The functional food sector is a multi-billion global market with high single-digit expected growth rates.

The term functional food can be difficult define. Broadly speaking, it refers to any food and beverage

items that claim to contain additives beneficial to people’s health. This can be done by adding new

ingredients or increasing already existing ones.

Most food items claim to have some benefit for human health, so there is an inherent problem in

defining the market and its size. Estimates differ notably.

The Market Data Forecast report puts the global market size at $177bn as of 2022, with expectations

that it will grow to $276bn by the end of 2028. This implies a compound annual growth rate (CAGR)

of 6.7% between 2023 and 2028.

Grand View Research has a higher estimate, putting world market for functional food at $281bn in

2021 with expectations of it expanding by a CAGR of 8.5% through to 2030. The rising demand for

nutritional and fortifying food additives is expected to propel market growth over the forecast

period.

Precedence Research ups the ante even higher by valuing the global functional food market at

$305bn as of 2022 and forecasting it to reach around $597bn by 2032, implying a CAGR of 6.93%.

Clearly, measuring methodologies and definitions of what constitutes functional food vary greatly

among analysts. What they all seem to agree on, however, is that the functional food market is a

multibillion global market with healthy high single-digit expected growth rates.

We tried to narrow the working definition of “functional food” as much as possible when looking at

VC deals in that space. We have excluded cannabis and CBD-related products from this analysis as

this is a separate market in its own right, and, being much bigger than the rest of the still nascent

functional edibles area, would overshadow and obscure our analysis of it.

When looking at deal numbers and values, we have focused here mainly on drinks, sweets and gums.

As this is a very new area, the number of relevant deals we have found on PitchBook’s database has

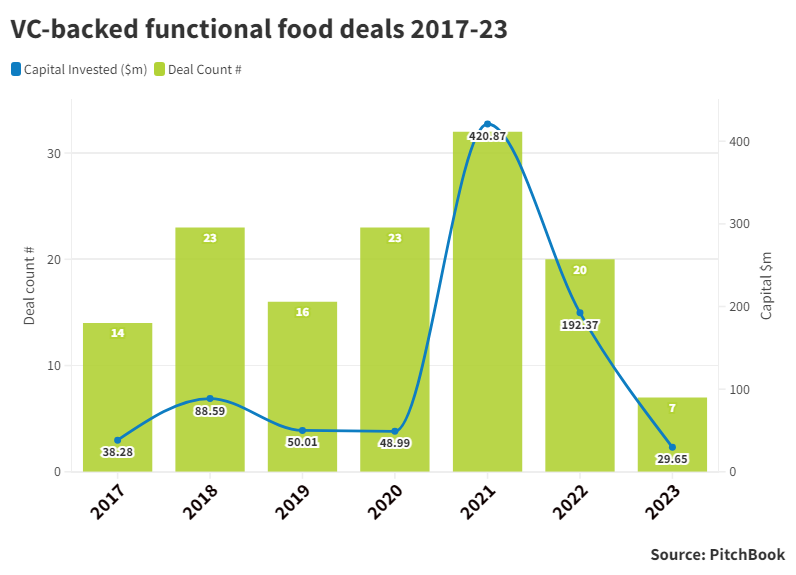

been relatively modest. We counted 134 deals since 2017, with a peak in 2021. Total estimated dollar

value of such deals — like deals in many sectors — similarly peaked in 2021 and have declined since.

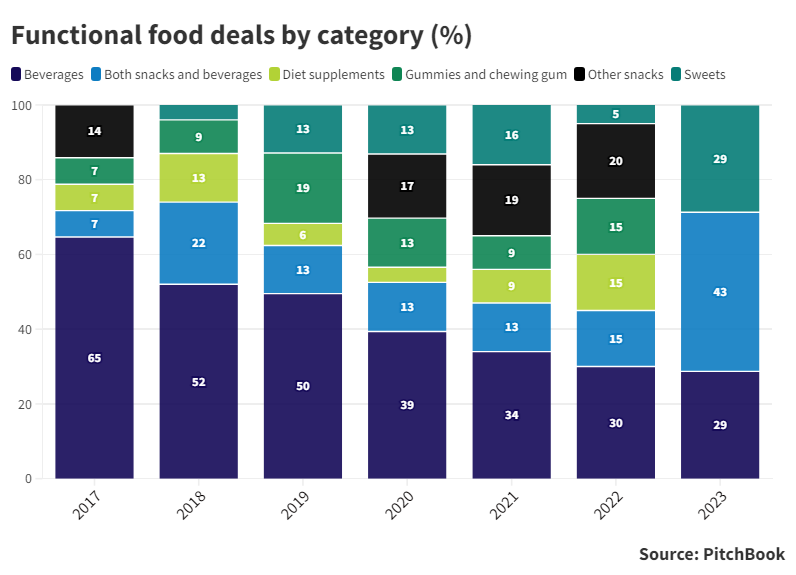

The majority of functional food VC deals have been in beverages, though their relative share has

been declining since 2017 and giving way to startups developing diet supplements, sweets and other

snacks.

Functional drinks startups raised some of the largest funding rounds, like the $68m series B round by

water-based beverages producer Waterdrop. Waterdrop makes cubes of concentrated fruit and plant

extracts that can be added to water, and it has received backing from Germany-based venture firm

Simon Capital alongside tennis player Novak Đoković and Singapore ́s sovereign wealth fund

Temasek.

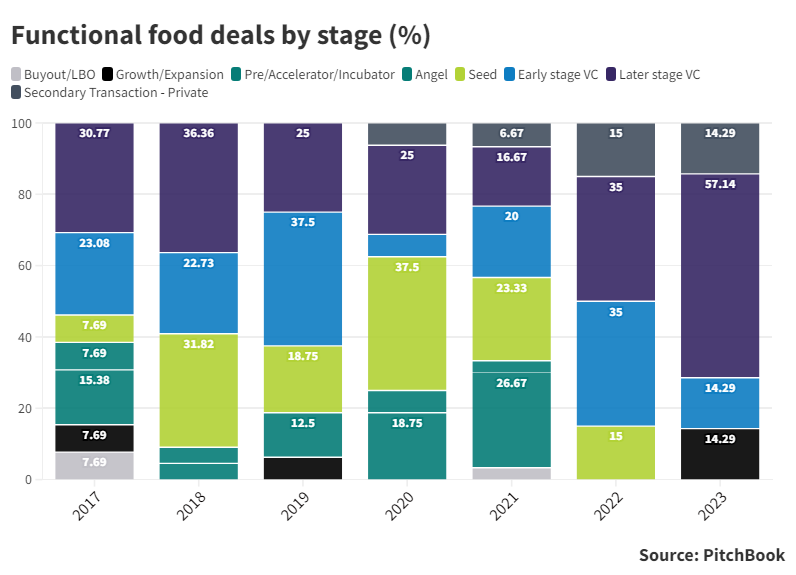

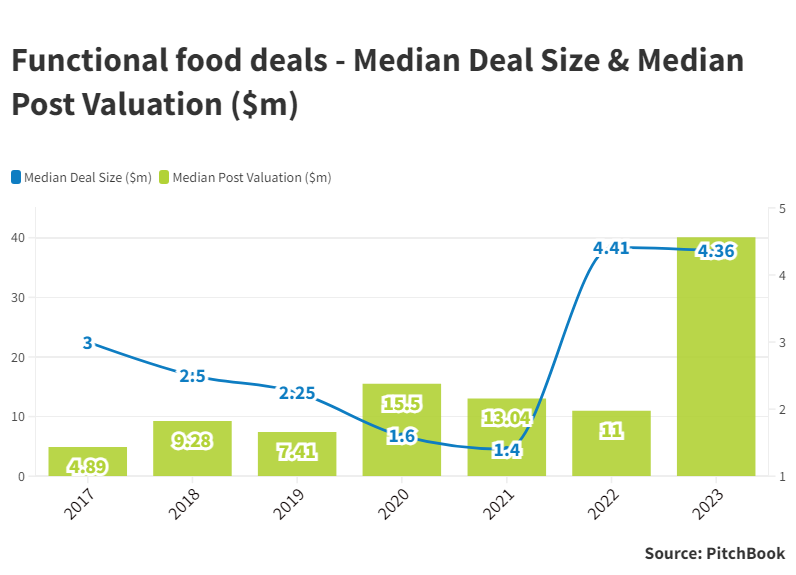

Given functional foods is a fairly nascent market, most of the startup funding deals we have seen are

for early-stage rounds, although we have seen some trending towards later-stage deals this year and

last year. Median deal sizes and median valuations in this area are also low with some spikes notably

this year. However, given the very small sample size, these should be treated with some caution.

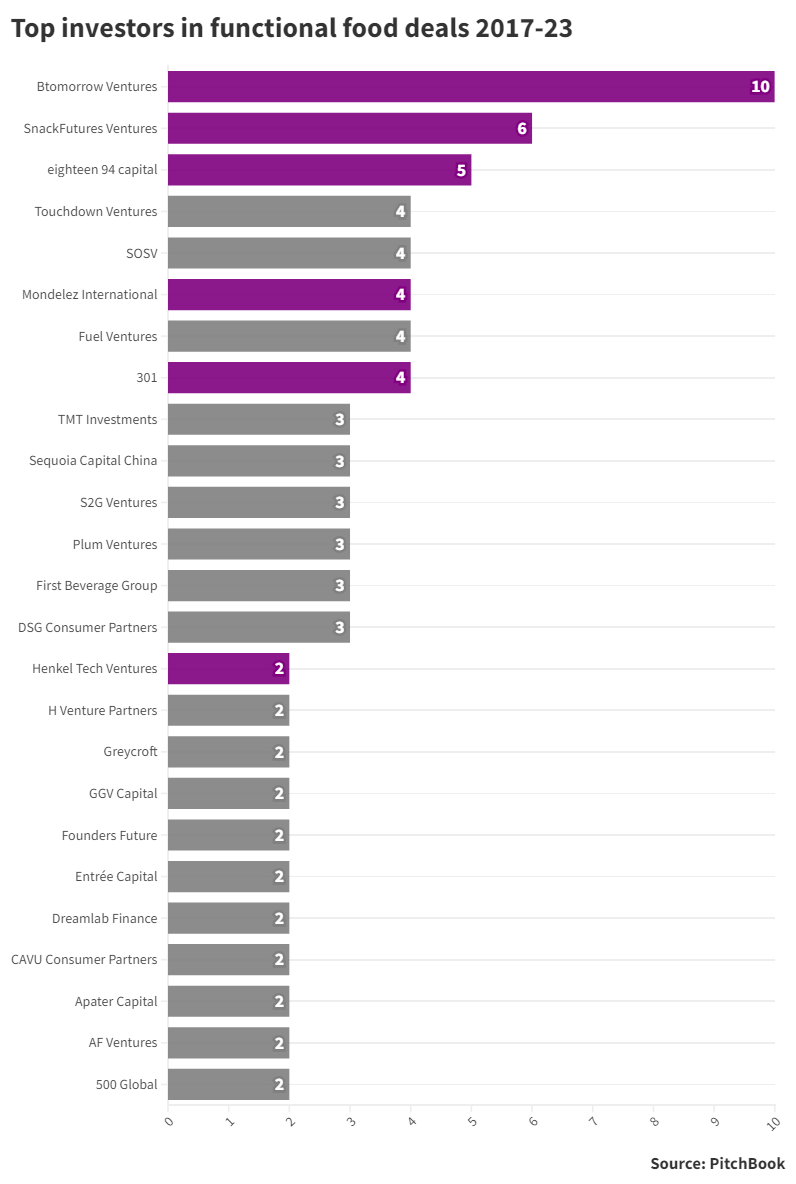

Btomorrow Ventures, the corporate venturing arm of BAT, has been the top investor in our narrowly

defined functional food category along with other corporate peers like SnackFutures Ventures –

venturing arm of food producer Mondelez, and eighteen 94 Capital, the venturing unit of cereal

maker Kellogg, among others.

Other CVCs were relatively less active in this space but often invested in the same startups. Henkel

Tech Ventures and ADM Ventures, for example, co-invested in $11m series A round raised by

Nourished. Nourished is the developer of patented 3D technology to create personalised vitamin-

induced gummies.

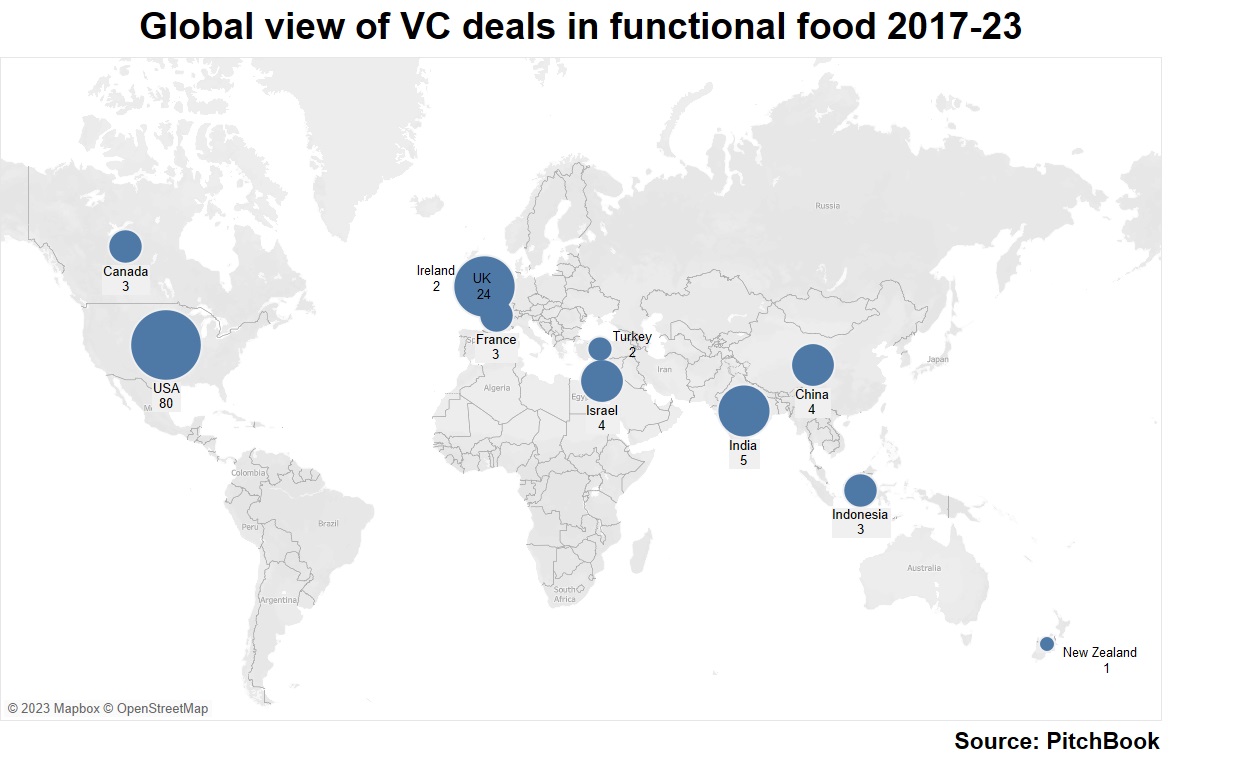

Geographically, most of the VC-backed functional food deals have taken place in the US and the UK.

Fear, perception and consumer behaviour

Consumer perception plays a big role in the demand for functional foods. Consumer attitudes,

subjective norms, perceived behavioural control and health consciousness contributed significantly

to purchase intention towards dietary supplements, according to a recent study.

Heightened concerns about health, caused by the Covid-19 pandemic, may be contributing to

growing interest in functional food. There were several documented cases of panic buying of dietary

supplements during the pandemic.

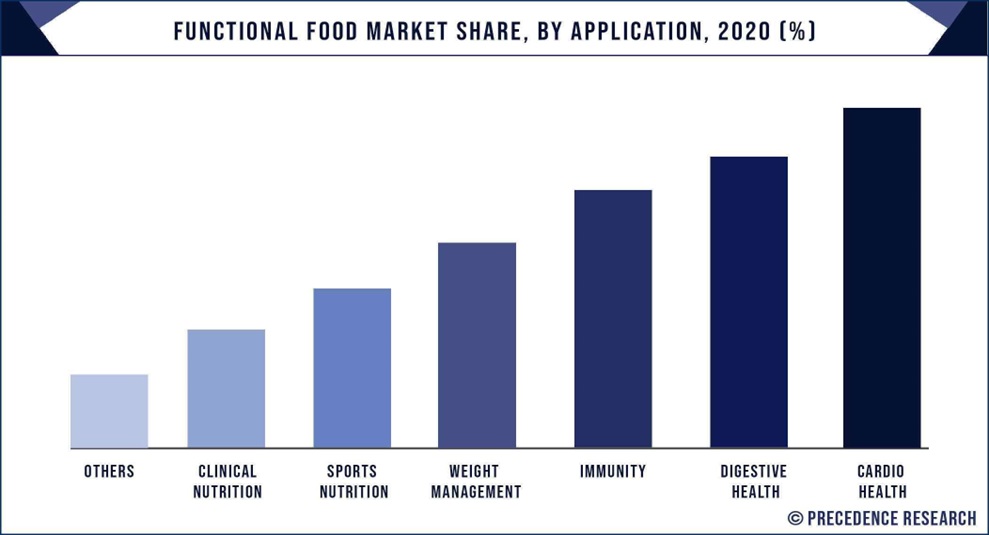

This behaviour translates across to functional food, say experts from Precedence Research. The

primary motivations for people buying function foods, according to the report, are cardio and digestive health, improving immunity and weight management. Their estimated relative market

shares surpass significantly other uses like sport and clinical nutrition.

Demand side

Increased consumer awareness of health benefits and hectic lifestyles are the major driving force

behind the demand for nutrient-rich food in the US and across the globe. The Grand View Research

report notes that this has to do in part with ageing populations in developed markets that are

striving to maintaining good health and avoid rising medical costs. It is the growing interest in the

connection between well-being and healthier eating that is fuelling demand for functional foods.

However, the trend is by no means limited to developed economies only. The Asia-Pacific region was

pointed as the largest market for functional food in the year 2022 by the Precedence Research. The

market growth of functional food in the region has been enabled by rising disposable incomes,

alongside a burgeoning population ever so concerned with fitness and health, while consuming a

higher proportion of processed food.

The functional foods market is growing also due to increased research and development for new,

healthy food and drink options. Consumer goods companies today are developing nutrition bars and

various functional snacks (chocolates, candies, chewings gums etc.) to cater not only to fitness

enthusiasts but also to a broader consumer base increasingly looking for convenient nutrition. This

explains the growing global demand for functional meals.

Supply side

On the supply side, developments in food technology are making functional foods easier to produce.

Functional food manufacturers make use of technologies such as vacuum impregnation,

encapsulation (especially in probiotics) and edible coating.

Other more common nutritional additives used by the food industry include fibres, omega-3 fatty

acids, vitamins, minerals, etc.

The Coca-Cola Company’s Vitaminwater, for example, introduced two new soft drink options in 2021:

‘Look,’ with blueberry hibiscus flavour, and ‘Gutsy,’ with watermelon and peach flavours, enriched

with vitamins.

Yoghurt producer Danone, which has been making gut-friendly drinkable Activia yoghurts for some

time, introduced a new version last year, with added zinc as well as vitamins C, D, and E to boost

immune system health.

The fact that established brands are repositioning their products in this way is a sign of growing

influence that the functional food idea is having on the industry.

Taste hurdle

By far the most significant commercialisation hurdle for any functional food items is taste. Functional

ingredients don’t always inherently taste so good, so flavouring is a key to the sales success of

functional food, notes Nutritional Outlook magazine.

Consumers strongly associate certain flavours like citrus, ginger, lavender, and mint with well-being,

says Brittany Lisanti, a project manager at International Flavors and Fragrances (IFF), cited by

Nutritional Outlook. What is more, flavours appear to be also moving to more natural profiles, with

non-GMO, organic and sustainability certifications.

The same is true for colourants (also known as colour additives). About a third of consumers dislike

foods and drinks with new and experimental colours because such colours are perceived as

unnatural, found a survey by FMCG Gurus.

Products and ingredient insights

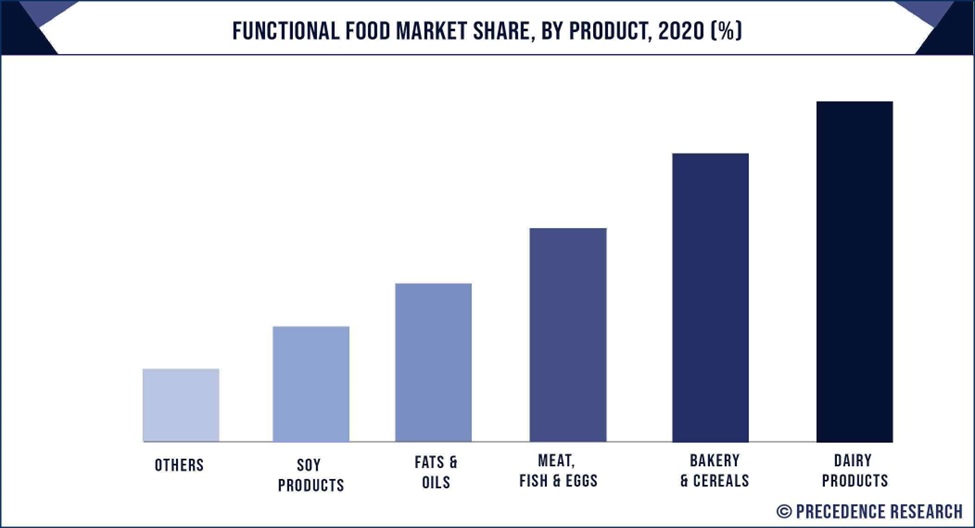

Dairy products dominated the global functional food market in 2022, when it comes to revenues,

followed by bakery and cereals, according to Precedence Research. The bakery and cereals segment

was projected to grow at a CAGR of nearly 8%, driven by demand for fortified snacks and cereal bars,

such as nutrition, energy and protein bars.

Today, the most common functional ingredients in foods are omega-3 in fish oils, probiotics in

yogurts and dietary fibre. The former is used to reduce risks of cardiovascular diseases, while the

latter two are meant to enhance the intestinal flora and lower cholesterol and regulate blood sugar,

among other things.

Aside from omega-3 and probiotics, other major ingredients segments within functional food include

dietary fibres, vitamin-enhanced foods and carotenoids.

Dietary fibre is naturally found in fruits, vegetables, whole grains and legumes and it is most often

commonly associated with relieving constipation. Its health benefits also extend to cholesterol

reduction, blood sugar control, maintaining a healthy body weight and reducing risk of coronary

disease and diabetes. It is the combination of all these benefits that are likely to drive demand for

dietary fibre, according to Grand View Research.

Common dietary habits in the developed world tend to leave people deficient in fibre. Children and

adults require anywhere from 25 to 35 grams of fibre per day to maintain good health, but most

Americans get only about 15 grams a day, according to Harvard’s School of Public Health.

Vitamin-fortified foods are a rapidly growing segment of the functional food market. This segment is

anticipated to grow at an estimated CAGR of 9.7%, says Grand View Research. Functional ingredients

from this segment include vitamin A (retinols and other), vitamin B (folic acid), vitamin C (ascorbic

acid) and vitamin D (cholecalciferol). The demand for vitamin-based functional foods has increased

due to heightened consumer interest in dietary supplements for preventive healthcare purposes and

general increased health awareness.

Carotenoids constitute another ingredient segment which is expected to grow at 7.2% from 2022 to

2030, according to Grand View Research. Carotenoids refer to any of a class of mainly yellow, orange,

or red fat-soluble pigments, including carotene, which give colour to plant parts such

as ripe tomatoes and autumn leaves. There is also scientific evidence suggesting their consumption

can play a part in reducing the risk of eye disorders, cancer and diabetes.

Carotenoids are also extremely flexible, as they are found in foods as sources of vitamin A, natural

colours, antioxidants and health-promoting substances, says a recent scientific paper from the

Journal of Food Bioactives, outlining their uses and applications. Carotenoids come in a variety of

forms in the market, including lutein, beta-carotene, lycopene, astaxanthin, zeaxanthin,

canthaxanthin and annatto.