The number of startup funding rounds backed by corporate investors dropped 43% year-on-year in February. Deal value was down by two-thirds.

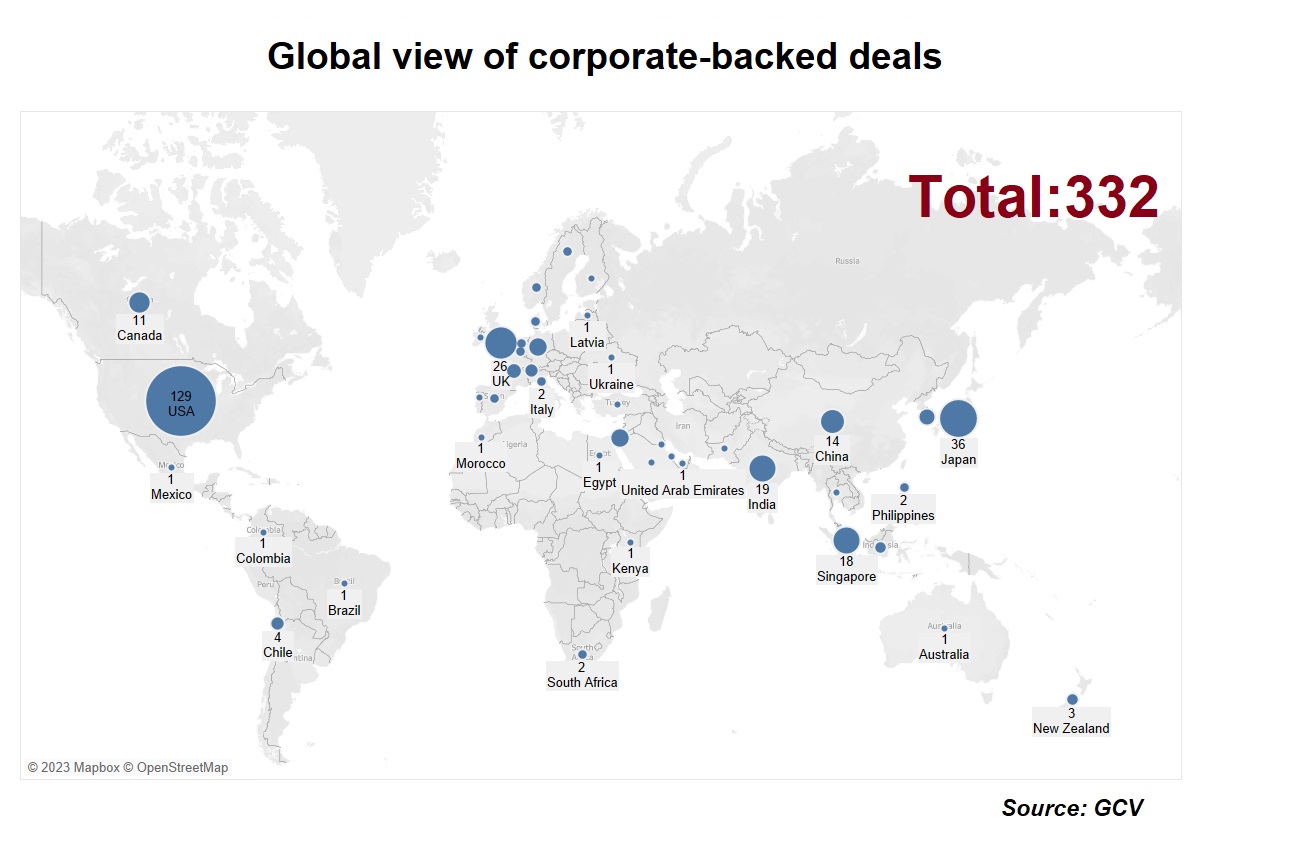

Only 332 startup funding rounds received backing from corporate investors in February, down 43% from the 582 rounds registered in the same month of 2022. Investment value stood at $8.59bn in total estimated capital –about a third of the $24.6bn of the same period last year.

The February numbers represented a 10% drop in deal numbers and…