The fund, co-managed with a seed-stage VC firm, will target AI, robotics and internet-of-things across multiple industries.

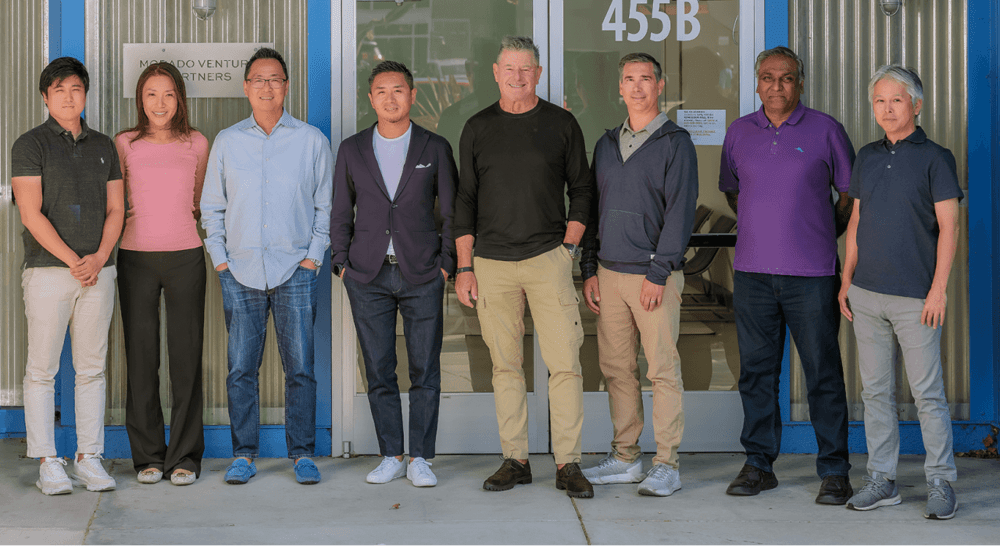

Team members of E12 Ventures

A group of Japanese corporates including Mitsui & Co, The Norinchukin Bank, Mitsubishi Pencil Company and Nitto Denko Corporation, have committed $105m to a new CVC fund based in the US.

E12 Venture Capital Fund I will be managed by E12 Ventures, a new firm formed in November last year by Mitsui & Co Global Investment (MGI) and seed-stage VC Morado Ventures. It has now reached final close.

It will invest primarily in early stage companies in the US in areas such as artificial intelligence, deep learning, robotics and internet-of-things, particularly as they apply to foodtech, agtech, climate tech, fintech and digital health.

While backed and co-managed by corporates, the fund will have the “sole objective” of maximising financial returns. The fund’s LPs have dispatched delegates to California’s Bay Area to look at new business opportunities in collaboration with E12.

Fernando Moncada Rivera

Fernando Moncada Rivera is a reporter at Global Corporate Venturing and also host of the CVC Unplugged podcast.