The sector is vulnerable to the economic downturn as lenders pull back and higher interest rates crimp borrowing. But pockets of the sector continue to attract financing.

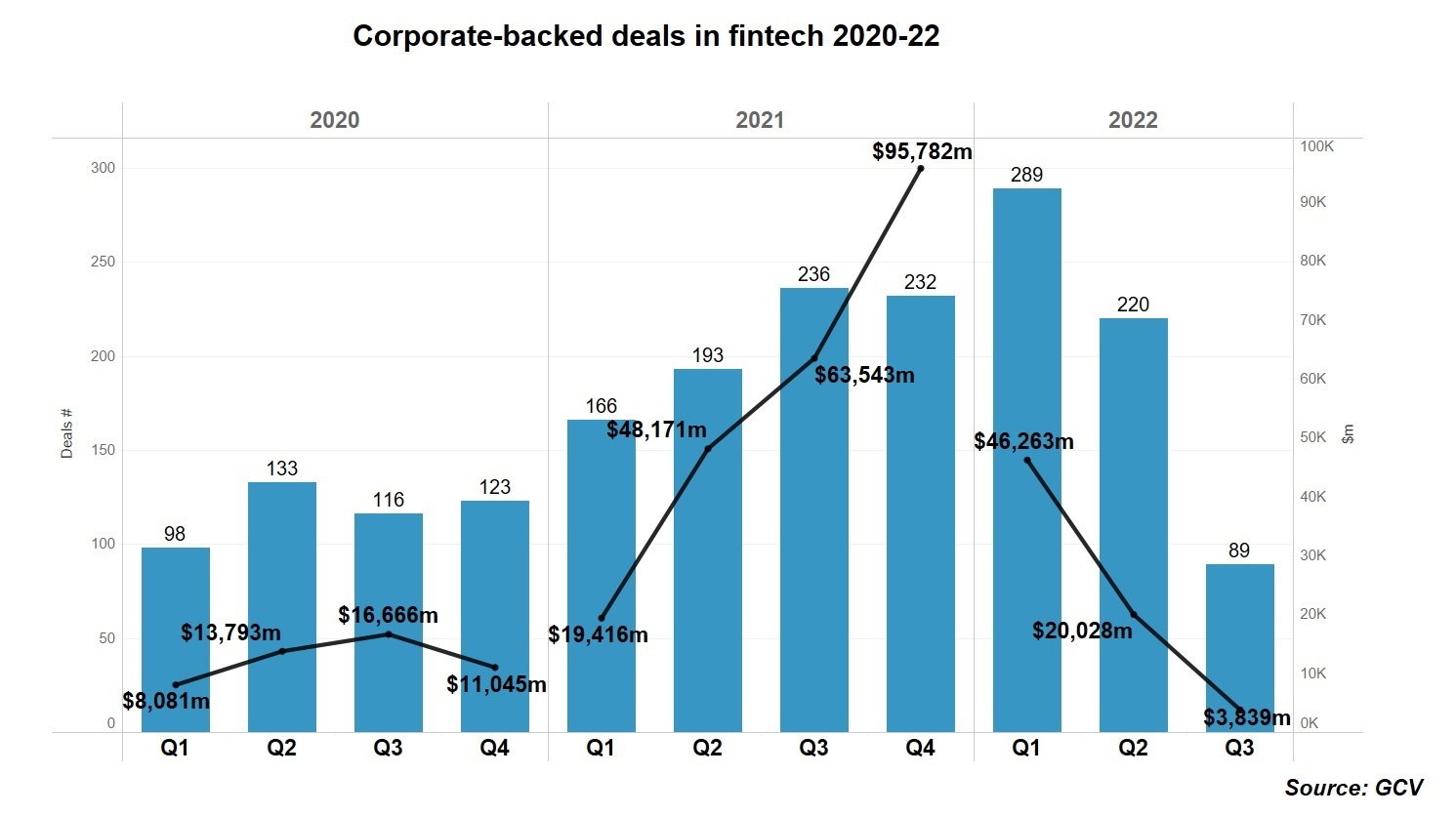

Corporate-backed investments into fintech companies dropped 92% in value in the third quarter, compared to Q1, amid a dramatic pullback in venture capital investing. Deals are still being done in a handful of fintech sectors, such as payments, suggesting that some areas are more recession proof than others.

Corporate-backed deals in fintech started the first quarter of 2022 strongly with 289 transactions tracked by GCV, totalling $46.3bn. In the third quarter, however, there were just 89 deals, with a total value of $3.8bn.

Fintech is among several sectors that have experienced a decline in corporate-backed startup funding this year. GCV analysis shows that gaming and energy transition-related deals are emerging as the only exceptions to the general downward trend.

Fintech is particularly vulnerable to the economic downturn as financial institutions pull back on lending, and higher interest rates make borrowing more costly for businesses and consumers.

But, despite negative economic news, a spurt of recent corporate-backed fintech deals indicate pockets of the sector are showing more resiliency.

Italian mobile payments app startup Satispay raised €320m ($316m) series D funding in September, valuing the company at more than €1bn. Tencent, the Chinese multinational tech and entertainment company, and Block, the US technology conglomerate, are corporate backers.

The payments industry may be less affected by the forecasted recession, according to a recent article by Wellington Management. The investment firm says historical consumption data show consumer spending is resilient even during recessions, with the exception being the 2008 global financial crisis. Moreover, today’s inflationary environment could be positive for the payments industry as revenue is generally tied to the price consumers pay.

Other recent deals include a €18.7m ($18.6m) series A investment in fintech software developer Toqio. Six Fintech Ventures, the corporate venture capital fund of Six Group, a Swiss financial services group, was an investor in the deal announced in October. The European startup offers fintech software as a service to financial and non-financial companies.

Verifast, a Canadian financial verification software provider, raised $3.5m in seed financing also in October. M3 Financial Group, a Canadian non-bank mortgage lender, lead the round. The startup’s software verifies borrowers’ financial data, such as income, assets and employment.

And, while the fall in Klarna’s valuation earlier this year showed investors concern over the prospects of the buy now, pay later industry, Saudi Arabia-based Tamara secured $100m in series B funding from investors, including online payments platform Checkout.com, in August. GCV profiled the financing in its Standout Six deals roundup that month.

If the economic downturn turns out to be long-lasting and deep, the value and number of fintech deals will likely continue on its downward path. But it would not be a surprise if pockets of the sector continue to attract investment.