Corporate investors continue to be bullish about investing in the energy transition, even into 2022.

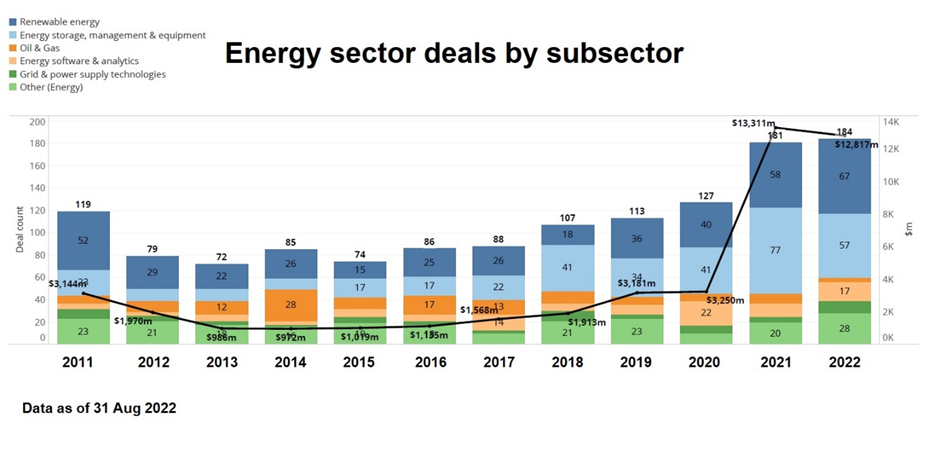

Corporate investments in energy-focused startups rose 42% in the 2021, from 127 rounds in 2020 to 181 by the end of 2021. The estimated total dollars in those rounds increased four times over from $3.25bn in 2020 to $13.3bn last year.

That pace has not subsided in 2022 despite a bearish investment market overall. By the end of August this year we had already tracked 184 rounds (slightly more than…