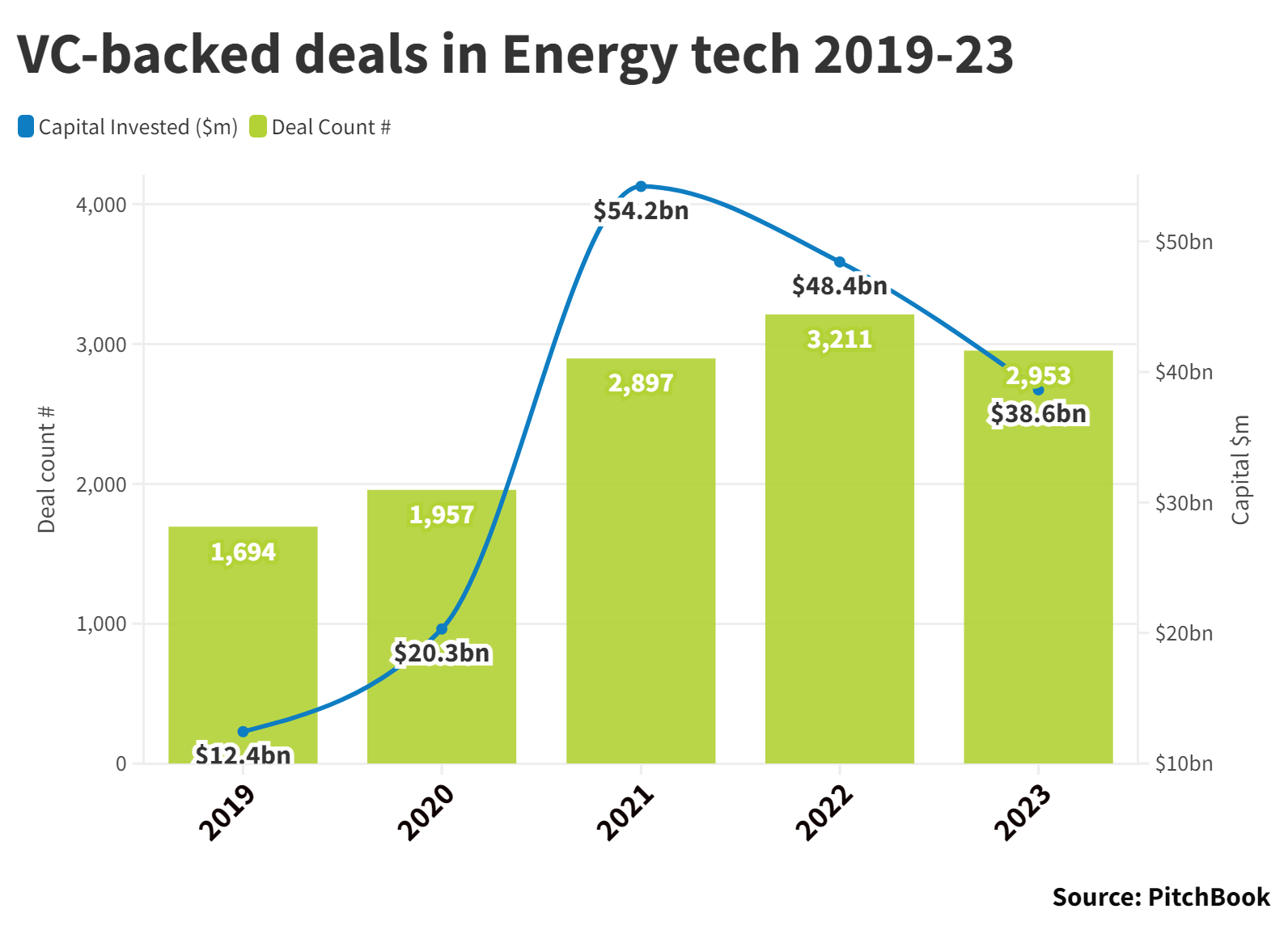

Corporate investors are disproportionately involved in the biggest funding rounds by energy sector startups.

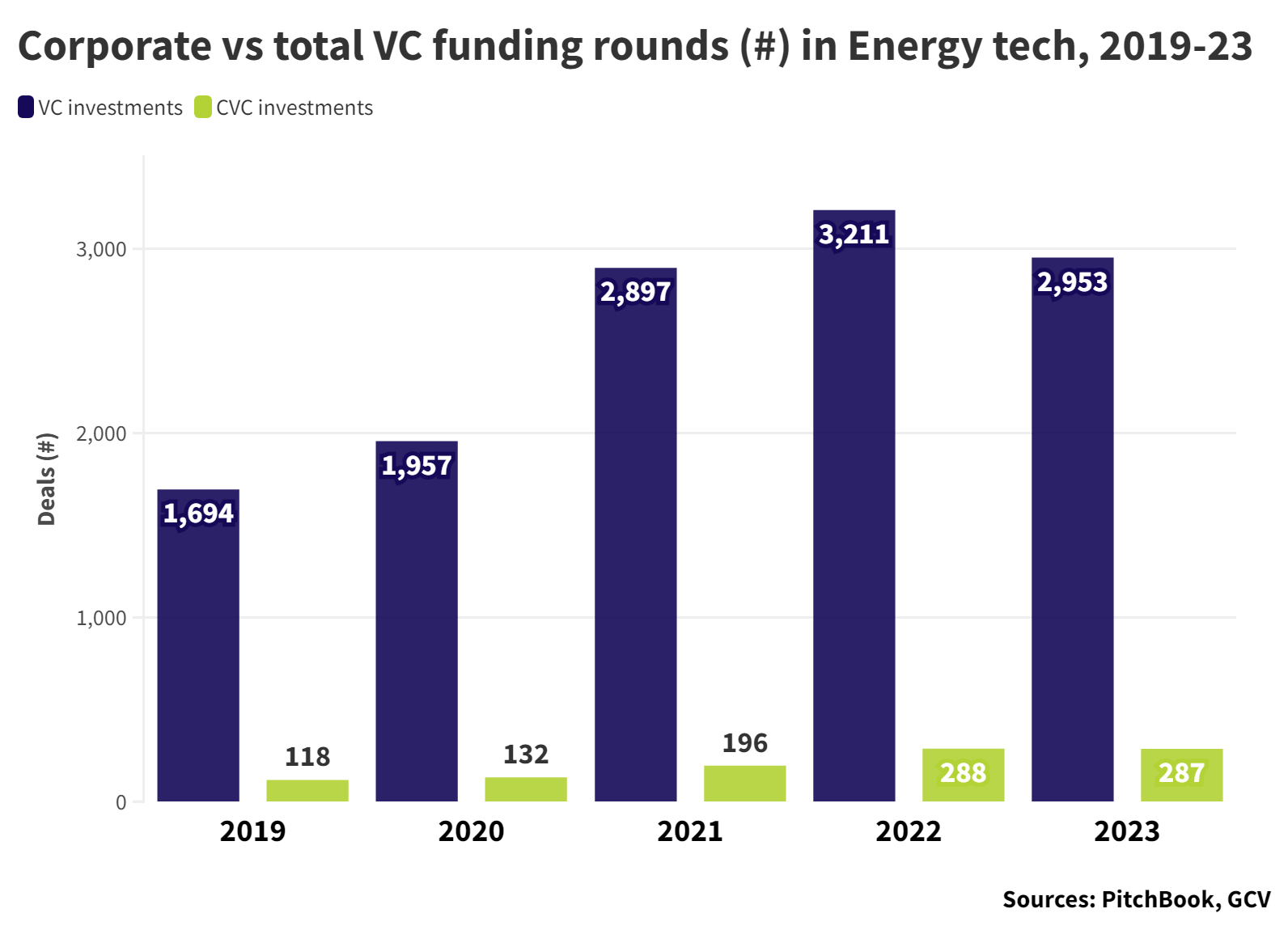

Corporates are becoming an increasingly critical source of funding for energy startups. Although corporates were involved in only 10% of the startup funding rounds in the sector last year, they are disproportionately likely to be involved in the high-value rounds.

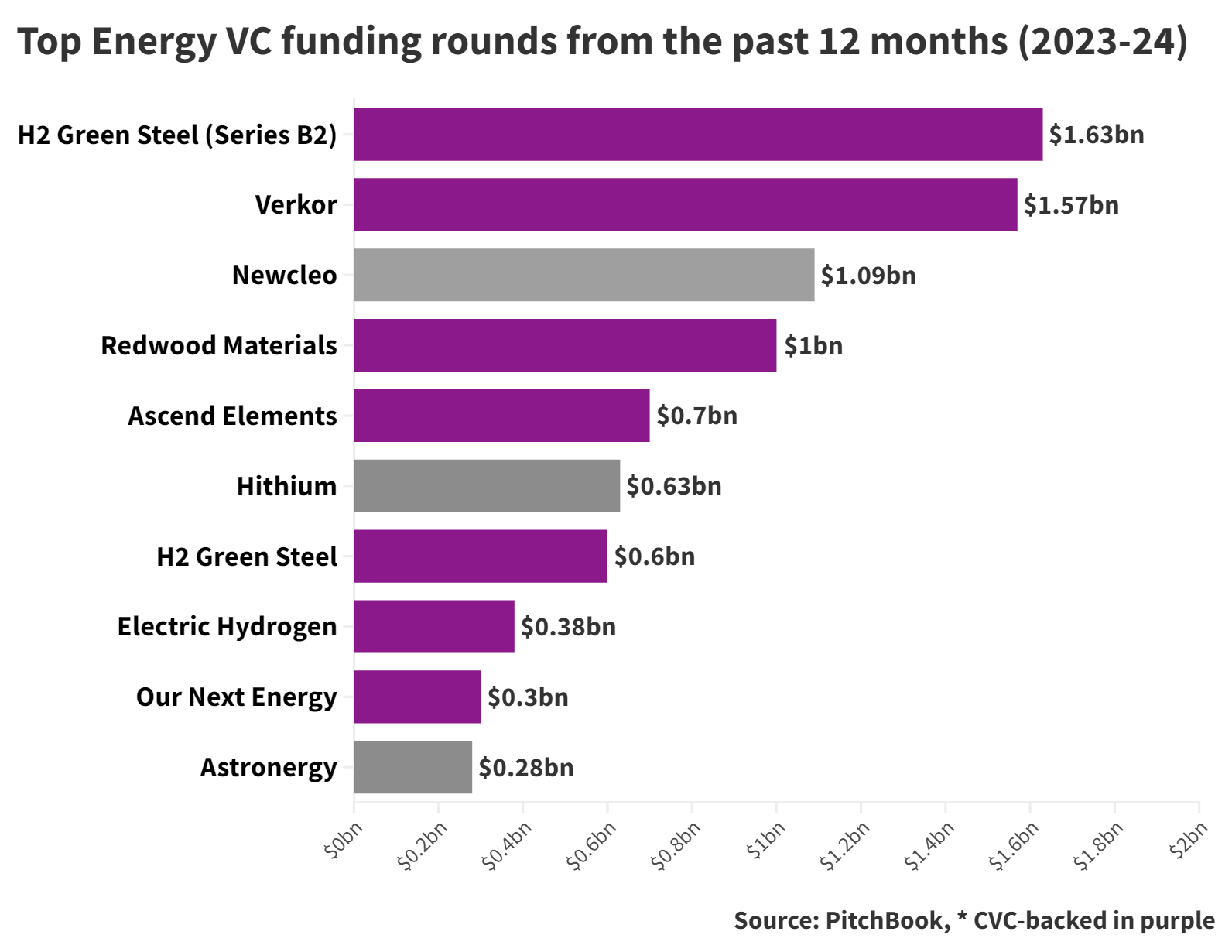

In the past year, seven out of the 10 biggest funding rounds for energy-related startups involved corporate investors.

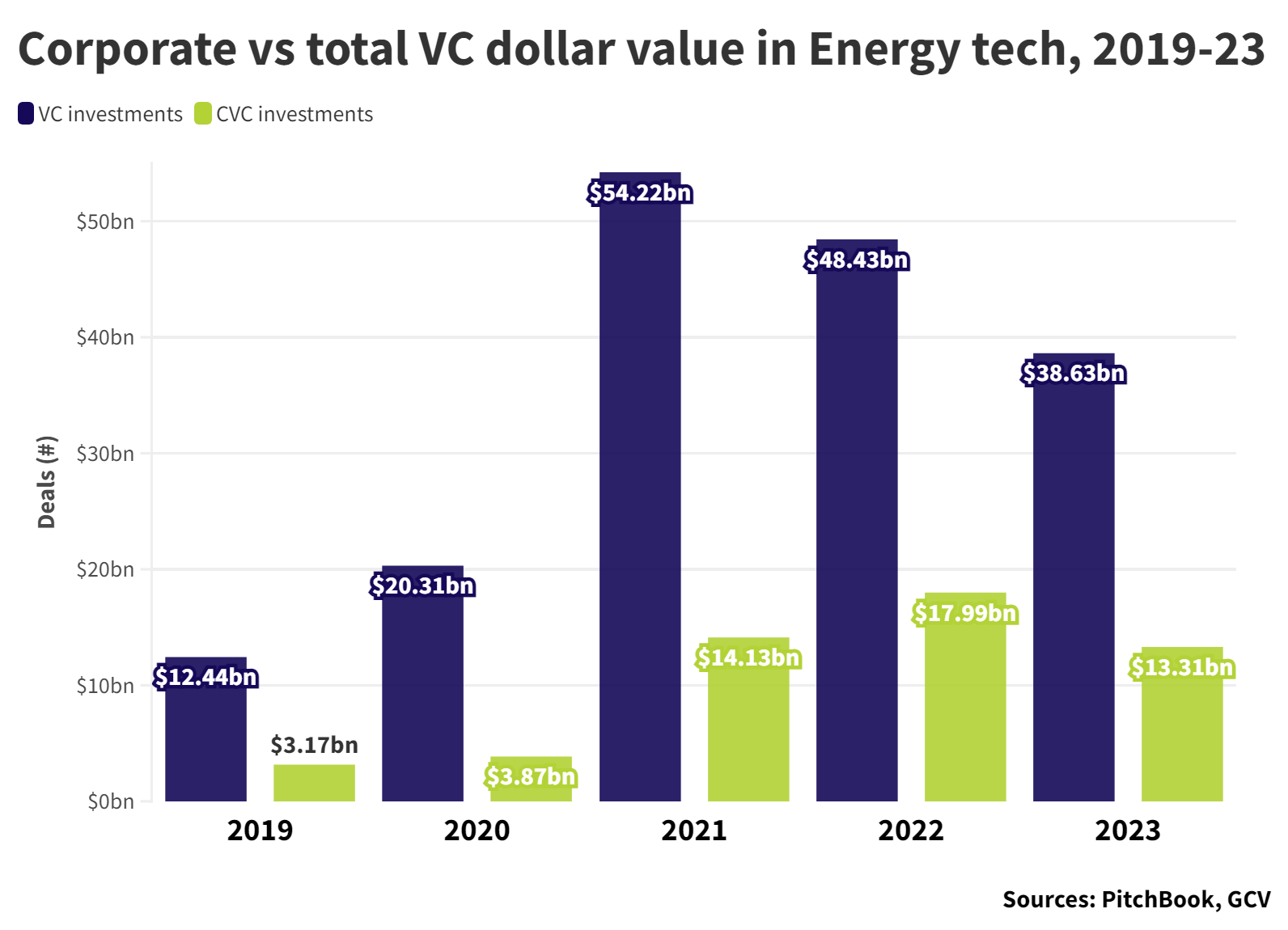

More than a third of all the dollars raised by energy sector startups comes from funding rounds involving corporate investors. Moreover, the sums raised in corporate-backed funding rounds stay steadier than the rest of the market.

Venture capital spending on energy-related startups boomed in 2021, reaching more than $54bn, but this has fallen nearly 29% in the past two years. The value of corporate-backed rounds, meanwhile, has been more stable. Although the 2023 total of $13.31bn is down from a 2022 high, it is only 6% lower than the level of investment in 2020.

ENERGY SECTOR SPEAKERS AT THE GCVI SUMMIT INCLUDE:

- Gareth Burns, Vice President, bp ventures

- Kendra Rauschenberger, Vice President, Siemens Energy Ventures

- Marc Van Den Berg, Global Managing Director, Climate Investment

Recent large deals include the $245.7m funding round in February for Koloma, a US startup planning to dig for sub-surface deposits of hydrogen, which was backed by Amazon’s Climate Pledge Fund and United Airlines’ Sustainable Flight Fund. UK energy company Octopus Energy invested $200m in Deep Green, a startup planning to reuse the waste energy emitted by data centres, while BP took part in the $182m fundraising round in November for Eavor, a startup reinventing geothermal heat generation.

Biggest investors

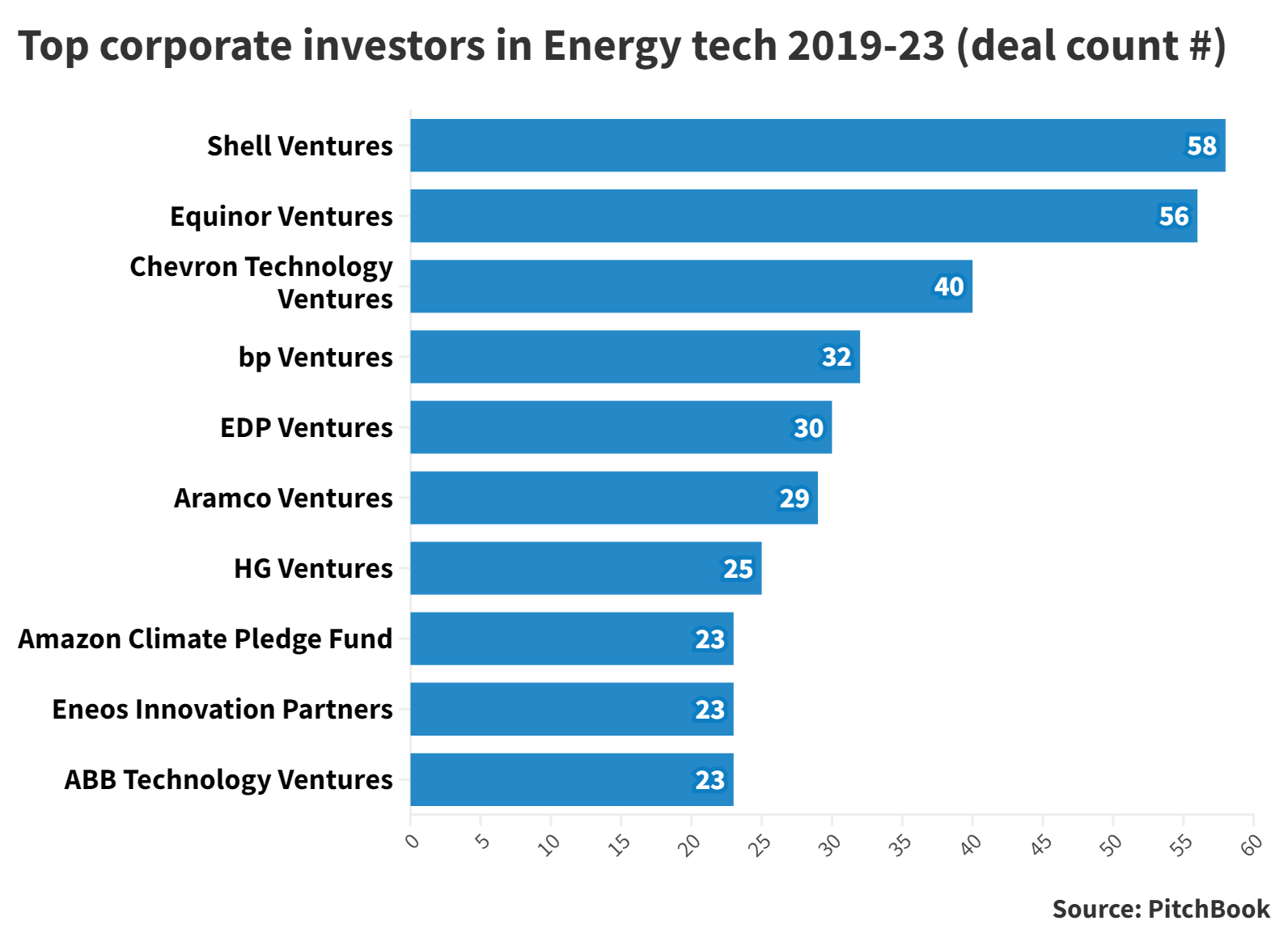

Anglo-Dutch energy company Shell has been the most prolific investor in energy startups over the past five years, backing 58 funding rounds in that time. Equinor and Chevron also lead the pack.

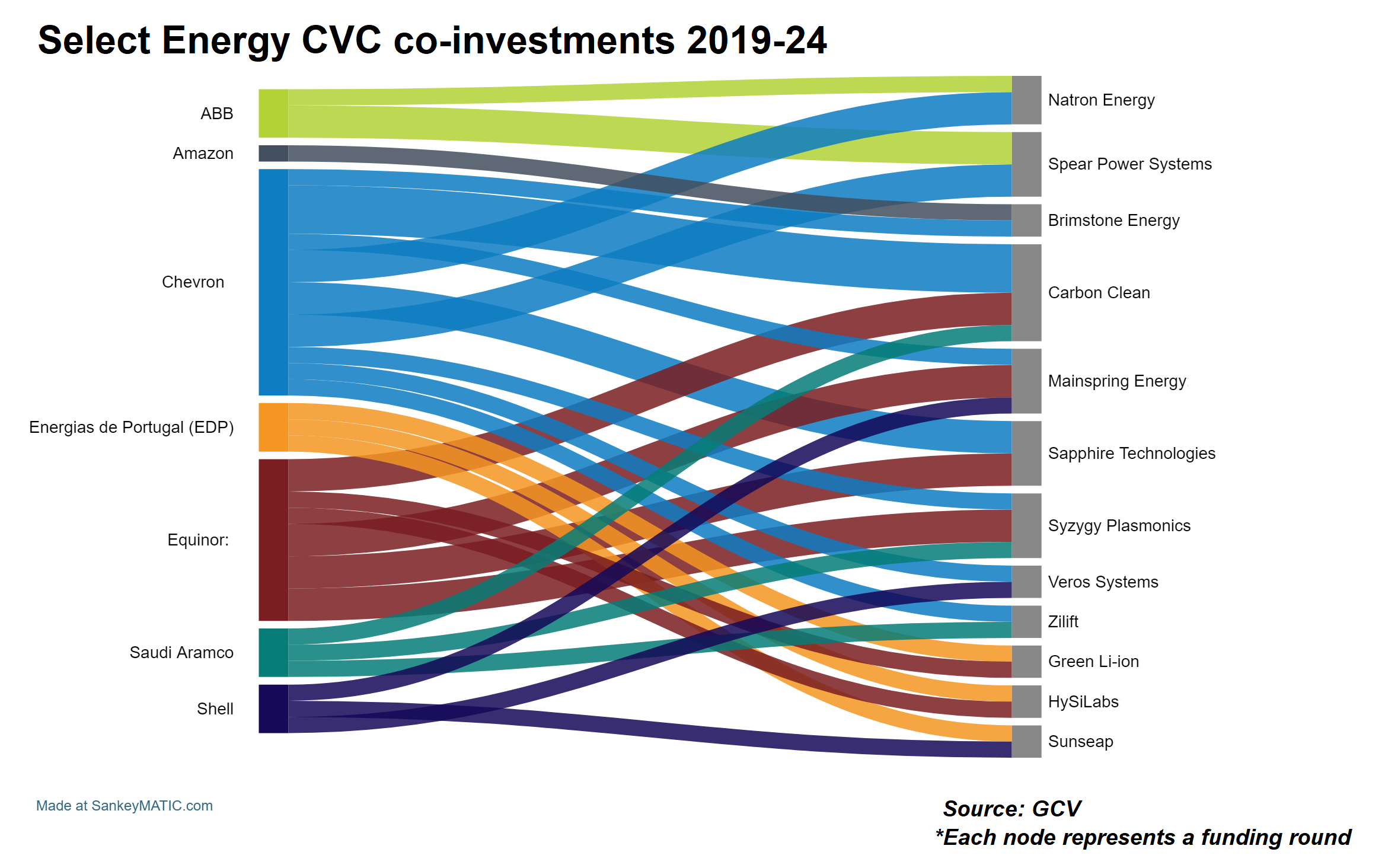

Many of the big energy companies tend to co-invest in energy startups. We have, for example, seen Chevron, Equinor and Saudi Aramco come together in backing Carbon Clean Solutions, a UK-based industrial carbon capture startup. Mainspring Energy, a US-based provider of generators for the clean energy transition, has also brought together Chevron, Shell and Equinor as investors.

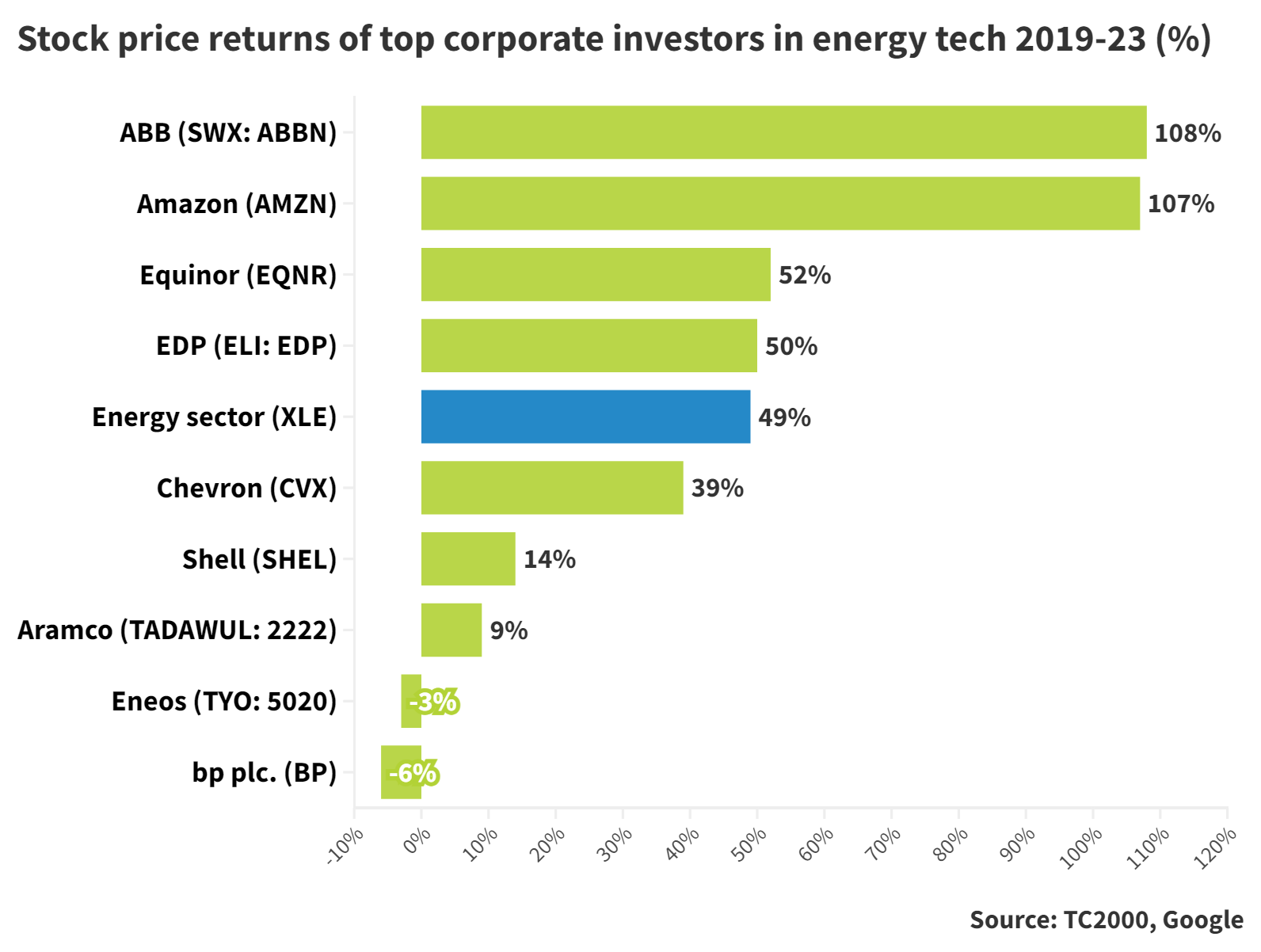

Stock market investors, however, are not necessarily rewarding efforts to invest in the future of energy. Energy company share price performance is more dictated by the price of oil and gas. Only Norway’s Equinor and Portuguese energy provider EDP have outperformed the energy sector average in stock price returns. BP, which saw its earnings halve in 2023 compared to 2022, is in negative territory on returns. Japanese oil refiner Eneos is also languishing, despite recently increasing its full-year profit forecasts.