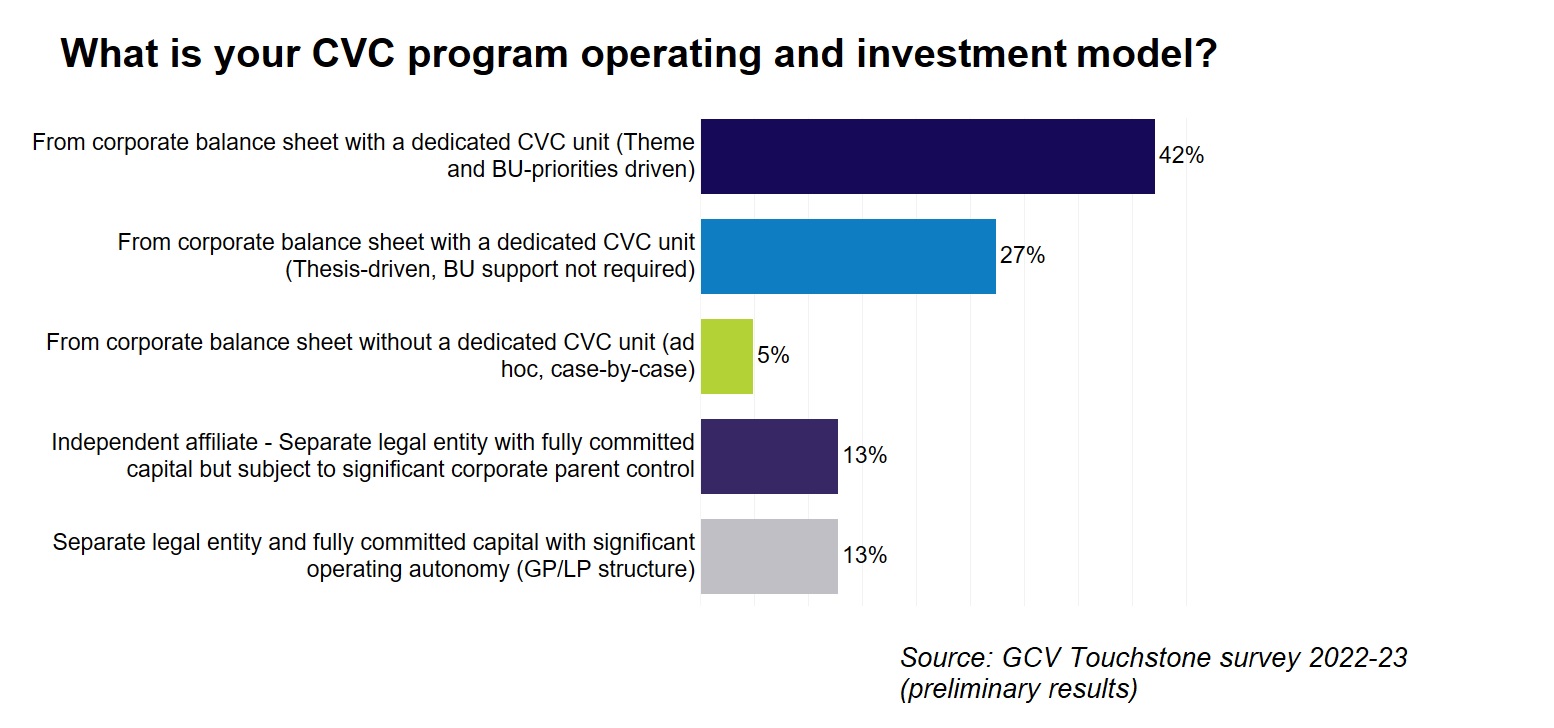

Most corporate investors (74%) employ capital directly from the balance sheet of their corporate mothership but there are many variations.

What is the ideal operating structure for a corporate investment unit? How closely should it be tied to the corporate parent? There is often an idea that the more autonomy a unit has the better, and in a ecent article we highlighted the reasons that more corporate investment funds are moving toward more independent legal structures — either fully independent GP/LP or hybrid models.

However, the vast majority continue to invest off the corporate balance sheet, something that was confirmed in the preliminary findings from our annual GCV Touchstone survey. Some 74% of corporate investor respondents told us they invest off the balance sheet in some way.

But investing off the balance sheet takes many different forms and one size does not fit all. Bell Mason Group | GCV Institute research identifies a range of balance sheet investing models which reflect different funding approaches, innovation goals, team makeup, governance, and performance expectations.

Balance sheet investment capital may be ad hoc, via annual allocations or via multi-year ‘fund’ commitments, though the majority invest through dedicated CVC teams.

The biggest differences among balance sheet models come in innovation and performance goals and associated levels of operating autonomy.

To build support and credibility, many CVCs may start with nearer-term performance or impact goals, driven by the priorities of corporate business units. They often invest deal-by-deal within broad investment themes and require business units’ sponsorship for approval. They tend to operate with low expectations of financial returns — a ‘don’t lose money’ mandate.

Teams that earn permission to invest further beyond the scope of the established business can develop and execute on investment theses/insights related to emerging trends, technologies/platforms, business models and ecosystems that may impact the future of the parent or broader sector. In many cases, these highly experienced investment teams may be granted a level of decision-making autonomy and compensation that rivals that of more independent peers. However, this comes with an expectation that portfolio financial returns should more than cover the full cost of the strategic investment program.

With the full GCV Touchstone annual survey and benchmarking platform we can now take a deeper dive into CVC operating model characteristics and implications by filtering aggregate operating and performance data across program maturity phases, industries, regions.

Please complete the full survey to get a copy of the summary aggregate report, and be entered into our prize draw to win tickets to GCV conferences or credits for filtered data reports or Institute courses.