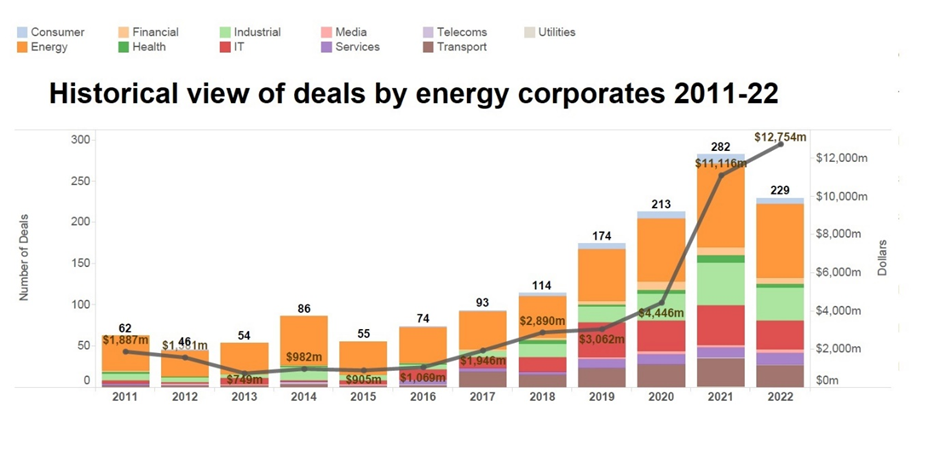

While the rest of the market pulled back investment, GCV data shows that the value of deals backed by energy companies continued to grow in 2022.

The energy sector seems to not have got the memo about the pullback in equity investing yet. While other sectors have seen a drop in deals, energy companies have already backed 229 deals this year, with a total estimated value of $12.75bn, more than in all of 2021.

Last year had already been a strong year for the sector, with total capital raised in rounds backed by energy corporates more than doubling from $4.45bn in 2020 to $11.11bn in 2021. The deal count also rose by 32% to 282, suggesting that deal valuations went up sharply in the investment frenzy of 2021.

But while VC deal counts overall have fallen significantly — from 9,044 in Q1 down 40% to 5,359 in Q3, according to PitchBook — corporate-backed energy deals are not slowing.

In the full energy report:

Energy deals continue to boom despite market downturn

Value of corporate-backed energy deals quadruples

Energy funds are back in vogue

Wave of job moves amid energy bull market

Funding spikes for university energy spinouts

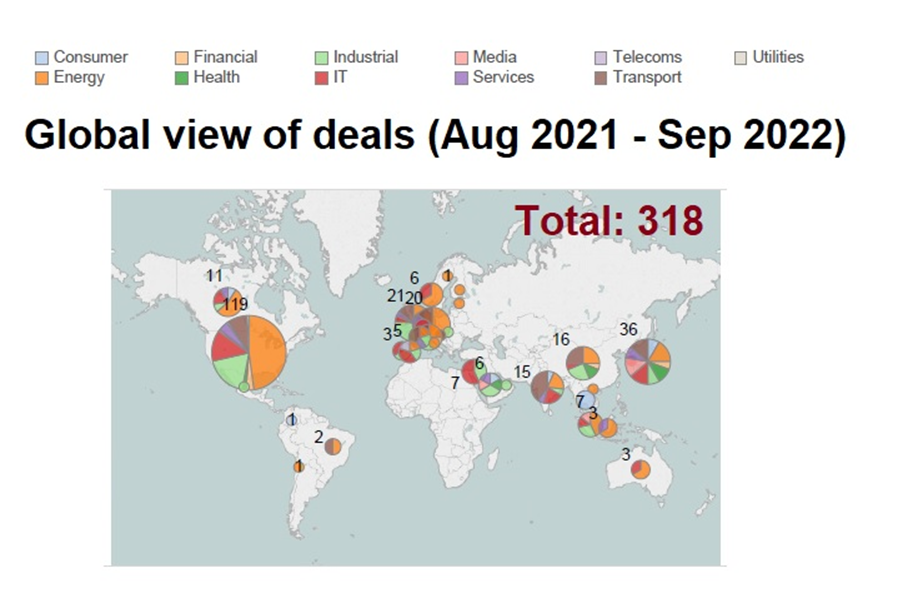

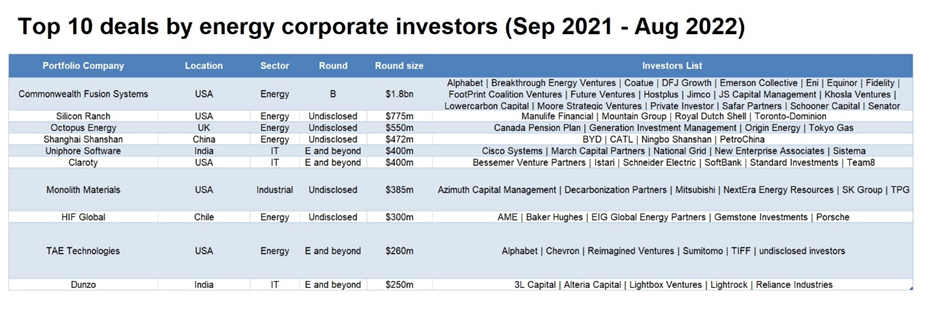

For the period between September 2021 and August 2022, we reported 318 venturing rounds involving corporate investors from the energy sector. Many of them (119) took place in the US, while 36 were hosted in Japan and 21 in the UK.

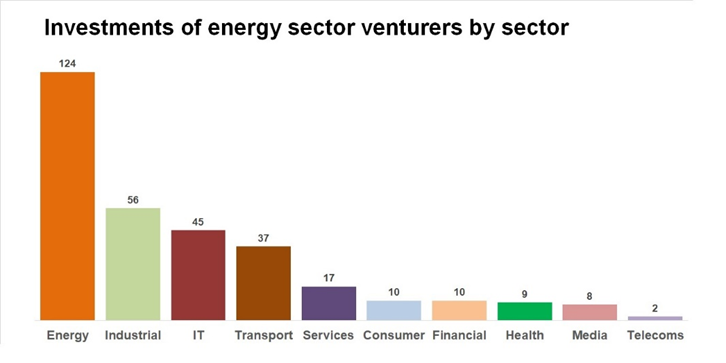

Many of those commitments (124) went to emerging enterprises from the same sector (mostly energy storage tech and renewable energy) as well as into companies developing other technologies in synergies with energy: 29 deals in the industrial sector (primarily robotics and unmanned aerial vehicles and advanced materials), 45 in the IT sector (enterprise software, artificial intelligence and other IT applications) and 37 in transport (connected and autonomous vehicle tech as well as parking and public mobility mostly).

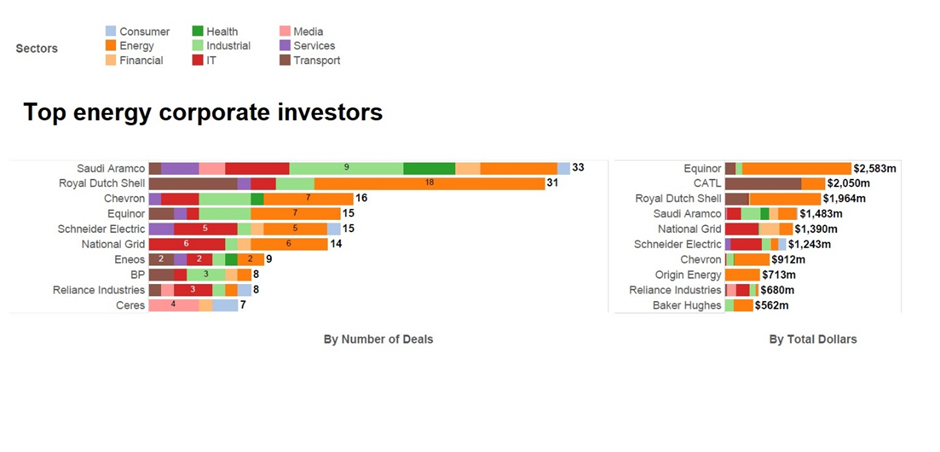

The leading corporate investors from the energy sector in terms of largest number of deals were oil and gas majors Saudi Aramco, Shell and Chevron. The list of energy corporates committing capital in the largest rounds was headed by oil and gas company Equinor, along with CATL, Shell and Saudi Aramco.

US-based fusion energy technology developer Commonwealth Fusion Systems (CFS) raised more than $1.8bn in a its series B round featuring internet conglomerate Alphabet and petroleum suppliers Eni and Equinor. Founded in 2018 and spun out of Massachusetts Institute of Technology, CFS is working on nuclear fusion technology that generates electricity by fusing two nuclei – rather than splitting an atom, as in current nuclear power stations. The company will use the funding to build, commission and operate its fusion machine – named Sparc – which is expected to achieve commercially relevant net energy by 2025.

US-headquartered solar power producer Silicon Ranch Corporation secured $775m in an equity funding round, led by insurance firm Manulife and which also included oil and gas supplier Shell. Silicon Ranch functions as the solar branch of Shell’s power distribution arm, Shell Energy, and runs a portfolio of solar farms and large-scale utility solar plants, on behalf of large businesses and governmental facilities. The company’s solar and energy storage projects run to 4 GW across North America.

UK-based renewable energy retailer Octopus Energy raised a $113m round, backed by Origin Energy. Launched in 2015, Octopus producer and supplies renewable solar, wind and tidal energy. It offers utility, generation and transmission services, not locked by contract to businesses and households.

China-listed provider Ningbo Shanshan was among the investors providing RMB3.05bn ($472m) in funding for its Lithium Battery Material Technology subsidiary. Electric vehicle manufacturer BYD and battery producer Contemporary Amperex Technology (CATL) also took part in the round, along with oil and gas supplier PetroChina’s Kunlun Capital unit and CATL-backed vehicle Wending Investment, at a valuation of $1.5bn. Formed in 2014, Shanghai Shanshan develops and manufactures lithium-ion battery anodes and carbon materials.

Uniphore, a US-based conversational automation technology provider backed by networking technology producer Cisco, energy supplier National Grid and conglomerate Sistema, raised $400m in a series E round led by New Enterprise Associates. The round valued the company at $2.5bn. Founded in 2008, Uniphore has built software that helps businesses improve the performance of their customer support staff. It relies on artificial intelligence and natural language processing technologies to power voice-based services.

Energy management system provider Schneider Electric and telecoms group SoftBank co-led a $400m series E round for US-based Claroty. The corporates were represented by SE Ventures and SoftBank Vision Fund 2 respectively. Founded in 2015, Claroty has built an extended IoT (XIoT) – covering industrial IoT (IIoT), internet-of-medical-things (IoMT) and enterprise IoT – cybersecurity software tool designed to help organisations safeguard their IoT operations and operational technology (OT) assets through threat identification, risk mitigation and encrypted remote access.

US-based clean hydrogen, carbon black and ammonia developer Monolith Materials raised $300m in a round led by TPG and Decarbonization Partners, which featured industrial and energy conglomerate SK Group as well as equipment manufacturer Mitsubishi Heavy Industries. Founded in 2012, Monolith makes carbon black and hydrogen gas intended to convert natural gas to carbon black in an eco-friendly and cost-efficient way.

Chile-headquartered alternative fuel developer HIF Global raised $260m from investors including funds run by carmaker Porsche, energy technology producer Baker Hughes and energy utility AME, which remains its majority shareholder. Formed by AME, HIF has developed a system which applies electrolysis to wind energy to produce carbon-neutral hydrogen fuel. The company has tested out the technology with a pilot facility called Haru Oni in Chile, and now intends to begin building out its first commercial-scale project in the United States.

US-based fusion power technology developer TAE Technologies raised a $250m series G2 round, which included oil major Chevron, Alphabet and Sumitomo as backers. Founded in 1998, TAE develops a technology intended to offer and commercialise safe and cost-effective fusion power. It offers solutions in power management, electric mobility, life sciences and other.