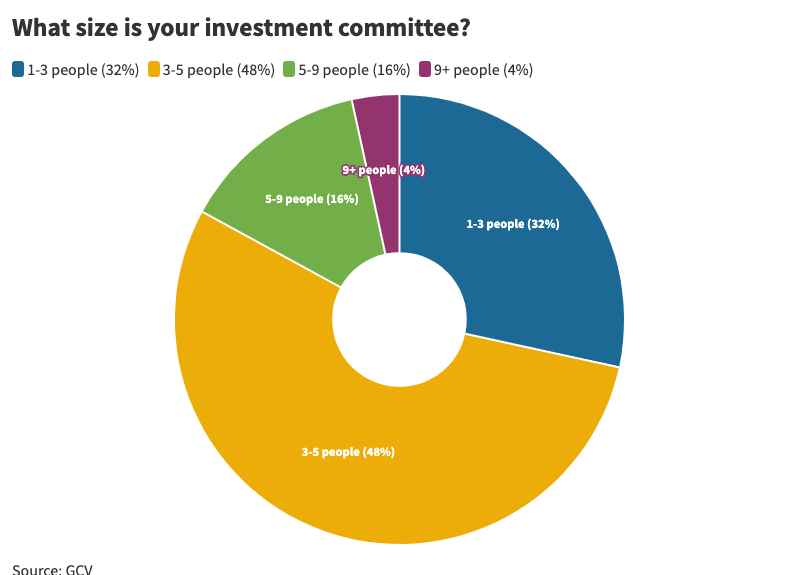

Keeping the investment committee small and lean appears to be the norm and c-suite executives are usually included.

Corporations tend to keep the committee that greenlights potential venture investments pretty small and lean. Having five people or fewer on the committee is the norm, with 80% of the companies we polled opting for this. In fact, around a third of companies went even smaller, with three or fewer members on the investment committee.

A small team can help make the decision process much faster. Having more than nine people on the committee is rare, with only 4% of respondents having a team this size. We’d love to know from those with the jumbo-sized committees — how do you ever get anything done?

What was also interesting was asking companies about the composition of the team — was it C-suite, investment team, heads of business unit, technical experts or outsiders who took up the seats?

In our recent webinar on CVC advice , Lisa Suennen, former head of GE Ventures’s healthcare fund, told us that it was important to have an investment committee full of allies, and that it was useful to include an outside committee member. An outsider can help “moderate the discussion” by taking a pragmatic approach to investment decisions.

We didn’t have enough answers for this part of the investment committee question to draw definite conclusions about norms. But from what we could see, it was very common to include the C-suite in the committee. There were only a handful of respondents that did not do this.

Of course, the C-suite could mean any number of roles, from the chief executive to the chief strategy officer. We may have to go back to dig deeper on this question.

This poll question is taken from our much broader annual survey of the corporate venturing industry. We’re looking for as many corporate investment units as possible to complete the full survey — it is important for the whole industry to get a really good sense of what the norms and benchmarks are.

Those who complete the survey will get a copy of the resulting report, and will also be entered into our prize draw to win tickets to our annual conference or credits for our professional training and bespoke research.

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).