Only 6% of large Canadian corporations invest in startups — and most of their spending is directed abroad, according to a new survey by Deloitte Ventures.

Only 6% of public Canadian companies with more than C$1bn in annual revenue are making venture investments in startups, according to a new report published today by Deloitte Ventures. This is compared to some 40% of their counterparts in the US.

The report identified just 19 Canadian CVC funds actively engaged in venture deals in 2023.

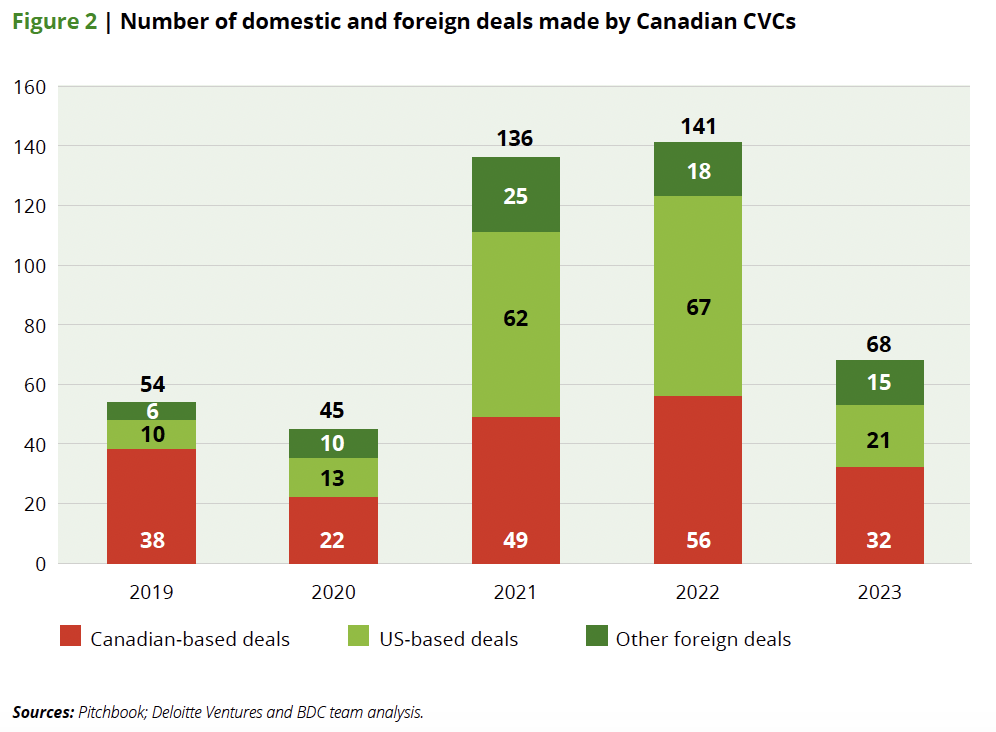

Moreover, when Canadian companies do invest in startups, they direct most of their spending abroad. Some 53% of Canadian CVC funding goes to companies outside of Canada.

“Canada’s corporate sector continues to punch below its weight in VC. When compared to countries like the United States, Canadian corporates exhibit lower activity in VC and tend to direct their investments primarily toward foreign companies,” says Jérôme Nycz, executive vice president of Business Development Bank of Canada’s BDC Capital unit, which co-authored the report.

“At the same time, the predominant share of CVC investments in Canadian startups comes from foreign entities.”

This is a missed opportunity for both corporates and startups, says Talia Abramowitz, managing partner of Deloitte Ventures, Deloitte Canada’s C$150m ($110m) venture fund.

“More engagement from Canadian corporates in venture capital can yield a ‘triple-win’ for Canada, benefiting corporations, start-ups, and the Canadian economy at large,” says Abramowitz.

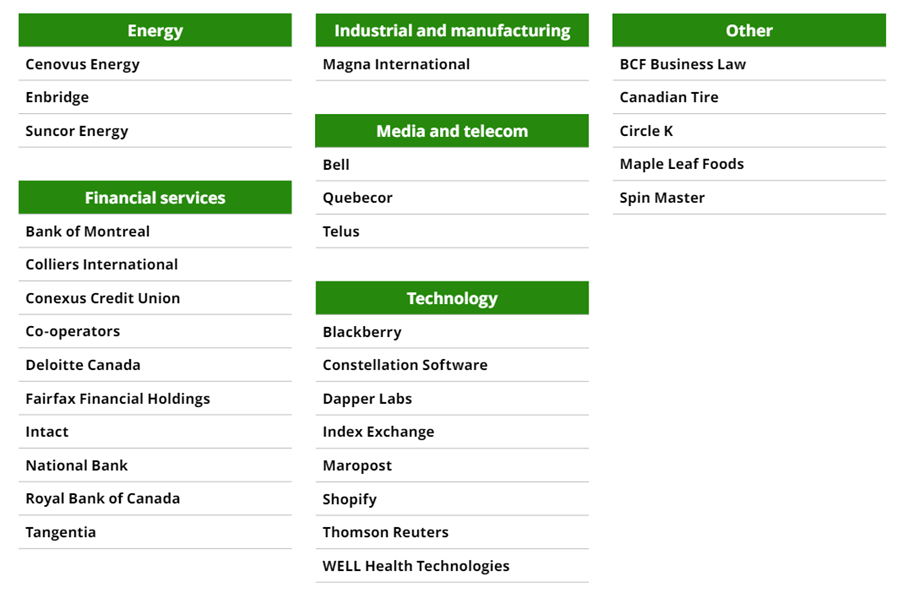

Most Canadian firms with corporate venturing funds are in the financial services, media and technology sectors, but sectors such as energy and natural resources, where Canada has natural advantages and a strong global presence have very few investment units.

Signs of growth

The good news is that there are some signs of growth in Canadian CVC. The number of corporate venture capital units is increasing in Canada and their dealmaking pace has grown faster than that of financial VCs between 2019 and 2022, Deloitte’s latest findings show.

Companies like Deloitte Canada, Bell, Canadian Tire and Thomson Reuters have all launched CVC units in the past few years.

“Building a CVC team has never been easier,” says Abramowitz. “There is greater availability of corporate executives with experience launching CVC funds and professionals operating within them. It’s also facilitating the sharing of best practices and pitfalls.”