Solar energy and grid storage saw some of the biggest funding rounds as falling prices put these clean energy options into the mainstream.

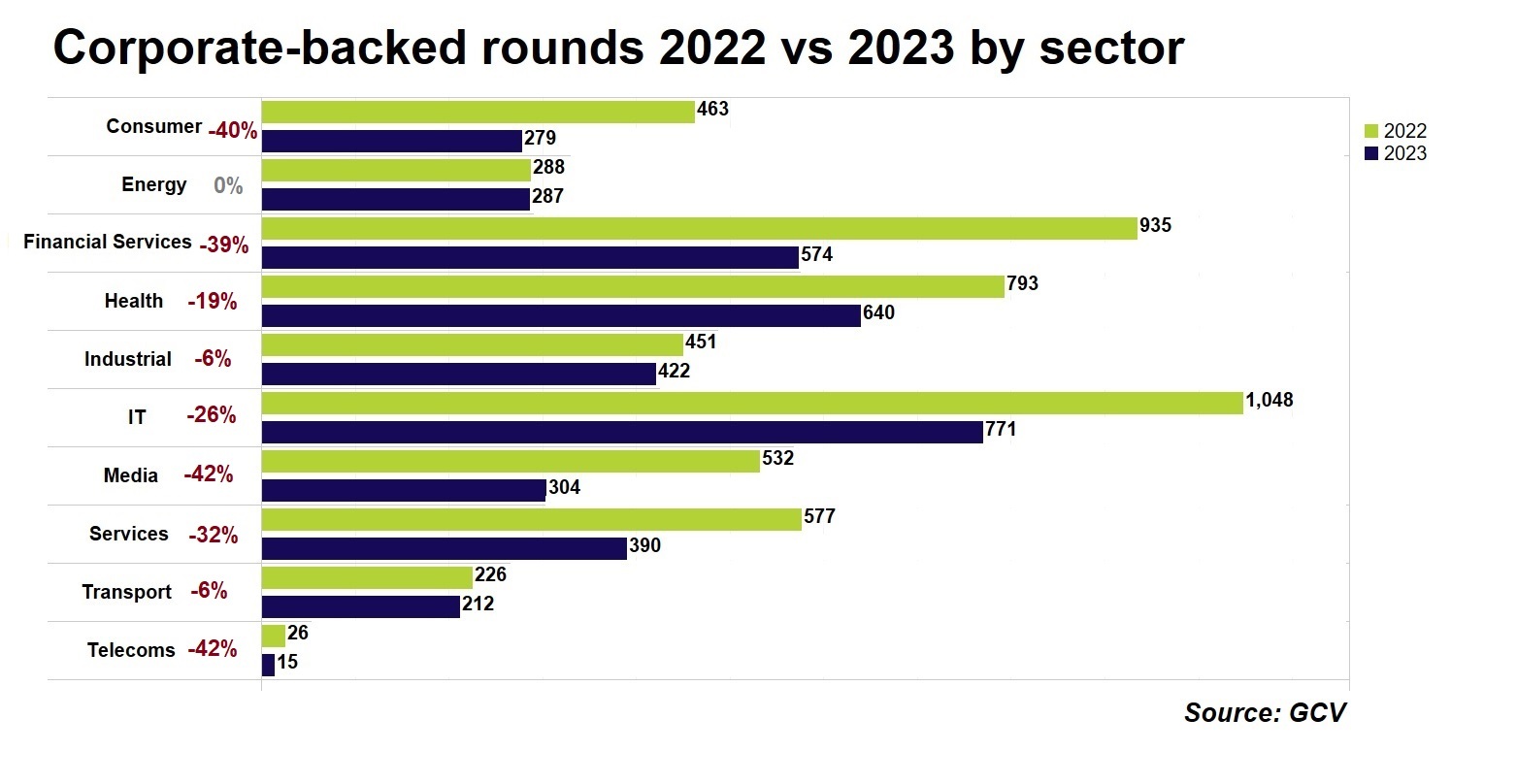

Corporate venture funding for startups fell significantly across every sector last year, as indicated in our recently released annual statistics — every sector apart from energy, that is. What has kept capital flowing to energy startups?

To a large extent it is down to the energy transition, with fossil fuels giving way to cleaner, more sustainable forms of power while infrastructure gets updated accordingly. This is high on the agenda for every energy company — even as the amount of oil and gas produced by the US last year reached record levels.

Energy transition is a vast space, however, and it is worth looking more granularly at what technologies have particularly driven spending.

Falling costs boost solar power project developers

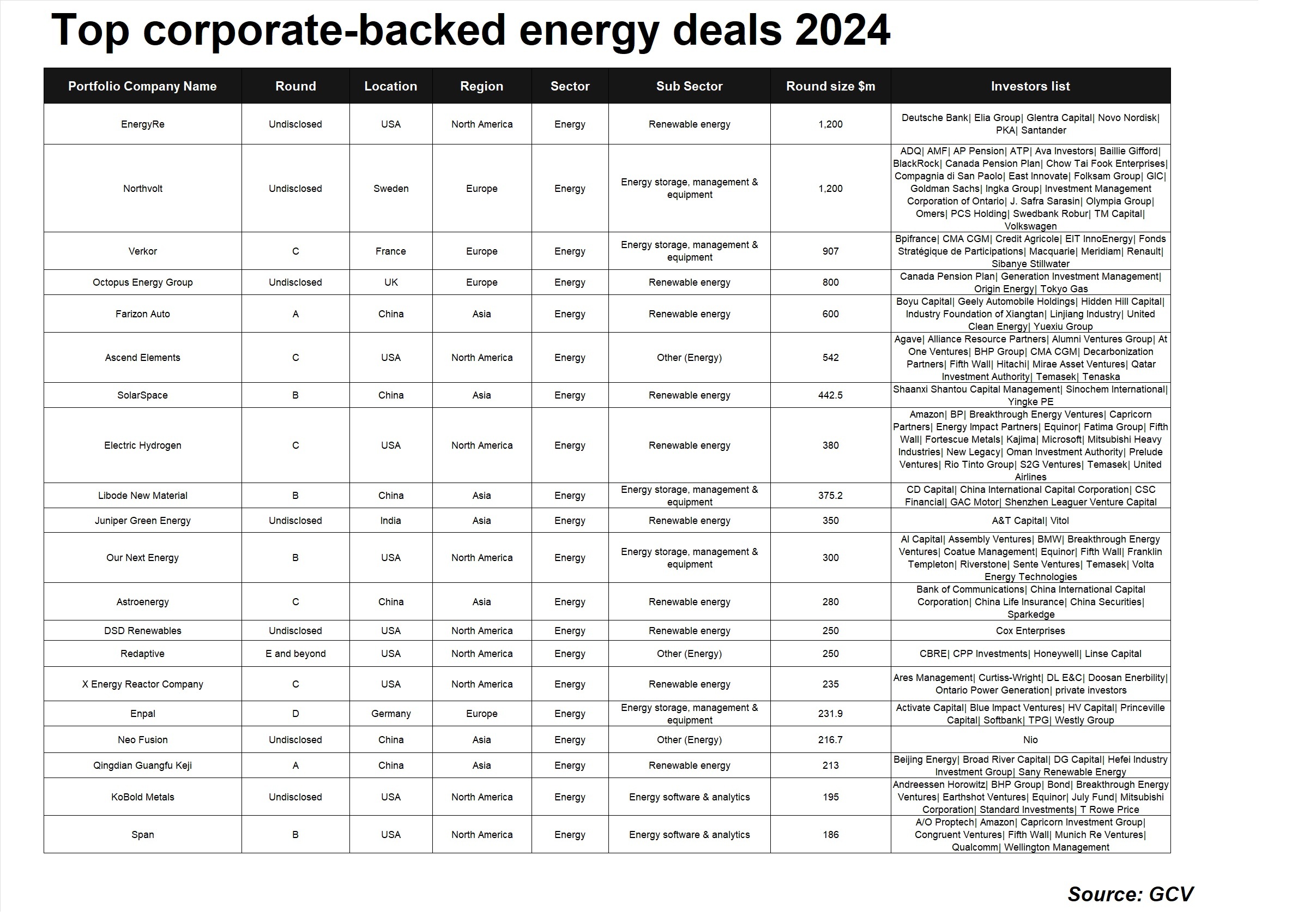

Renewable energy projects, particularly solar, made up some of the biggest energy deals last year. Corporate funding including VC, public market and debt financing jumped 42% to $34.3bn for solar energy last year, according to consulting firm Mercom Capital Group. EnergyRe, an independant US clean energy producer, headed the bunch, pulling in $1.2bn from investors including Novo Holdings to support a range of solar and wind projects.

Last year’s largest fundraisers also included India’s Juniper Green Energy, which raised $350m in September to put toward building a 4.3 GW portfolio of wind, solar and hybrid power projects, and DSD Renewables, a US renewable energy design and engineering company, which received $250m from Cox Enterprises as it looked to expand its solar and energy storage project across the US. Germany-based home solar system provider Enpal bagged $231m in a series D round alongside $461m in debt financing.

Cash didn’t just go to project developers, particularly in China, where solar cell producer SolarSpace pulled in over $440m in funding from investors including petrochemical group Sinochem and Sinopont, a developer of encapsulation films for solar panels, secured $145m in series D funding.

The cost of solar photovoltaic panels has fallen by two thirds over the last decade, according to International Renewable Energy Agency data, and the kilowatt-per-hour cost of solar energy is now below that of onshore wind. Combined with solar power’s relative flexibility — it can be installed on domestic rooftops as well as in grid-scale projects — these factors are making solar a key pillar for meeting the 2030 renewables targets set by China, the US and the European Union.

Green hydrogen emerges as a cleaner baseload option

At the same time, newer clean energy options are also coming through. Chief among those is hydrogen, and particularly green hydrogen – generated through clean electricity-powered electrolysis – which is advancing at a rapid rate.

Electric Hydrogen, developer of an electrolyser system that generates green hydrogen, became the sector’s first unicorn with a $380m series C round backed by Fortescue, United Airlines, Rio Tinto, Amazon, Microsoft and BP in October, as it prepared to begin installation of its first systems this year. Others like Advanced Ionics, Reverion and HySiLabs meanwhile chipped in with corporate-backed rounds at early stage.

One key advantage of hydrogen is its potential as a source of electricity, a more sustainable alternative for industrial processes like direct iron reduction, and as a transport fuel, chiefly for large-scale forms of transport like trains or commercial vehicles. More and more corporates that have traditionally leaned on fossil fuels are now actively exploring the area.

Corporate venture units keen to back the sector include BP Ventures, EDP Ventures, Jera Ventures and Syensqo Ventures (newly rebranded from Solvay Ventures).

Nuclear is moving towards its next phase

The other notable new energy form on the rise is nuclear technology, which has already been selectively well funded at the startup stage, Commonwealth Fusion and Helion Energy having each raised big money over the last two years. But the field is expanding as more new companies move toward unveiling prototypes.

X-energy led the way, completing a $235m series C round in December, three months after the US Department of Defense agreed to expand financing for a prototype model of what the company claims is the safest, most efficient and most advanced small modular reactor to be developed.

But the big breakthroughs are coming in nuclear fusion technology. In China, new energy carmaker Nio paid upwards of $200m for a 30% stake in Neo Fusion, which is looking to advance a version of the technology that can be controlled enough for commercial use. Japan’s Kyoto Fusioneering is meanwhile working on gyrotron technology that can be used for fusion plasma heating in fusion systems, and bagged $79m in a corporate-backed series C round.

The one thing most onlookers agree on is that fusion technology is a long way from being commercially viable – it was just over a year ago that scientists first demonstrated a fusion reaction that produced surplus energy – but things are moving. Microsoft signed a power purchase agreement with Helion last year, shortly after the US government finalised a regulatory framework for the technology. There’s certainly a need for fusion, which promises an efficient method of energy production alongside low carbon emissions, but it’s going to need patient investors.

Energy storage is becoming a huge-scale infrastructure bet

Energy storage is also becoming an ever larger part of the overall pie, especially in regard to electric vehicle batteries. More and more battery developers are picking up big money as economic realities make the need for vast-scale gigafactories more important.

Sweden-based Northvolt typifies this dynamic, having raised $1.2bn in August from backers including Volkswagen as it ramped up production at its Swedish gigafactory, Northvolt Ett (below). It added $5bn in project financing through a green loan last month that will go to expanding the plant and building a giga-scale recycling plant next door.

Verkor is also building a gigafactory that will produce battery cells, and it closed $906m in series C funding from investors including Renault alongside over $1.3bn in grants and debt financing the following month. Libode New Material meanwhile secured $375m in a round backed by another carmaker, GAC, as it looked to more than double its production capacity.

The trend can be seen across the battery sector’s biggest rounds, including a $300m BMW-backed series B for Our Next Energy, closed as it prepares to launch a gigafactory for its battery cells this year. Skeleton Technologies and CMBlu also completed nine-figure rounds expected to fund manufacturing capacity, and with several countries including the US offering generous subsidies related to green energy infrastructure, this trend can be expected to continue.

Software is making energy management smarter

Although generation and storage are the two largest elements of the energy technology industry, advances in software including artificial intelligence are continuing to help ensure that energy is used efficiently – both at large and small scale.

Kobold is the developer of a software-based system that uses artificial intelligence to predict which areas will be most likely to hold mineral deposits, cutting down the environmental impact of mining – including the mining used to find the metals used in batteries and solar panels – and it raised $195m from investors including Standard Industries, Equinor, BHP and Mitsubishi.

You could see these changes coming in more domestic settings too. Span closed a series B round backed by Qualcomm, Munich Re and Amazon at over $186m, in support of a home electrification system that can manage a range of electric systems, such as electric vehicles, heat pumps and induction stoves.

Verdigris and BluWave-ai were among the other smart energy management startups to pull in cash last year. With corporates hurtling toward their net-zero targets at the same time as governments, funding new and cleaner forms of energy is becoming more of a priority. But advances in AI and other software technologies will also be needed to organise it all.