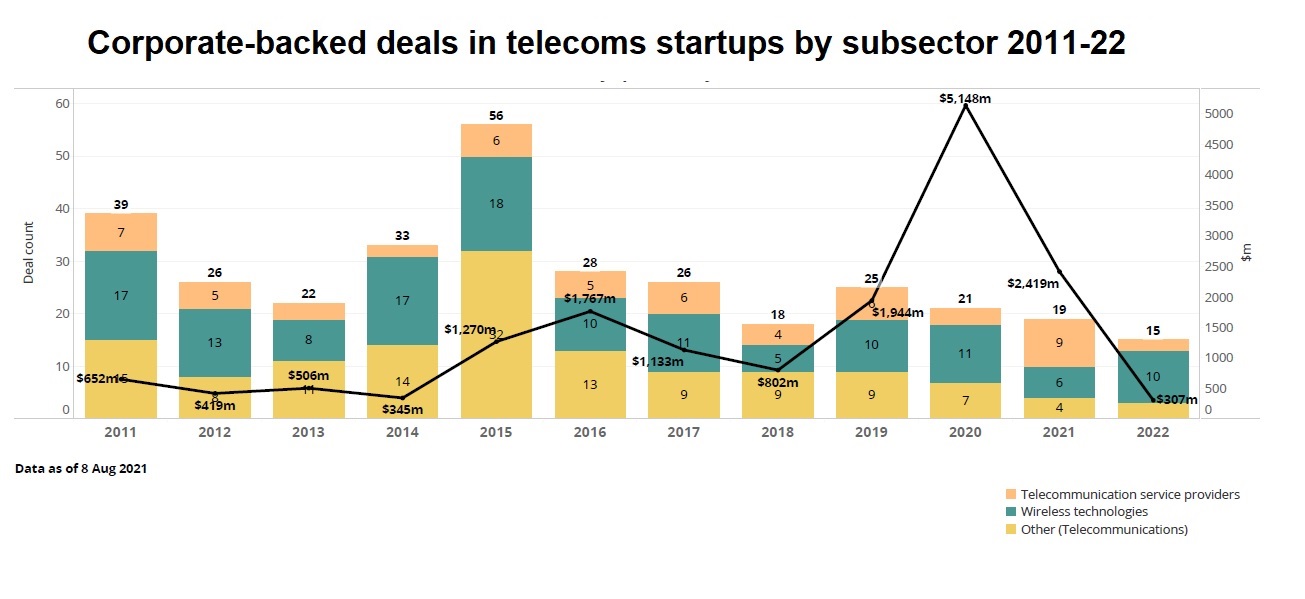

Corporate investors shied away from big funding rounds for telecoms startups, with the value of deals down to $2.42bn in 2021 from $5.14bn the year before.

Increased 5G investment would come as a welcome boost for the telecoms sector as corporate investors were cautious about investing in telecoms startups last year. The value of telecoms-related startup deals involving a corporate backer dropped more than 50% last year from $5.14bn in 2020 to $2.42bn for 2021. The number of deals was down only 10% — from 21 to 19 deals, but investors were clearly focused on the small-ticket end of the market.

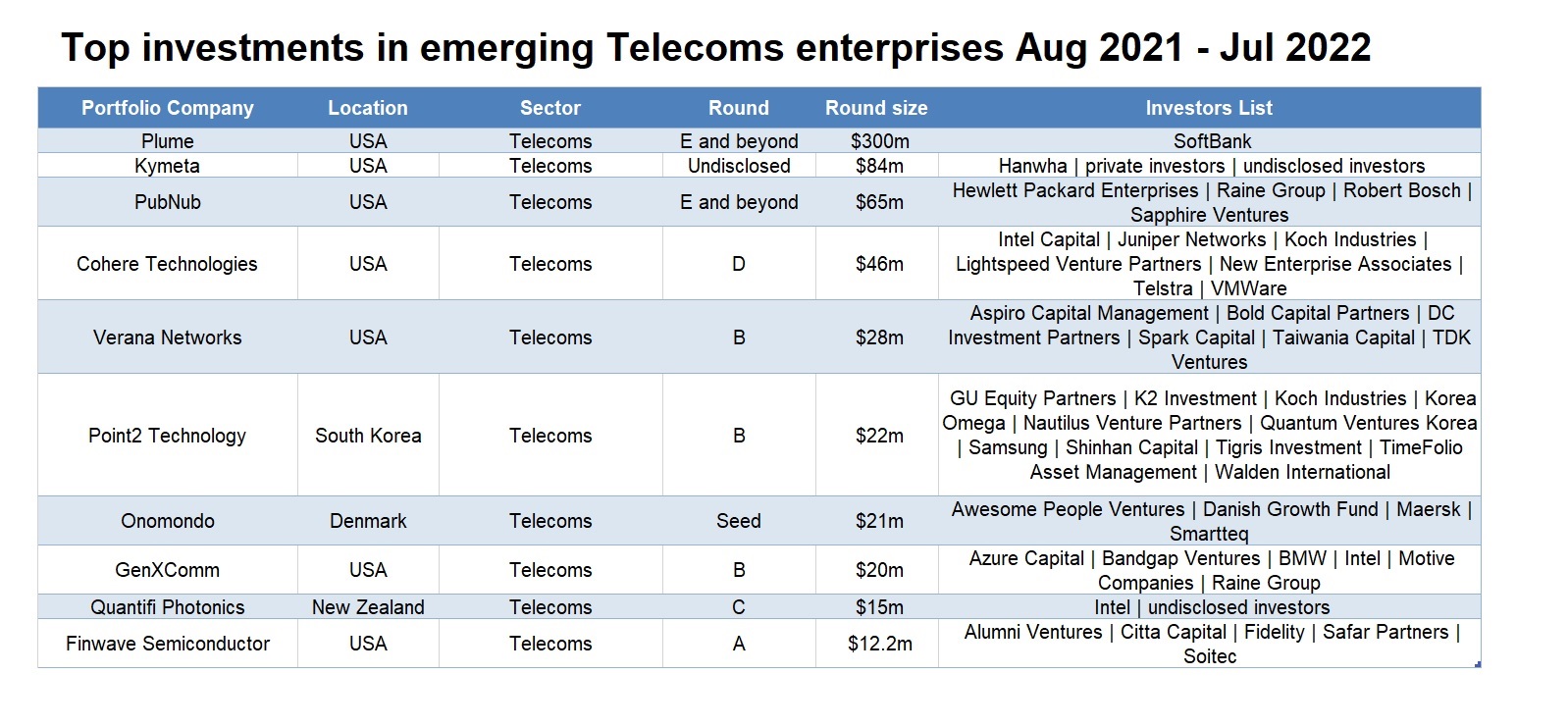

The biggest deal was the $300m series F fundraise by Plume, a US-based online communication software developer. The SoftBank-led round valued the company at $2.6bn. Founded in 2015, Plume has developed an artificial intelligence-driven platform that helps internet service providers improve their customers’ home wifi connection speed while optimising cybersecurity, access and parental controls and internet-of-things security.

In the full telecoms report:

- 5G starts to pull telecoms sector out of investment doldrums (free to read)

- Web3 is a ‘game changer’ for telecoms says Telefónica Ventures (free to read)

- Singtel on the hunt for new 5G tech with extra $100m (free to read)

For subscribers:

- What is strategic investing for a telecoms company in 2022?

- Investments in telecoms startups halved in value last year

- Telecoms incumbents part of $50bn worth of exits in 2021

- A resurgence in telecoms funds?

- Fundraising by university telecoms spinouts picks up

- SoftBank creates ripple of job moves in telecoms sector

US-based communication satellite builder Kymeta received the next-biggest round, a $84m raise led by private investor Bill Gates and backed by Hanwha Systems, the aerospace technology division of conglomerate Hanwha, and unnamed others. Kymeta is developing flat-panel satellite antennas designed satellite-based mobile and broadband use.

The numbers in 2020 had been inflated by the gargantuan $4.5bn investment of Alphabet in Jio Platforms, the digital services spinoff of diversified India-based conglomerate Reliance Industries. The year had also seen a number of large deals, such as the $120m series D round raised by France-based customer support software provider Aircall, which was backed by Deutsche Telekom.

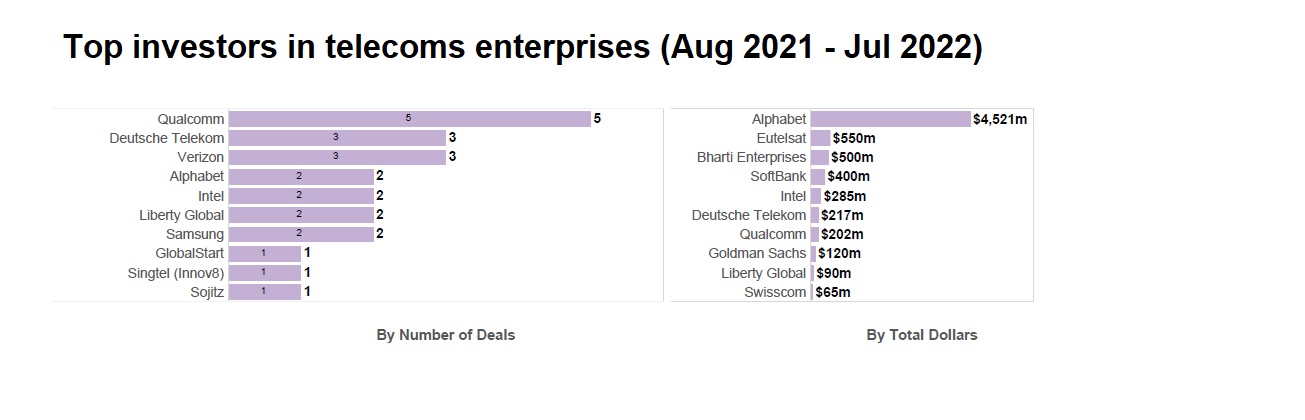

Qualcomm, the semiconductor company, was the most active investor into telecoms startups, backing companies like enterprise networking tech developer Celona and mobile customer data provider Embee Mobile.

Qualcomm also paid a reported $350m to acquire portfolio company Cellwize, an Israel-based company that has developed a mobile network automation and orchestration platform designed to help mobile network operators accelerate their network deployment.

That deal provided a payout for telecoms operators Deutsche Telekom and Verizon, which had been investors in Cellwize, and those two carriers have lost no time in reinvesting the money back in the ecosystem. DT and Verizon have been some of the most active telecoms carriers investing in telecoms startups.

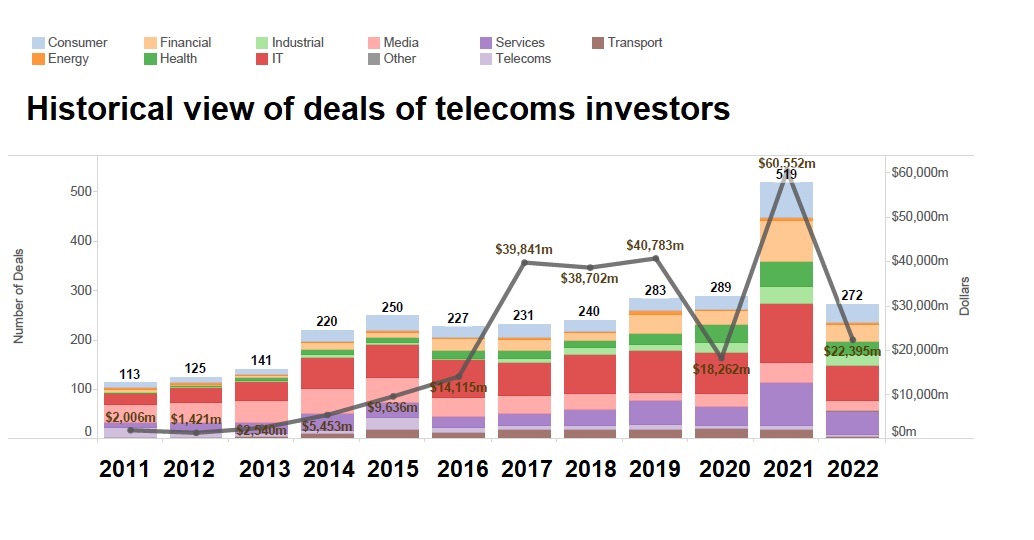

Investments by telcos nearly doubled in 2021

Telecoms companies themselves were more active investors in invested in 2021, participating in 519 rounds, compared with 289 deals in 2020. The total estimated capital in the 2021 round ($60.55bn) was three times larger than in 2020 ($18.26bn), reflecting the raging bull market for the VC space last year, which has not been sustained in 2022.

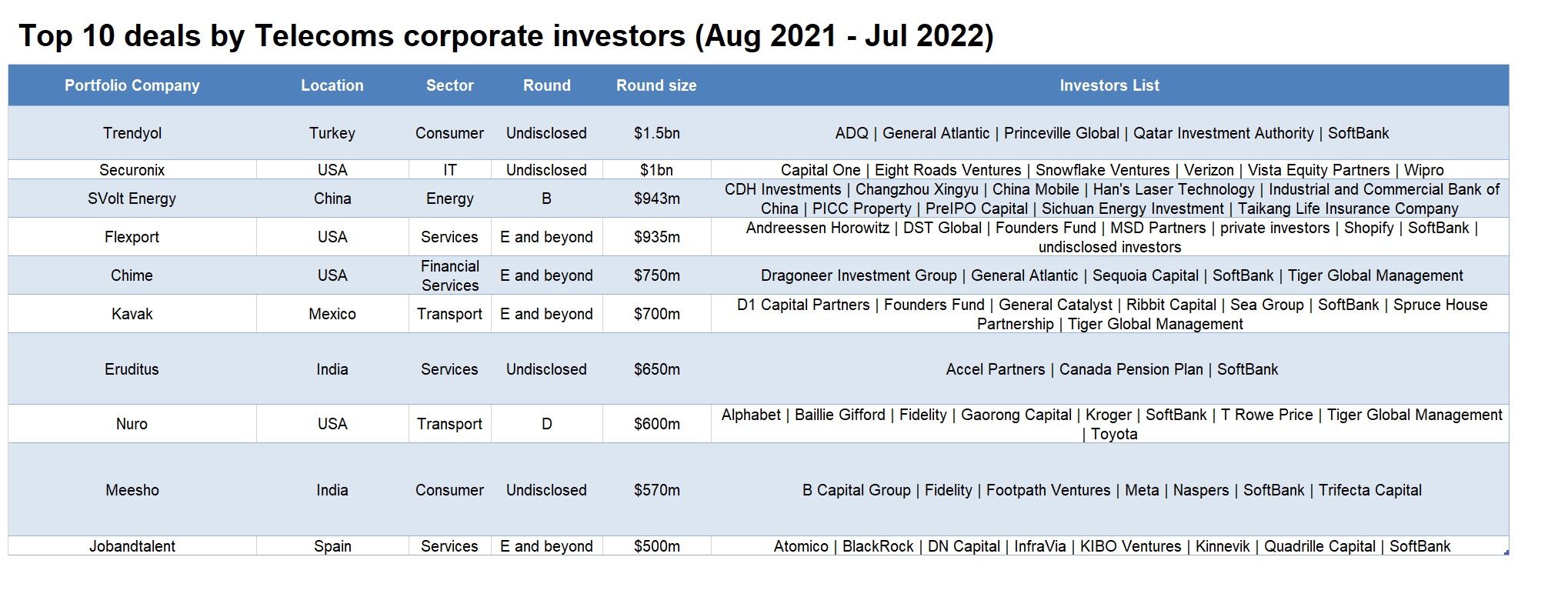

For the period between August 2021 and July 2022, we reported 518 venturing rounds involving corporate investors from the telecoms sector.

The largest number of deals (186) took place in the US, but Japan — with 51 deals — and Indonesia with 33 — also emerged as particularly active hotspots.

Telkom Indonesia and Japan’s KDDI active in deals

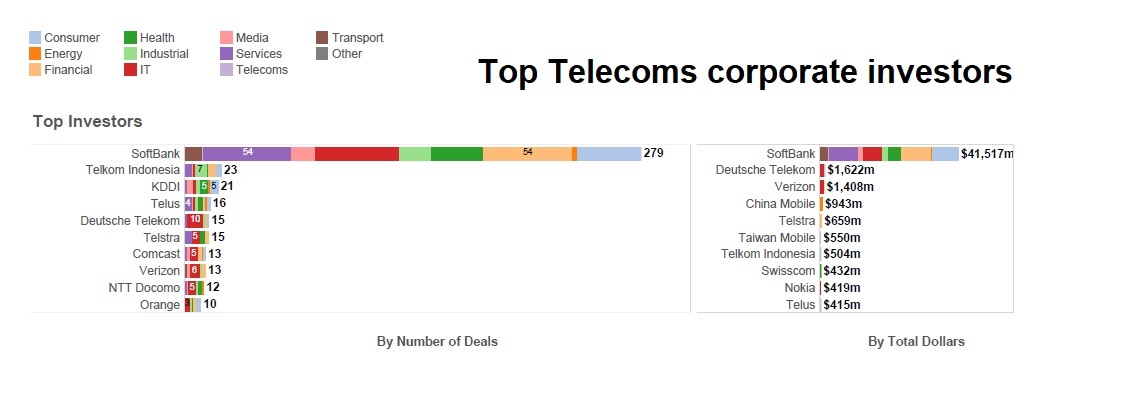

SoftBank, with its Vision Funds, muddies the picture for telecoms investment overall. SoftBank made 279 investments worth a total of $41.5bn in the period August 2021 and July 2022.

SoftBank was involved in most of the top 10 larges funding rounds. For example, SoftBank’s Vision Fund 2 co-led a $1.5bn funding round for Turkey-headquartered e-commerce marketplace Trendyol at a valuation of $16.5bn.

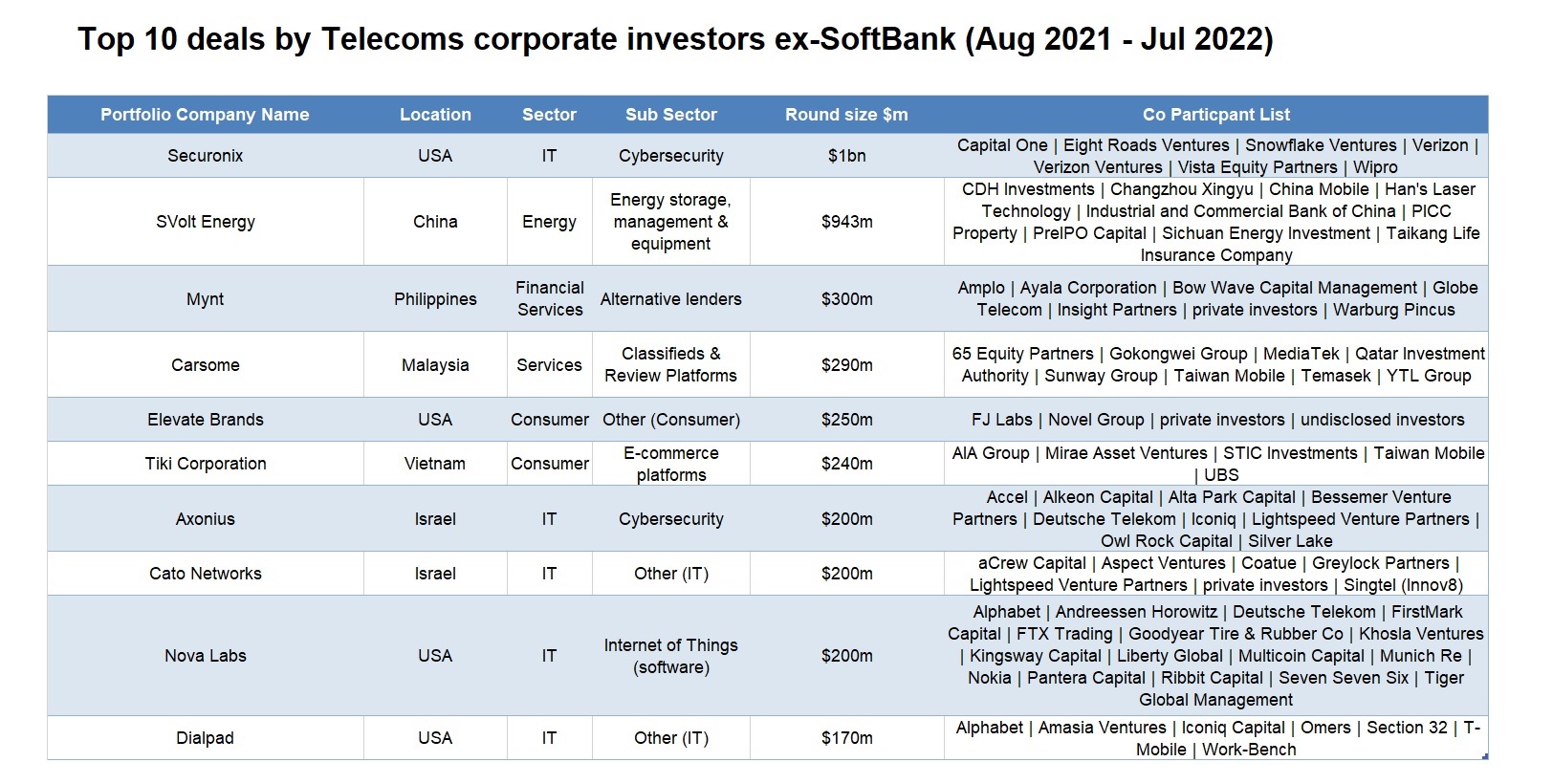

But strip away SoftBank and a more nuanced picture emerges, with Telkom Indonesia and Japanese carrier KDDI emerging as the leading investors in terms of the number of deals. Deutsche Telekom and Verizon, meanwhile, were involved in some of the largest deals.

Indonesia-based telecoms firm Telkom Indonesia has developed a network for angel investors to coinvest alongside its corporate venturing unit, MDI Ventures. The eMerge network has signed up more than 60 angel investor members, ranging from startup founders to conglomerate owners. MDI Ventures led a $108m series C round for Indonesia-based business lending platform KoinWorks, consisting of $43m in equity funding and $65m in debt financing. KoinWorks runs a peer-to-peer lending platform connecting investors and borrowers, offering loans relating to business and health at low-interest rates and provides financial aid for pursuing educational degrees.

While Telkom Indonesia got involved in alternative lending with this investment of MDI’s, its peer Japanese peer KDDI tapped into the human resources tech space. Its KDDI Open Innovation Fund, helped Japan-based part-time job listings platform Timee secured a total of ¥5.3bn ($48.5m) in equity and debt financing in a series D round, also featuring diversified trading group Itochu Corporation. Timee has built an online portal that helps part-time employment seekers and recruiters connect with each other.

Verizon Ventures, meanwhile, was part of the latest funding round for US-based cybersecurity technology developer Securonix, which is sized at over $1bn. The round was led by investment firm Vista Equity Partners, but featured a number of corporate investors in addition to Verizon, including Capital One Ventures, Snowflake Ventures and Wipro.

Verizon Ventures also took part, alongside internet and gaming technology group Tencent, in a $100m series B round for Israel-based public mobility operation management software provider Optibus. The deal reportedly valued the company at $1.3bn post-money. Optibus has developed a cloud-based platform facilitating mass transportation through AI and optimisation algorithms. It creates an operational plan and schedule that orchestrates the movements of every vehicle and driver in a city-wide transportation ecosystem.

Verizon Ventures also backed US-based autonomous retail technology developer AiFi in its $65m series B round, featuring other corporates like supermarket chains Aldi South Group (Aldi Süd), Rewe, Żabka, computing technology provider HP and Qualcomm. AiFi has built an AI-equipped autonomous retail software tool that helps stores digitalise and automate their checkout process.

Much like Verizon’s, some of the most notable VC deals of Deutsche Telekom (and subsidiaries) have also spanned across similar tech verticals, including cybersecurity and communications tech.

DTCP, the investment managing firm of telecoms firm Deutsche Telekom, backed Axonius, a US-headquartered cybersecurity management software provider, in its $200m series E round reportedly at a $2.6bn valuation. Axonius runs a cybersecurity asset management platform which enables customers to catalogue their IT products. The funding will support global expansion and further development of its cybersecurity asset management and software-as-a-service management products.

Mobile carrier T-Mobile (part of Deutsche Telekom) participated in a $170m funding round for US-based AI-powered cloud communication platform Dialpad. The transaction was also backed by internet and technology group Alphabet via its venturing subsidiary GV. Dialpad’s products and services include video meetings, cloud call centres, sales coaching and enterprise phone systems – all powered by AI.

What are telcos investing in?

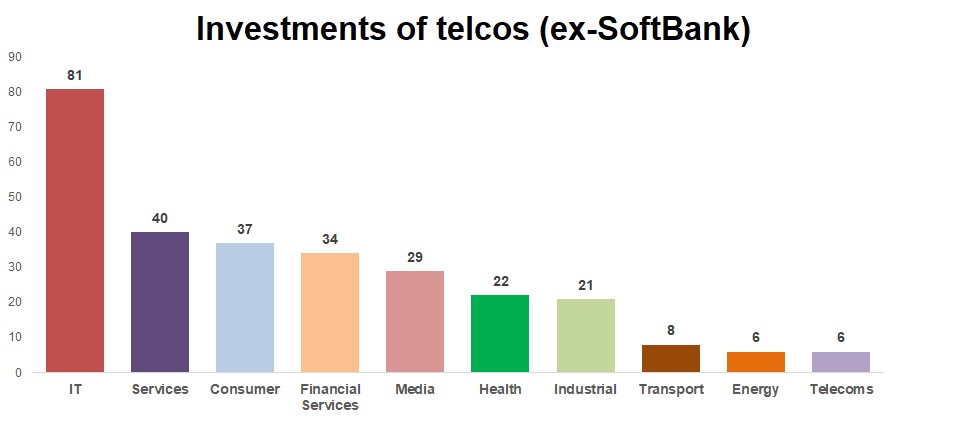

While SoftBank is an especially versatile investor across many sectors, the rest of telecoms corporates are probably no less so. Many of the deals backed by telecoms companies were in the IT sector (81), including areas such as cybersecurity, enterprise and other software, where there are clear synergies with telecoms.

However, some 40 deals were in the services sector, including edtech, HR tech and logistics, 37 went to the consumer space (mostly e-commerce and foodtech) and 34 were in the financial sector including payment technology.

Philippines-based Globe Telecom, for example, backed the $300m funding round for digital payment technology provider Mynt along with conglomerate Ayala Group. Formed by Globe Telecom, Ayala and Ant Group – the financial services affiliate of China’s e-commerce group Alibaba – Mynt operates a mobile wallet known as GCash and a mobile lending platform called Fuse.

Beyond fintech, there was no shortage of instances of notable deals backed by telecom incumbents in the consumer space either. Mobile carrier Taiwan Mobile also took part in a $240m round for Vietnam-based online marketplace operator Tiki, led by insurance provider AIA Group. Founded in 2010, Tiki operates an e-commerce portal where users can shop varied items that have a two-hour delivery window.

Swisscom Ventures and Singtel Innov8 participated in the $200m series F round raised by Israeli enterprise network connection developer Cato Networks, putting its pre-money valuation at $2.3bn. Cato has developed a secure access service edge(SASE) platform designed to offer a enterprise network connection to all enterprise locations, people, and data.

Telstra Ventures took part in the $46m series D round Cohere Technologies, a US-based developer of software for open radio access networks. Founded in 2010, Cohere has developed a spectrum multiplier software designed to enhance the performance of mobile and wireless networks, improving spectrum and user experience with channel detection, estimation, prediction and precoding.

Non-telecoms corporates are also coming in to invest in areas like IoT and Wifi, which have obvious applications for the logistics and mobility industries.

Maersk Growth, the investment subsidiary of shipping company AP Moller Maersk, for example, stepped into the $21m funding round for Danish IoT-focused wireless network operator Onomondo. Founded in 2012, Onomondo operates a global cellular network intended to connect and simplify enterprise-grade IoT connected services across the globe.

BMW iVentures and Intel Capital, meanwhile, joined a $20m series B round for US-based GenXComm, which is developing technolohgy that could decrease the cost of WiFi networks.

At the same time, there continues to be investment into new areas such as optical communications. New Zealand-based photonics testing and measurement equipment maker Quantifi Photonics raised a $15m series C round that featuring chipmaker Intel´s venturing arm Intel Capital.