These corporate investment teams are young but have big money — and they mostly invest from the balance sheet.

Every year, together with the International Chambers of Commerce (ICC), Mind the Bridge looks for top 100 companies that are the most start-up friendly — we call them the “Corporate Startup Stars”. They can be involved with startups in a number of ways, from having corporate innovation outposts in global tech hotspots like Silicon Valley to running accelerator programmes, venture builders and intrapreneurship programme as well as having partnerships with startups, investing in then, and of course, occasionally acquiring them.

Our Corporate Startup Stars tend to be very large companies with, on average, $51B in annual revenue and 100k employees.

This year, we took a look at how many of them are active in corporate venture capital — and looked at how exactly they make those investments. The full analysis is in the report Evolve or Be Extinct. Open Innovation Models for the Future- Season 2022 – Highlights from Corporate Startup Stars. But here are some of the highlights:

Top companies do CVC (but mostly from the balance sheet rather than through a separate fund).

Some 84% of the top 100 2022 Corporate Startup Stars invest in startups in a stable and structured way. This is what is generally referred to as corporate venture capital, although implementation techniques may vary, ranging from:

- closed separated venture capital funds (about one out of 10)

- evergreen off-balance sheet approaches (the vast majority)

- indirectly participating as limited partners (LPs) into third party VC funds (residual as standalone strategy, more frequent as a complement of the approaches above).

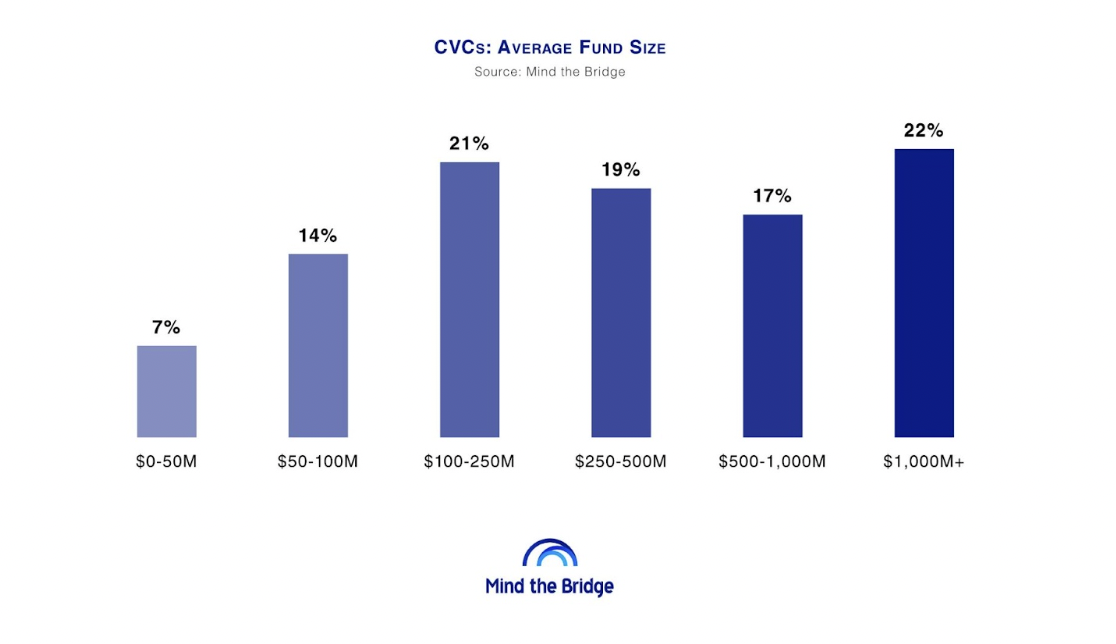

A fund size of $250m+ is the norm

Over 58% of the top 100 2022 Corporate Startup Stars that are active in CVC operate have fund allocations larger than $250m. Of them, one out of three have funds larger than $1bn.

Only 21% operate with capital allocation below $100m, and only 7% have funding of less than $50m.

Annual investments range on average between $25 and $100m for about one third of active top 100 2022 Corporate Startup Stars.

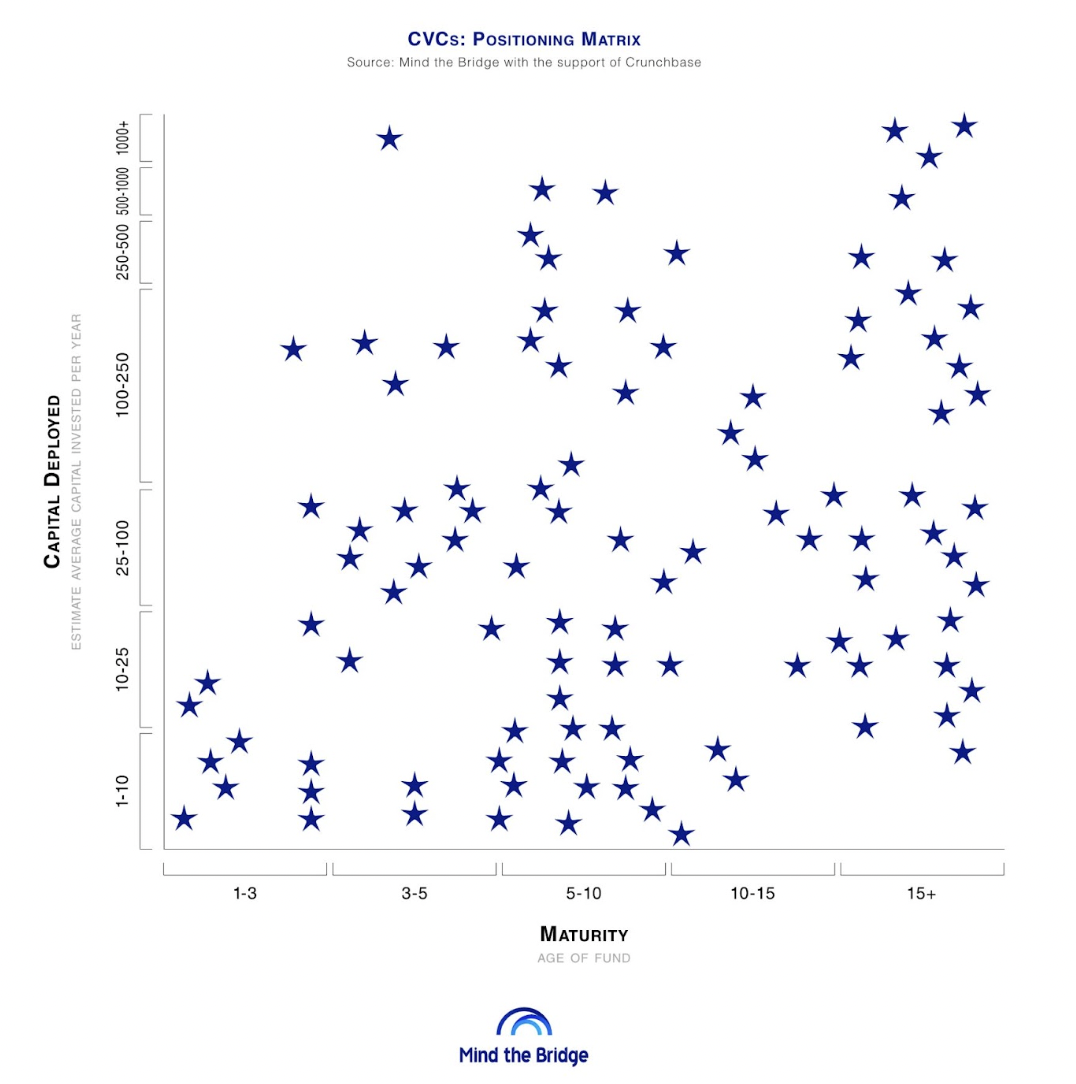

A quarter of top 100 CVCs are less than 5 years old

The graphic below plots the 2022 Corporate Startup Stars according to their age and the amount of capital they have deployed. There is a broad range of ages among our Startup Stars:

- About one third were established between 5-10 years ago.

- Some (28% of total) have a 15+ years history

- A considerable percentage (25% of total) is more recent (established between 1-5 years ago).

There is some weak correlation between age and amount of capital — few young teams leap to a $250m+ fund straight away. The $1bn+ funds are mostly all more than 15 years old. But a surprising number of long-lasting funds are also in the lower brackets on fund size. Dispersed data might suggest that the CVC industry is still far from market standards and still far from maturity.

Alberto Onetti is Chairman of Mind the Bridge.