GCV has looked through our data to find the busiest investors in corporate venture capital. Here's how and where they invested in 2024.

The landscape of corporate venture capital keeps evolving, with the telecoms companies and chipmakers of the 90’s giving way to the internet boom of the following decade and ultimately the Web3 operators of recent years.

In 2024 it was investors focused on AI — such as Alphabet’s many venture funds, as well as Microsoft and Nvidia — that were the most prolific backers of startups. Web3 investors, particularly OKX Ventures, are also still very active, while Aramco Ventures, the investment arm of the Saudi oil company, is increasingly becoming a force in the startup ecosystem.

Here are the ten leading investors of the year:

1. Alphabet

GV, the corporate venture unit formerly known as Google Ventures, led the way again for Alphabet, displaying one of the most diverse investment strategies in VC, one that ran from small seed rounds for startups like Vocode and Sync Labs all the way to a $700m round for food delivery service Wonder. Notable funding deals backing large rounds for early-stage AI (Metsera, Tessl), legal software (Harvey, Lawhive), supply chain tech (Climate X, Scope3, Verse) and customer service software (UJet, Infinitus) alongside a raft of healthcare deals. Not to mention outliers like geothermal heating provider Dandelion Energy and sports XR startup StatusPro.

Alphabet’s AI venture fund, Gradient, dialled its investment rate back a little in 2024, but still proved itself one of the most active CVC units worldwide. And while most of its deals came at its sweet spot of seed and series A, Gradient isn’t afraid of follow-ons. It contributed to a $320m series C round for AI cloud services provider Lambda and a $200m round for enterprise generative AI platform Writer – both established portfolio companies.

CapitalG, the corporate’s growth equity arm, also doubled down on AI during its first full year under managing director Laela Sturdy, taking part in a series of large-scale rounds for the likes of unified data management platform Cribl, legal software producer Clio, AI coding startup Magic and AlphaSense, which is working on AI-based decision-making software.

But all of those paled next to Alphabet’s biggest move: leading a gargantuan $5.6bn series C round for autonomous taxi service Waymo that valued it at $45bn.

2. Animoca Brands

The blockchain, gaming and NFT group continued to be among the most active corporate investors this year, especially at seed and series A stage, with corporate venture subsidiary Animoca Ventures in particular becoming an increasingly visible presence. The company backed more than 50 rounds at seed stage or earlier alone in 2024.

That doesn’t mean Animoca was unafraid of the larger rounds. Its Animoca Ventures unit contributed to a $225m series A round for Monad, which is working on a faster version of the Ethereum blockchain, in early April. The company was also part of a $40m seed round for 0G Labs, developer of a decentralised operating system for artificial intelligence, in November.

With the election of Donald Trump in the US, expect to see Web3 investors like Animoca near the top of this list again next year. CEO Yat Siu said earlier this month he expects NFTs to become a force again and to perform better than they did at the market’s peak in 2021.

3. OKX

Cryptocurrencies had a big year on the back of a Bitcoin halving and the election of a US president that is openly bullish about the sector. Some of the largest corporates in the industry are still among the most active venture investors. Crypto exchange OKX beat peers like Binance and Coinbase, topping a hundred deals for the year, primarily through corporate venture arm OKX Ventures.

OKX stands out not only in its volume but also its focus: the majority of its investments were at seed or pre-seed stage, and none were later than series A. The largest deal it backed was the $40m seed round closed last month by 0G Labs, which is working on a decentralised AI operating system.

The unit doesn’t seem to be in danger of slowing down either. Jeff Ren, head of OKX Ventures, told GCV last month: “Based on the number of users and transaction volume, don’t think we haven’t seen a retreat. Every government is progressing with the regulation for crypto. Crypto is here to stay.”

4. Samsung

Electronics producer Samsung had another strong year, balancing three active venture units, the busiest of which was early-stage tech fund Samsung Next. While several investors targeted the core part of artificial intelligence, Samsung Next went for the startups applying AI to areas like health (Centaur Labs, Nym), robotics (Standard Bots, Aidin Robotics) and generative AI integration (Opus Clip, Sahara, Leonardo AI). It was also among the most active Web3 investors outside companies already in the industry.

Samsung Ventures made the occasional seed investment but made its presence felt more fully at later stage, backing huge series B rounds for generative AI software startup Mistral ($499m) and smart humanoid robot developer Figure ($675m). More esoteric bets included magnet manufacturing technology provider Niron Magnetics and Liquid Wind, which is working on systems that will convert wind energy to liquid fuel.

Deeptech and data-focused unit Samsung Catalyst Fund invested less often but was part of nine-figure rounds for the likes of AI networking chip developer Enfabrica and optical interconnect technology producer Celestial. The rest of the investments came from Samsung itself, the pick being a $277m series D round for advanced biological tool provider Element Biosciences in June.

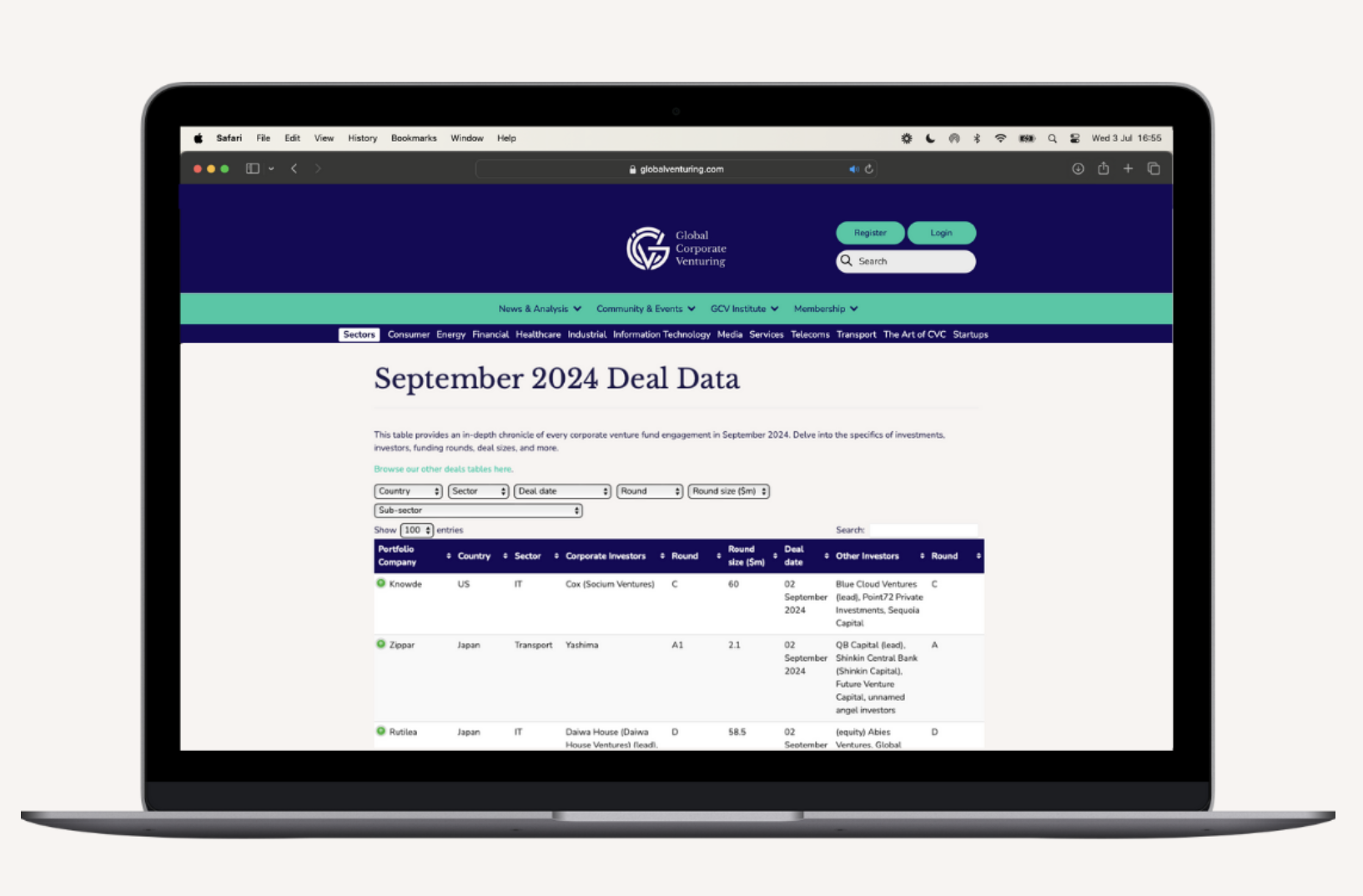

GCV subscribers can see all the corporate-backed startup funding rounds going back to January 2023 here.

5. SoftBank

SoftBank isn’t quite the corporate VC force it was in the past, having divested its SoftBank Ventures Asia unit last year, while its Chinese venture arm also seems to have gone quiet. But CEO Masayoshi Son’s recent pledge to invest $100bn in the US over the next four years was a signal that it’s still among the big names.

The company’s largest bets this year were on AI and healthcare, headlined by a $1.5bn contribution to the $6.6bn round OpenAI closed in October. It joined Nvidia and Microsoft in autonomous driving software producer Wayve’s $1bn series C in May and SoftBank Vision Fund backed a $650m round for market intelligence platform AlphaSense as well as cancer drug developer ArsenalBio’s $325m series C and two $200m+ rounds for obesity treatment startup Metsera.

SoftBank Latin America Ventures meanwhile may not be one of the region’s busiest investors but it is one of the few that’s unafraid to go big, taking part in several nine-figure rounds. Much of the Japan-based corporate’s earlier-stage activity came through its domestic AI fund, Deepcore, which targeted startups applying the technology to areas like supply chain risk (Resilire), farming (HarvestX) and medicine (Revolka).

6. Nvidia

It was a big year for Nvidia, culminating in the graphics chip developer briefly becoming the world’s most valuable company last month on the back of its chips being used in generative artificial intelligence.

The company also expanded its focus on artificial intelligence into adjacent areas like energy (data centre and energy startup Crusoe), gaming (Astrocade) and farming (Carbon Robotics). But the largest adjacent sector was healthcare, where Nvidia and its NVentures unit invested in a range of startups applying AI to drug discovery and development. Sid Siddeek, head of NVentures, told GCV in May that the length of the development process made it a natural fit for the computing power of AI.

Nvidia was among the most deep pocketed investors too, participating in more than 20 nine-figure rounds including the $6.6bn raised by OpenAI, as well as billion-dollar rounds for Wayve and AI application development platform Scale AI.

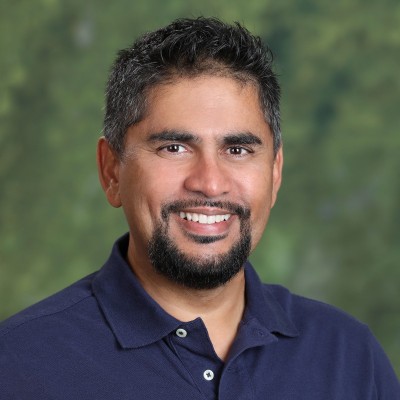

7. Citi

Arvind Purushotham, head of Citi Ventures, told GCV in March that the bank’s CVC arm was looking to capitalise on a predicted $84 trillion transfer of wealth between generations over the coming years, and it accordingly upped its investment rate this year.

A lot of that activity came in the series B and C range, where it backed big rounds for generative AI platforms Poolside and Writer, and slightly smaller rounds for more traditional targets such as asset-backed lending platform Setpoint, asset risk management service Sepio and payment processor Finix. Other areas of interest included cybersecurity (Sublime Security, Island, Traceable) and loyalty schemes (Wildfire Systems, Point.me).

Citi’s $500m Impact Fund had a quieter year but took part in rounds for employer-focused primary care provider Vitable and medical treatment management platform TailorMed, bumping its portfolio up to nearly 50.

8. Saudi Aramco

The oil and gas producer began the year by pledging a further $4bn for CVC subsidiary Aramco Ventures, bringing its overall funds under management to $7bn. The unit had a quieter year in 2024 however, but backed several carbon capture startups, its largest round being an $80m series A for CarbonCapture, which was joined in the portfolio by peers Parallel Carbon and Captura. Other bets included ecosystem restoration platform Dendra Systems and GraphEnergyTech, a creator of graphene solar cell technology.

Wa’ed Ventures, the unit set up by Aramco to boost the local entrepreneurial ecosystem, reserved $100m of its $500m fund for artificial intelligence startups, in October. It was a formal recognition of the direction Wa’ed was already going in, having funded Tenderd, a provider of heavy equipment analytics software, as well as AI accelerator developer Rebellions and AI development platform aiXplain earlier in the year.

The largest investments tended to be made by Prosperity7 Ventures, the diversified venture subsidiary that had its budget tripled to $3bn in January. The fund was part of a $400m round in May valuing Chinese generative AI software developer Zhipu at $3bn, having contributed to a $106m series A for open-source AI technology provider Together AI two months before. It also led rounds for radiotherapeutics developer Full-Life Technologies and supply chain security startup Lineaje.

9. Microsoft

Microsoft has been among the deepest pocketed CVC investors of recent years, a trend that has accelerated with the artificial intelligence boom. The corporate provided $1.5bn for Abu Dhabi-based AI technology holding company G42 in April and was one of several corporates in autonomous driving tech provider Wayve’s $1bn series C round the following month. It then returned for long-term portfolio company OpenAI’s $6.6bn round in October, the largest corporate-backed funding round of 2024.

As in the past, the company was most active through corporate venture arm M12. The unit had typically invested $150m to $250m per year but Microsoft increased its annual budget to $275m for 2024 and it was again one of the busiest IT investors between series A and C stage. A lot of that went into AI in different forms, and new M12 portfolio companies this year included voice-controlled game developer Volley and Allstacks, creator of a software engineering intelligence platform.

Of course, one of the largest issues with AI is the way it gobbles up natural resources, and Microsoft’s Climate Innovation Fund racked up investments in carbon capture and/or storage startups Twelve, Applied Carbon and Terradot, as well as nine-figure rounds for sustainable aviation fuel developer LanzaJet and energy-efficient steel producer H2 Green Steel. The $1bn vehicle also backed the $250m third fund raised by Farmland LP, billed as the largest fund manager in the US concentrating on organic regenerative farmland.

10. Eli Lilly

Eli Lilly was the most active of the pharmaceutical corporate VC investors this year, and one of its earliest deals was also one of its largest. The firm’s Lilly Ventures unit was one of the investors that helped BioAge Labs close a $170m series D round in February as it looked to advance an obesity drug expected to be used in combination with Lilly’s diabetes and weight loss drug, Zepbound.

The firm cast a wide net over the course of the year, either directly or through Lilly Ventures Asia, exploring genetic disorders (ProQR Therapeutics), radiopharmaceuticals (Aktis Oncology, Ionetix), degenerative and neurodegenerative diseases (XellSmart, Augustine Therapeutics) and metabolic disorders (OrsoBio).

Lilly wasn’t only funding pharmaceutical startups. It invested in molecular diagnostics technology developer Sunbird Bio in October and was part of a $10m series A for RetiSpec, which has developed an eye scanner to detect Alzheimer’s, and a $4m seed round last month for Revisto, creator of an AI software platform that streamlines the review process for pharmaceutical marketing materials.