Pasqal's $109m series B is the fourth corporate-backed round for a quantum computing startup this month, and its capabilities make the sector a strategic bet for a range of corporates.

Oil and gas providers Saudi Aramco and Eni were among the participants in a €100m ($109m) series B round for quantum processor developer Pasqal this week.

It is a sign that energy producers are increasingly interested in the value that quantum computing could bring to their operations.

Grid management is becoming increasingly complex, with various energy sources having to be balanced, combined with storage and delivered to customers while keeping the grid stable. Quantum computers, modelled on quantum physics and using qubits rather than the ones and zeros of classical binary computers, open up the possibility far greater calculating power than even today’s supercomputer can provide. Energy companies could harness the technology to calculate the most efficient way to make sure the grid runs smoothly, or simply to improve battery or fuel cell design.

France-based Pasqal claims to be the leader in neutral atoms quantum computing, a branch which arranges ordered neutral atoms in 2D and 3D arrays. The approach could potentially be more scalable than other types while also reducing complexity.

Aramco struck a deal last March to design and develop quantum machine learning models with Pasqal while looking for other ways it can be used along the corporate’s supply chain. Eni, which had already backed Pasqal’s $30.4m series A round, agreed later in the year to collaborate with the company on high performance computing technology for the energy industry.

Aramco and Eni took part in the round through respective subsidiaries Wa’ed Ventures and Eni Next. It was led by Singaporean state-owned investment firm Temasek and also featured European Innovation Council (EIC) Fund, BPIfrance’s Large Venture Fund, Quantonation, Defense Innovation Fund and Daphni.

Pasqal isn’t the only company working on neutral atom-based quantum technology. Pennylane and Atom Computing have each collected over $75m in funding, though neither has corporate backers. QuEra came out of stealth with $17m and e-commerce and fintech group Rakuten among its investors.

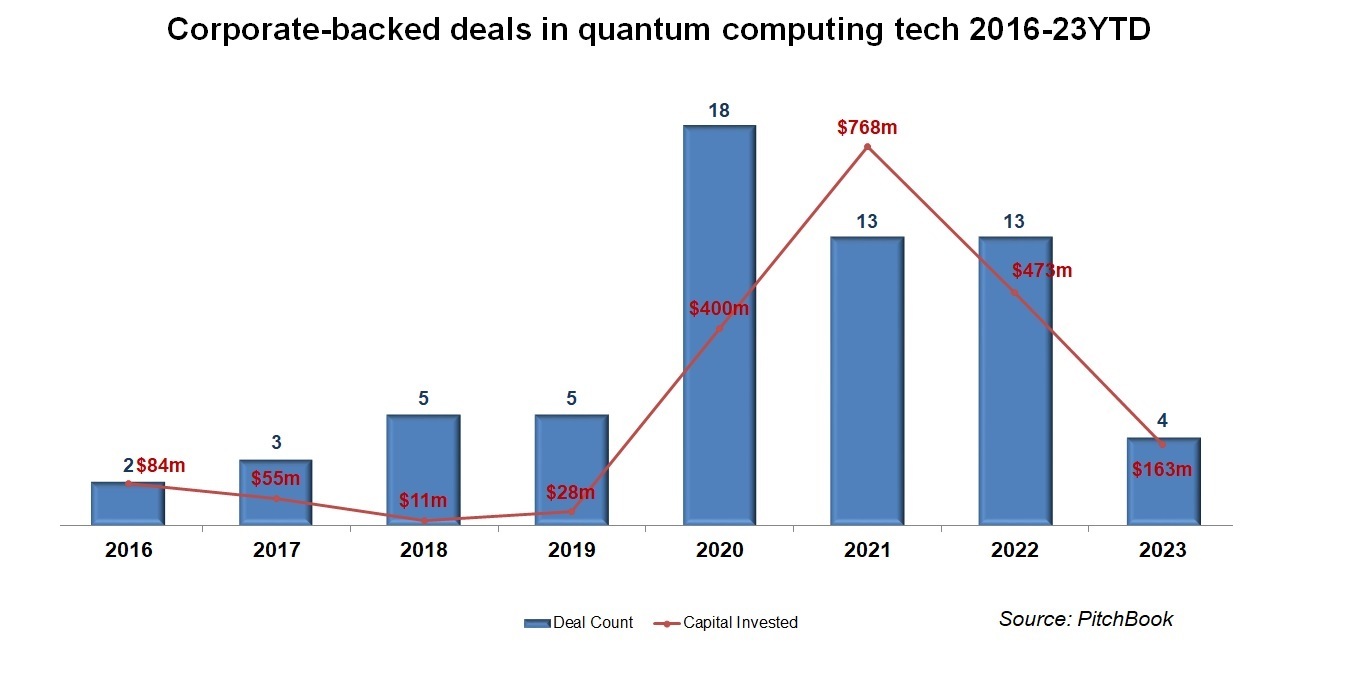

The last three years have seen steady corporate investment in quantum computing startups, as the chart below shows, with 2022 equalling the number of deals the previous year. There was a drop in overall funding, but that could well be a consequence of companies like IonQ, Rigetti Computing and D-Wave listing on public markets in the preceding months.

The sector is off to a roaring start in 2023, however, with Quantum Machines adding $20m to a Qualcomm and Samsung-backed series B round now sized at $70m, and e-commerce and internet group Prosus contributing to a $36.6m series A round for Oxford Ionics.

Neutral atoms represent one of many different types of architecture for quantum computing. Oxford Ionics and IonQ use trapped ions while Marshall of Cambridge-backed Nu Quantum and PsiQuantum, the recipient of $450m from investors including Microsoft, utilise photonics.

While quantum computing is still at an early stage, without a clear indication of which model will become predominant, it is clear that corporates are starting to put down some bigger bets on the technology.

Pasqal may have attracted petroleum producers, but carmakers could use its technology to simulate aerodynamics for vehicle testing, drug developers could apply it to modelling possible molecular structures for new medicines, and it could be utilised by banks to price derivatives.

The question by the end of this year may not be which corporate VCs have a quantum technology startup in their portfolio, but which ones are yet to make the leap.

Photo courtesy of Pasqal