Investors either focus almost exclusively on investments where there was a commercial deal, or avoid any requirement at all.

Corporate venture investors often say that the ideal is to create joint partnerships and deals between the parent company and the startups they invest in. But how many explicitly make working together a condition of investment?

It turns out that investors are in two starkly different camps on this question. It is all or nothing.

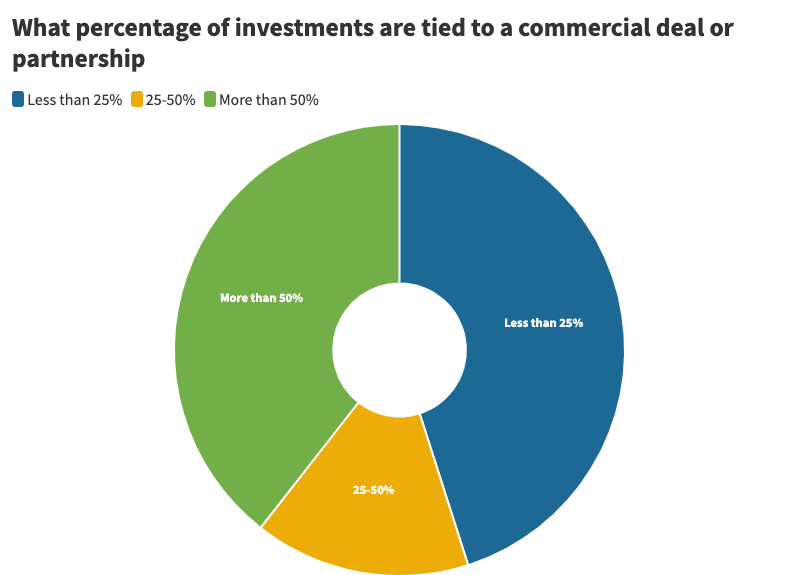

Some 45% of corporate investors who responded to our poll said that 25% or less of their investments were tied to the completion of a partnership or commercial deal. In some cases that “or less” meant a lot less, i.e. none at all. Where we gave respondents the opportunity to choose “none” as one of the options, this was selected more often than the “less than 25%” option.

It is not that commercial deals aren’t important for this contingent — they just didn’t want to make this mandatory.

“Product pull through is an important feature of the investment, but it’s not a formal requirement,” one respondent explained.

On the other hand, nearly 40% of respondents said that more than half of their investments were dependent on there being a partnership or commercial deal. Some respondents told us that nearly all of their investments had this requirement.

Hardly anyone is in the middle ground. It seems you either zero in on investments you can work with straight away, or you steer clear of tying yourself down to such criteria at all.

This question is part of our annual benchmarking survey of the CVC ecosystem. We’d like to invite every CVC to fill in the full survey so that we can build up a full picture of what “good” looks like for the industry. Survey answers are anonymised and cannot be traced back to individual respondents. All respondents will receive a free copy of the benchmarking survey, which is published in January.

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).