Last year, over 400 corporate venture units participated in the GCV Keystone annual survey, creating one of the most comprehensive snapshots of the global CVC landscape—from ambitious new teams to long-established leaders.

You can take the survey in:

The insights we gathered were shared back with the community, enabling teams to benchmark their performance, discover best practices, and see how they stack up against their peers.

This year, we’re aiming even higher. By contributing your perspective, you’ll help shape the most in-depth view of CVC to date.

- Every response is kept fully anonymous

- As a thank-you, you’ll receive exclusive early access to the survey results—well before they’re published in our World of Corporate Venturing report in January 2026.

Take a few minutes to add your voice and help strengthen the global CVC community.

Highlights from the 2025 World of Corporate Venturing:

How many corporate venture units are there globally?

The number of companies actively investing in startups has more than tripled in the past decade, with 2,344 corporate investors actively taking part in startup funding rounds in 2024.

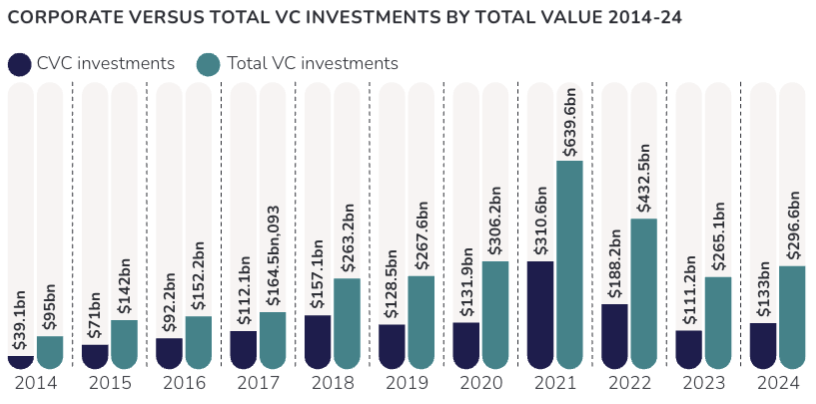

How much money do corporates invest in startups?

Startup funding rounds involving a corporate investor rose 20% in value last year, to $133bn.

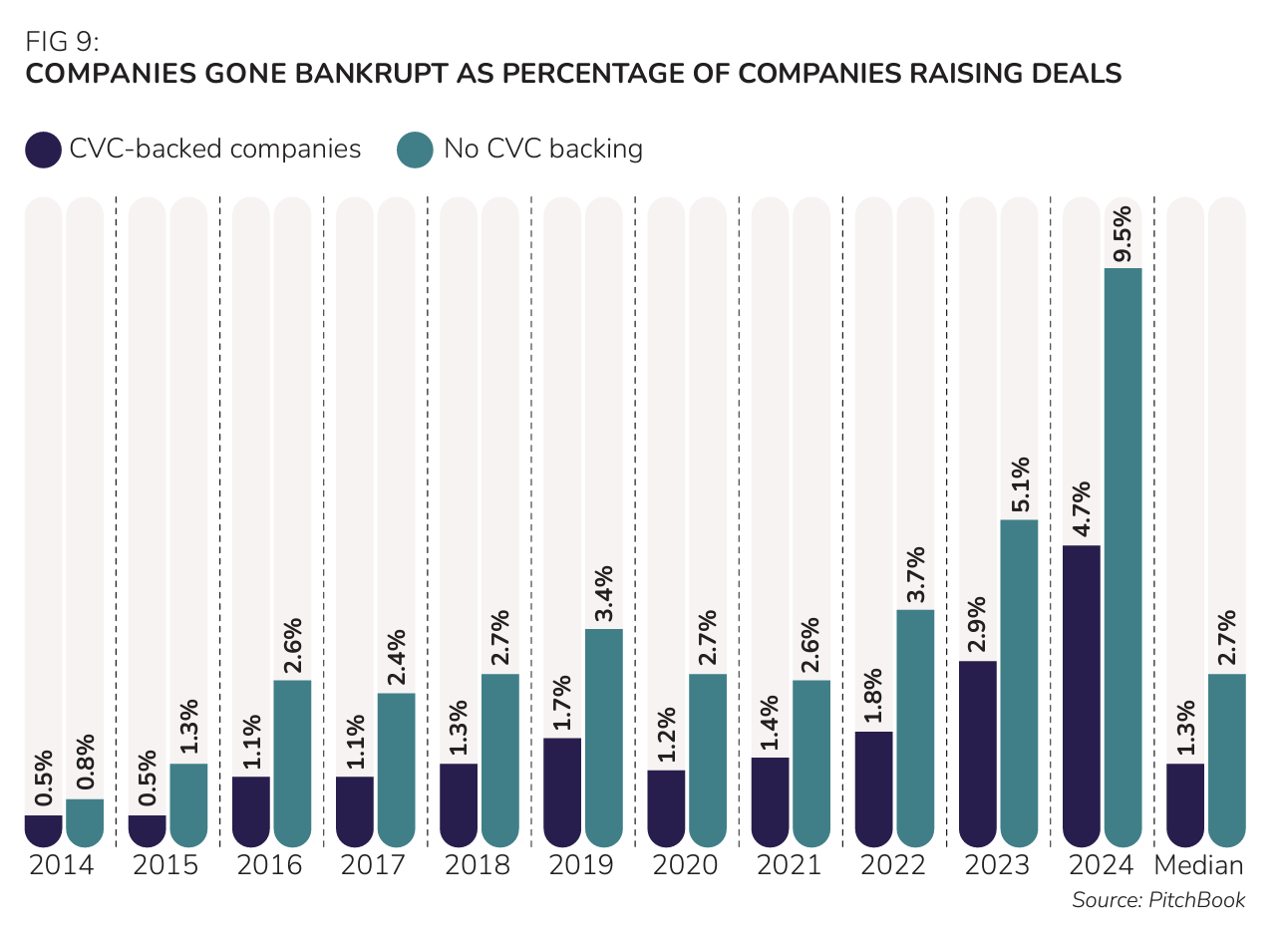

How does having a CVC investor on the cap table impact startups?

Corporate-backed startups are less likely to go bust than one without CVC investors.