There was a promising (or surprising) rise in corporate-backed funding rounds for cryptocurrency startups in November. Despite many heralding the demise of crypto, it looks like it isn't dead yet.

Despite many gleefully declaring its death many times over, cryptocurrency isn’t dead just yet, at least not according to corporate investors, as November’s corporate backed deals trends are showing.

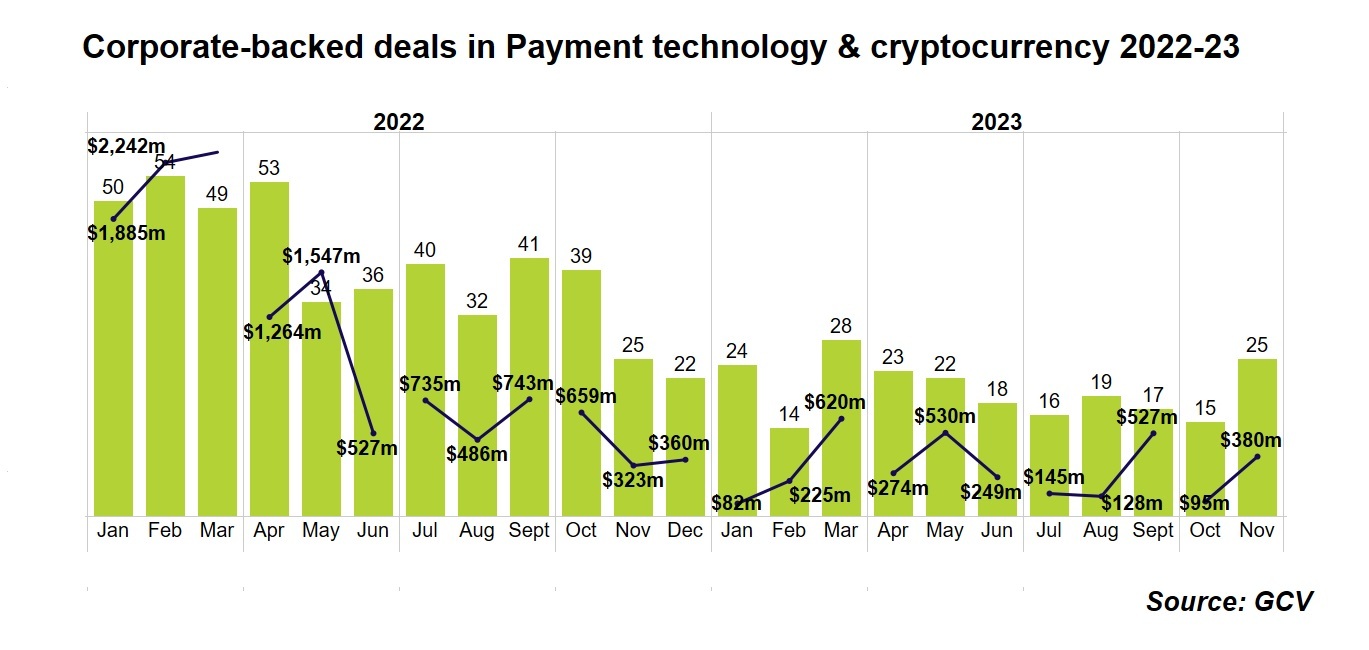

Throughout this year we have become used to seeing corporate-backed funding round numbers at a much lower level than the relative boom of 2021 and 2022. And this is especially true for cryptos. But November saw a promising (or surprising, depending on which way you look at it) boost in deals relating to payment technology and cryptocurrency. Given the bad press that crypto has had over the past year, that’s notable.

Crypto creeping back

The largest round of funding within the subsector came from Blockchain.com, a leading blockchain and crypto tech provider. It closed a series E funding round at $110m.

Blockchain.com’s valuation has decreased from $14bn in 2022 to under $7bn, however, and though it cites revenue growth of 1,500% in four years, the wider investment industry is still waiting for mainstream blockchain uses. Nevertheless, this round of funding, which included the likes of Access Industries, Alphabet, and Coinbase, is a beacon of hope for the cryptos.

The funding comes amid a bear market, but external factors like Bitcoin’s price surge and regulatory developments (in August, Coinbase secured regulatory approval to offer crypto futures for retail customers in the US) offer hope for the industry’s revival. Read the full story.

Other notable crypto deals included $7.5m in seed funding for Taproot Wizards, a Bitcoin-focused Ordinals project. Led by Standard Crypto and contributed to by software company StarkWare and digital asset security company Masterkey, Taproot Wizards describes itself as “magic internet JPEGs”. The project, inspired by a 2013 Bitcoin meme, mints non-fungible tokens (NFTs) on the Bitcoin network using the Ordinals protocol. Despite criticisms for network congestion, the funding aims to rebuild and redefine Bitcoin’s image, and innovate within the ecosystem.

Bitcoin mining company Mummolin also secured $6.2m in seed funding, with contribution from Barefoot Mining and Bitcoin.com.

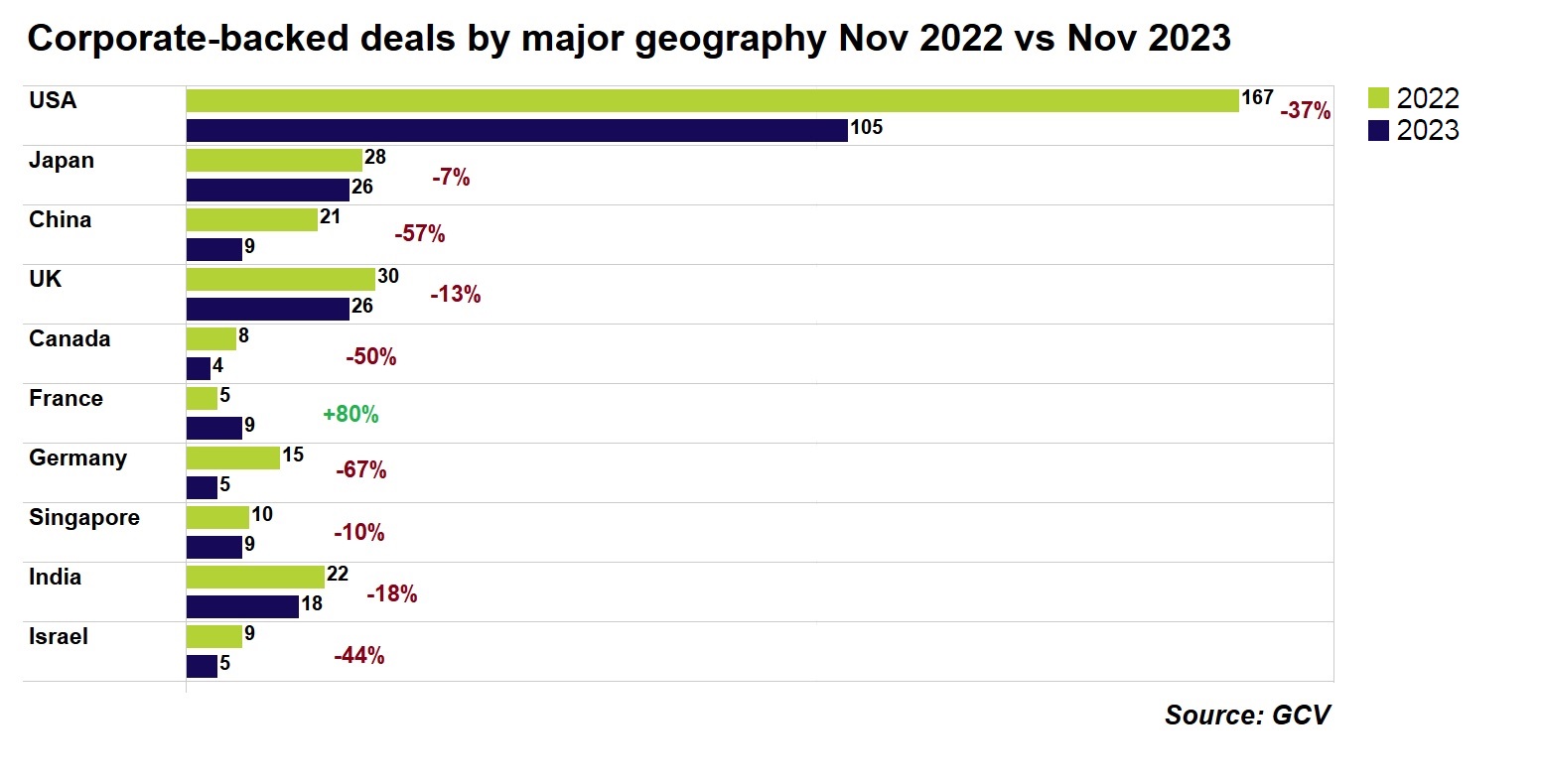

France corporate investment boost

In other notable November trends, France was the only major country in November to see a year-on-year increase in the number of corporate backed funding rounds, perhaps reflecting a growing confidence in the country’s business environment. Both domestic and international corporations took part in deals, with sectors like financial, industrial, transport and renewable energy all experiencing interest from corporate entities seeking to capitalise on France’s skilled workforce and favourable economic conditions..

The biggest rounds were renewable heat suppler Newheat raising $32.7m, with contribution from French construction company Etchart, Paris-based e-bike marketplace Upway raising $30m with contribution from Dutch holding company Exor, and pioneer in eco-friendly lithium extraction Adionics securing $27m in series B funding from investors including chemicals company SQM, and water treatment company Ovive.

Other trends

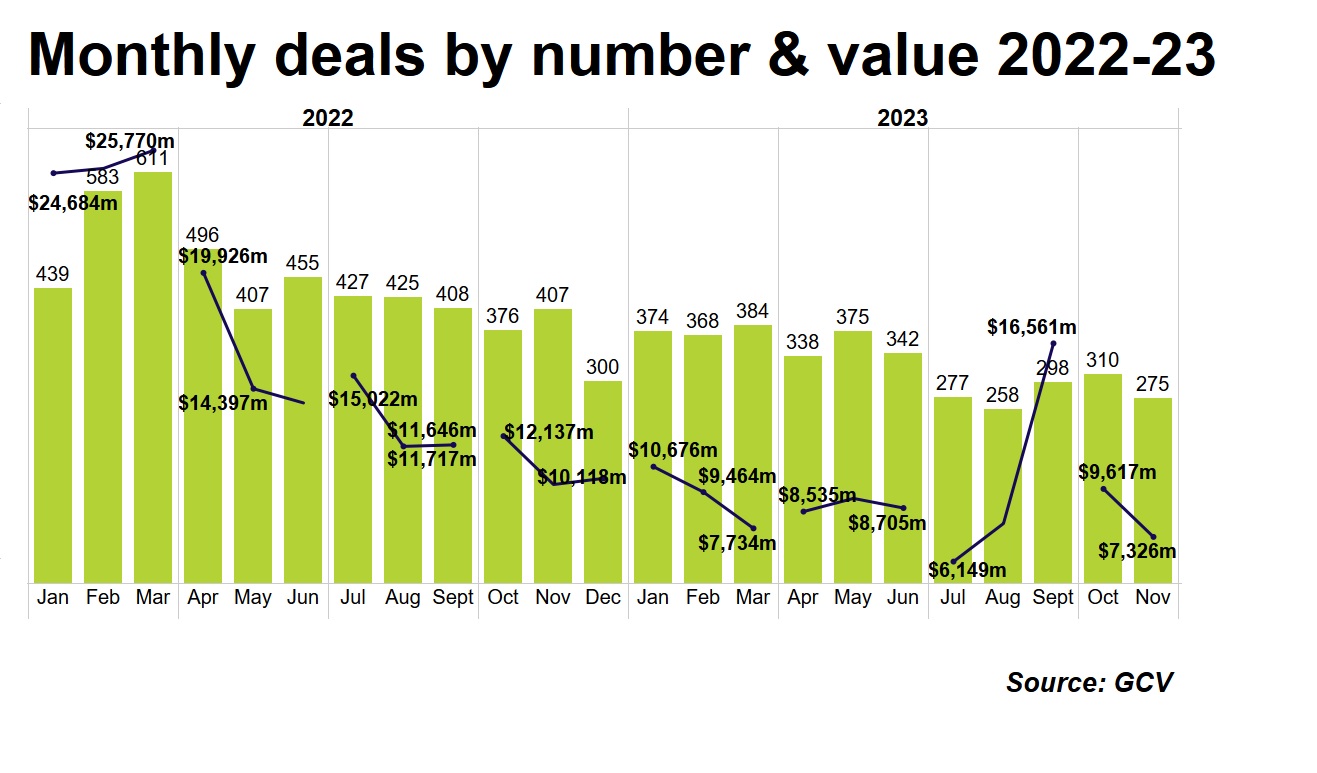

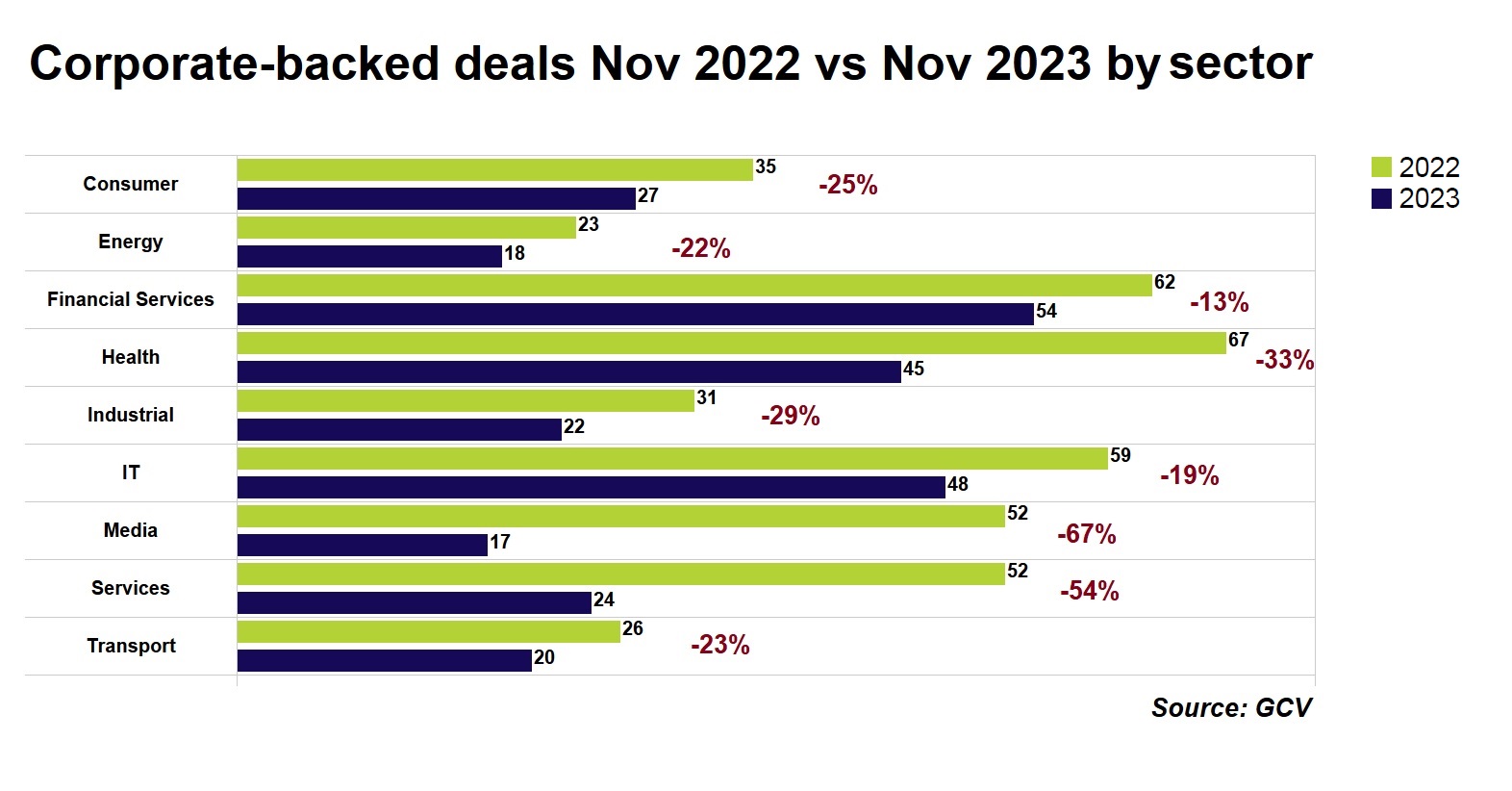

Corporate-backed investments overall, however, dipped in November. The total count we tracked stood at 275 deals, down 32% from 407 of November 2022. The total dollar volume estimated for November this year was $7.33bn, down 28% from the $10.12bn of the same month last year.

Unsurprisingly, we saw a drop in deals from all sectors year on year. In some of the sectors like financial services (-13%), IT (-19%), energy (-22%) and transport (-23%) the decreases were smaller than in others, such as media (-67%) and business services (-54%).

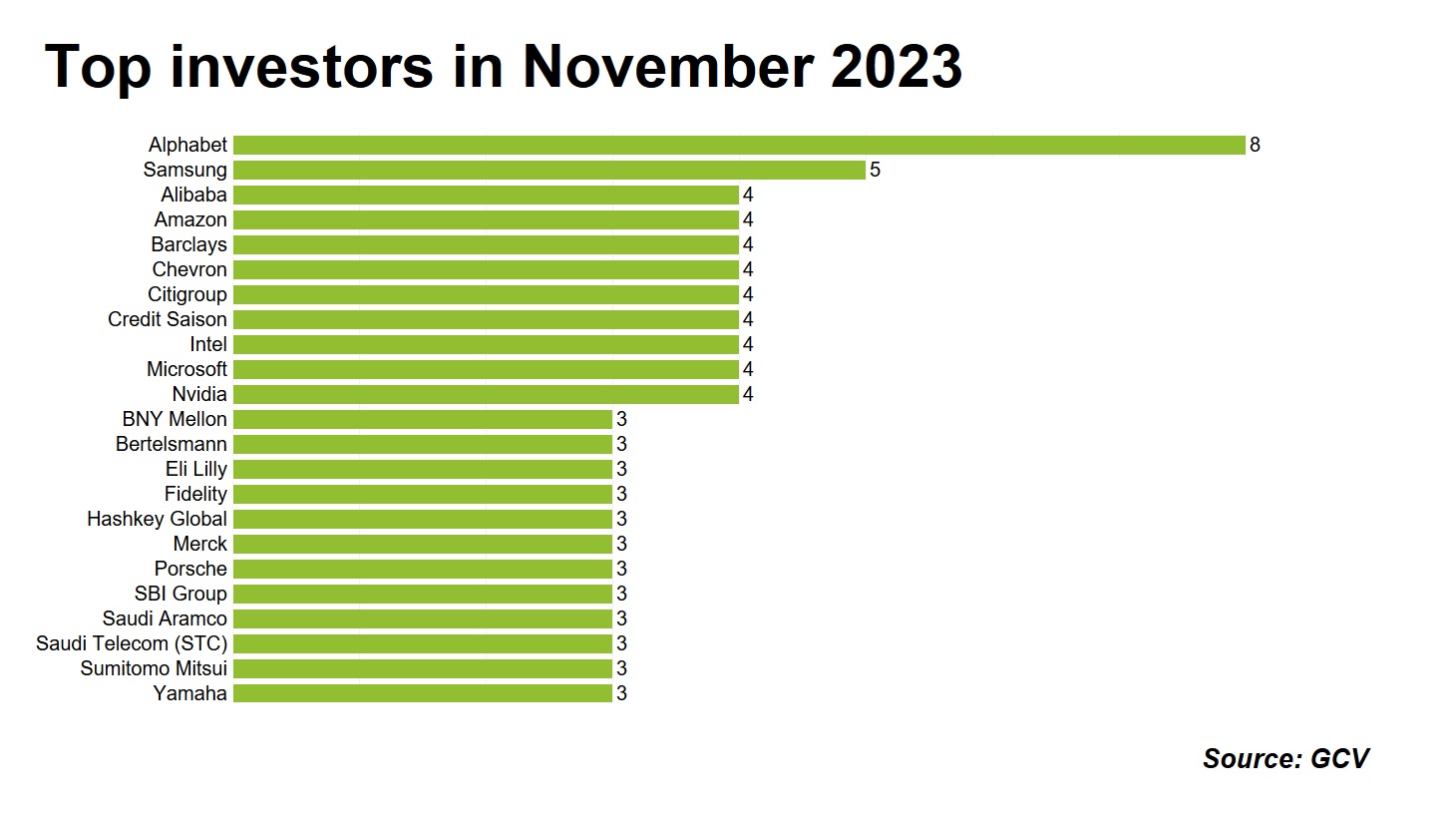

The leading corporate investors for November by number of deals were internet conglomerate Alphabet and semiconductor and electronics maker Samsung, among others.