Backed by one of the largest Philippine conglomerates, Ayala, Globe Telecom’s CVC unit is a leading force in the country’s emerging ecosystem.

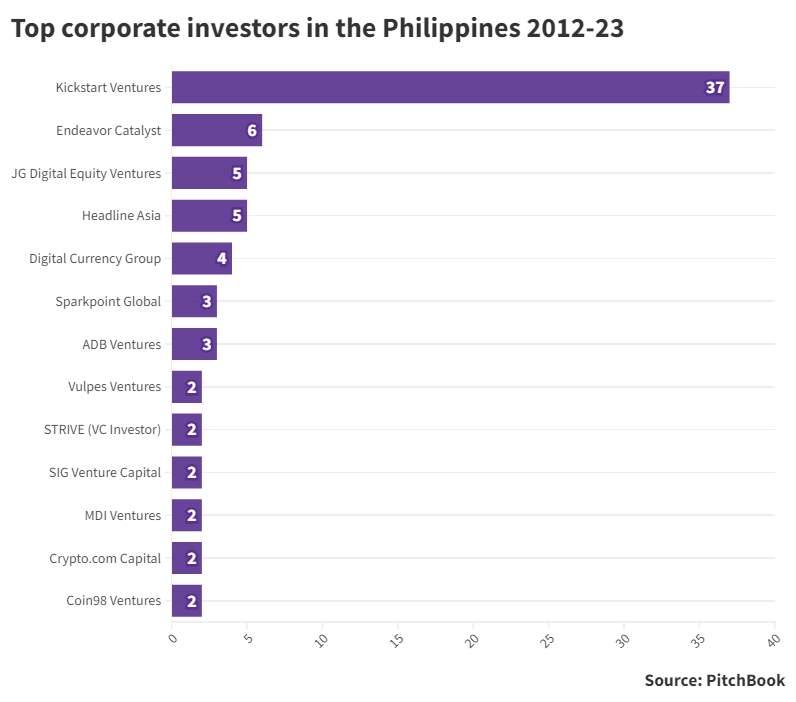

Start looking at corporate venturing in the Philippines, and you will keep coming back to one name: Kickstart Ventures.

The investment team, which started as the investment arm of local mobile operator Globe Telecom, has been overwhelmingly the most active corporate investor in the country, participating in 62 startup funding rounds in the past 11 years across nine countries, supporting 132 founders.

Kickstart Ventures’ investments include a stake in Pickup Coffee, a budget coffee startup that raised $40m earlier this year, and Transcelestial, a space laser network developer based in Singapore.

Nowadays, Kickstart has gone beyond just investing for Globe Telecom, which was the limited partner for Funds 1 and 2. The Active Fund has Globe’s parent company, Ayala Corporation, as one of the anchor investors. In addition, it counts the Bank of the Philippine Islands, AC Energy and AC Industrials – all affiliated with Ayala – among its LPs.

Singtel, the Singaporean telecommunications company that is a Globe shareholder, is working closely with Kickstart, having set up Innov8 Sparks, Singtel’s Southeast Asia startup support and funding network co-founded alongside Singtel Innov8, AIS The Startup, Optus-Innov8 Seed and Telkomsel Teman Dev.

The multi-LP $180m Active Fund backed by Ayala

Kickstart has $255m under management. Its third and latest of these funds is the $180m Ayala Corporation Technology Innovation Venture Fund (Active Fund), which follows a $50m growth fund in 2015 and the early-stage fund, now sized at $25m, formed in Kickstart’s early days.

“The Active Fund invests globally, consistent with our belief that best-in-class innovations can emerge from anywhere in the world,” Brian Dy, research manager at Kickstart, says. “To date, it counts 13 portfolio companies from Singapore, the US, UK, Indonesia and the Philippines.

Ayala, one of the largest and oldest conglomerates in the Philippines, which was founded in 1834 during the Spanish colonial period, operates across a variety of industries including real estate, financial services, utilities, telecommunications, healthcare, logistics, energy and transport. This gives Kickstart Ventures a very wide remit in terms of investment focus, including everything from ecommerce and coffee to energy and fintech.

Strategic partnerships with portfolio companies

One of Kickstart’s key differentiating factors is its ability to create strategic synergies between its portfolio companies and the Globe and Ayala ecosystems.

“Working in mutually beneficial partnerships is standard practice for us, and that helps open doors for our portfolio companies,” says Carla Samson-Montemayor, corporate communications manager at Kickstart.

For example, Singaporean space laser company Transcelestial was introduced to Globe Telecom, which played a crucial role in closing its resellership agreement with Fiber Infrastructure and Network Services (Finsi), a fibre engineering group launched by Globe’s shared services subsidiary Asticom Technology.

Transcelestial is also conducting a pilot test with Globe’s Information Security and Data Privacy (ISDP) team for their Centauri wireless fibre optics nodes.

“We take pride in nurturing meaningful connections and fostering successful partnerships for our portfolio startups,” says Mick Aguirre, chief of staff for Kickstart. “We facilitate mutually beneficial introductions and advocate for them when seeking partnerships with Globe and Ayala companies.”

Philippine coffee chain operator Pickup Coffee was connected with the right team from Ayala Malls and it swiftly expanded to other branches in various locations across the country.

Pickup Coffee was also introduced to GCash, Globe Telecoms’ mobile wallet platform, to make grab-and-go coffee even easier for its customers.

Kickstart vouched for SariSuki, a community selling platform headquartered in the Philippines, and enabled them to use the backhaul of Air21, the AC Logistics Holdings’ air express delivery service also known as Airfreight 2100. The partnership reduced the company’s logistics costs when transporting goods from the different areas of the country to the Metropolitan Manila area.

These strategic introductions, which explore collaboration and partnerships, are mutually beneficial – they allow Globe, Ayala and affiliates within the groups to tap into innovative technologies across their businesses.

Racking up big exits

Kickstart Ventures has scored multiple exits when its portfolio companies were acquired, including the $72m acquisition of Philippines-based crypto exchange Coins.ph by Indonesia’s Gojek in 2019, the sale of mobile loyalty programme operator Zap, as well as the $600m sale of Canadian story publishing platform Wattpad to Korean internet portal giant Naver in 2021.

Samson-Montemayor says that these successes were due to Kickstart being a long-term, patient investor in these companies.

“For each of these, Kickstart has provided patient capital and active support for their operations, especially with respect to business development and corporate communications,” she says.

Top corporate-backed deals in the Philippines

| Companies | Description | Series | Investors | Deal size $m | HQ location | Deal type |

|---|---|---|---|---|---|---|

| GrowSari | Shopowner-focused B2B marketplace | C | Bossanova Investimentos, Endeavor Catalyst, ICCP SBI Venture Partners, International Finance Corporation, Kohlberg Kravis Roberts, Pavilion Capital, Saison Capital, Wavemaker Partners | 78 | Manila, Philippines | Later stage VC |

| Kumu | Social live stream platform | C | Core Capital, Endeavor Catalyst, Foxmont Capital Partners, General Atlantic, Gentree, Kickstart Ventures, Manila Angel Investors Network, Openspace Ventures, Susquehanna Asia Investments | 74 | Makati, Philippines | Later stage VC |

| Kumu | Social live stream platform | B | ABS-CBN Holdings, Bossanova Investimentos, Endeavor Catalyst, Foxmont Capital Partners, Gentree, Openspace Ventures, Susquehanna Asia Investments | 37 | Makati, Philippines | Early stage VC |

| GrowSari | Shopowner-focused B2B marketplace | B | ICCP SBI Venture Partners, International Finance Corporation, JG Digital Equity Ventures, Pavilion Capital, Robinsons Retail Holdings, Saison Capital, Tencent Holdings, Wavemaker Partners | 30 | Manila, Philippines | Later stage VC |

| Pickup Coffee | Coffee chain operator | A1 | Antler, Go Ventures, Kickstart Ventures, Openspace Ventures, Saison Capital | 27 | Taguig, Philippines | Early stage VC |

| SariSuki | Grocery delivery platform | A | Foxmont Capital Partners, JG Digital Equity Ventures, Kickstart Ventures, Mintian Capital, Saison Capital, SIG Venture Capital | 25 | Quezon, Philippines | Early stage VC |

| Edamama | Baby product retailer | A | Alpha JWC Ventures, Foxmont Capital Partners, Gentree, InnoVen Capital, Kickstart Ventures, Lisa Gokongwei-Cheng, Robinsons Retail Holdings, Temasek Holdings | 20 | Makati, Philippines | Early stage VC |

| Salmon | Financial services platform | A | DisruptAD, TNB Aura | 16 | Taguig, Philippines | Early stage VC |

| Inteluck | Logistics management platform | B | Creo Capital, East Ventures, Headline Asia, Silverhorn Investment Advisors | 15 | Makati, Philippines | Later stage VC |

Building an emerging ecosystem

Above all, however, Kickstart believes it has a role as a key pillar of the wider Southeast Asian startup and innovation ecosystem. The team prides itself on being able to work well not just with industry but startups, too.

The 20-strong team has a broad range of skill sets. “Every Kickstart team member has to be competent, credible and open to challenge,” explains Aguirre.

“This helps us to work well with startups and other VCs – especially important when the startups are under immense pressure.”

Kickstart also values diversity and openness, with more than half of the team being women, including those in key leadership roles such as Minette Navarrete, president and co-founder of the unit, and Joan Yao, vice president of investments.

“Every month, we invite relevant subject matter experts from across the ecosystem to speak at Raid the Fridge, the longest-running ecosystem mixer in the Philippines – 118 events and counting,” Samson-Montemayor says.

“Raid the Fridge speakers span the range of startups, venture capital, accelerators, big tech, large corporates, government and NGOs; and our fridge is open for everyone who wants to listen to, learn from, and meet interesting leaders in the ecosystem, over a beer.”

Kickstart has been one of the most active promoters of the Philippine startup ecosystem for more than a decade, creating virtuous cycles in the local startup industry.

“We break down barriers and build bridges to create a chain reaction of opportunity,” says Dy. “Sustained innovation needs a community working together to overcome obstacles and achieve growth and shared success, especially in emerging markets.”