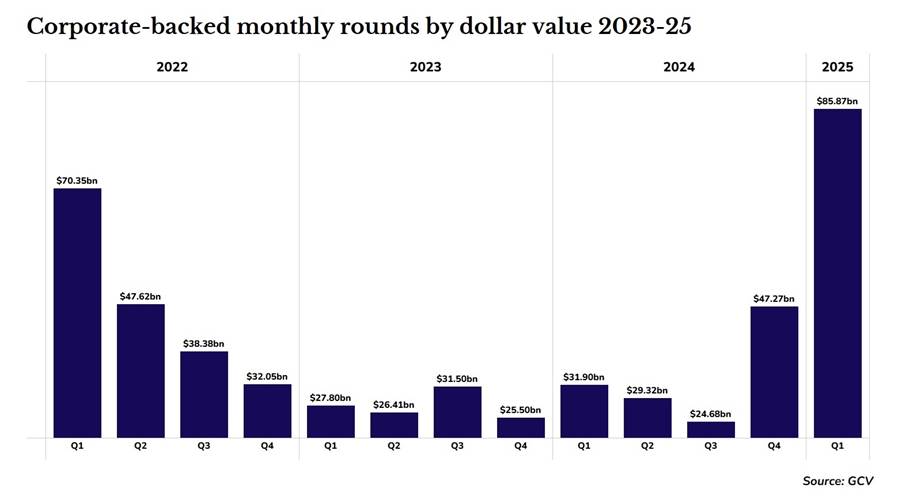

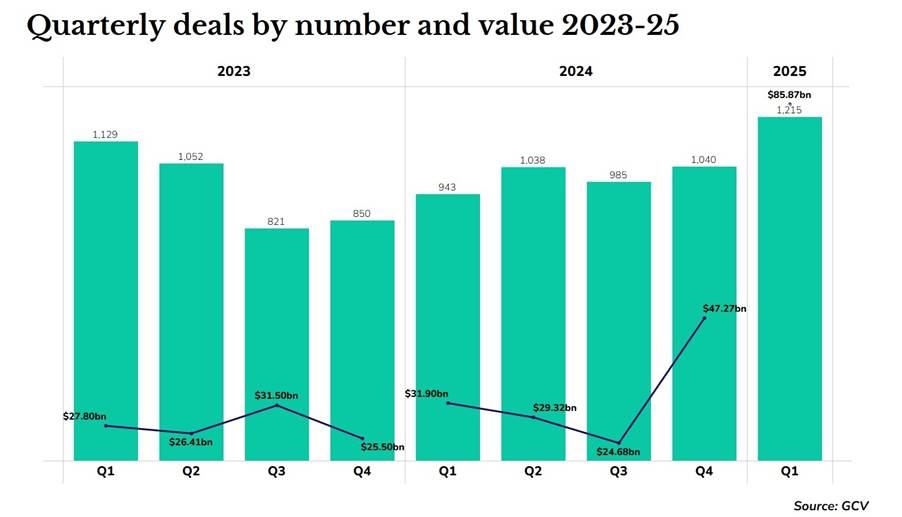

There were 1,215 corporate-backed startup funding rounds in Q1, the highest quarterly total for two years.

Thanks to two extraordinarily large deals, Q1 2025 was a record quarter for the amount of capital raised in corporate-backed funding rounds. OpenAI raised $40bn at the end of March, in the largest ever funding round for a private tech company. In January, the big data analytics company Databricks raised $10bn. These two deals made up more than half of the $85.9bn in total funding raised across rounds where the value was disclosed.

This is the largest amount raised in a quarter since 2021, showing that corporate investors are continuing to take large bets on US AI companies, even after the emergence of the Chinese rival DeepSeek posed a challenge to their business models. The OpenAI round was led by SoftBank, which has for the last decade been a prominent venture investor in emerging tech trends. The company’s former CFO recently told GCV that despite its patchy record on previous investments, he thinks SoftBank’s funding of AI infrastructure is a strong bet.

Leaving the large deals to one side

But these anomalous investments do not tell us much about CVC as a whole.

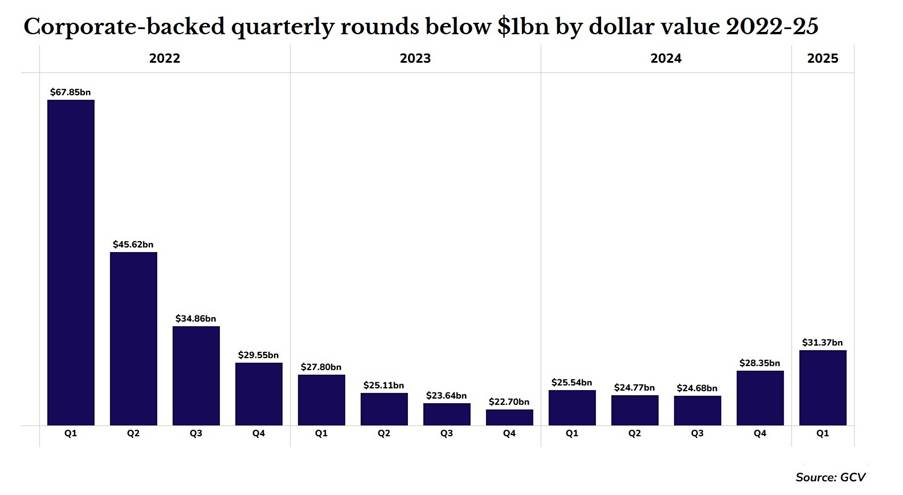

We can get a better idea of the underlying state of corporate venturing for the quarter if we take out the distortive funding rounds totalling over $1bn. This gives a flatter graph which makes for a more reliable comparison between the quarters:

What it shows is that, even without the very large deals included, there is still a discernible upward trend since the dip to the low point of Q4 2023, in a shallow U shape.

Some of the largest sub-$1bn deals were in China, where state-owned corporations invest heavily into capital intensive startups including Shenzhen Energy Environment, a waste management company that raised $691m. XCMT, an electric vehicle fleet company covered in GCV’s February data roundup, raised $881m.

But European startups also raised in the hundreds of millions. Germany’s Reneo, a company providing turnkey decarbonisation services for residential buildings, raised $627m in a series B raise. In the UK, Isomorphic Labs, a spinout from Alphabet’s DeepMind which uses AI in drug discovery, raised $600m from Alphabet and Thrive Capital, a VC firm.

The highest number of deals for two years

In terms of deal volume, Q1 2025 also saw unusually high activity, reaching a total of 1,215 corporate-backed deals. This is the most in one quarter since 2022, and is a 29% increase on the same period last year.

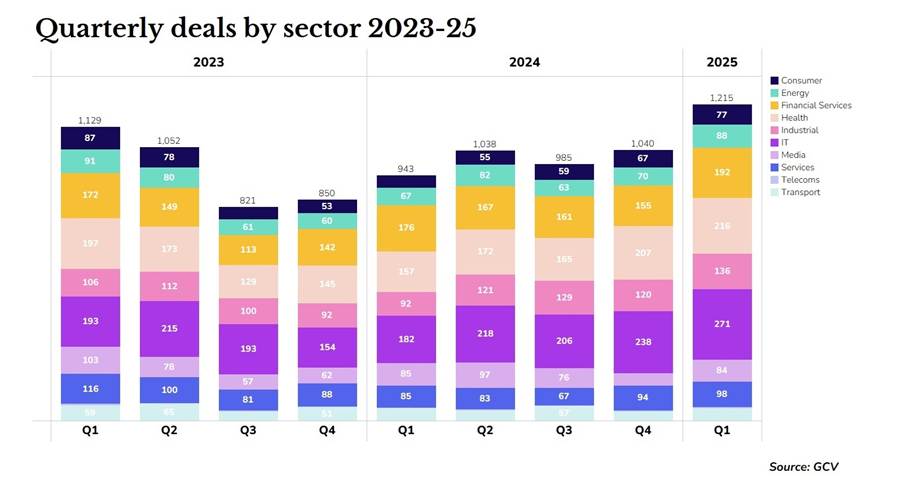

This high deal volume was largely focused in the fintech, healthcare, industrial and IT sectors. All of them showed the highest number of deals in a quarter since 2022. The graph below gives an idea of how the mix between sectors has shifted over the last two years.

Industrial startups: rise of the robots

When comparing the Q1 2025 data to Q1 2024, the number of deals for robotics and drone startups rose by 183% between the periods, with 34 deals recorded in Q1 2025 versus 12 the year before. This is the largest percentage change of any of the sub-sectors that make up the industrial category.

In last month’s data roundup, we noted that some of the largest robotics investments were for companies making humanoid robots. Zoom out for the whole quarter, and it’s clear that these are attracting strong investor interest in 2025.

The US humanoid robot maker Apptronik raised $350m in February, with Alphabet participating. Germany’s Neura Robotics raised $124m and China’s Fourier Intelligence raised $109m, both of which held funding rounds in January.

Neura Robotics has released video demos of one its robots, called the 4NE-1, which is designed for performing domestic chores. Fourier started by making robotic rehabilitation devices for people suffering disabilities. It pivoted to designing humanoid robots in 2019, and recently demoed the second iteration of one of its models.

IT deals: can the world still stomach software?

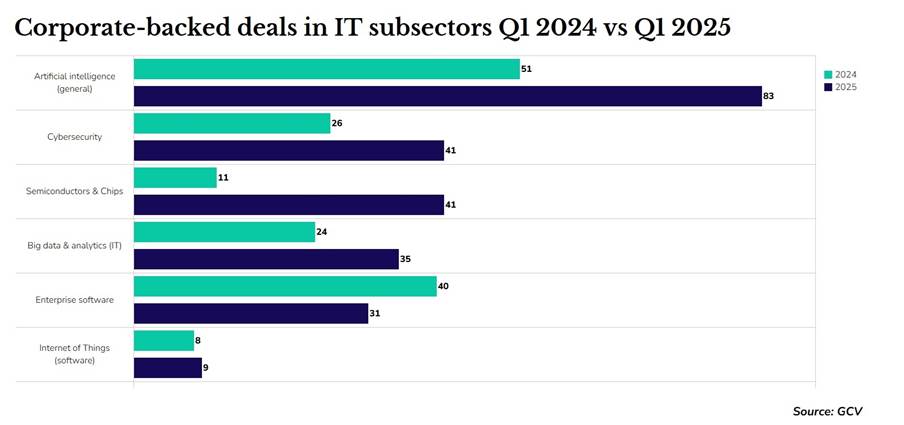

GCV has previously reported on the threat that AI poses to the traditional enterprise software business model. Current packages are designed around the fact that a human being will be interacting with the system, like a sales rep entering details in a CRM. But with the increasing sophistication of AI models, we are moving into a world where software will have to be designed for an AI product that interacts directly with the system. And so investors have told GCV that they are taking a close interest in AI-based software platforms and AI agents, to see where things are heading.

The quarterly data appears to support this. A comparison between Q1 2024 and Q1 2025 shows a 23% drop in enterprise software deals, despite every other IT subsector we track rising over the period.

And this is not just a story of shifting deal volume. AI startups generally attract larger investments, according to our data. The average corporate-backed funding round for an AI startup was $42m, excluding the large $1bn+ deals. For enterprise software startups, the figure is $34m.

Semiconductors: Chinese investment continues to rise

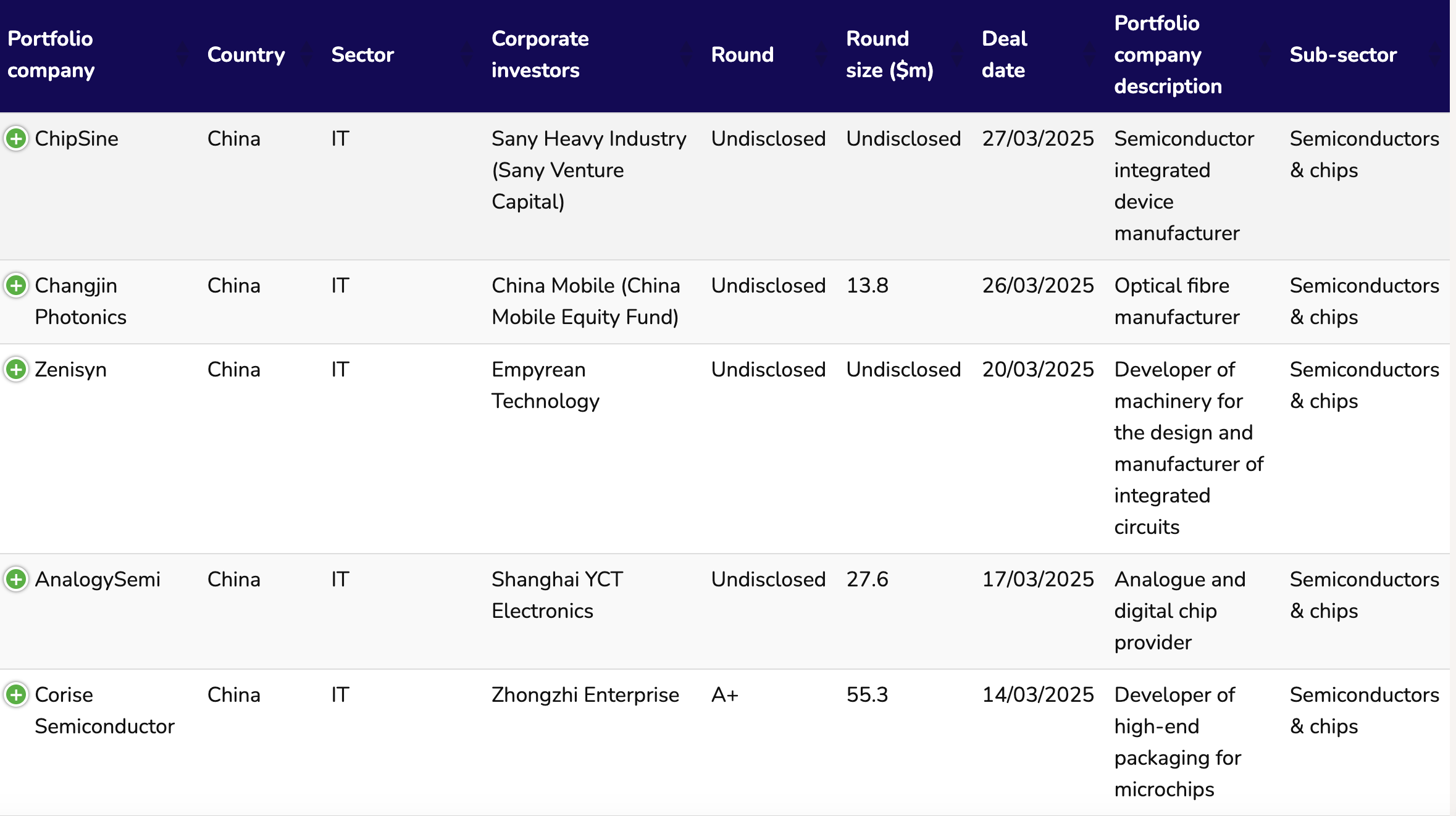

Semiconductor investments nearly tripled between Q1 2024 and Q1 2025. The bulk of the 2025 figure came from Chinese startup funding rounds, which account for 25 of the 41.

China’s semiconductor sector had shown strong investor activity in February with eight deals, but March was an even hotter month, with 12.

GCV+ subscribers can see all these Chinese semiconductor deals — as well as deals from hundreds of other subsectors and countries — in our CVC Funding Round Database.

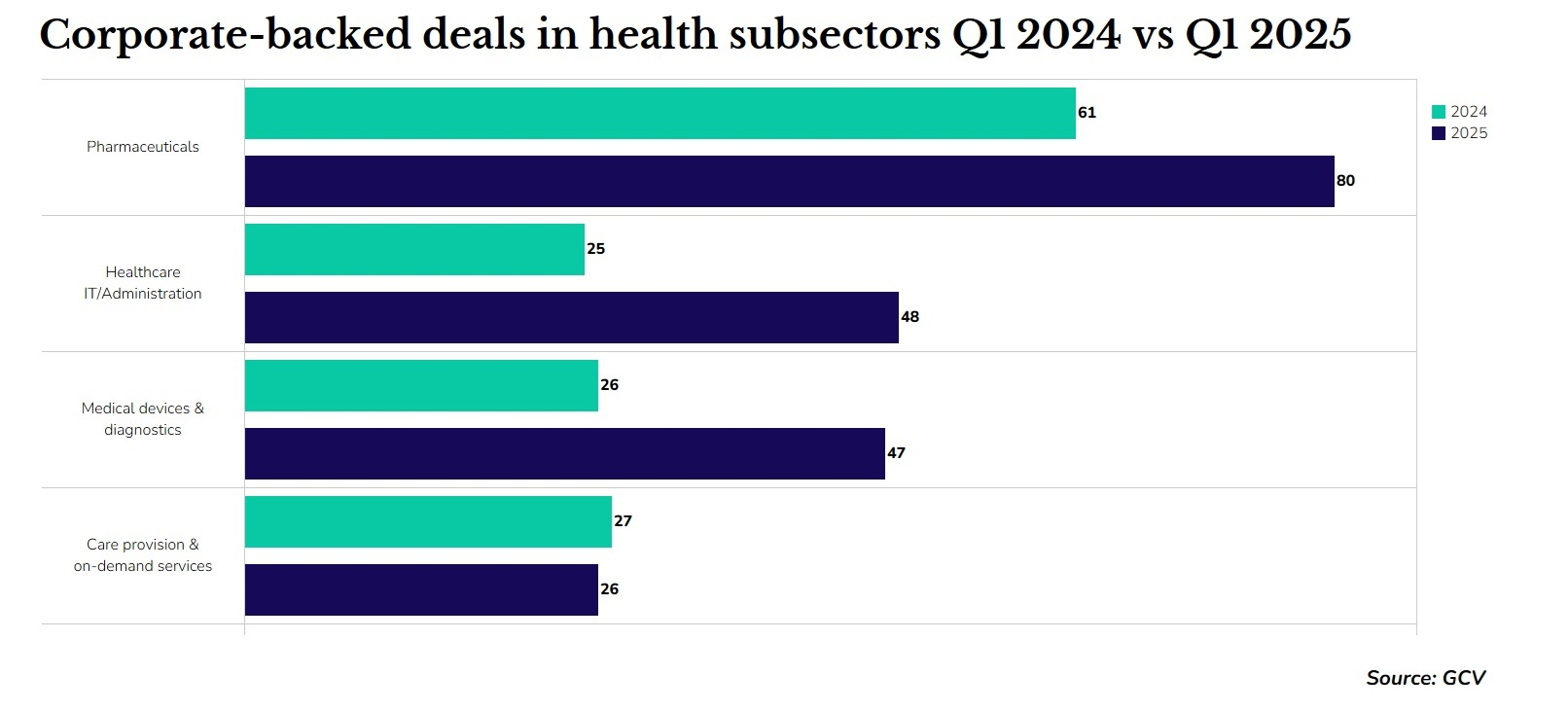

Health: the core areas show large rises

Health startups had a strong quarter compared to Q1 2024. Pharmaceutical, healthcare IT – which includes telemedicine and health-specific software – and medical device startups all increased deals considerably on the prior year.

This was more pronounced for healthcare IT and medical devices, which saw 92% and 81% increases, respectively.

Among the large healthcare IT deals was the $320m series A round for Truveta, a US developer of a software platform that uses clinical data to help researchers accelerate therapy development. Microsoft participated in the round.

Abridge, another US startup, makes software that transcribes medical conversations and highlights and defines key terms for patients. It raised $250m in an undisclosed round, with participation from Alphabet.

An Irish medical device startup, Fire1, which makes remote monitoring devices for patients suffering from heart failure, raised $120m from investors that include Novo Holdings, the investment vehicle for Novo Nordisk. A Chinese company that also makes medical devices for heart failure, Pulnovo, raised a $100m series C round that Eli Lilly took part in.

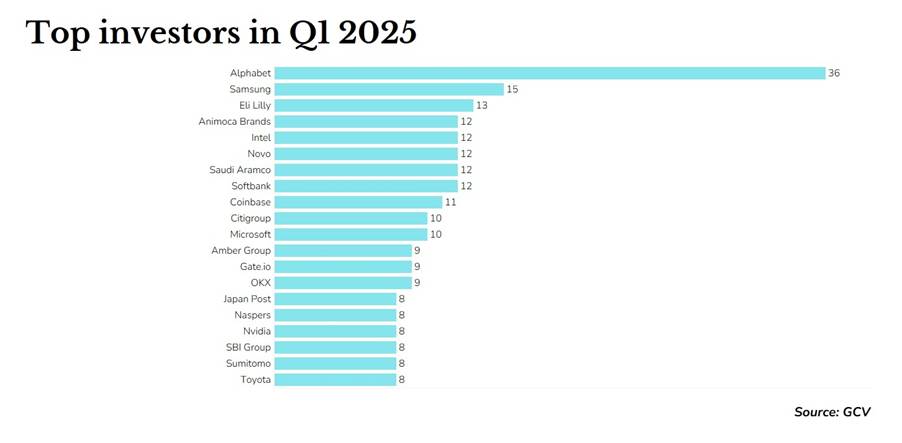

The biggest investors of the quarter

It is no surprise that Alphabet leads the quarter by the number of deals. The tech conglomerate is a voracious investor and always comes out top in the monthly roundups.

But the quarterly view puts in perspective how much more investment appetite it has than other corporates, accounting for more than double the volume of the next biggest investor, Samsung.

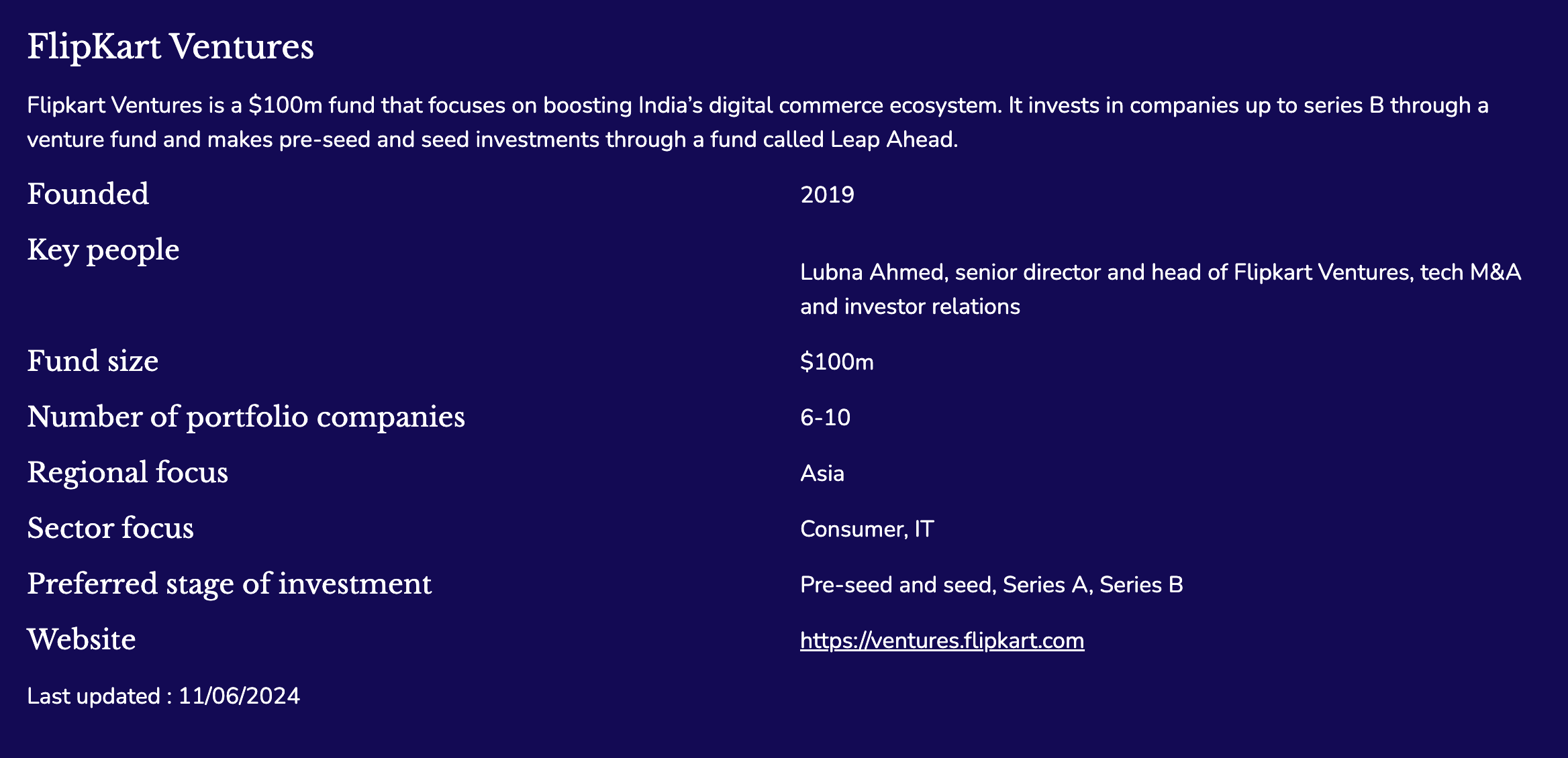

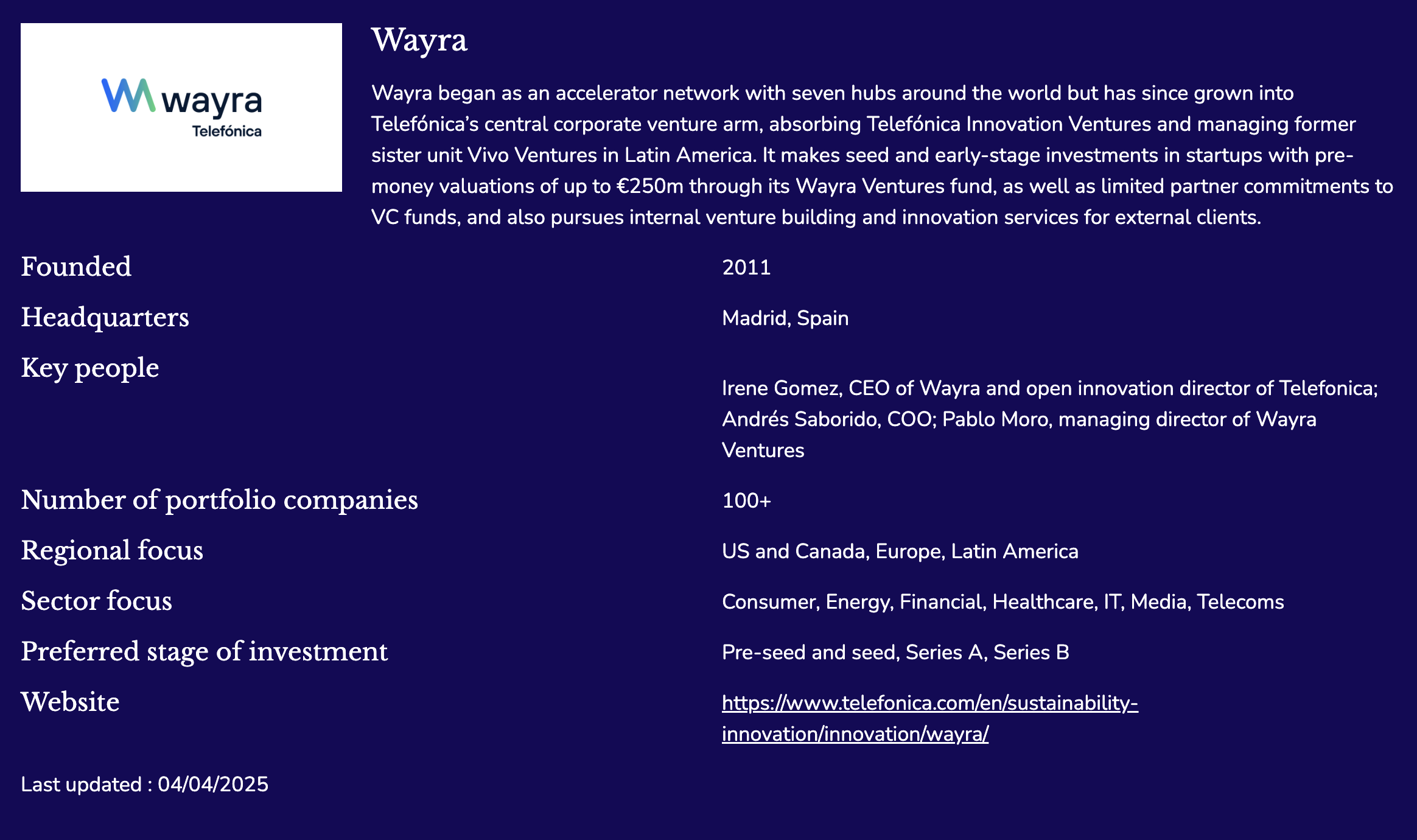

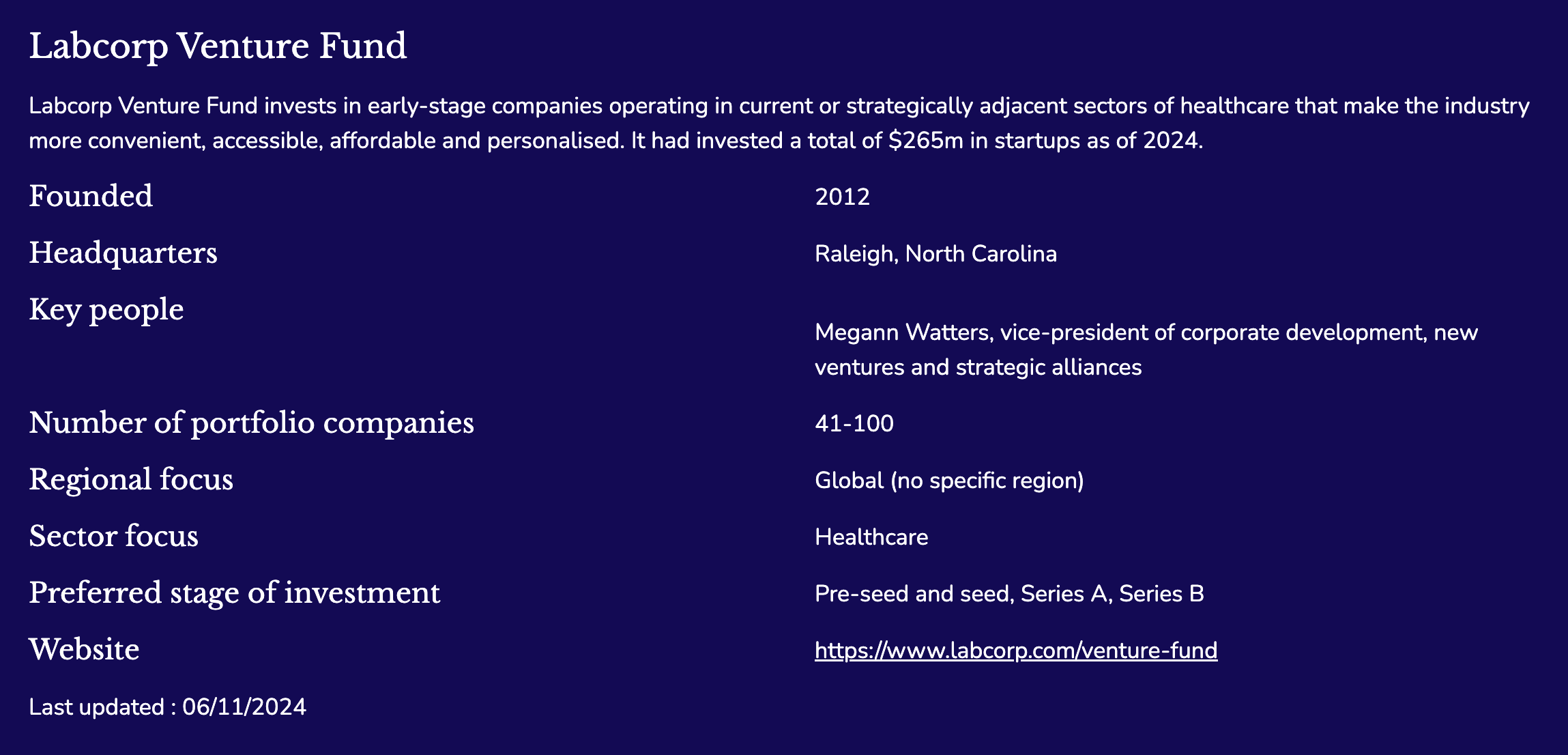

Another advantage of the quarterly ranking is that it shows where the consistent investment is coming from. February and January’s totals included CVCs like those belonging to Flipkart, Telefónica and Labcorp, which all had unusually prolific months. But over a three-month period, the large tech, pharmaceutical and energy companies tend to dominate, challenged only by financial institutions and the crypto companies that make lots of small bets in niche blockchain technology.