Guest comment by Stefan Gabriel, Hitachi Ventures

“No, there are some principles and objectives that significantly contribute strategic value-add to corporates and are not fully utilized!”

How can companies develop new capabilities to adapt to increasingly rapid developments and technological disruptions? How can a Corporate Venture arm add value to corporate mother and support facing global challenges in Society, Environment and Health?

This is 2022 more than ever the focus of interest for companies, which goes back to Scottish economist Adam Smith’s interest in explaining in his seminal book, The Wealth of Nations, what makes a nation prosperous and how a nation’s prosperity can be increased.

In academia and practice, therefore, CVC has taken centre stage in this context as a source of competitive advantage and a means of enhancing financial and non-financial performance.

Background History

Professor Henry Chesbrough nearly two decades ago in 2003 was the first person who coined the expression “open innovation”.

The expression “open innovation” describes how corporates can no longer afford to rely solely on their internal ideas, capabilities and resources when an abundance of knowhow exists in the present external environment. Equally, corporates can no longer limit themselves to bringing their internal innovations or spinouts to market along a single path.

This has triggered many companies to look outside and work with innovative startups to accelerate their innovation efforts and contribute to growth.

However, open innovation approaches can lead to organizational conflict. Gaining external knowledge to start internal innovation, often leads to a loss of control and a loss of core competences of the corporation, as Chesbrough and other researchers later found.

In addition, the so-called “not invented here” syndrome might emerge, where external ideas and knowhow are rejected by corporate employees.

Therefore, a corporate must ensure that an organizational culture is established which promotes an environment of openness and acceptance of external knowledge sources as, fundamentally, the future lies in a good balance of internal and external innovation practices, where core competencies are promoted and intellectual property (IP) rights protected, Chesborough found.

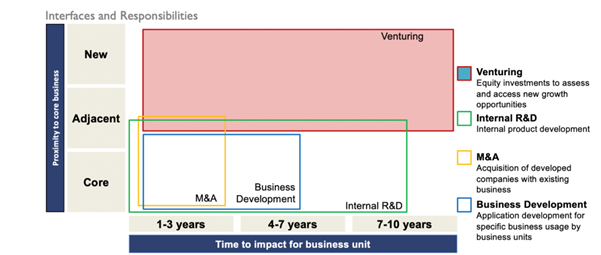

But research has moved on in the intervening two decades from identifying open innovation as an important issue to working out how to apply it best through corporate venturing, including taking minority stakes in startups.

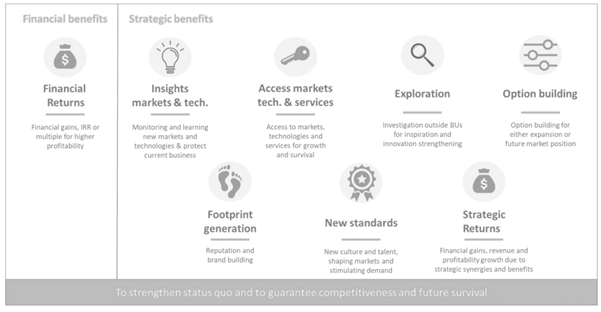

Such corporate venture capital (CVC) deals, however, struggle to show how they add strategic (sCVC) returns beyond but in addition to financial measures that can be easier to track following overall Venture arm’s mandate: collaborate with startups, innovate, and contribute to generate mutual growth.

More and more CVC units now have a predominant strategic focus with a financial component being a prerequisite for investment. CVC units generally aimed to make a strategic contribution to the corporate mother company and its entire ecosystem through CVC investments.

In addition to strategic ambition, CVC units also targeted financially attractive companies, such as the next future billion-dollar businesses or so-called unicorns. One of the aims for doing this was to send the right message to startups and other investors that CVC units also care about the financial return of a startup same time.

CVC is effectively an options game that can deliver financial and strategic results, or sometimes just foster collaboration and partnering.

More specifically, CVC is, when setup correctly, a great “tool” to experiment, collaborate or exercise Open Innovation opportunities and can create tremendous value-add, generate growth and provide insight and learning from fast changing digital new markets and can therefore even beware of disruption.

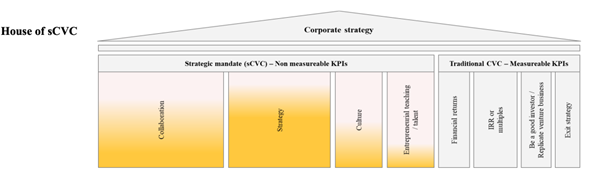

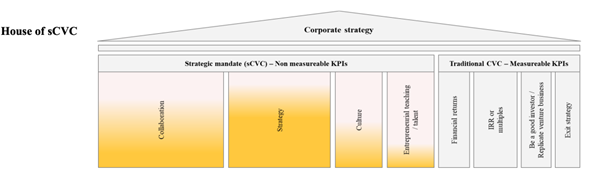

So how to build this “House of sCVC”?

The four strategic pillars that characterize a Strategic Corporate Venture arm – as they are not entirely separable due to their interrelationships and interdependencies – are: (i) Collaboration, (ii) Strategy; (iii) Culture; (iv) Entrepreneurship / Talent.

First, collaboration and partnering is the activity and project between the startup and one or several selected business units – sometimes even corporate customers – or corporate R&D. Within Hitachi this activity is strongly supported and facilitated by the so called “Corporate Venture Office (CVO)” with executive guidance.

Second, corporate and business strategies depend on dialogue between various stakeholders, especially between an sCVC unit and corporate strategy to challenge and promote current “overall strategy” following a corporate’s vision as well as its “cluster strategies”, and finally Business unit strategies or even R&D roadmaps. Good transparent, aligned and trusted strategic dialogue is a success factor.

Third, corporate culture combined with employees’ expertise is key to success. Some corporate cultures used to be very hierarchic, full of policies, restrictions and “rules”, slowing down business development speed. A culture that is welcoming “Open innovation”, regional cultures and business attitude in contrast to focussing on cost cutting and problem-solving is a good investment into future growth. Working and partnering with startups motivates people to adapt and learn new modern cultural attributes and form an attractive innovative workplace environment. Some ideas can arise from working with an entrepreneurial culture of a CVC unit through lean and fast processes, independent structures and autonomous fast processes and responsibilities. Such a corporate culture attracts talent from around the globe.

Fourth, for HR entrepreneurial teaching and talent development is the “elixir” to build strong leaders and foster business growth. Even attracting and hiring the right people for a corporate job with new entrepreneurial and business mindset and expertise, attractive forms of incentives and compensation, new management training programs. Senior leaders in finance need to understand that some startup investments will not be successful (from their perspective) because CVC is characterized as high risk but will add a lot of strategic value (as addressed above) and within fund-cycle will have a good performance, if setup and managed well.

Accordingly, making mistakes and being open to failure is essential, but at the same time reacting, pushing, dealing with these challenges and solving issues quickly is essential. Always follow the spirit of: “Be open for innovation, take risk, evaluate fast, but contribute to growth.”

But measuring strategic value-add by sCVC to corporate mother is difficult. One tool that should be considered at least for R&D is the NPVI (New Product Vitality Index), which measures the impact on revenue of products that have been new to the company’s portfolio for less than five years. SCVC certainly is contributing to that NPVI.

Hitachi has applied these principles in its ventures unit’s governance, processes and management set up in 2019 to be a good benchmark for sCVC today.

Above only some characteristics and objectives are shown and discussed but most of them are already approved by CVC community. However, without data and collaboration many of the insights are hard to unleash fully.

Improved collaboration would result in greater learning and provide better guidance on how to use resources and corporate budgets more effectively to achieve synergies, invest in open innovation, and address global challenges. [SG1] This is where the GCV Institute’s new benchmark platform promises some more transparency and best practice while retaining confidentiality on strategic value-add for corporates.

The author’s personal message regarding future research proposals is: “I would be happy to see some future research projects started, implemented and communicated, as I see great benefit and contribution to corporate growth for all global companies that have started or want to start a more strategic CVC activity. Ideas for future research projects that could be interesting for CEOs could be like: “What is the ideal setup for a more Strategic CVC arm” or “How to measure strategic value-add and make it visible?” or “Is SCVC the new booster for organic R&D?”