Telecoms companies had 91 exits for their portfolio companies last year, with an estimated total value of $50bn.

In the full telecoms report:

- 5G starts to pull telecoms sector out of investment doldrums (free to read)

- Web3 is a ‘game changer’ for telecoms says Telefónica Ventures (free to read)

- Singtel on the hunt for new 5G tech with extra $100m (free to read)

For subscribers:

- What is strategic investing for a telecoms company in 2022?

- Investments in telecoms startups halved in value last year

- Telecoms incumbents part of $50bn worth of exits in 2021

- A resurgence in telecoms funds?

- Fundraising by university telecoms spinouts picks up

- SoftBank creates ripple of job moves in telecoms sector

Telecoms companies saw a bumper crop of exits from their investment portfolios in 2021.

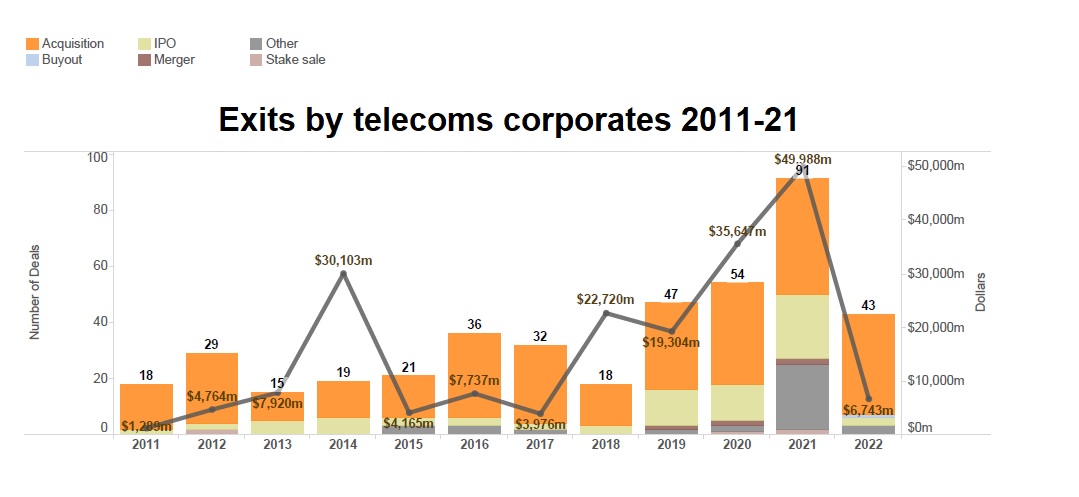

On calendar year-on-year we registered an increase in the number of exits by telecoms corporates last year, which reached 91, up 69% from 54 in 2020. The total estimated capital in those exits stood at $50bn, up significantly from the $35.65bn in 2020.

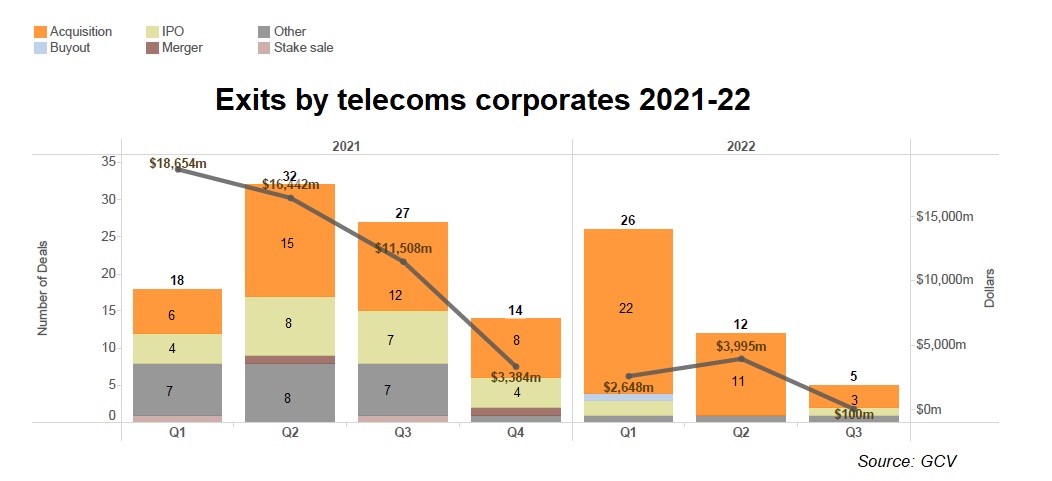

However, as in many other sectors, exits have slowed in 2022 when we look at the exits data on a quarterly basis. In particular, for 2022, we see how the number of exits for telcos going progressively down. The Q2 figure (12 in total) was half of that of Q1 (26). The total estimated dollar figures are only a fraction of what they were a year ago.

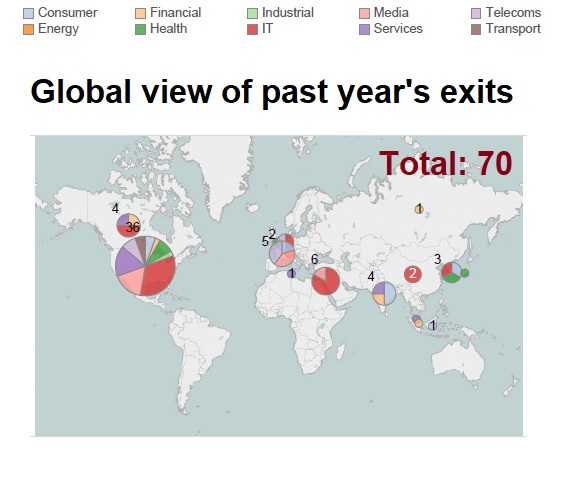

Corporate VCs from the telecoms sector completed 70 exits between August 2021 and July 2022 – 52 acquisitions, nine initial public offerings (IPOs), six other transactions (including reverse mergers with Spacs), one merger of equals, one stake sale and one buyout.

The biggest exits

The biggest deal was the $1.9bn acquisition of US-based edge computing technology provider Pensando by AMD. It provided an exit for telecoms equipment maker Ericsson and other corporates like Hewlett Packard Enterprise (HPE), Equinix, Alphabet, NetApp, Oracle, Liberty Global and Qualcomm to exit. Pensando has developed a distributed, programmable processor and software platform to help customers’ existing network architecture function more like cloud networks in order to support high-velocity applications. The purchase would help AMD compete with the likes of Nvidia and Intel’s data centre chip businesses.

Another big exit came for French telecoms operator Orange, when Deezer, the France-headquartered online audio streaming service agreed to a reverse takeover with I2PO, a special purpose acquisition company that floated on the Euronext Paris market in July 2021. The feal values the music service €1.05bn ($1.13bn) pre-money. As well as Orange, corporate investors including Access Industries, Rotana, ProSiebenSat.1, Universal Music Group (UMG), Sony and EMI will benefit from the exit.

Content delivery network services provider Akamai Technologies agreed to buy Israel-based cybersecurity technology developer Guardicore for about $600m, providing exits for Deutsche Telekom, Access Industries, Dell and Cisco. Founded in 2013, Guardicore operates an online security software platform that helps businesses to manage and protect data held in cloud-based, hybrid or traditional digital infrastructure. The company’s platform can also protect against and address ransomware attacks.

Media company The New York Times agreed to purchase US-headquartered online sports media platform The Athletic in a $550m deal allowing media group Bertelsmann and telecoms conglomerate Comcast to exit. The transaction represents a profitable exit for all the company’s investors and marks a contrast with the fortunes of the previous wave of digital media companies, which focused on a free-to-read business model and which have seen their valuations decline in recent years. Founded in 2016, The Athletic oversees a subscription-based online platform covering a range of sports using experienced journalists familiar with specific regional sports markets. The company has 1.2 million subscribers internationally and will boost the offering of New York Times, which has 8 million subscribers of its own.

A less happy story for telecoms startup exits

While corporate venturers from the telecoms sector have enjoyed notable liquidity events, those have likely not come from telecoms startups, for which exits have been rather rare and disappointing.

It was not such a happy story for Sigfox, the French IoT technology producer, which entered bankruptcy protection in January this year. Sigfox had a $640m valuation in 2016 but internet-of-things (IoT) service provider UnaBiz paid just €25m ($26.7m) to acquire the company in April 2022, according to Enterprise IoT Insights. It is a drop in the ocean against the more than $300m Sigfox had from investors including corporates Salesforce, Air Liquide, Intel, Tamer, TotalEnergies, Engie, Eutelsat, SK Telecom, Telefónica and NTT Docomo.

Another telecoms company that has been in rescue mode after entering bankruptcy protection in March 2020 is OneWeb. The latest move for the UK-based operator of low-Earth satellites has been to merge with satellite operator Eutelsat, which already owned some 22.9% of the company. OneWeb’s other investors, which include satellite services provider Hughes Network Systems, SoftBank and Hanwha Systems, a smart technology subsidiary of conglomerate Hanwha, will get 230