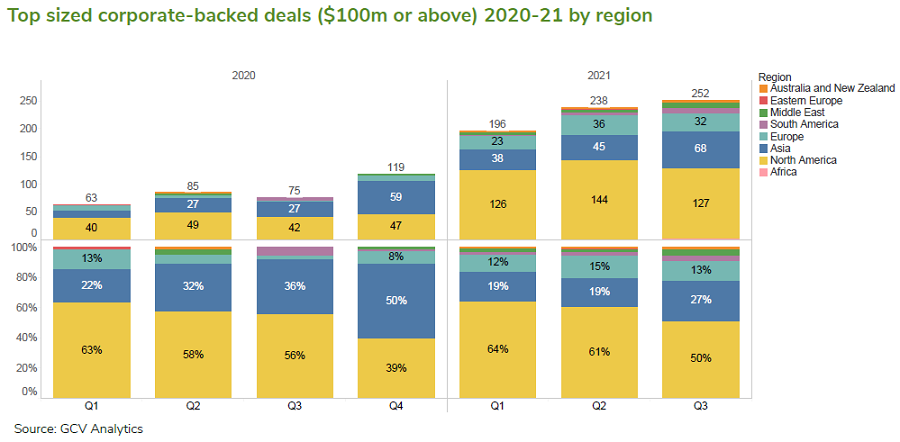

What we can do is try to see how such expansion in valuation multiples is forming sector-wise and spreads geographically? The upsurge appears to have started in the last quarter of 2020 and accelerated during this year. Geographically, it is concentrated in North America (though not limited to it), particularly in the United States, which accounts for 50-60% of all large deals throughout 2021. There does not seem to be a specific concentration of such large deals in a particular sector, as most sectors within this group of deals have retained their relative share, except for deals in financial services. Fintech startups appear to be increasing their relative share of the total in the third and second quarter of 2021 (25% and 15%, respectively, versus 10% in Q1 of this year).

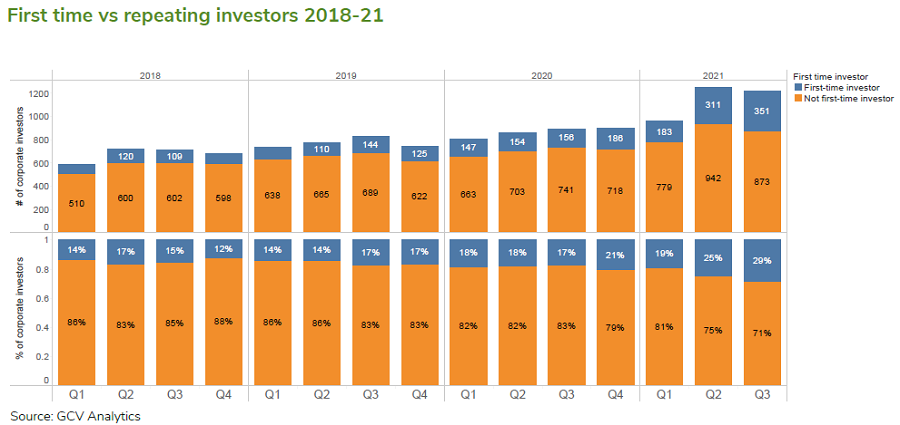

Most of the corporate investors taking minority stakes during the third quarter were investors that have done at least one deal before (71%). However, roughly three out of every ten (29%) corporates were disclosing their first minority stake deal during this quarter. There appears to be a trend of newcomers to venturing – whether having a specific venturing unit or not – comprising roughly a fifth to a third of all corporate investors, from 2018 onwards.

Deals

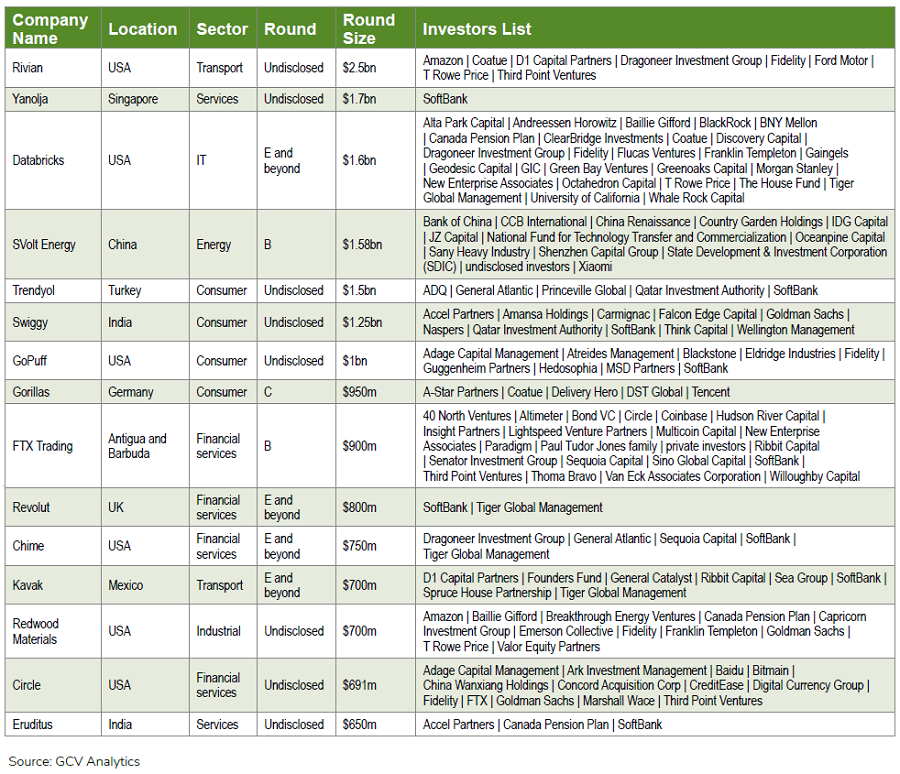

Most of the funding from the biggest rounds reported in the third quarter went to emerging enterprises from the consumer, fintech, transport and services sectors. Seven of the top 15 rounds stood above $1bn.

E-commerce group Amazon’s Climate Pledge Fund and automotive manufacturer Ford Motor Company co-led a $2.5bn funding round for US-based electric truck developer Rivian. The round was also co-led with investment firm D1 Capital Partners and funds and accounts advised by T Rowe Price, and included Third Point, Fidelity, Dragoneer Investment Group and Coatue Management. FoRivian is about to begin production on a range of electric trucks that will include an electric pick-up truck dubbed the R1T as well as the R1S, an all-terrain electric sports utility vehicle. Its vehicles are also set to be supplied to Amazon to serve as their last-mile delivery vans.

SoftBank’s Vision Fund 2 supplied $1.7bn in funding for South Korea-based travel and accommodation services provider Yanolja. Yanolja will use the capital to invest in its technology and expand its technology-based services into new markets. It intends to build a global travel platform that leverages artificial intelligence technology and big data to provide more automated and personalised services. Founded in 2005, Yanolja initially began as a short-term accommodation services provider before adding hospitality, food, leisure and transportation booking services to its offering, which is accessible through a mobile app.

US-based data analytics software developer Databricks, which counts a host of corporates as investors, raised $1.6bn in a series H round led by investment bank Morgan Stanley’s Counterpoint Global unit. The round valued the business a $38bn post-money. UC Investments, which manages University of California’s retirement, endowment and cash assets, took part in the round as did funds and accounts managed by BlackRock and funds and accounts managed by T Rowe Price Associates. Launched in 2013, Databricks has developed a cloud-based data management platform for aggregating and processing unstructured and structured data. The company intends to use the proceeds from round to invest in technology innovation and enter new markets.

SVolt Energy Technology, a China-based energy storage and battery technology developer spun off by carmaker Great Wall Motor, completed a RMB10.28bn ($1.58bn) series B round backed by consumer electronics manufacturer Xiaomi. Heavy equipment manufacturing company Sany also took part in the round, which was led by Bank of China Group Investment, a subsidiary of financial services firm Bank of China. Unnamed sub-funds of the National Fund for Technology Transfer and Commercialization, Country Garden Venture Capital, Shenzhen Capital, CCB Investment, IDG Capital, Oceanpine Capital, China Renaissance, SDIC and JZ Capital contributed to the round, together with unnamed new and existing backers. SVolt is working on solid-state, cobalt-free car batteries and artificial intelligence-powered smart manufacturing technology. It was created by Great Wall Motor in 2012 and spun off in 2018.

SoftBank’s Vision Fund 2 co-led a $1.5bn funding round for Turkey-headquartered e-commerce marketplace Trendyol at a valuation of $16.5bn. The round was co-led with growth equity firm General Atlantic, investment firm Princeville Capital and sovereign wealth funds ADQ and Qatar Investment Authority. Citi was financial adviser and placement agent on the deal. Trendyol operates a diversified online retail platform which incorporates on-demand grocery delivery and a peer-to-peer e-commerce marketplace. It has also built its own courier and last-mile delivery infrastructure in addition to a mobile wallet.

Exits

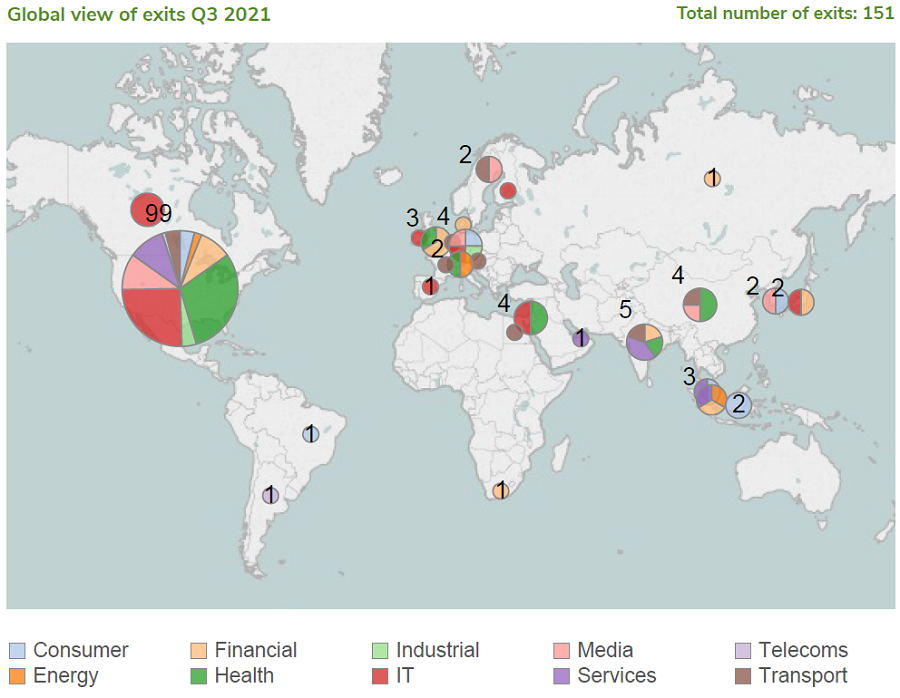

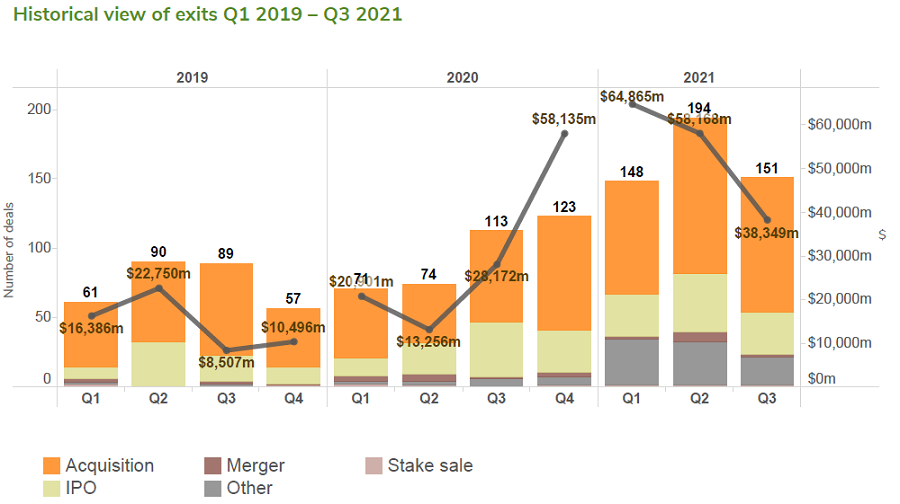

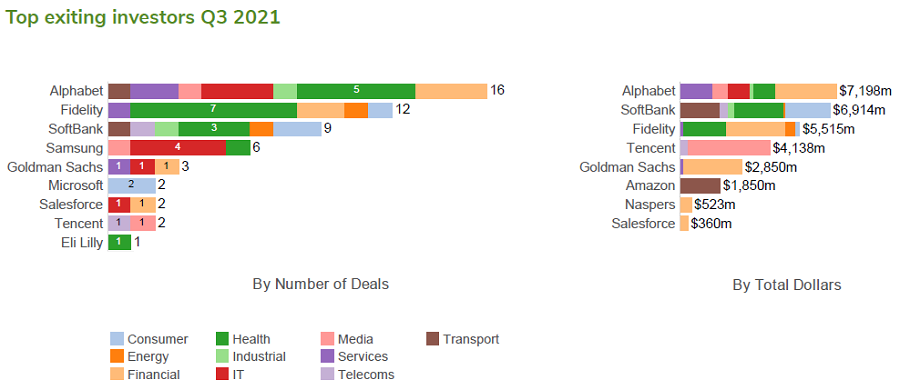

GCV Analytics tracked a record 151 corporate-related exits during the third quarter of 2021, including 97 acquisitions, 30 initial public offerings (IPOs), 21 other transactions (mostly reverse mergers with Spacs), two mergers and one stake sale. Top exiting corporates this quarter included Alphabet, Fidelity and SoftBank.

The total estimated amount of exited capital in Q3 2020 was $38.35bn, some 36% higher than the $28.17bn in Q3 of the previous year but lower than the record figure from the first quarter of this year ($64.87bn). A total of 12 out of the top 15 reported exits stood above the $1bn mark.

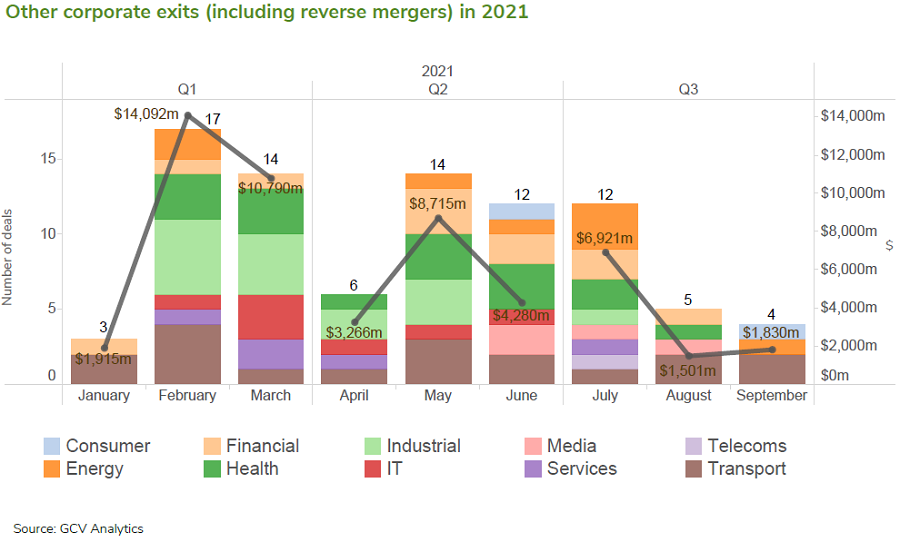

What has been a notable trend throughout 2021 in exits is the number of reverse mergers with special purpose acquisition companies (Spacs), which became something of a frenzy in public markets during the first half of this year. To put things in perspective, Spacs – also popularly referred to as “blank cheque companies” or “poor man’s private equity” – already constituted a significant chunk of all IPOs in US public markets. During the first half of 2021, we saw 56% or 311 Spacs out of a total of 558 IPOs by late June, according to data aggregator Statista.

Such popular vehicles that make it less burdensome for certain companies to go public enable private investors, including corporate venturers, to score potential exits. However, the number of reverse mergers with Spacs, involving corporates, appears to have somewhat subsided during the months of the third quarter. This is likely because the hype around Spacs has somewhat waned in public markets. The latter could be attributed largely to two major factors – the intervention of regulators and a possible loss of interest on part of some participants in public markets, given jitters around the Fed’s expected tapering policy. As far as the former is concerned, the SEC has already stepped and imposed stricter requirements on what may or may not be presented as a forecast in the prospectus of a Spac as well as stricter rules on how warrants are to be accounted for in the balance sheet of the company.

South Korea-based computer game publisher Krafton, backed by gaming and internet group Tencent, raised KRW4.3 trillion ($3.75bn) in its IPO. Krafton offered 8.65 million shares priced at the top of a revised KRW400,000 to KRW498,000 ($350 to $436) range, making it the second largest IPO held in the country so far. The amount was about 25% smaller than the one disclosed earlier, after a regulator demanded the company amend its filings. Formed by video game producer Bluehole as a holding group in 2018, Krafton oversees subsidiaries including Bluehole Studio, PUBG Studio and Striking Distance Studios. It has sold some 70 million copies of its battle royale game, PlayerUnknown’s Battlegrounds.

Digital payment processing firm PayPal agreed to acquire one of its portfolio companies, Japan-based consumer finance service provider Paidy for about $2.7bn. After the acquisition is complete, the company will continue to operate under the leadership of its founder and executive chairman Russell Cummer and president and CEO Riku Sugie. Founded in 2008, Paidy provides a buy-now-pay-later service which makes it possible for customers to make instant credit purchases, which they can subsequently repay on a monthly basis. PayPal plans to use the acquisition to strengthen its capabilities and presence in the Japanese market.

US-based online trading platform developer Robinhood Markets floated in a $2.09bn IPO representing exits for Alphabet and entertainment agency Roc Nation. The company priced 55 million shares at the foot of the IPO’s $38 to $42 range. It issued nearly 52.4 million on the Nasdaq Global Select Market while the remaining shares were divested by co-founders Vladimir Tenev and Baiju Bhatt as well as by chief financial officer Jason Warnick. Robinhood operates an online platform with 17.7 million monthly active users who can use its Robinhood Financial marketplace to trade stocks and shares, and its Robinhood Crypto to do the same with digital currencies. It made a $7.4m net profit in 2020 from $959m in revenue.

Aurora, a US-based self-driving technology developer backed by multiple corporate investors, agreed to a reverse merger with special purpose acquisition company Reinvent Technology Partners Y. The combined company will have a $13bn pro forma implied market capitalisation and will take on Reinvent’s listing on the Nasdaq Capital Market, which was secured through an $850m IPO in March 2021. The transaction also included a $1bn private investment in public equity (PIPE) financing featuring truck manufacturer Paccar, ride hailing service provider Uber and commercial vehicle producer Volvo Group, among many other investors. Formed in 2017, Aurora is working on an autonomous driving system initially aimed at the trucking market. It expects to launch its first product by 2023 and expand the application of its technology to the last-mile delivery and ride hailing sectors.

SoftBank sold 57 million of its shares in South Korea-based e-commerce platform operator Coupang, which had gone public in March 2021, for approximately $1.69bn. The sale valued the shares at about $29.69 each, below the IPO price of $35.00. SoftBank continues to hold roughly 568 million shares in the company after the transaction. Founded in 2010, Coupang operates an online marketplace that delivers diversified consumer goods to users on the day of purchase. It floated on the New York Stock Exchange (NYSE) in a $4.55bn IPO in which 100 million shares were issued by Coupang and 20 million were sold by its investors.

Funding initiatives

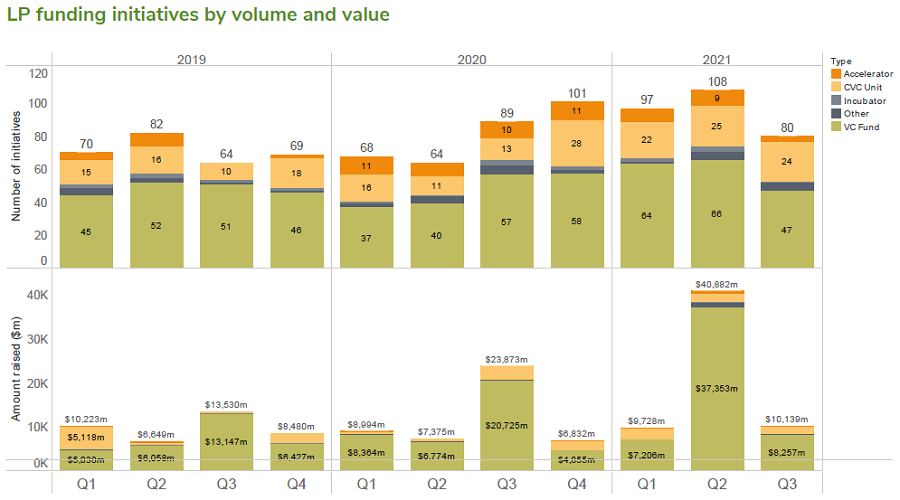

Corporate venturers supported a total of 80 fundraising initiatives in the third quarter of this year, down 10% from 89 such initiatives reported during the same period in 2020 but more than the 64 reported in 2019. The estimated total capital raised surged to $10.14bn, due to the effect of SoftBank committing $3bn to its second Latin American fund (discussed below).

The 80 initiatives in question included 47 announced, open and closed VC funds with corporate limited partners (LPs), 24 new corporate venturing units, three accelerators, one incubator and five other initiatives.

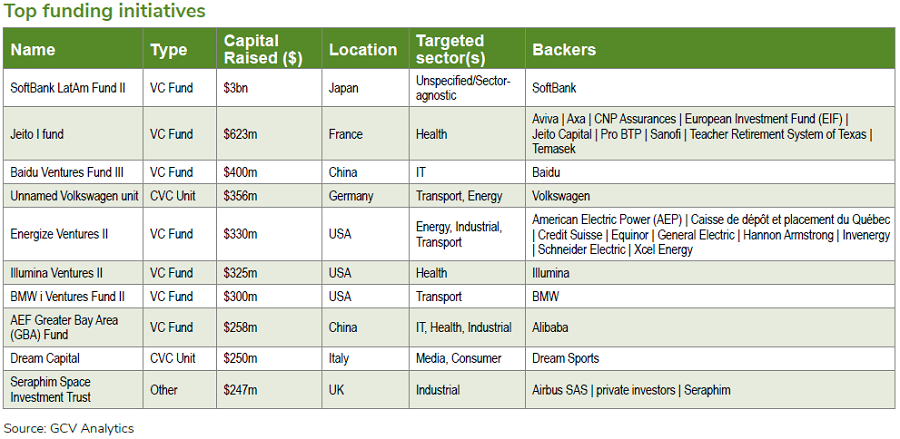

SoftBank revealed its second fund targeting the Latin American Region. It allocated $3bn to its second Latin America-focused fund. The corporate launched a $5bn first fund in early 2019 focused on the region, and the unit is headed by its chief operating officer, Marcelo Claure. The $3bn represents Fund II’s initial allocation, but SoftBank is exploring options to add to its size. SoftBank also intends to expand the range of Latin America-based companies it targets to include seed and series A-stage startups as well as publicly-listed companies. Marcelo Claure will continue to lead its Latin America-based operations.

Pharmaceutical firm Sanofi has made its first commitment to an external fund, providing €50m ($59m) in capital for France-headquartered life sciences investment firm Jeito Capital. Jeito Capital invests in biotech and biopharmaceutical product developers and operates as part of a larger organisation that includes a foundation which supports medical innovations by female entrepreneurs. The fund’s recent deals include co-leading a $110m series A round for T-cell therapy developer Neogene Therapeutics and backing a $52.8m round for ocular therapy developer SparingVision. Sanofi’s investment was made through a larger commitment to support healthcare innovation in its home country of France.

Baidu Ventures, the corporate venturing arm of China-based internet company Baidu, raised $400m for its third fund. The fundraising has increased the unit’s assets under management to over $700m. Baidu is a limited partner in the fund, however, it is unclear who else has backed the vehicle or which denomination the capital has been raised in. The fund will primarily be used to invest in early-stage technology startups in artificial intelligence (AI) technology-focused business sectors. Baidu Ventures has already tapped the fund to complete several investments including in Tsing Standard, a developer of electric vehicle testing technology, and cancer drug and diagnostics technology developer Gene+.

Germany-headquartered automotive manufacturer Volkswagen intends to set up a €300m ($356m) corporate venture capital fund. The cash will be allocated to startup companies as well as decarbonisation initiatives. Specific targeted areas would include robotic taxis, car sharing and vehicle electrification as crucial branches in the decarbonisation of the private transport sector. The still unnamed fund is the first to be formally launched by the carmaker. It has not been among the most frequent corporate venturers in the automotive space but has made several large late-stage investments. Volkswagen put up $620m to co-lead a $2.75bn private placement for advanced battery manufacturer Northvolt in June this year, and had provided $2.6bn in capital and assets for autonomous driving software developer Argo AI in a mid-2019 deal valuing it at $7bn.

Energize Ventures, a US-based venture capital offshoot of power producer Invenergy, closed a $330m second fund featuring a host of corporate investors as limited partners (LPs). Invenergy anchored the fund and was joined by backers including energy management technology producer Schneider Electric’s SE Ventures vehicle and industrial and power equipment maker General Electric’s GE Renewable Energy subsidiary. Energy utilities American Electric Power, Equinor (through its Equinor Ventures subsidiary) and Xcel Energy also committed capital, as did financial services firm Credit Suisse, pension fund manager Caisse de dépôt et placement du Québec and property investment trust Hannon Armstrong. Unnamed institutional investors and family offices supplied 70% of the capital. Formed in 2016, Energize Ventures has over $700m under management and targets energy technology developers focusing on process automation, decentralisation, risk mitigation, electrification and asset optimisation. It typically leads series A to C rounds, providing between $10m and $20m per deal.

Illumina Ventures, the venture capital firm sponsored by US-headquartered genomics technology producer Illumina, closed its second fund at $325m. The fund is anchored by Illumina but it sourced the majority of the capital from external limited partners including sovereign wealth fund Ireland Strategic Investment Fund. Founded in 2016, Illumina Ventures invests in developers of therapeutics, diagnostics technology, life science tools and personal wellness products. It closed its first fund at $230m the following year, with Illumina putting up $100m.

BMW i Ventures, the US-based venture capital firm formed by Germany-headquartered automotive manufacturer BMW, launched a $300m fund that will focus on sustainability. Launched by its parent in 2016, BMW i Ventures has accumulated a portfolio of some 50 companies including Chargepoint, the vehicle charging network set to list at a $2.4bn valuation, and manufacturing services marketplace Xometry, which floated in a $302m IPO. The latest vehicle will operate alongside the unit’s $500m first fund and will target early and mid-stage companies concentrating on sustainability, transportation, manufacturing and supply chain technologies. BMW i Ventures announced the new fund together with the appointment of Marcus Behrendt and Kasper Sage as managing partners, Behrendt having joined the unit as CEO in 2018.

China-headquartered e-commerce group Alibaba’s Hong Kong Entrepreneurs Fund (AEF) anchored a HK$2bn ($258m) vehicle dubbed AEF Greater Bay Area (GBA) Fund. GBA Fund counts undisclosed conglomerates, financial institutions and family offices among its limited partners, and is scheduled to reach its final close in the first half of 2022. The fund will target developers of technologies in areas including deeptech and sustainability, healthcare, artificial intelligence and industry 4.0 technology. It is being managed by venture capital firm Gobi Partners. Investments will focus on startups based in, or that intend to enter, the GBA, a geographical cluster that includes nine southern cities in China and both the country’s special administrative regions: Hong Kong and Macau.

India-based fantasy sports game operator Dream Sports launched a corporate venture capital arm called Dream Capital with $250m in cash. Dream Sports runs Dream11, an online fantasy sports game that allows users to assemble teams for individual rounds of league games in sports such as cricket or football in order to win money. The newly formed fund will invest in early-stage companies across areas such as gaming, sports and fitness technology, and the deals are expected to support Dream Sports’ expansion into adjacent areas to fantasy sports. The capital has come from its balance sheet.

Aerospace manufacturer Airbus and Richard Branson, founder of conglomerate Virgin, have bought shares in UK-headquartered space technology investment firm Seraphim Space Investment Trust. The deal was part of a £178m ($247m) initial public offering for Serpahim, which operates as a fund. Branson has set up Virgin Galactic within the wider Virgin organisation to take tourists into space, while Airbus had previously committed to Seraphim’s $95m closed-ended space technology fund in 2017.