Failure rates are high for VC-backed companies, and corporate-backed startups are not exempt. But which have been the biggest recent flops that left corporate investors licking their wounds?

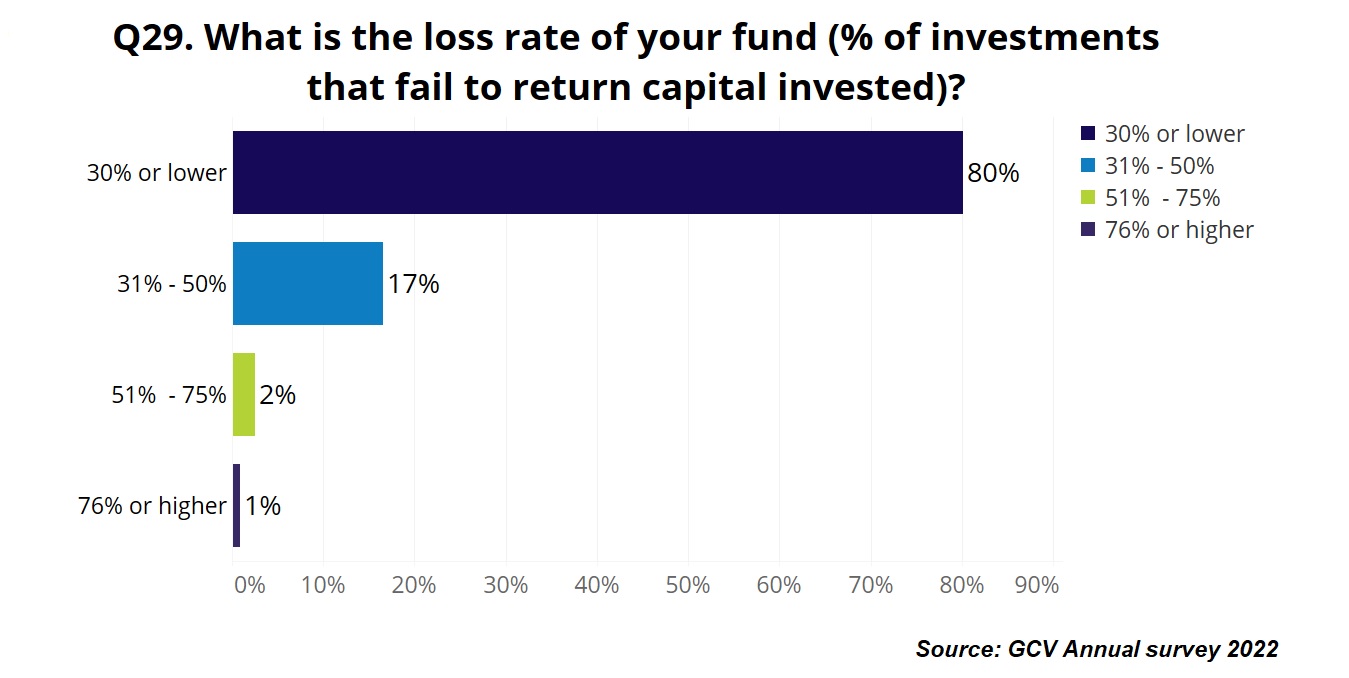

Venture capital is said to be the riskiest asset class in the world of finance and perhaps for a good reason. Estimates of how many investments in a venture portfolio fail vary greatly, depending on how you define “failure” — and it is particularly difficult to gauge this in an industry still wrapped in a veil of relative secrecy. Harvard Business School professor Shikhar Ghosh calculated in 2012 that three out of four venture-backed startups fail. Meanwhile, the US National Venture Capital Association estimates a slightly more benign failure rate of 25-30%.

Our own research into corporate-backed startups is more in line with this lower number. When we define failed portfolio companies more broadly as those failing to return the capital invested, the majority of corporates claim that it is 30% or less of their portfolios, according to data from our last annual survey.

[We are now running this year’s survey. If you are a corporate VC investor or traditional VC have a corporate LP check out our new 2023 survey and complete it to get a free copy of our annual report.]

In any case, it is fair to say that failure is commonplace. But what are the really big flops that have really left corporate investors licking their wounds? We’ve compiled a list here — deliberately excluding some of the well-known and more publicised failures of businesses backed by SoftBank, such as WeWork. This list includes some well-known investors, including Intel, GE, BP, Ford, TotalEnergies, AirLiquide — and shows that failure really does happen to everyone.

- OneWeb

Satellite company OneWeb had received $3.4bn in total prior to its insolvency declaration, from shareholders including Indian conglomerate Bharti, satellite companies Eutelsat and Hughes Network Systems, the SoftBank’s Vision Fund, conglomerates Grupo Salinas and Virgin Group, beverage provider Coca-Cola, aerospace group Airbus and mobile semiconductor manufacturer Qualcomm.

Founded in 2012, OneWeb had built a network of some 650 low Earth orbit (LEO) satellites to provide high-speed internet connection. The company filed for insolvency in March 2020 after it was unable to raise additional funding due to the impact of the Covid-19 public health crisis. Conglomerate Bharti Enterprises and the UK government invested $1bn in OneWeb in July 2020, before the corporate increased its stake to 38.6% through a $500m call option agreed in June 2021.

In 2022, OneWeb eventually found a solution and merged with Eutelsat, which had already owned some 22.9% of the company. The transaction reportedly valued OneWeb at $3.4bn. Not a bad ending, all in all.

2. Sigfox

France-headquartered internet-of-things (IoT) technology provider Sigfox, which had raised over $300m from a wide investor base including some 10 corporates, filed for bankruptcy protection in January this year. Sigfox had created an end-to-end connectivity system for IoT devices, enabling them to communicate with each other without using significant quantities of power. The company fell victim to the pandemic and the shortages of components, which ensued. According to a statement to TechCrunch, the decision was spurred by slow product sales. With the bankruptcy process, Sigfox sought an entity to acquire it. Eventually, Unabiz agreed to acquire it reportedly for just €25m ($26.7m). This was a drop in the ocean against what Sigfox had raised from investors including corporates like Salesforce, Air Liquide, Intel, Tamer, TotalEnergies, Engie, Eutelsat, SK Telecom, Telefónica and NTT Docomo.

3. Argo

The pandemic’s supply chain disruptions took their toll on the automotive sector as well. Car manufacturer Ford in latest earnings report had to take $2.7bn impairment cut because of its autonomous vehicle unit Argo AI, which was commented on by TechCrunch, resulting in an $827m net loss for Q3 2022. The company said it would focus on technologies with greater acceptance, such as advanced driver assistance. Ford was not the first to take such a paper loss, Volkswagen had already taken one with Argo in 2020.

Argo was aiming for fully autonomous (driverless) vehicles. The company was backed by Ford and Volkswagen with more than $3.5bn and even was expected to go public with a valuation of over $7bn. These accounting operations potentially relieve automakers in the short run when it comes to their tax bills but will they give up on the autonomous driving dream? That remains rather uncertain at present. Read more on it in James Mawson´s recent comment here.

4. Peloton Technology

No, it is not the treadmill with tablet slapped on it (though that one seems to be in trouble as well). Peloton Technology claimed to be the first company to test truck platooning technology — where trucks drive in convoy using automated driving assistance to maintain set, close spacing — on US roads. Peloton had received backing from numerous corporate VCs across sectors – semiconductor maker Intel (Intel Capital), petroleum producer BP (BP Ventures), communications equipment provider Nokia (NGP Capital) and logistics service provider UPS (UPS Strategic Enterprise Fund), automotive systems producer Denso International America, oil and gas company Schlumberger, carmaker Volvo, conglomerate Mitsui, aerospace company Lockheed Martin, electronic display provider Okaya and fuel management company Breakthrough Fuel.

The company went out of business, definitively ceasing operations in 2021. How did so many corporates get it wrong all at the same time? It is not entirely clear. It was known that the company got into a legal scuffle with its landlord Kelly Ventures in mid-2020 over alleged violation of the then-nationwide moratorium on evictions. In the legal battle, the company claimed to have lost significant amounts of revenue due to the pandemic.

5. Chushou

Up-and-coming tech businesses don’t only fail in the Western world; there is no shortage of publicised failures in Asia. One of them was China-based live-streaming platform Chushou, which received a $77m investment from Google in 2018 and its Chinese peer Baidu´s iQiyi subsidiary, among other investors. The platform was focused on live streaming eSports events. According to an interview with its founder for Surging News in 2019 it was even close to breaking even – something which should be taken with a pinch of salt, as subsequently, the streamers reportedly started complaining about not receiving revenue share payments and at least one influencer agency sued it, according to the EsportsObserver.com. Much like other live streaming companies that tried and failed, this one most likely could´t stand the heat being in competition with giants like Tencent.

6. Basis

With the FTX bankruptcy drama unfolding and Bitcoin price pulling back well below $20,000, we cannot help including a cryptocurrency company on this list. US-headquartered Basis had developed an online cryptocurrency platform designed to keep prices stable by algorithmically adjusting supply. Basis was one of the early attempts to create a dollar-pegged stable coin, way before the infamous Terra fallout. This one didn’t live long enough to see Bitcoin surge to over $60,000, pulling the entire cryptomarket up with it. It filed for insolvency in late 2018. Prior to that, it had raised a $133m funding round featuring the Digital Currency Group and another round featuring Binance Labs. According to some observers in the crypto space, it went down because of the team’s failure to understand and comply with existing SEC regulations. Its dollar-pegged bonds and stocks were treated as unregistered securities, subject to transfer restrictions. Its founder reportedly returned the remaining funds to the company backers when the regulatory hurdle became too big to handle.

7. uBiome

With most developed drug molecules never making it to market, it is hardly surprising that at least company on this list should come from biotech. This one was uncannily reminiscent of Theranos, too. uBiome was the developer of sequencing-based clinical microbiome tests designed to gather, analyse and translate data about the human microbiome. In 2018, the company had raised $83m in series C funding from investors including Dentsu Ventures, the corporate venturing arm of marketing firm Dentsu.

The company struck a partnership with L’Oréal in 2019. However, shortly after, the FBI raided uBiome’s offices, following an intense scrutiny of the lab-testing company’s billings involving Medicare. CNBC reported that uBiome had committed insurance fraud, routinely billing patients multiple times without consent and pressuring doctors to approve tests with minimal oversight. Later on, company insiders told Business Insider that uBiome’s science was flawed. In October 2019, less than one month after filing for bankruptcy, uBiome shut its doors and sold off its assets. The morale of the story is that, whether in biotech or elsewhere, there are always bound to be some bad apples in venture capital.

8. Airware

Business failures did not spare the drone space either. US-based drone operating system developer Airware, backed by multiple corporates, shut down in 2018, having reportedly secured a total of $118m in funding prior. Founded in 2011, the company had developed an operating system for commercial drones dubbed the Aerial Information Platform, which enabled enterprise clients in industries such as construction, mining and insurance to analyse aerial data. Eventually it pivoted to building its own drones, but could not compete with more established players and finally tried to offer consultancy services on how companies could benefit from unnamed aerial vehicles. The company counted among its backers internet conglomerate Alphabet (GV), industrial equipment maker Caterpillar, semiconductor maker Intel (Intel Capital), industrial conglomerates General Electric (via the now defunct GE Ventures) and Mitsubishi as well as John Chambers, the executive chairman of networking technology provider Cisco. Curiously, the company even ran its own corporate venture capital arm, Commercial Drone Fund.

9. Adero

US-based tracking device developer Adero developed a bluetooth-based tracking device designed to assist people in finding their lost items. Its corporate backers included Amazon’s Alexa Fund and telecoms firm NTT Docomo, who helped it to raise a $51.5m series B round in 2017, reportedly putting its pre-money valuation at $150m. Later in 2018, Adero raised $10m in its series C round at a massively reduced valuation of $40m, according to PitchBook. According to Tech Crunch, it was at around that time when Adero pivoted from making an increasingly commoditised tracking device hardware to building software, while laying off 45% of its staff. The pivot didn’t work, however, and the company shut down in 2021.

This list shows how varied the reasons for failure are. Criminal behaviour is definitely a factor, and shows how important it is not to skimp on due diligence. Misjudging the market, underestimating the strength of competition and poor timing, however, are far more commonly — if less dramatically — the reasons that an investment fails to work out.