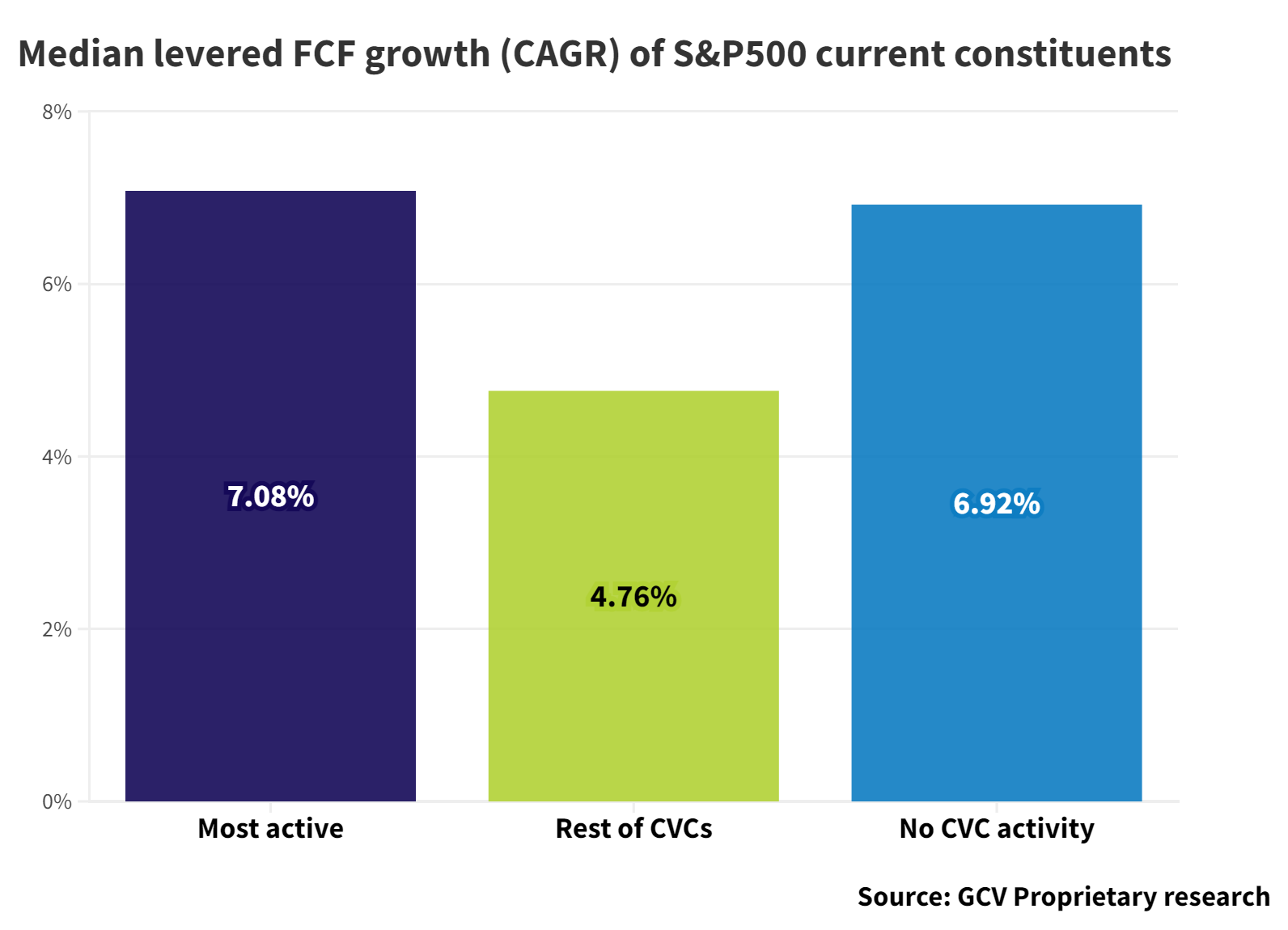

In fact, doing it badly is worse than not having any CVC activity at all.

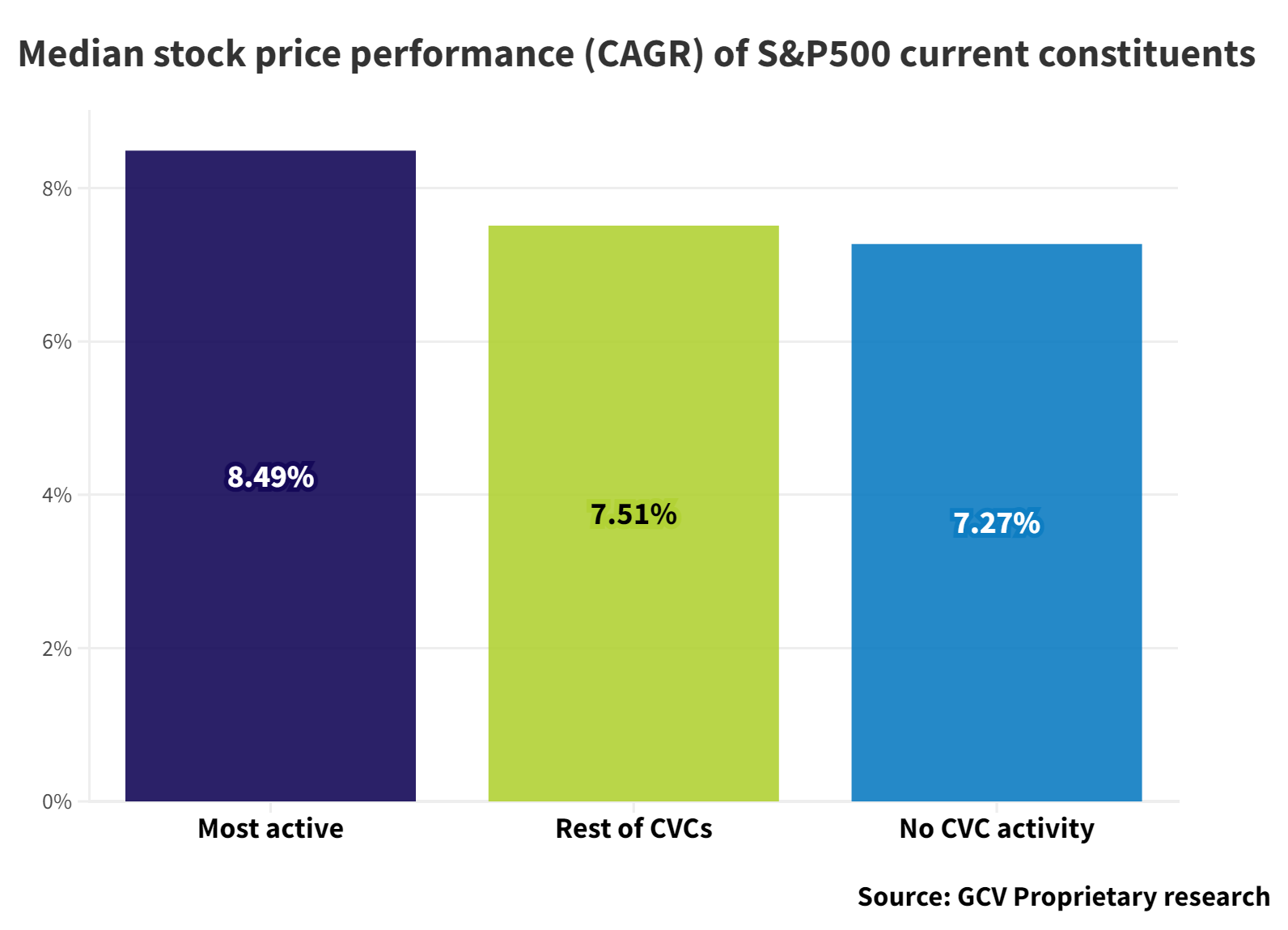

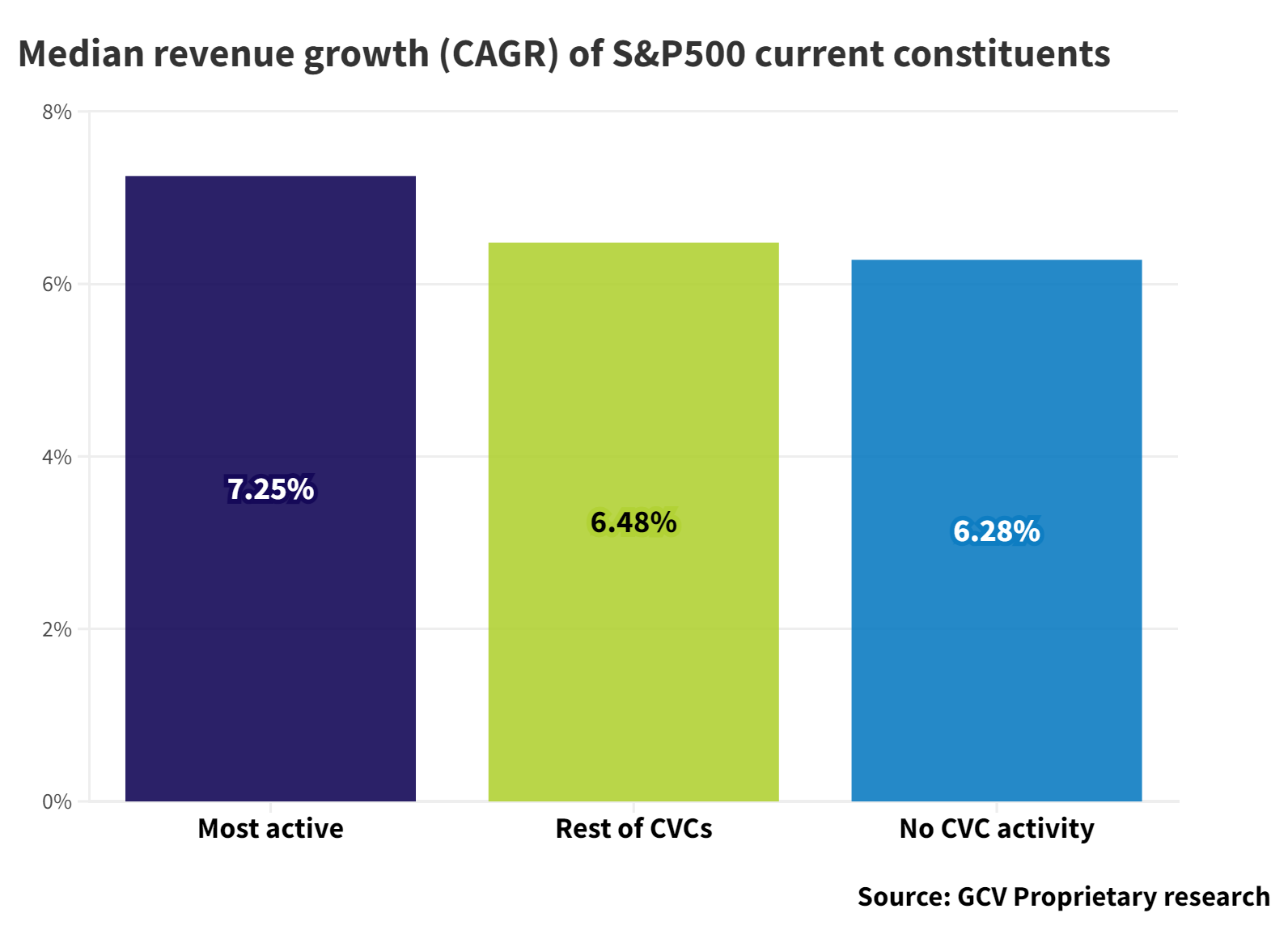

S&P500 companies with “active” corporate venturing arms outperform those with little or no CVC activity on various measures, according to research carried out by Global Corporate Venturing. Those include stock price performance, revenue and free cash flow.

We looked at a group of companies on the S&P500 list that had cumulatively made more than 11,000 corporate venture deals over the five-year period between 2019 and 2023, and compared them with those that had no CVC activity at all. We looked at the performance of companies over a 10-year period between 2013 and 2022.

We found some small differences in performance when companies were divided simply into two groups — those engaging in CVC and those that did not (GCV subscribers can see the full analysis here).

However, differences became much more significant when we further subdivided the CVC-activity companies into those that were “most active” in corporate venturing — meaning they had made at least 25 investments that period — and those who did fewer.

This “most active” corporate investor group outperformed other S&P500-listed companies on a number of performance measures. One of the most noticeable of these was stock price growth in the period between 2013 and 2022.

There was also a difference in revenue growth over the same ten-year period for these three groups of companies.

Interestingly, when it came to free cash flow — arguably one of the best ways to evaluate corporate performance because this measure is the least susceptible to manipulation — corporates with an active CVC unit performed best, but those with low or ad hoc CVC activity performed worse than companies with no CVC activity at all.

The fact that there was significant difference between groups with active and low CVC activity raises some interesting questions. It suggests that if CVC activity does have a positive impact on corporate performance, that only happens when a company commits to organised and consistent investment activity. Doing CVC in a more half-hearted or ad hoc way might, in fact, be detrimental to corporate performance, if you look at the free cash flow trend.

The research comes with some caveats. It is important to note that correlation is not causation. Our study cannot show if the presence of a CVC unit is the reason that these companies see stronger performance. It may be that better-run companies, which are more likely to have strong performance indicators, are also more likely to have an active corporate venturing programme. Or that such a programme is put in place only by companies that are already performing well and thus have some excess resources to allocate. Poorly-performing companies may also be more likely to cut an existing CVC programme.

But the gap in performance levels between corporations with high levels of CVC activity and those without is big enough to raise interesting questions, and merits further investigation.

GCV subscribers can see the full analysis here.