- News & Analysis

- Home

- Global Corporate Venturing

- Global University Venturing

- Latest News

- Publications

- Podcast

- Deal Data

- The CVC Directory

- Video

- Subscribe

- Newsletters

- Events

ContentsFeature: Corporate funding makes up a third of startup investmentFeature: National Grid looks to speed up startup collaborationFeature: BP signals beefed-up $1bn venture spending strategyFeature: XGS continues wave of geothermal investmentFeature: Samsung backs magnet startup Niron MagneticsAnalysis: Oil and gas investors keep steady pace in Q1 2024Deals of noteFundsPeople MovesKaloyan Andonov and Maija Palmer

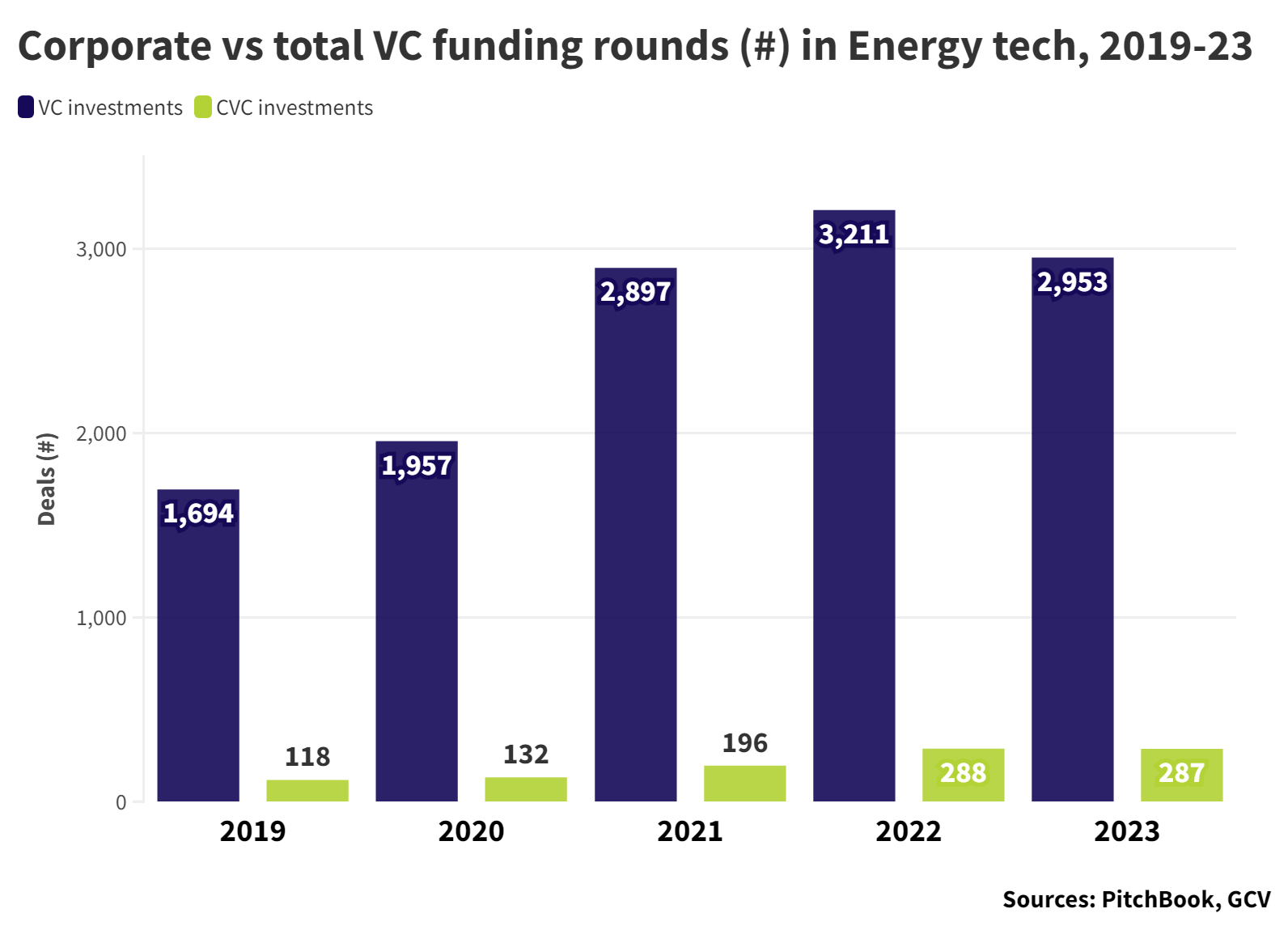

Corporate funding makes up a third of startup investmentCorporates are becoming an increasingly critical source of funding for energy startups. Although corporates were involved in only 10% of the startup funding rounds in the sector last year, they are disproportionately likely to be involved in the high-value rounds.

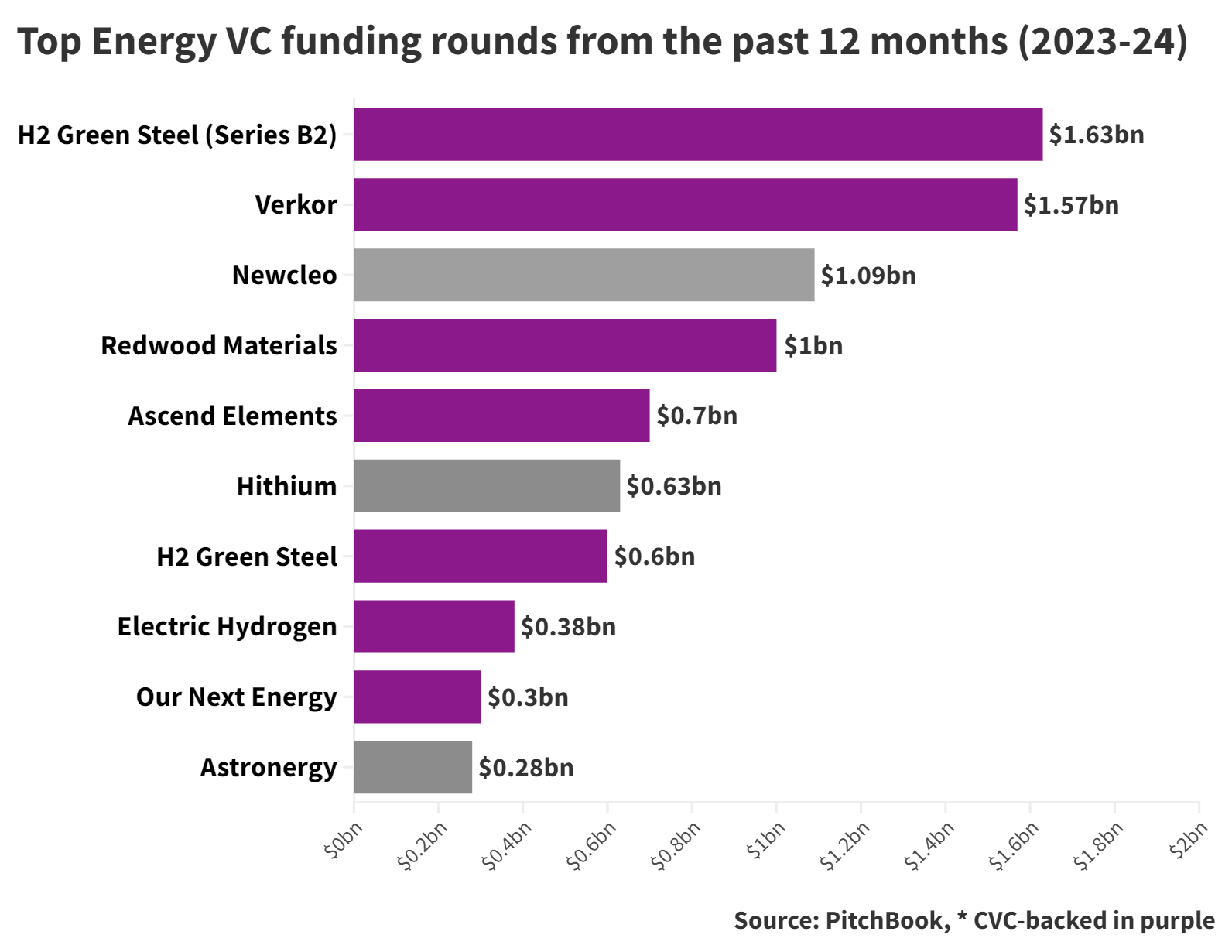

In the past year, seven out of the 10 biggest funding rounds for energy-related startups involved corporate investors.

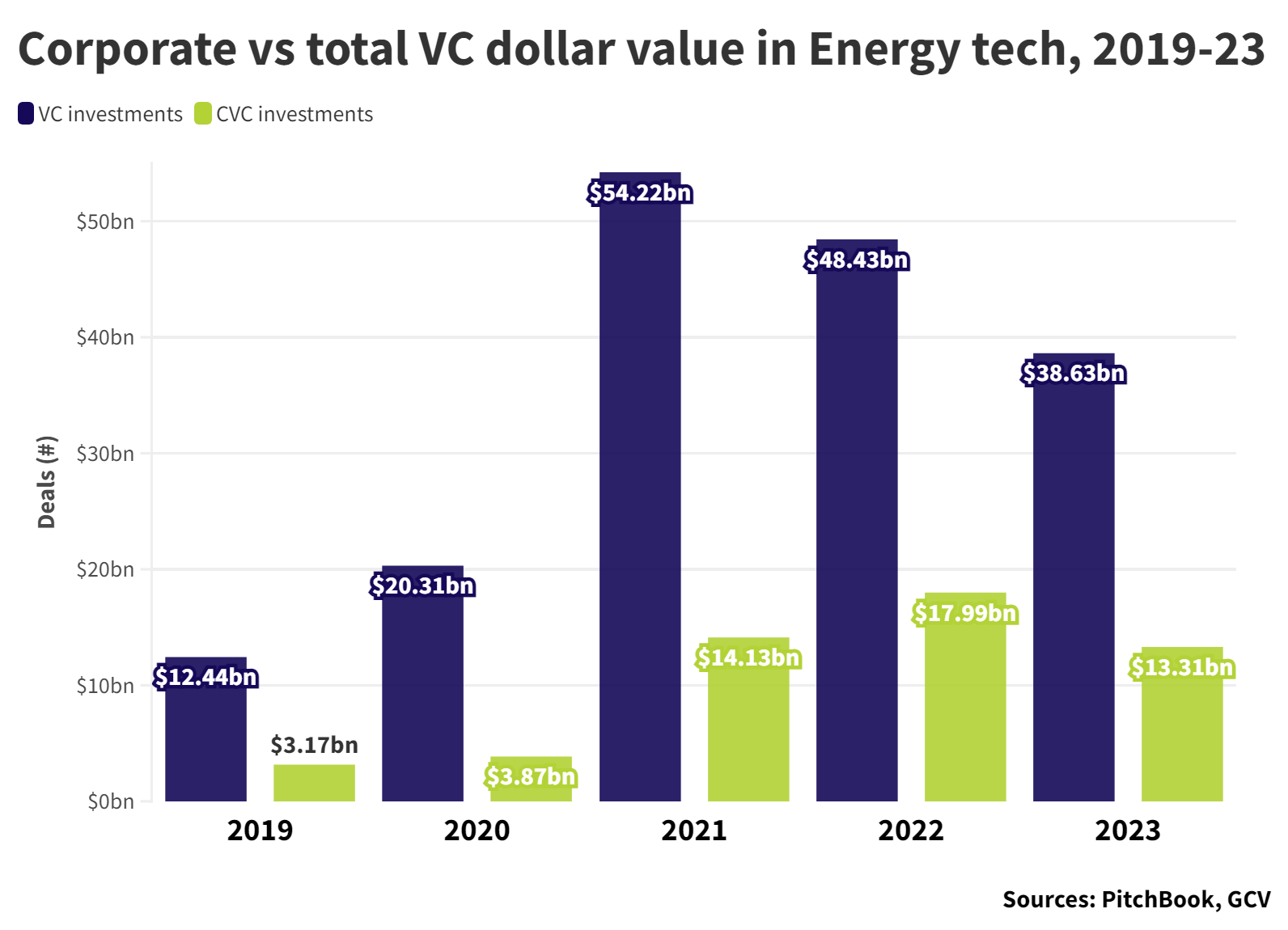

More than a third of all the dollars raised by energy sector startups comes from funding rounds involving corporate investors. Moreover, the sums raised in corporate-backed funding rounds stay steadier than the rest of the market.

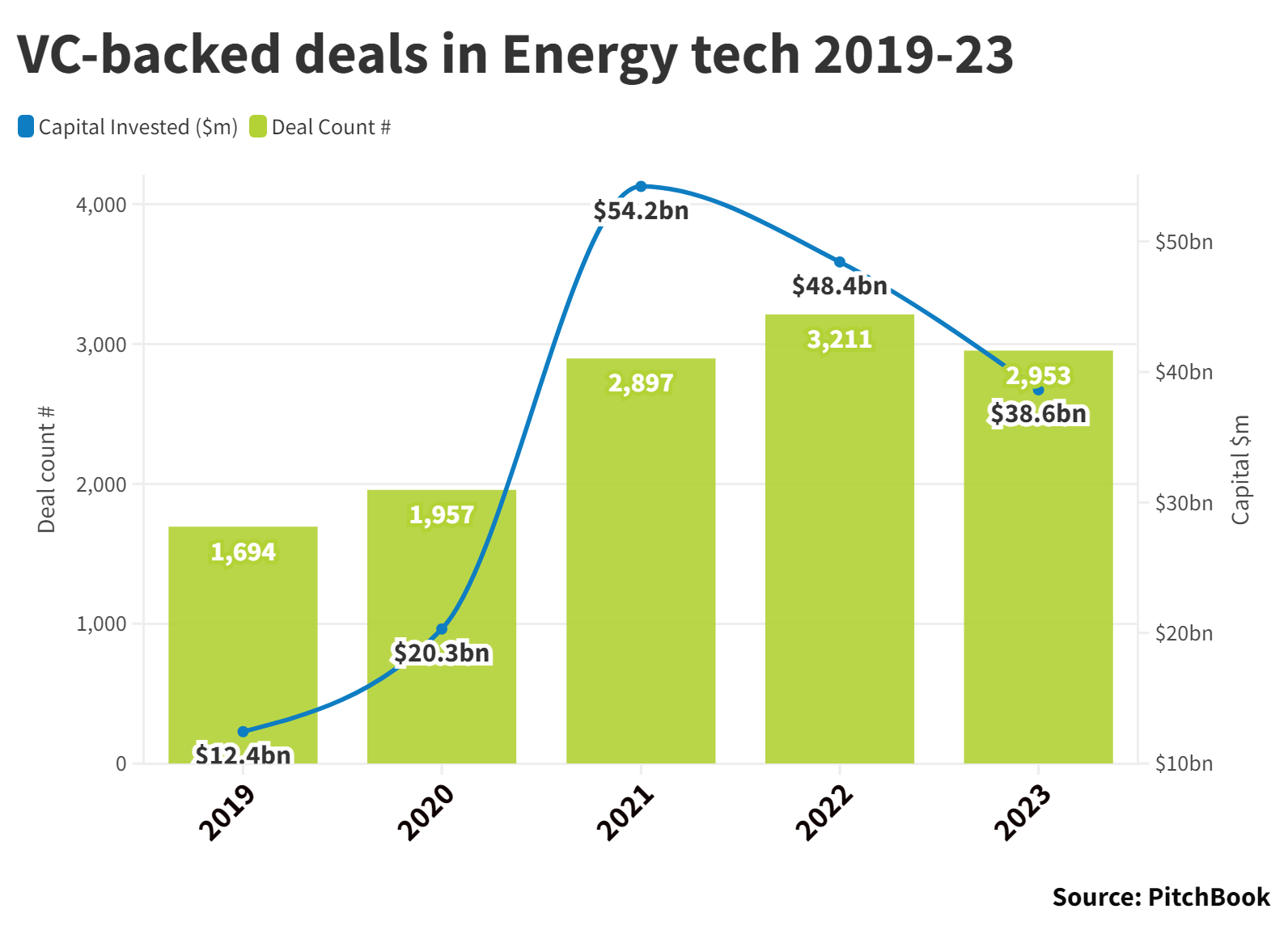

Venture capital spending on energy-related startups boomed in 2021, reaching more than $54bn, but this has fallen nearly 29% in the past two years. The value of corporate-backed rounds, meanwhile, has been more stable. Although the 2023 total of $13.31bn is down from a 2022 high, it is only 6% lower than the level of investment in 2020.

Recent large deals include the $245.7m funding round in February for Koloma, a US startup planning to dig for sub-surface deposits of hydrogen, which was backed by Amazon’s Climate Pledge Fund and United Airlines’ Sustainable Flight Fund. UK energy company Octopus Energy invested $200m in Deep Green, a startup planning to reuse the waste energy emitted by data centres, while BP took part in the $182m fundraising round in November for Eavor, a startup reinventing geothermal heat generation.

Biggest investors

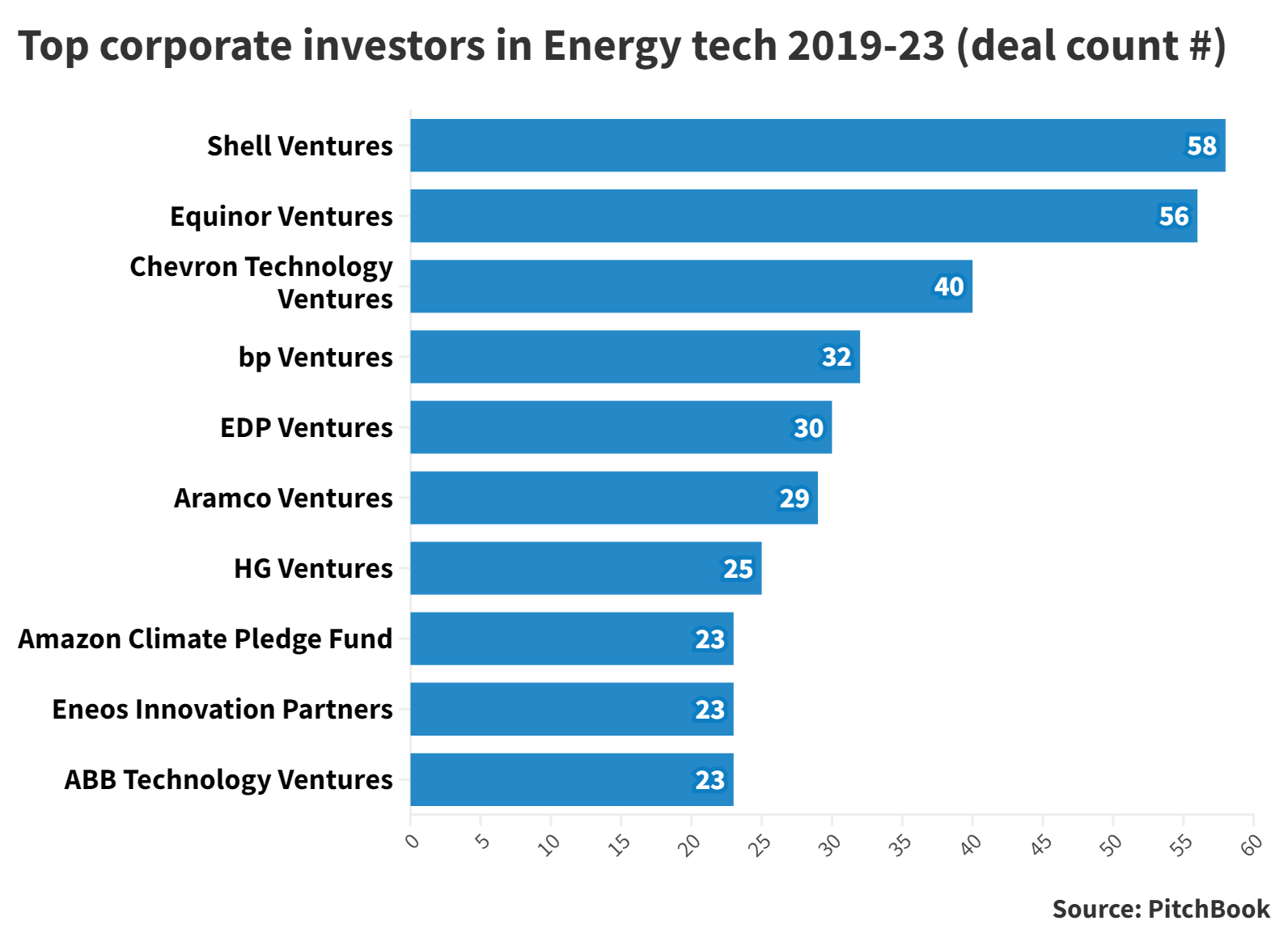

Anglo-Dutch energy company Shell has been the most prolific investor in energy startups over the past five years, backing 58 funding rounds in that time. Equinor and Chevron also lead the pack.

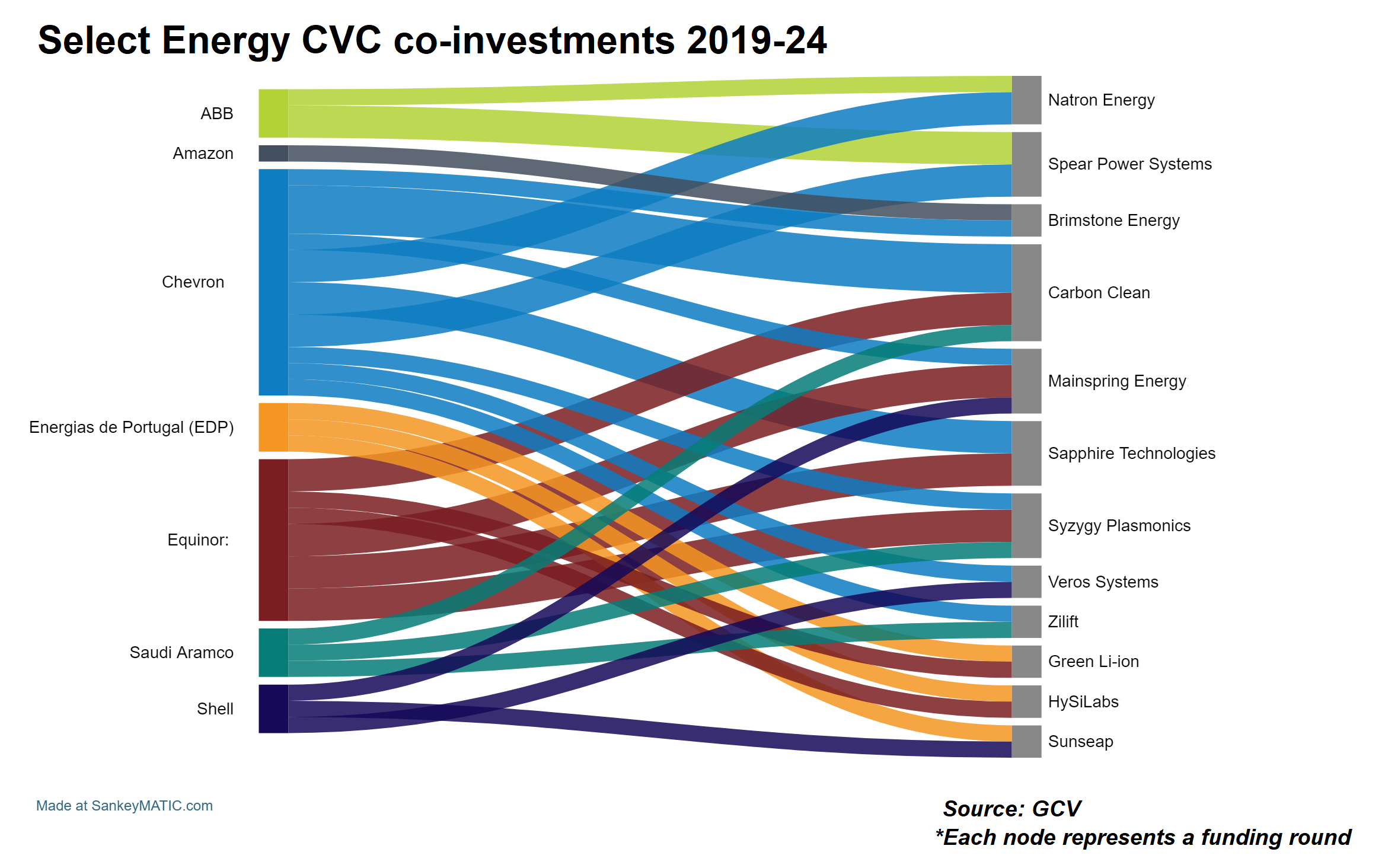

Many of the big energy companies tend to co-invest in energy startups. We have, for example, seen Chevron, Equinor and Saudi Aramco come together in backing Carbon Clean Solutions, a UK-based industrial carbon capture startup. Mainspring Energy, a US-based provider of generators for the clean energy transition, has also brought together Chevron, Shell and Equinor as investors.

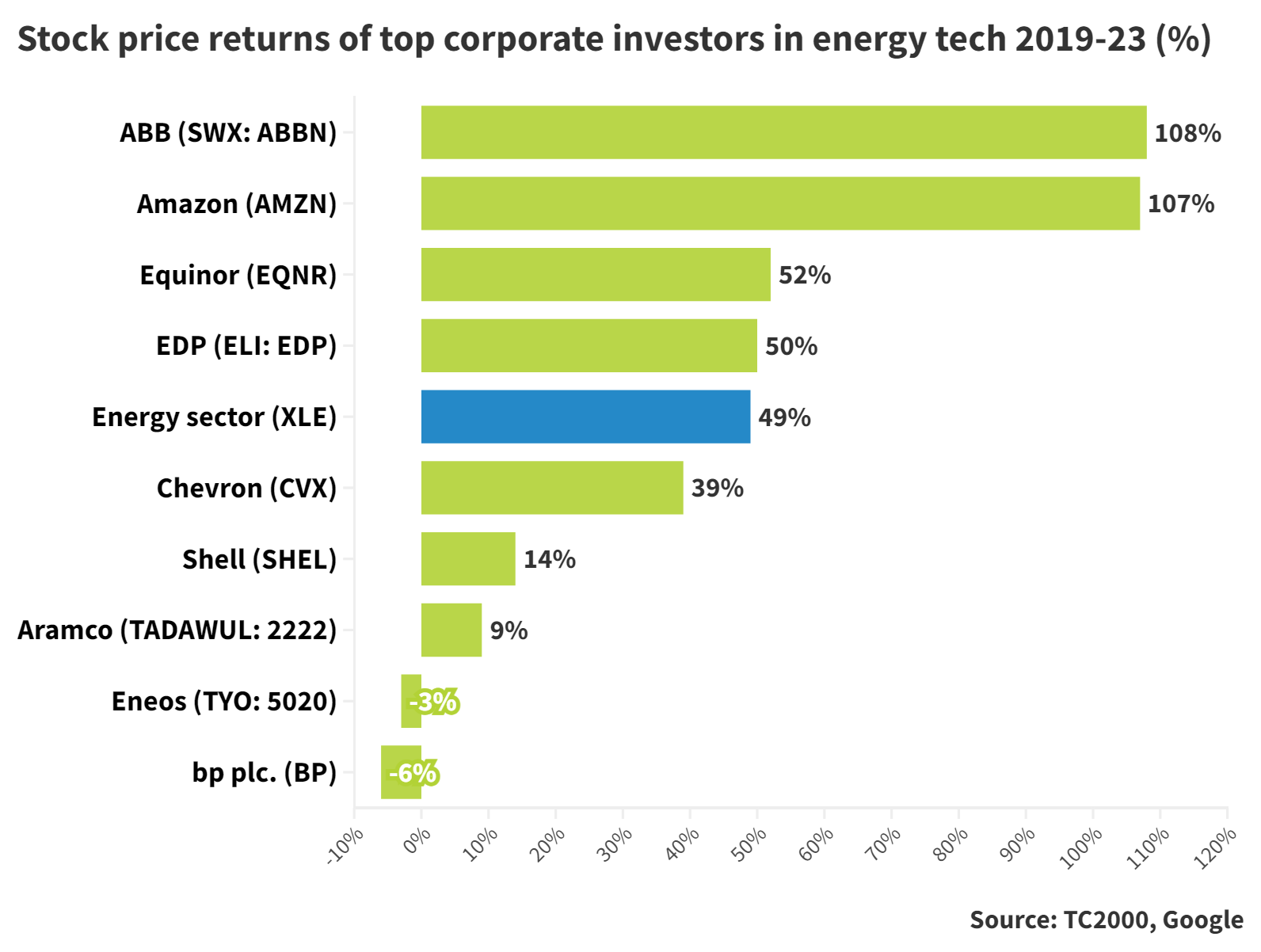

Stock market investors, however, are not necessarily rewarding efforts to invest in the future of energy. Energy company share price performance is more dictated by the price of oil and gas. Only Norway’s Equinor and Portuguese energy provider EDP have outperformed the energy sector average in stock price returns. BP, which saw its earnings halve in 2023 compared to 2022, is in negative territory on returns. Japanese oil refiner Eneos is also languishing, despite recently increasing its full-year profit forecasts.

Healthcare | Human microbiome

Publications | Reports | GCV

Read the full report on your tablet or device.Download PDFRob Lavine

National Grid looks to speed up startup collaboration as net zero pressures grow

Steve Smith, the new head of National Grid Partners, has shifted focus to technologies that directly impact the operation of the power grid.

National Grid has restructured its venturing arm and is bringing the startups it invests in closer to its core operations, as it grapples with the need to modernise the power grid amid the energy transition.

The electricity and gas provider wants to get startups collaborating with its business units much faster.

“We’re trying to get them to the point where we can get pilot projects up and running in a matter of 10 to 12 weeks,” says Steve Smith, president of National Grid Partners (NGP), the company’s investment arm. It is notoriously hard for startups to navigate the legal processes of utility companies. Left to their own devices, Smith says, it can take them 12 or 18 months to get through the process.

NGP has also streamlined its investment focus to technologies that directly impact the operation of the grid and help customers manage the energy transition. National Grid is coming under pressure from regulators in its home country of the UK over the time it is taking to connect new renewables to the grid. Ofgem, the UK energy regulator, has said urgent reform of the connections system is needed.

Smith was already National Grid’s head of strategy, innovation and market analytics, but recently took over as president of NGP, replacing Lisa Lambert, who founded the unit in 2018. He says NGP invests tens of millions of dollars each year in startups, and that the National Grid Group has invested around $460m to date.

Faster partnerships with startups

“Utilities are not easy to deal with for startups, nor are most large corporates,” Smith (above) says. “We have all kinds of restrictions about how we can procure, which makes sense because we’re a utility and we have to avoid improper relationships and things like that.

“What that means is for the typical startup, our procurement process and the kind of legal documents we’d ask them to sign, the securities and guarantees, would crush them and they wouldn’t be able to sign up.”

Part of the solution is a dedicated business development team led by NGP vice-president Brett Chandler that helps portfolio companies get through the process of signing on with the company more quickly so their products can be tested by one of its business units.

The idea is to prove the efficacy of a startup’s technology before scaling it across the unit in question, and then expanding its usage from the US, where NGP is headquartered, to the UK, where its parent company has much of its operations, or vice versa. The next step is to help them expand internationally, which is where the NextGrid Alliance (NGA) comes in.

NGA is a collection of some 100 worldwide utilities and was formed by NGP to discuss experiences and solutions and share knowledge. It held its first meetings in 2020 and while there are working groups dedicated to issues like net zero transition and cybersecurity, the largest group focuses on corporate venture capital. That means there is a ready route for portfolio companies to internationalise.

“We allow them to deploy quickly with us, prove themselves and then scale across our networks, which gives them significant business because we’re a major global player,” Smith says. “But we can also get them in front of major utilities across the world quickly, hopefully to help them be successful there.

“Because global warming is a global problem – there’s no point us decarbonising our networks and achieving net zero in the UK and the Northeast US if no one else does it. So, we have a vested interest in these companies if they’re able to successfully deliver that globally, as well as a financial interest.”

The move to a more streamlined investment plan

NGP’s investment strategy now concentrates less on power generation or decarbonisation and has been consolidated in four pillars: technologies that can help transform the electricity grid to one more heavily based on renewable energy, ways to help customers manage that transition fairly and affordably, methods of decarbonising gas networks, and products that use technologies like artificial intelligence, robotics, cloud and edge computing to strengthen operations.

NGP is still interested in some of the new innovations in energy. For example, it has a stake in Modern Hydrogen, which uses methane pyrolysis to convert natural gas to hydrogen. But Smith is skeptical about the immediate applicability of some of the edge energy technologies to National Grid.

“Whether carbon capture is direct air-based, sea-based or sequestration, it’s hugely interesting and could be part of the mix,” he says. “But the real challenge is that nobody has really deployed at scale yet, so the economics will remain a bit murky until someone does. There are things that have been done in Norway, and there are a few projects in the US, but nobody’s really got it going at a scale that would make you believe the economics are compelling.

“I’d put fusion in the same bracket – it’s pretty much been 20 years away my whole life going back to being a 15-year-old at school. But there’s serious money going in, and for me the big difference these days is that a lot of that is private money. Historically, all the fusion research was publicly funded, but you’re now seeing billions of dollars going in through private investment.”

Conversely, there are more generalised parts of the tech scene that do fit NGP’s core aims. Innovations in robotics could help automate some of the more dangerous jobs when it comes to building and maintaining transmission lines, and AI may make sure they’re designed more efficiently in the first place.

“Our aim is to drive through a lot of the conservatism you naturally get in network companies, and say: ‘Look, we’ve got AI tools for vegetation management. The biggest things that take down your power distribution lines are storms and trees, and it turns out modern high-resolution satellite imagery with AI is really good at telling you exactly where you need to cut back and where trees can bring down your lines if you don’t,’” says Smith.

“There is loads of exciting stuff around predictive maintenance. A lot of our maintenance schedules are built around condition or age of assets rather than using AI and sensors to detect when those assets actually need an intervention. There’s a huge amount we can do with AI in areas like planning routes.”

A focus on follow-ons

Smith expects that NGP will take part in more follow-on funding rounds for its existing portfolio, rather than new investments. The current VC bear market means even its more successful startups are struggling to find new backers, but for National Grid cannot wait for those breakthrough technologies to reach maturity on their own.

“Historically, when building large network assets, the distribution and transmission levels have been painfully slow,” he says. “So, we have to do it quicker, smarter and, really importantly, cheaper as well because we also need to keep it affordable for customers.

“When NGP was set up I think there was a lot of uncertainty around what the role of utilities in the transmission system was going to be. Now, it’s a lot clearer we are going to move transport to electric and a lot of heating to electric. Therefore, the role of network companies is a lot clearer and so the innovation needs are a lot clearer as well.”

Healthcare | Human microbiome

Publications | Reports | GCV

Read the full report on your tablet or device.Download PDFMaija Palmer

BP signals beefed-up $1bn venture spending strategyBP has significantly increased its capital allocation to its venture unit, with around 90% now going to energy transition, says head of unit Gareth Burns.

BP Ventures plans to invest around $1bn into startups over the next three to four years, mainly in energy transition, as the new head, Gareth Burns, pushes through a strategic change at the energy company’s investment unit.

“It’s a significant step up in capital,” says Burns.

While Burns and BP have stopped short of confirming a precise dollar figure for investment in startups, they have indicated that this next tranche of investment capital – Fund Five – will be on par with what BP Ventures has spent in total so far in its 10 years of existence. More than 90% of this spending will go to startups working on technologies related to what BP refers to as its five transition growth engines: bioenergy; electric vehicle charging; convenience; renewables and power; and hydrogen.

Gareth Burns, vice president of bp ventures “In dollar terms, that is around a 60% increase compared with our previous investment activity,” says Burns.

The BP investment team has also been expanded to 25 people since Burns took over at the start of the year.

But Burns’s plans for BP Ventures are not just about becoming bigger. He is bringing a different approach to the unit. For one thing, Burns, who is based in London, is shifting the focus of the unit to be less US-centric. He is also changing the way the unit evaluates potential investments.

“I have tried to bring greater focus to delivering on the investment strategy. We have made some adjustments to how people focus on different elements. We have got a greater link to the transition growth engines, so that when we are looking at a new investment within a particular segment, it is being compared with all other opportunities within that same segment,” says Burns.

Recent investments include leading the series A round for Advanced Ionics, a US developer of lower-cost electrolysers for green hydrogen production, and Electric Hydrogen, which is building larger-scale plants for the production of green hydrogen. Both of these have a potential tie-in with BP’s broader hydrogen plans.

“We hope to have the opportunity to deploy those technologies into our activities over time, as those technologies prove themselves,” says Burns.

At the same time, BP Ventures will continue to invest in startups beyond the immediate needs of BP business units. This is what Burns calls the “explore” space.

“What are the new technologies and new opportunities that are being developed sometimes in scientific labs, sometimes around business models? We will look to allocate some capital into that white space with a view to informing what will be BP’s future strategies further out in time,” he says.

This is a model he already had some experience developing in his previous role leading Equinor Ventures, the investment arm of the Norwegian energy company.

“I talk about ventures being the pointy end of the sphere. It is seeing where the energy ecosystem is developing and moving, and then using that insight to impact what we do at a corporate level,” he says. “At Equinor, we were using venture to inform what we were going to do in the future. That is something that we are looking to do [at BP], getting a strong link between the transition growth engines and the venture activities. We can bring insights into what they will do in the future.”

“I talk about ventures being the pointy end of the sphere. It is seeing where the energy ecosystem is developing and moving, and then using that insight to impact what we do at a corporate level”

Gareth Burns, Vice president, BP Ventures

Burns says one of the reasons that he was eager to join BP was that the UK energy company, which has revenues of more than $230bn, around twice those of Equinor, gave him the chance to try this strategy on an even broader scale, as the group transitions from oil company to integrated energy company.

“It’s a much bigger sandbox to test some of these different ideas,” he says.

CVC of choice

At the same time as proving the value of ventures internally, Burns wants to improve the way that BP is perceived as a startup investor.

“I would like BP Ventures to become the energy CVC of choice. I do not think we are there today. But with this new investment strategy, with the mandate and support we have got from BP, I believe it is something that we will be able to deliver on over time,” he says. “Ultimately, we need to work really hard to do that.”

Burns confirmed that BP Ventures’ focus would be on equity investments. BP Launchpad, an internal venture builder and scale- up division that BP launched with ambitious targets in 2018, is something that Burns says has “served its purpose” and will not be a focus for him. Many of the companies Launchpad built and grew are being integrated into BP. “My primary focus is on ventures,” says Burns.

Healthcare | Human microbiome

Publications | Reports | GCV

Read the full report on your tablet or device.Download PDFRov Lavine

XGS continues wave of investment for geothermal startups

XGS is the third geothermal startup to raise cash this year, as the industry looks to overcome drilling costs and geography.

Baltimore-based energy producer Constellation Energy led a $9.7m funding round for XGS Energy this week, one of three geothermal startups to raise cash so far this year as the industry looks to innovations in technology to fulfil its promise.

Geothermal energy is sourced from heat found beneath the Earth’s surface which is then used to heat water in order to turn turbines. Because it doesn’t rely on weather, it can be used as a more constant power source to complement more intermittent types of renewable energy like wind or solar power.

But geothermal energy is also only currently usable in certain parts of the world, which is why less than 16 GW of capacity had been installed worldwide as of 2021, as opposed to over 740 GW of wind energy and over 1 TW of solar. The hope is that a new wave of technologies could expand the range of use or extract more from existing systems.

Constellation Technology Ventures, the strategic investment arm of Constellation Energy, was joined in the round by BlueScopeX, Thin Line Capital and undisclosed individuals. It followed a $13m round nearly a year ago and the proceeds will be used to build a pilot plant to demonstrate the company’s Thermal Reach Enhancement (TRE) technology.

TRE uses a single drill to get to hot rock, then implants thermally conductive material which can draw more heat to the well that is then collected and used to heat water. The heated water is returned to the surface and converted to electricity.

XGS has been testing its technology in laboratories for two years and aims to build commercial projects in Japan, the Philippines and its home country, the US, once the prototype facility is shown to be successful. It claims its materials are 50 times more conductive than typical underground rock, and that the technology can be used anywhere in the world without needing the millions of gallons of water required for current systems.

The company is the third early-stage geothermal technology startup to raise funding since the start of 2024, following Octavia Carbon, which plans to use Kenya’s geothermal resources to power its carbon capture systems, and Enerdrape, an Après-demain and Romande Energie-backed Swiss company that has created a prefabricated geothermal panel that can take drilling out of the equation altogether.

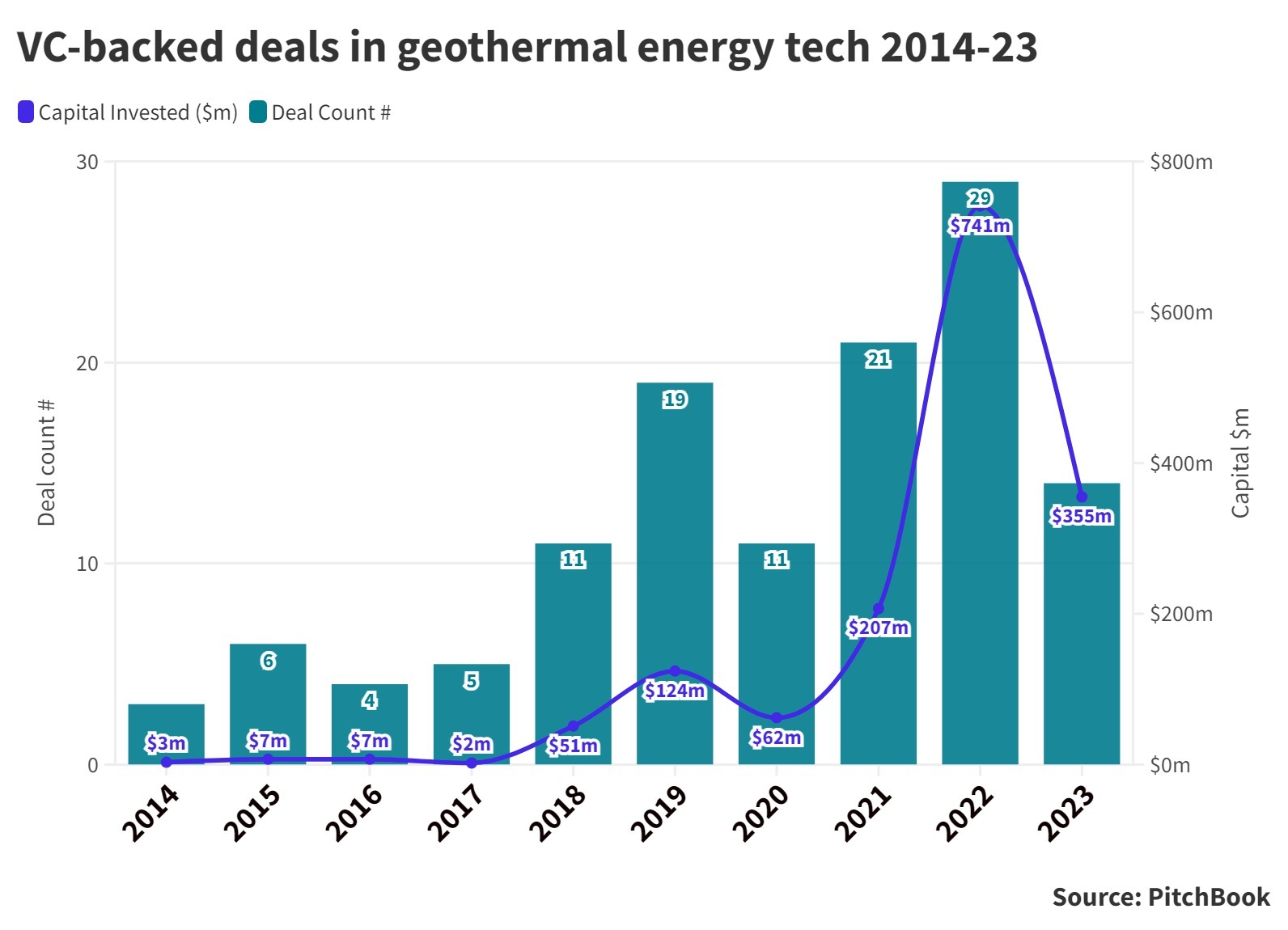

Geothermal energy in general has a lot of room to grow, and it is progressing. While 2023 was not a vintage year for the sector, early-stage funding for geothermal tech is generally on an upward trend and remains significantly above what it was for much of the last decade (see below).

The US Department of Energy released a study a year ago claiming geothermal energy in the US could potentially grow from 3.7 GW to 90 GW by 2050, but only with advances in technology that could reduce the costs by 90%.

That 90% seems like a huge figure, but it’s worth noting that drilling currently makes up half the cost and that wells are currently dug less than 3km deep. Much of the hottest rock is found further down where drilling has so far been impossible or overly expensive. Startups are working towards overcoming that problem.

Fervo broke ground on a 400 MW project in September that will use precision horizontal drilling techniques to deploy several wells at a single location. Quaise, which is backed by Techint unit TechEnergy Ventures, is developing millimetre wave drilling that can drill through hard rock by vaporising it, meaning the company could theoretically reach as deep as 20km. It is currently raising $25m for its next round.

Corporates might have technological expertise to contribute. BP and Chevron are both investors in Eavor, a Canadian company currently building out a global footprint of geothermal power plants based on a closed-loop system that combines two vertical wells with several horizontal wellbores. Fervo’s equipment makes use of developments in oil and gas exploration, the industry that’s home to several of its corporate investors.

Fracking may not have lived up to early hype, but the drilling innovations that allowed shale oil and gas companies to drill faster and deeper could be passed on to geothermal startups.

Ultimately, there are lingering doubts as to whether deep drilling could affect seismic activity and possibly lead to earthquakes, but right now the largest barrier apart from cost is geography. Only three countries – Iceland, Kenya and El Salvador – rely on geothermal for more than 20% of their energy needs, and only the US and Indonesia have installed more than 2 GW.

Geothermal could possibly become the baseload clean energy source that could facilitate solar and wind worldwide, but if it is to do, technologies like XGS’s will be essential.

Healthcare | Human microbiome

Publications | Reports | GCV

Read the full report on your tablet or device.Download PDFRob Lavine

Samsung backs magnet startup Niron Magnetics

With not enough rare earth metals to make the magnets that industry will need in the next decade, the race is on to find alternatives.

Consumer electronics company Samsung and car parts manufacturers Allison Transmission and Magna have become the latest corporate investors to back Niron Magnetics, a US startup that has developed a new magnet technology that avoids the use of rare earth metals.

Industrial companies are under pressure to find new magnet technologies as supplies of the rare earth metals needed to make strong permanent magnets are in limited supply — and what little there is is mostly controlled by China.

It is no wonder, then, that corporate investors, including General Motors, Stellantis and Volvo Cars, have been racing to back Minnesota-based Niron, which has developed a way of making magnets using iron nitride, a chemical compound made from iron and nitrogen, rather than rare earth metals like neodymium and cobalt.

“It’s the first new magnetic material in 40 years, and we’ve perfected how to make that material at scale,” Niron CEO Jonathan Rowntree tells Global Corporate Venturing. “We’re currently scaling the technology and what’s great is that it really solves major three problems with rare earth permanent magnets today.”

Not only does the mining and processing rare earth metals have a big environmental impact — Rowntree claims 2,000 tons of hazardous and even radioactive waste can be produced for every ton of magnets — but magnets have become a geopolitical flash point, with China controlling some 90% of rare earth ore processing.

“They really control the pricing and supply of that, and they’ve started to use that as a way to combat some of the tariffs and trade restrictions the US has placed on exports of semiconductor technology equipment,” he explains, adding that this factor is currently the biggest concern for corporates, which need a steady supply of magnet materials for their products.

The third issue is that there is set to be a huge shortfall between supply and demand in the coming years as the world looks to move from fossil fuels to electrification. Permanent magnet demand is predicted to triple over the next decade but there is only enough rare earth metals to cover double. In fact, Rowntree says, by 2035 the shortage of rare earth metals will actually be bigger than the market is today.

“That’s where our iron nitride technology comes in,” he adds. “It’s an 80% to 90% cleaner process than with rare earths. We’re using readily available raw materials, iron and nitrogen, so we can manufacture them anywhere in the world. And we intend to build significant plants in the next several years, to provide a significant portion of the demand required to fill that gap.”

Niron Magnetics, a spinout from the University of Minnesota, has raised over $160m since it was launched in 2014. This $25m round was led by Samsung through its Samsung Ventures unit, investing together with automotive part manufacturers Allison Transmission (through its Allison Ventures subsidiary) and Magna in addition to Shakopee Mdewakanton Sioux Community and University of Minnesota itself.

Why Niron’s corporate backers are set to be its first customers

Niron now has a wide range of corporate backers covering a lot of technological ground, Rowntree says.

“GM and Stellantis invested in November, and they’re top-five global automotive OEMs (original equipment manufacturers),” he says. “What’s great is that in this round, we have some of the largest tier-one suppliers to carmakers, Magna and Allison, investing. Again, that completely validates the potential for EVs.

“With Samsung Electronics, there’s a lot of potential in the shorter term for us in consumer electronics, mainly around audio applications. About 25% of the magnet market is in audio. They go into speakers, and the material we’re launching later this year is very well suited to audio applications. So, we’re excited about the collaboration and partnership with Samsung to bring those products to market.”

The corporates are investing in Niron as strategic customers and working with it to test and develop its technology for a variety of uses. You could end up seeing the magnets in both the tiny accessory motors that make a car’s power windows go up and in its electric motor. Other potential areas include heating, ventilation and air conditioning units, industrial motors and brick-sized magnets for use in wind turbines – an area it is looking to enter in late 2024 or early 2025.

Expanding to larger magnets will however involve scaling up Niron’s manufacturing capabilities, and the company has ambitious plans on that front. It is set to complete its pilot plant this year, allowing it to conduct performance and reliability testing with its partners. Then, it intends to build out a low-volume production facility in 2025, most likely in Minnesota.

The next step will be to move to high-volume production, and Niron has already begun a nationwide search for a site. The company aims to expand the initial commercial plant in 2026 while it builds a high-volume plant it can bring online the following year. But it is targeting a more gradual approach than the gigafactories constructed by battery startups like Northvolt and Verkor.

“We will probably do another round late this year or early next year that will really be targeted around funding the expansion to high-volume manufacturing scale,” Rowntree says. “We will be investing not just tens of millions but hundreds of millions of dollars to build that high-volume facility, but the plan is that we wouldn’t build that all in one go.

“We would build the infrastructure for that and put the first few manufacturing lines in place. Then, as we match demand and sign offtake agreements with customers, we can then raise the investment to build out that factory.

“I think a lot of these battery companies have gone for the big-bang approach and that’s not the one we’re taking. It will be a phased investment matched with our qualifications and offtake agreements with customers. The same strategic customers we’ve got investment from recently will most likely be the first customers.”

Healthcare | Human microbiome

Publications | Reports | GCV

Read the full report on your tablet or device.Download PDFKaloyan Andonov

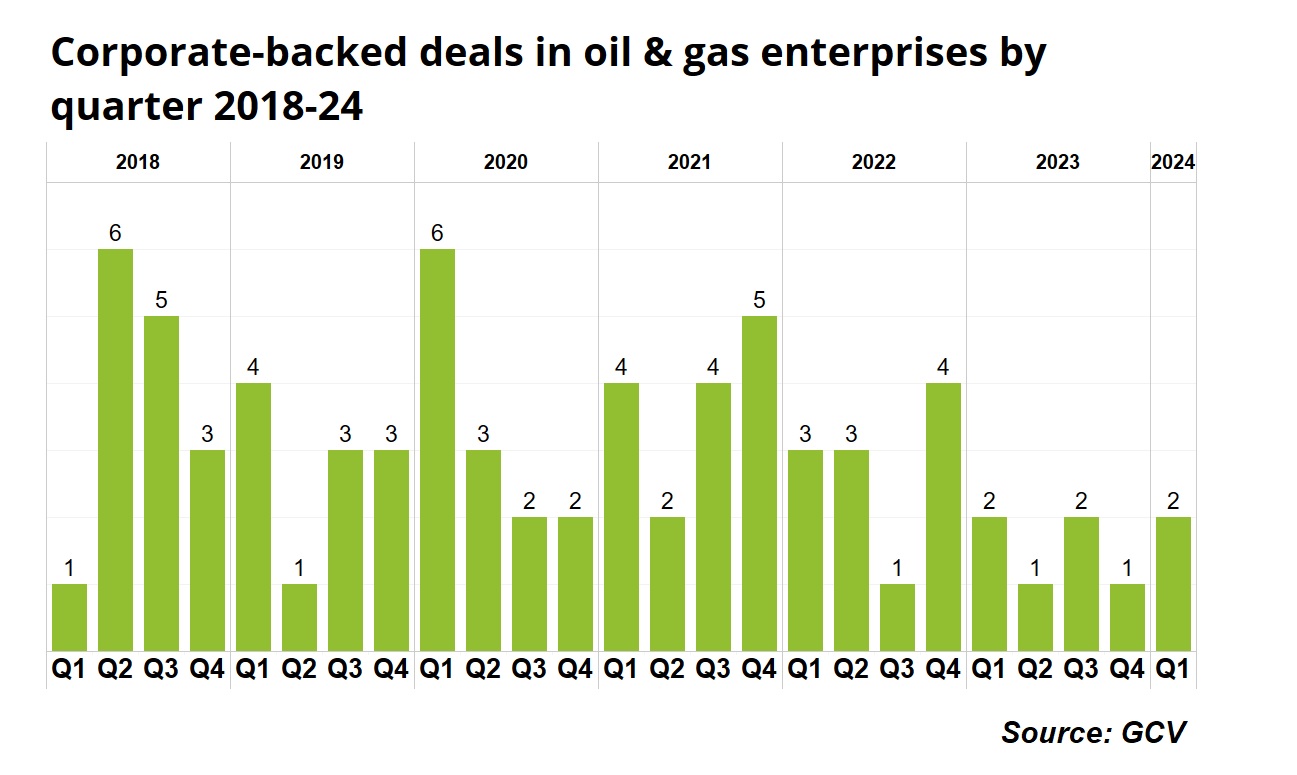

Oil and gas investors keep steady pace in Q1 2024Startup funding rounds backed by oil and gas companies kept a somewhat steady pace in the first quarter, but there has been a discernible increase in the number of funds directed toward the energy sector

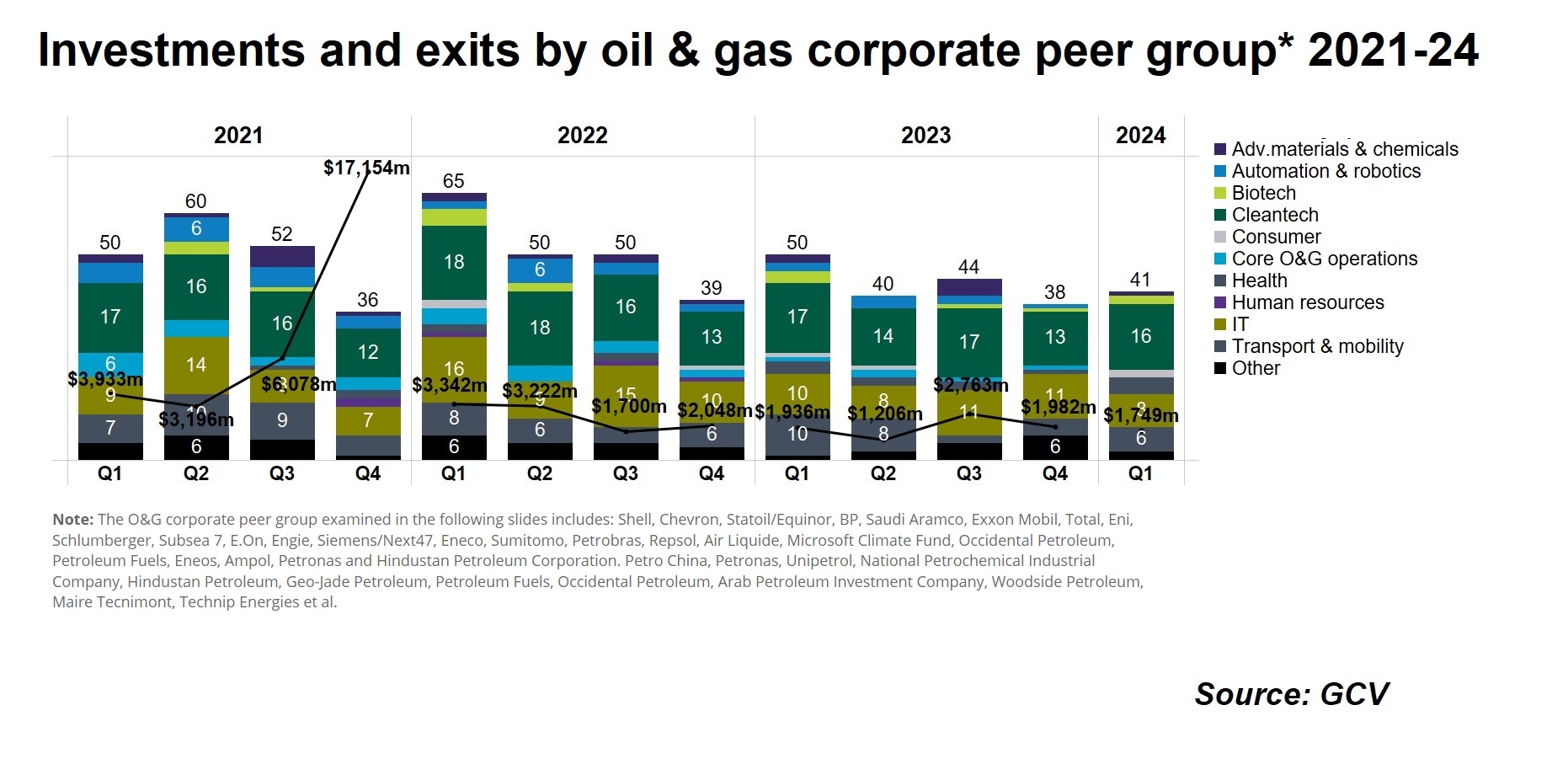

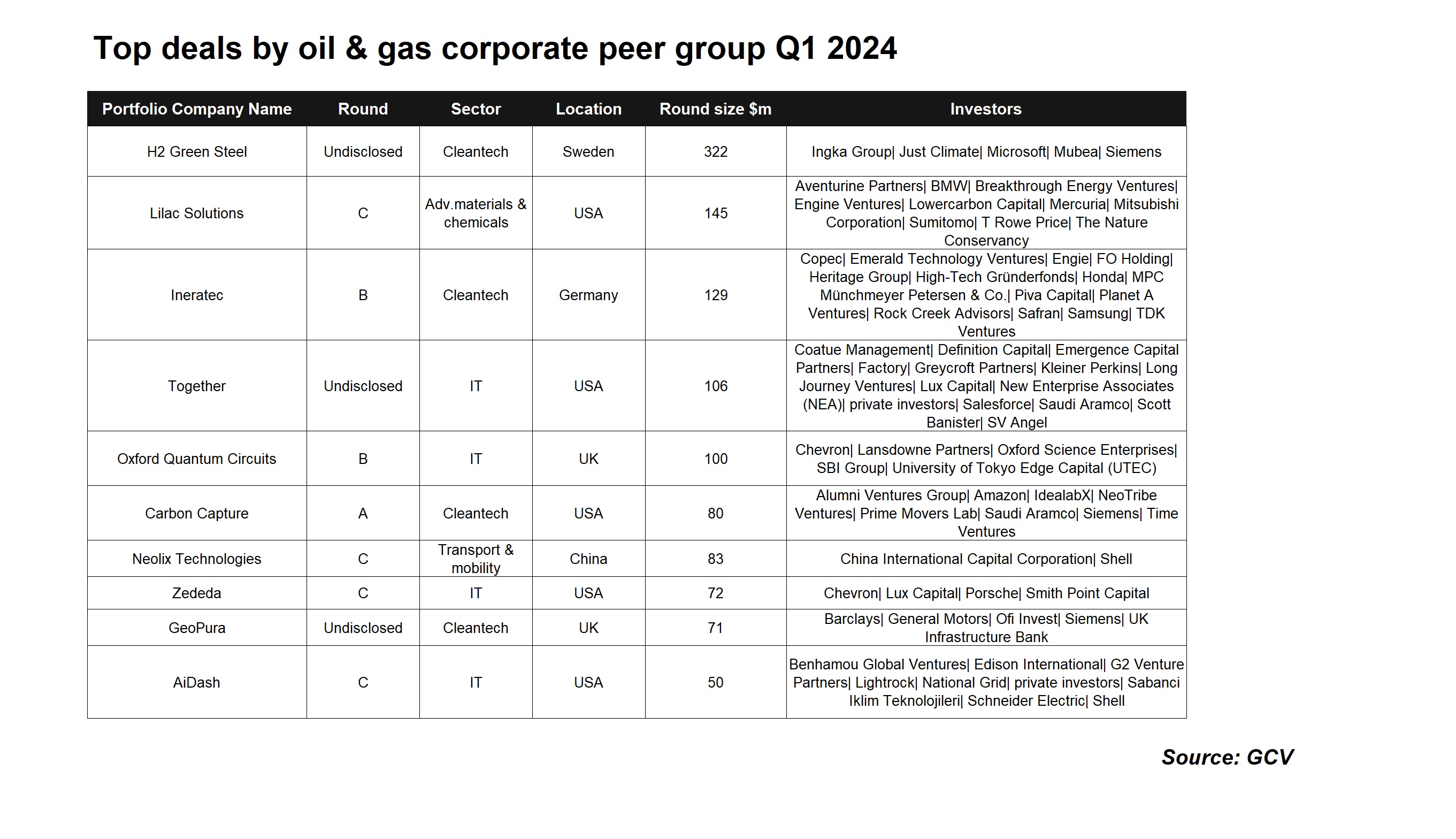

Oil and gas corporate venturers backed 41 startup rounds during the first quarter of this year, down 18% from the 50 tracked in the same quarter in 2023. The total estimated dollar value of those deals stood at $1.75bn, down 10% from the estimated $1.94bn deal value of the same period last year.

But while they were down on an annual basis versus the same quarter in 2023, the Q1 figures of this year do not differ much from those in the intervening quarters. Throughout most of last year, there were roughly 40 rounds per quarter executed by the oil and gas peer group we have been tracking.

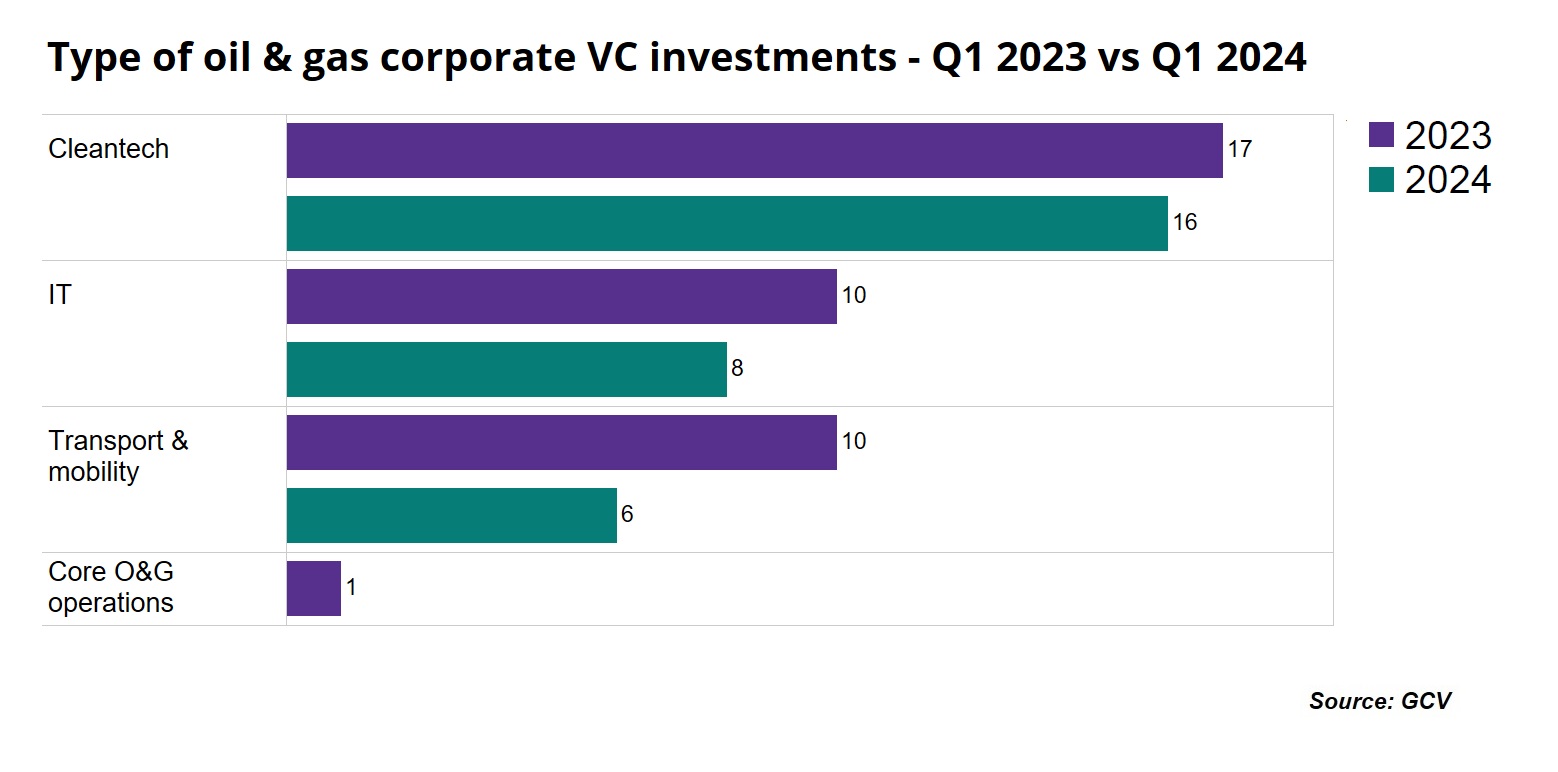

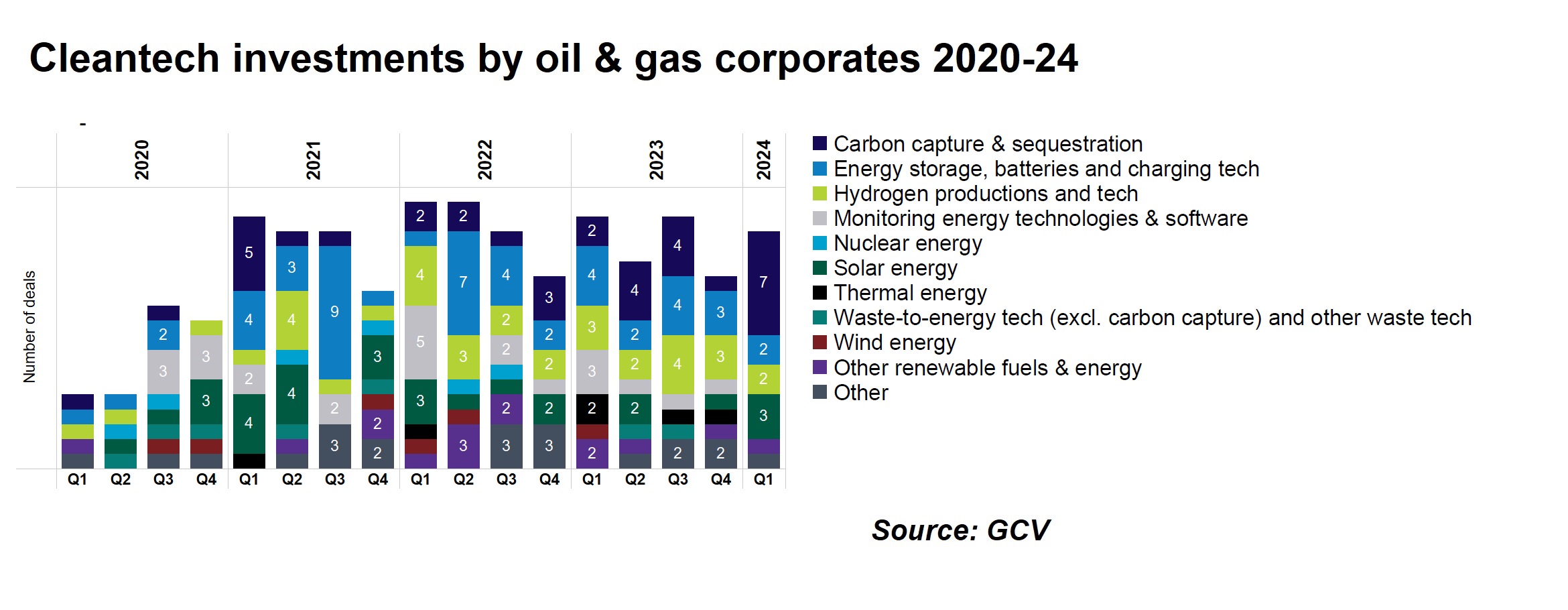

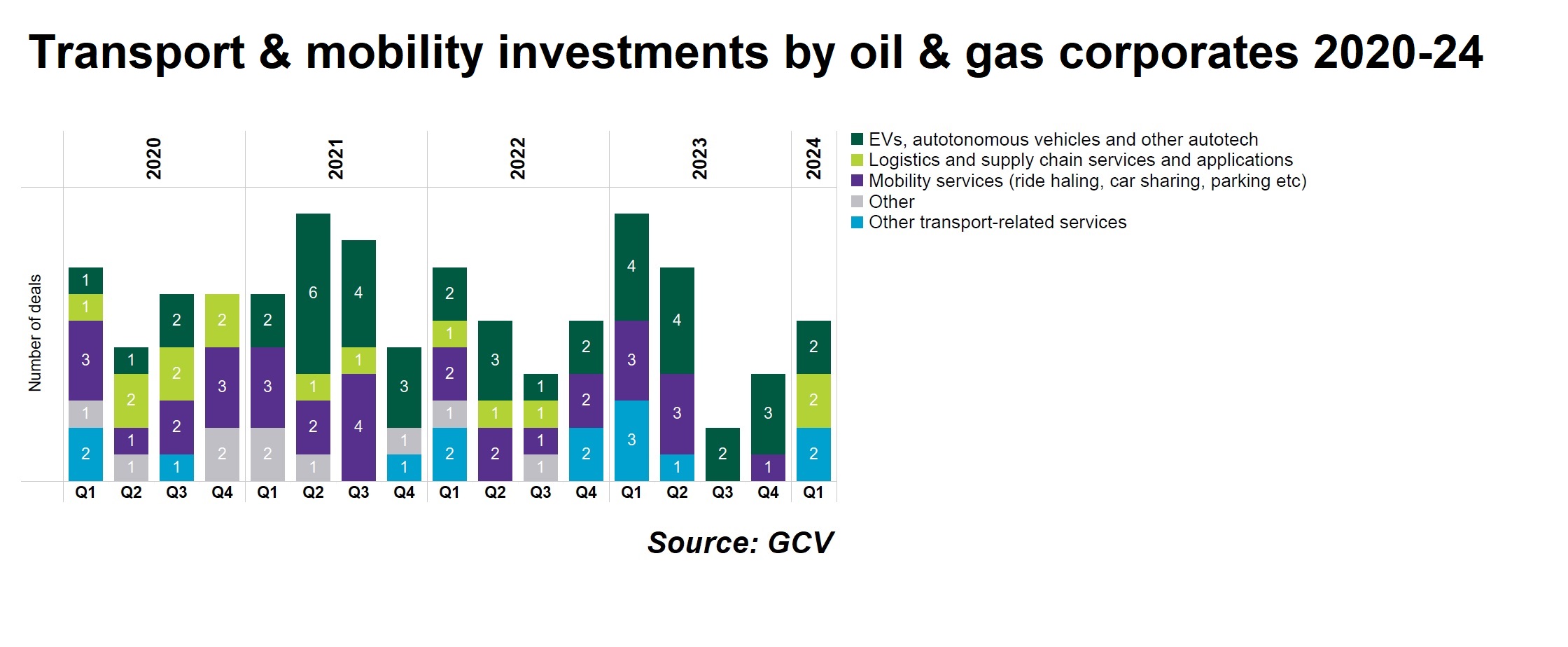

The number of deals so far this year appears somewhat modest, but it is still too early for conclusive projections. In terms of the three major areas for the peer group – core oil and gas (O&G) tech, IT and mobility – dealmaking has slowed down on a year-over-year basis. The number of cleantech rounds was roughly the same (17 in Q1 2023 compared with 16 in Q1 2024) and this was also true for deals in IT (10 in Q1 last year compared with eight this year). Only transport and mobility has seen markedly fewer deals in 2024.

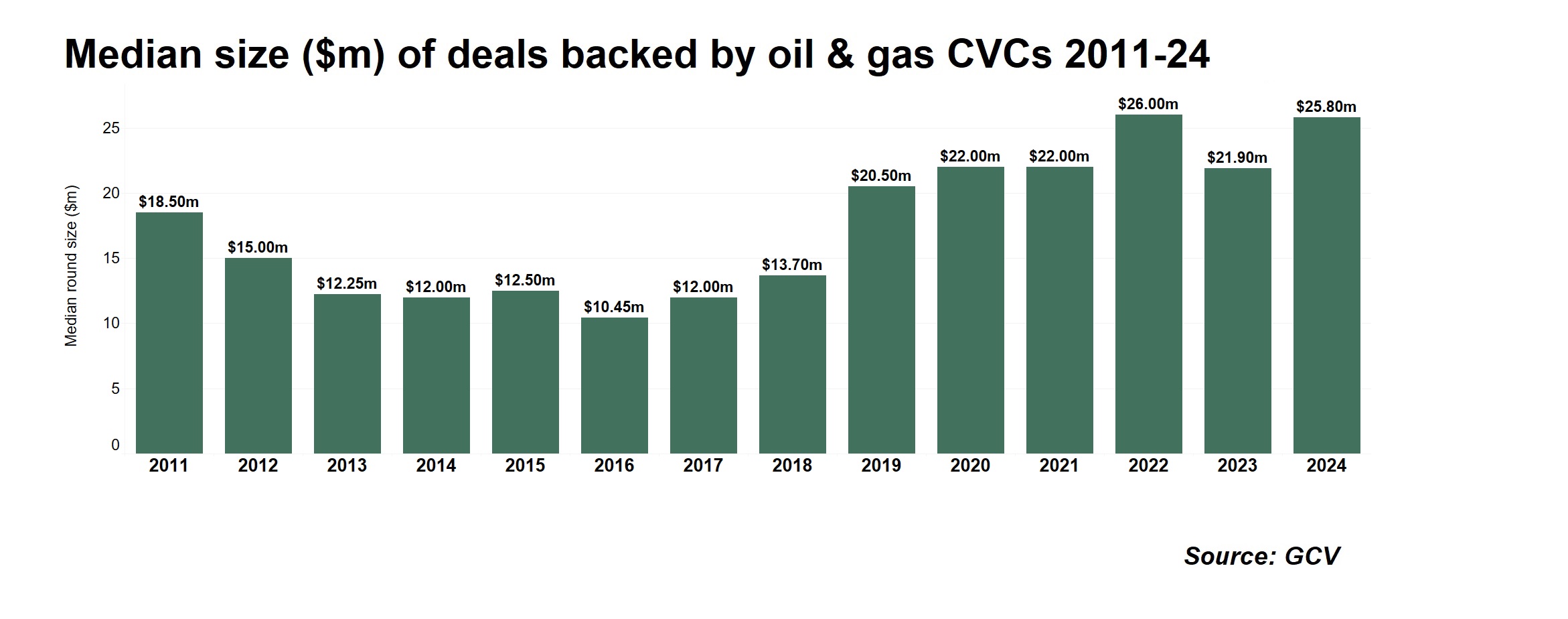

The median size of deals, covering both funding rounds and exits, for oil and gas CVCs stands at $25.8m so far in 2024. While this figure may well change throughout the year, it is broadly comparable with 2019-20 levels.

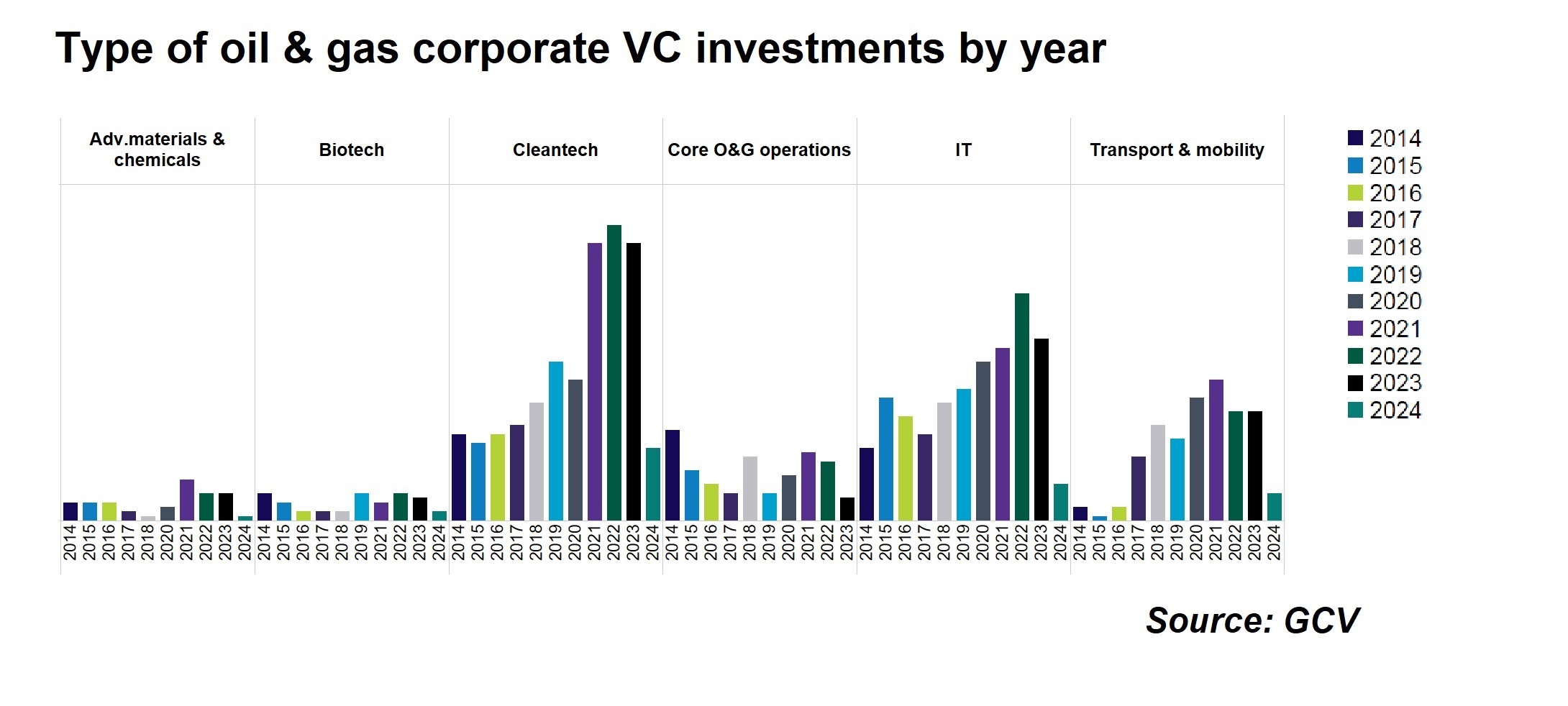

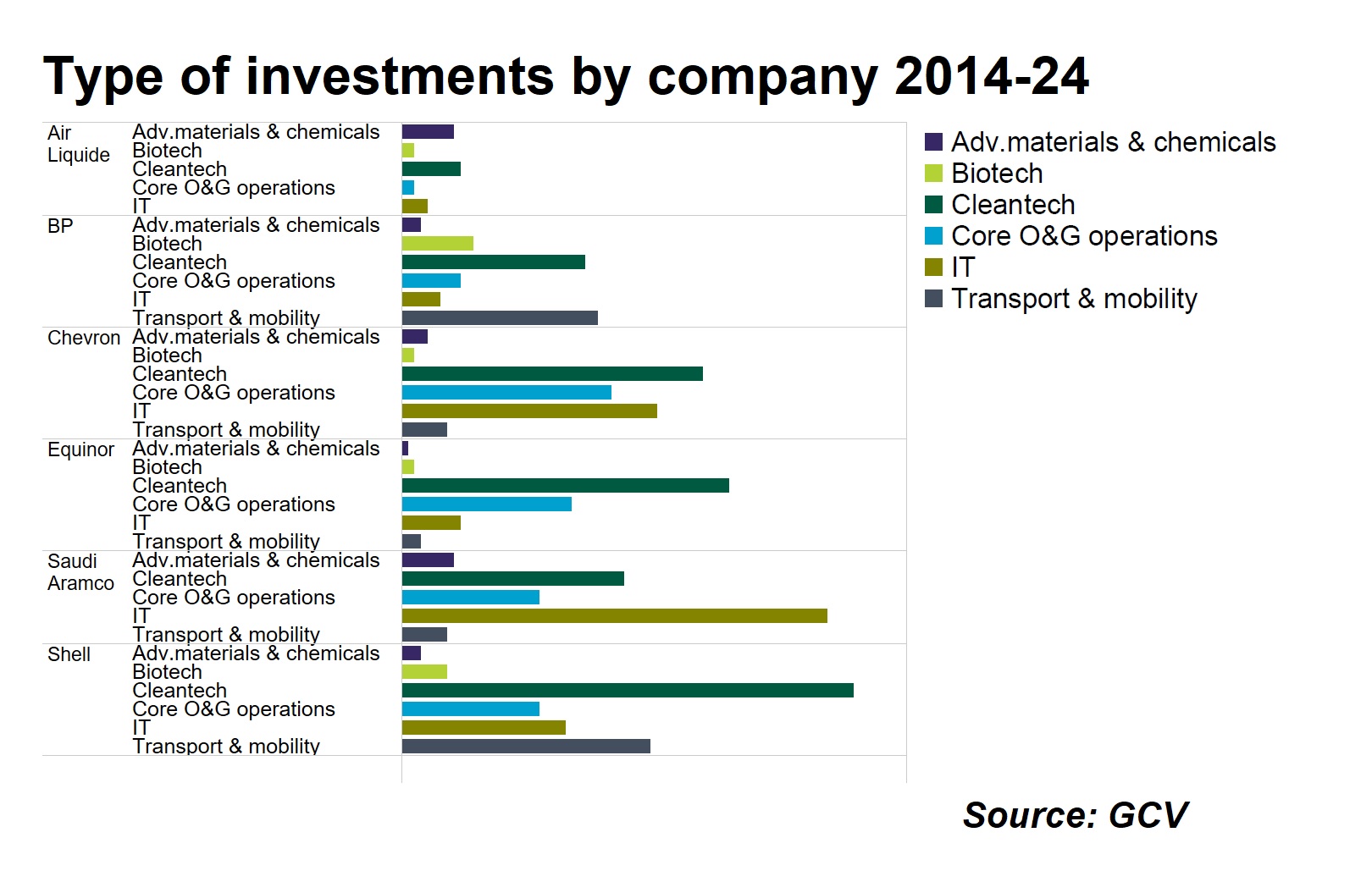

Since 2014, Shell, Chevron, and Equinor have been strongest in early- stage cleantech investments among the oil and gas corporates. Saudi Aramco and Chevron have dominated in the IT technology area, while Shell and BP have been the biggest investors in the transport and mobility sector.

Shift in focus

Over time, there has been an ongoing shift in focus among corporate venture investors from the oil and gas sector toward non-core domains, particularly IT, cleantech and transport and mobility.

Such non-core areas hold the greatest potential for disruption of oil and gas corporations. This narrative is often reinforced by media outlets, governments and various stakeholders advocating for the necessity and inevitability of a low- carbon future, ultimately signalling the need for a gradual phaseout of fossil fuels.

The increasing embrace of electric vehicles could potentially impact a significant portion of oil and gas firms’ customers, though the pace of this transition remains uneven. On the other hand, there are also promising decarbonisation technologies that can cut pollution by oil and gas operations.

There has also been a surge in the digital transformation of industrial processes, influencing production methods and operational efficiency. Recent advancements in fields such as artificial intelligence and edge computing, as well as the potential emergence of quantum computing have further propelled this trend, which is expected to hold in the foreseeable future.

Carbon capture and storage

Looking more closely at cleantech, it is technologies such as carbon capture and energy storage that have accounted for a large part of the investments in each quarter over the past few years. Q1 2024 was no different in that regard, with seven deals for carbon capture tech.

In the transport and mobility space, automotive technology (especially related to electric vehicles) and mobility-related services were the most popular investment areas in 2023. In Q1 this year, we also noted some interest in logistics tech showing up in the numbers (India-based Alt Mobility was backed by Shell Ventures and Israeli Sensos by Sumitomo).

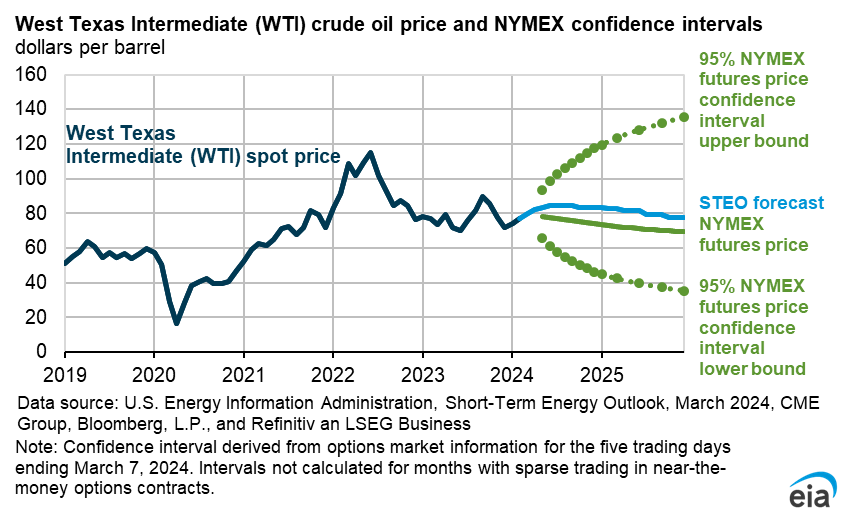

Commodity price impact

The oil and gas sector continues to be closely intertwined with fluctuations in commodity prices, which can occasionally experience heightened levels of volatility.

The benchmark price of West Texas Intermediate crude rose from around $72 a barrel at the start of 2024 to about $83 a barrel at the end of March and seems to be on an upward trajectory.

That increase has been propelled to some extent by a narrative of rising political tensions in the Middle East and further output reductions by Russia and OPEC, which has made some investment bank analysts raise their forecast to $100 a barrel this year.

This is not entirely surprising. OPEC supply cuts went on through much of last year, as we have commented previously, and the geopolitical tensions in the Middle East are not necessarily new at this point.

The latest Short Term Energy Outlook report by the US Energy Information Agency (from March 2024) revised its growth forecast for oil production downward because of OPEC production cuts. It expects the Brent crude oil spot price to average $88 per barrel and projects the WTI benchmark to peak at around $82 a barrel.

The report also forecasts that US retail gasoline prices will likely average about $3.50 per gallon this year, almost 20cents/gal higher on an annual average basis, due to higher crude prices.

The EIA Outlook expects natural gas prices to average below $2/MMBtu (million British thermal units) in 2024, due to a combination of stable production and natural gas inventories standing at 37% above the five-year average.

In the following sections, we will go over some of the largest deals, funds and people move highlights from the first quarter of 2024.

Healthcare | Human microbiome

Publications | Reports | GCV

Read the full report on your tablet or device.Download PDF

Deals- Oil and gas majors Chevron, Saudi Aramco and Shell were the most active in the top funding rounds by dollar size.

- The top fundraisers featured companies in a variety of areas, from AI and quantum computers to hydrogen tech and carbon removal to decarbonised steel production and autonomous vehicles.

H2 GREEN STEEL

H2 GREEN STEELSwedish electrified steel maker H2 Green Steel raised €300m in equity financing from investors including Microsoft’s Climate Innovation Fund and Siemens Financial Services. An additional €250m of grant funding was provided by the European Innovation Council Fund and the transaction was supported by €4.75bn in debt financing. The capital will go to building the company’s flagship production and recycling facility in the Swedish town of Boden, slated to be the world’s first large-scale green steel project

LILAC SOLUTIONS

US-based lithium extraction technology developer Lilac Solutions secured $145m in a series C round led by Mercuria Energy Trading, while other investors in the round included Presidio Ventures, Mitsubishi and BMW i Ventures. Lilac is developing lithium extraction technology designed to absorb lithium from brine resources more efficiently than current approaches. The process should enable lithium producers to accelerate project development, boost lithium recovery, streamline operations and unlock new resources

INERATED

German synthetic fuel technology developer Ineratec raised $129m in a series B round led by Piva Capital that also featured corporate backers Engie New Ventures, Safran Group, Honda Motor, TDK Ventures, Wind Ventures, Samsung Venture Investment and HG Ventures. The funding will be used to start building larger, industrial-scale plants worldwide. Ineratec’s technology produces hydrogen and synthetic fuels by combining renewable electricity with recycled CO2.

TOGETHER

Salesforce Ventures led a $106m round for Together, the US-based developer of an open-source artificial intelligence platform, at a reported $1.2bn post-money valuation. The round featured Saudi Aramco’s Prosperity7 Ventures fund alongside investors such as Hugging Face, Coatue Management, NEA and Kleiner Perkins. The funds will support the company’s expansion plans. Together has built a decentralised cloud platform that can be used to train and deploy advanced AI models.

OXFORD QUANTUM CIRCUITS

UK-based quantum computer developer Oxford Quantum Circuits (OQC) received $100m in a series B round led by SBI Investment and backed by Chevron’s venture arm, Chevron Technology Ventures, as well as University of Tokyo Edge Capital and Oxford Science Enterprises. Founded in 2017, OQC is developing quantum computers capable of crunching large quantities of data and designed to assist in solving challenges such as climate change and new drug discoveries. The funds will be used for R&D to bring enterprise-ready quantum computers to businesses globally.

CARBONCAPTURE

US carbon dioxide removal technology developer CarbonCapture raised an additional $90m in series A funding, adding to at least $35m already closed. Prime Movers Lab led the latest tranche, which included Aramco Ventures, Amazon’s Climate Pledge Fund and Siemens Financial Services, among others. CarbonCapture has created air capture systems that use molecular sieves, low-cost solar power and smart AI controllers to remove carbon from the atmosphere. The cash will be used to further refine the company’s technology.

NEOLIX TECHNOLOGIES

Chinese electric vehicle producer Neolix Technologies secured CNY600m ($83m) in its series C round, which was backed by Shell China, Qianhai FoF and CICC Capital. The funding will be channelled into research and development and the nationwide delivery and deployment of its technology. Neolix is developing and manufacturing unmanned logistics vehicles which can autonomously deliver and unload goods and cargo to any destination within a last-mile area such as an office park or university campus.

ZADEDA

Zadeda, the US-based provider of an edge computing orchestration platform, raised $72m in a series C debt and equity round led by Smith Point Capital. The round included Chevron Technology Ventures and fellow corporate investors Rockwell Automation, Juniper Networks and Porsche Ventures. Zadeda has developed a cloud-native virtualisation platform to monitor, visualise and secure real-time edge applications. It can connect to any cloud or on-premises system and helps organisations control their edge data and avoid being locked into specific vendors.

GEOPURA

UK-based green hydrogen producer GeoPura completed a £56m ($71m) round co-led by UK Infrastructure Bank and Sustainable Impact Capital that also featured General Motors and Siemens Energy, through GM Ventures and Siemens Energy Ventures, respectively. The funds will be used to expand the manufacturing of GeoPura’s hydrogen production systems. They use renewable energy, typically solar or wind power, to generate hydrogen and hydrogen-based zero emission fuels.

AIDASH

US-based satellite data analytics company AiDash secured $50m in a series C round led by Lightrock. It was joined by corporate backers Shell Ventures, Edison International, National Grid Partners, Schneider Electric, Duke Investments and Sabancı Ventures. According to PitchBook, $10m of the total funding came through convertible debt that was subsequently converted into equity. AiDash runs an AI-based data platform that facilitates satellite-powered operations and maintenance processes across a range of industries.

Healthcare | Human microbiome

Publications | Reports | GCV

Read the full report on your tablet or device.Download PDF

Funds- Fundraising activity in the first quarter of 2024 was particularly noteworthy, as one large oil and gas major doubled down on its commitment to corporate venture capital.

- We also saw funds focused on the energy and cleantech space being launched, raising money or closing. If this trend continues, energy innovation will continue to benefit from a relative availability of capital.

Aramco Ventures

Oil and gas major Saudi Aramco expanded its rebranded corporate venturing unit Aramco Ventures by committing an additional $4bn of funding. The move more than doubles the total capital allocated to Aramco’s CVC units from $3bn to more than $7bn. Ahmad Al Khowaiter, Aramco executive vice president of technology and innovation, says: “By injecting an additional $4bn in funding over the next four years, we intend to provide the financial backing required to take game-changing solutions to the next level. This will provide crucial impetus to businesses at various stages of development around the world, while also contributing to Aramco’s own long-term objectives.”

Before this capital allocation, Aramco Ventures oversaw three funds: a $500m Digital/Industrial Fund, targeting strategic technologies for Aramco; the $1bn Prosperity7 Fund, which focuses on disruptive tech ventures outside the energy realm; and the $1.5bn Sustainability Fund, which invests in startups aligning with a corporate aim to achieve net-zero emissions by 2050.

Nio Capital Domestic Fund

Nio Capital, the Chinese venture capital firm spun out of Shanghai-based electric vehicle producer Nio, raised RMB3bn ($417m) for a domestic-orientated fund. According to Nio Capital managing partner Ian Zhu, the fund will continue focusing on innovative technologies in the automotive and sustainable energy industries. Limited partners in the fund include unnamed local government guidance funds, national funds and family offices, as well as listed companies active in the energy and automotive space. The vehicle will remain independent from Nio and the companies will not be required to supply their products exclusively to the carmaker.

World Fund

World Fund, a venture capital firm focused on climate technology, closed its first fund at $325m. Ecosia, the German operator of an ecologically-minded search engine, formed World Fund in 2021 to back entrepreneurs working to tackle climate change. It aims to address the critical funding gap faced by climate tech startups, particularly at series B stage, known as the ‘valley of death,’ where many innovative firms struggle to secure the capital necessary to scale their operations. Consulting firm PwC was among the vehicle’s backers.

ABB Motion Ventures

Swiss electrical equipment producer ABB unveiled an open innovation and venturing arm called ABB Motion Ventures to back startups developing sustainability and resource-efficient technologies. The unit will be led by London-based Ana Troncoso Ceola, who joined ABB in November 2023 as executive vice president and global head of strategy, business development, sustainability and marketing. She previously worked at Shell as global VP of acquisitions, divestments and new business development for nearly four years, after more than a decade at mining group Rio Tinto.

Overture Climate VC

VC firm Overture Climate VC closed its debut fund at $60m, with limited partners including Schneider Electric’s SE Ventures, WovenEarth and Arcadia founder Kiran Bhatraju. It aims to back 35 startups, with a target cheque size of $1.5m to $5m. The fund has already invested in 21 hardware and software companies, including thermal battery developer Antora and geothermal heating and cooling provider Bedrock Energy.

Ada Ventures

UK-based diversity-focused VC firm Ada Ventures attracted $80m for the final close of its second fund. Limited partners in the fund include Legal & General Capital, as well as British Business Bank, The University of Edinburgh, Big Society Capital, Atomico, The Export and Investment Fund of Denmark and Molten Ventures. The fund will invest in climate equity, economic empowerment and healthy ageing projects to promote inclusivity and diversity.

Orano Venture Fund

French nuclear energy provider Orano set aside €50m to launch a corporate venture subsidiary dubbed Orano Venture Fund. Formed in partnership with deep tech VC firm Supernova Invest, the fund will focus on strategic investments in industrial technology startups. Key target areas include industrial performance and safety, advanced engineering technologies and sustainable chemistry and materials. It is expected to invest in around 20 startups at pre-seed to series A stage based in France and other European countries.

Corran II

UK-based private equity firm Corran Capital secured £80m for its second fund, dubbed Corran II, to invest in clean energy and climate tech across the UK. The fund has been backed by utility firm Scottish & Southern Energy and Corran used a portion of the capital to acquire a 30% stake in Vital Energi, a heat infrastructure and energy efficiency firm, from Scottish Equity Partners. Corran will collaborate closely with Vital Energi’s management to expedite the delivery of low-carbon heat and energy efficiency solutions across the UK.

Future Energy Ventures Fund I

Future Energy Ventures, a venture capital fund backed by German energy utility E.on, raised €110m for the first close of its climate technology fund. The vehicle, Future Energy Ventures Fund I SCA SICAV-RAIF, was launched in August 2022 when Future Energy Ventures was spun out of E.on, which remains its anchor investor. The fund can raise external capital as an independent entity and will focus on energy transition and sustainability technology developers based in Europe, Israel and North America. It will provide between €1m and €10m per deal, at series A and B stage.

People moves- We saw several personnel moves during the first quarter of 2024.

- Most notably, one of the most active units from the utilities space, National Grid Partners, completed a restructuring process and has a new leadership structure in place.

Steve Smith and Pradeep Tagare, National Grid Partners

National Grid Partners, the corporate venturing and innovation arm of utility National Grid, underwent a restructuring process. Steve Smith, NGP’s new president, will lead the unit with a renewed investment focus. National Grid hired Smith in late 2021 to oversee group strategy, innovation and market analytics. He held various innovation and regulatory roles at Lloyds Banking Group for more than a decade. Meanwhile, NGP’s vice president of investments, Pradeep Tagare, part of last year’s GCV Powerlist, will lead the unit’s investment team. Brett Chandler, VP of business development, is also part of the new leadership team, as is Gerard Kelly, VP of innovation and venture acceleration.

Masatoshi Nishi, Inpex Americas

Inpex Americas, a Houston-based subsidiary of Japanese oil and gas supplier Inpex Corporation, appointed Masatoshi Nishi as vice president of venture and business development. He will focus on startup investment and business incubation. Nishi joined Inpex in 2013 in Tokyo, and has held roles in areas including digital transformation and operational support. In 2022, Nishi moved to the US as VP of digitalisation and climate tech, before becoming VP of technical, new venture and business in May 2023. He had previously spent more than 20 years in various roles at oilfield services provider SLB.

Abhishek Shukla, Prosperity7 Ventures

Abhishek Shukla was promoted to managing director of Prosperity7 Ventures, a $1bn corporate VC fund formed by Saudi Aramco. He previously served as a partner for enterprise, infrastructure and deep tech investments for Prosperity7, which he joined in 2022. Shukla spent nearly four years at IT corporation Hewlett Packard Enterprises, where he was managing director of global venture investments, before being appointed senior managing director at CVC subsidiary HPE Pathfinder

Patrick Elftmann, Future Energy Ventures

Patrick Elftmann, a US-based partner at venture firm Future Energy Ventures, was promoted to managing partner. He joined Future Energy Ventures, then the corporate venturing arm of German energy utility E.on, in 2020, two years before it was spun off. Elftmann spent three and a half years at one of the unit’s predecessors, Innogy Ventures, initially at its Berlin office, before relocating to California in 2018. The announcement for his promotion came along with news the fund had boosted its coffers to €110m.

Mark Ritzmann, E.on Group Innovation

E.on Group Innovation appointed Mark Ritzmann as chief executive and chairman. Ritzmann joined the unit in 2020 as managing director, before moving up to vice president of corporate and startup partnerships. E.on hired Ritzmann as VP of innovation management two years prior. He already spent nearly two decades at telecoms firm Vodafone in roles spanning mobile commerce, financial services and business development.

Healthcare | Human microbiome

Publications | Reports | GCV

Read the full report on your tablet or device.Download PDF

About us

GCV provides the global corporate venturing community and their ecosystem partners with the information, insights and access needed to drive impactful open innovation. Across our three services - News & Analysis, Community & Events, and the GCV Institute - we create a network-rich environment for global innovation and capital to meet and thrive. At the heart of our community sits the GCV Leadership Society, providing privileged access to all our services and resources.

Navigation

test reg

test regLogin

Not yet subscribed?

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.Accept Read MorePrivacy & Cookies PolicyPrivacy Overview

This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience.Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.