More than 300 new CVC units have been created since 2020. They are less US-centric and more focused on energy than older peers.

The investment arms set up by corporations in the past four years are more strategically focused than the average corporate venture unit, according our 2024 survey of the global corporate investor ecosystem. Newer CVCs also have a more focused interest in energy and IT and are more likely to be looking at making investments outside of the US.

Every year the GCV Keystone benchmarking survey records the operating structures and investment focus of corporate venture units globally to see what emerging trends are in the sector. Since 2020 we have seen more than 300 corporate venture units being formed, many of them in Asia and Latin America.

We took a look at what this group of new “startup phase” CVC units is focusing on, looking at the way this group differs from the general population of corporate investment arms.

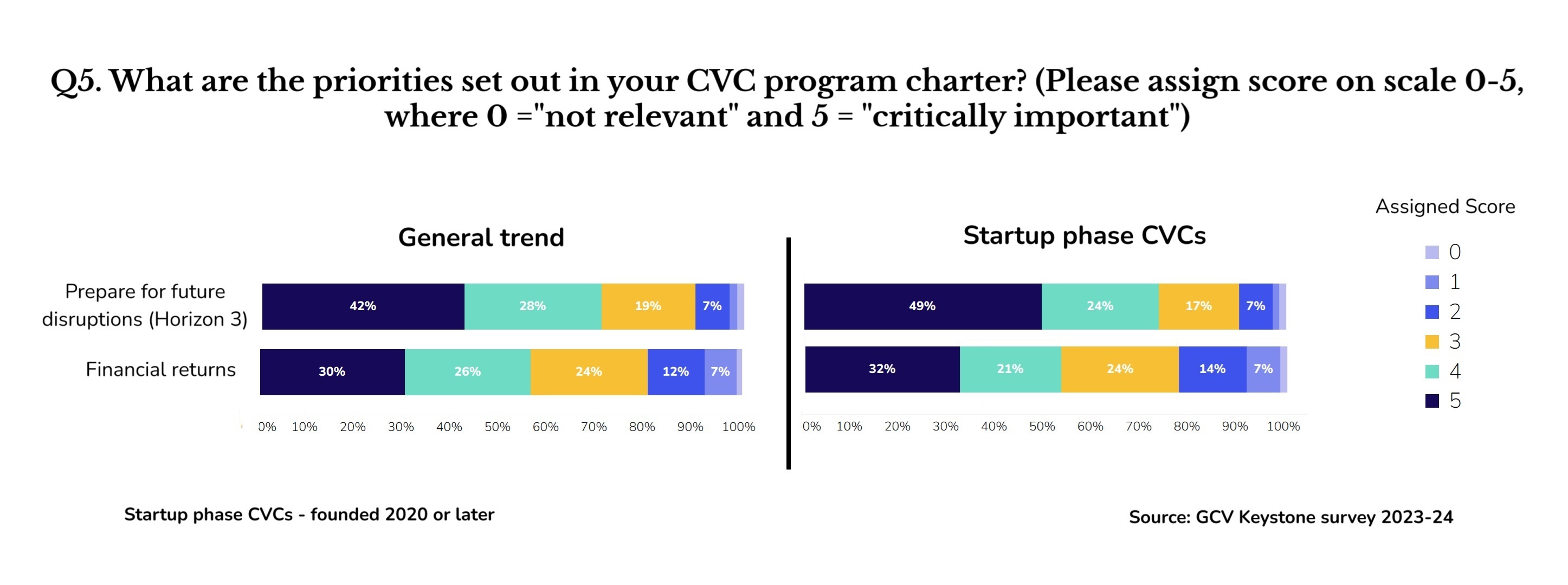

One difference was a lightly lower emphasis on financial returns. Some 53% of startup-phase CVC units indicated that these were critically important (dark blue bar) or important (mint green) compared with 56% in the overall study. A higher percentage — 21% — of startup-phase CVCs said financial returns had low or no relevance (lighter blue bars), compared with 19% in the overall group.

At the same time, some 63% of startup-phase CVCs saw preparing for future disruptions in their industry as critically important or important in their programme charter, compared with 60% in the industry overall.

The differences may be relatively small, but nevertheless point to a shift in positioning at these units. CVC units almost always have dual missions of both financial returns and strategic benefits but the relative importance of these varies at each unit.

A greater emphasis on looking at the strategic benefits that investment in startups can bring to big companies is not entirely surprising, given that over the past two years the venture capital markets have slowed, with startup valuations down and fewer exits for investors. With the financial returns of investment portfolios muted, it is natural that corporate investors would emphasise the other benefits of these commitments: opportunities to learn from and collaborate with startups bringing new ideas to their sector.

Help us make the 2025 survey even better!

The annual GCV Keystone study is the world’s largest survey of corporate investors, and allows units to benchmark their performance against global norms.

If you take part by filling in your unit’s data we will send you a free, advance copy of the 2025 report.

Growing focus on non-US startups

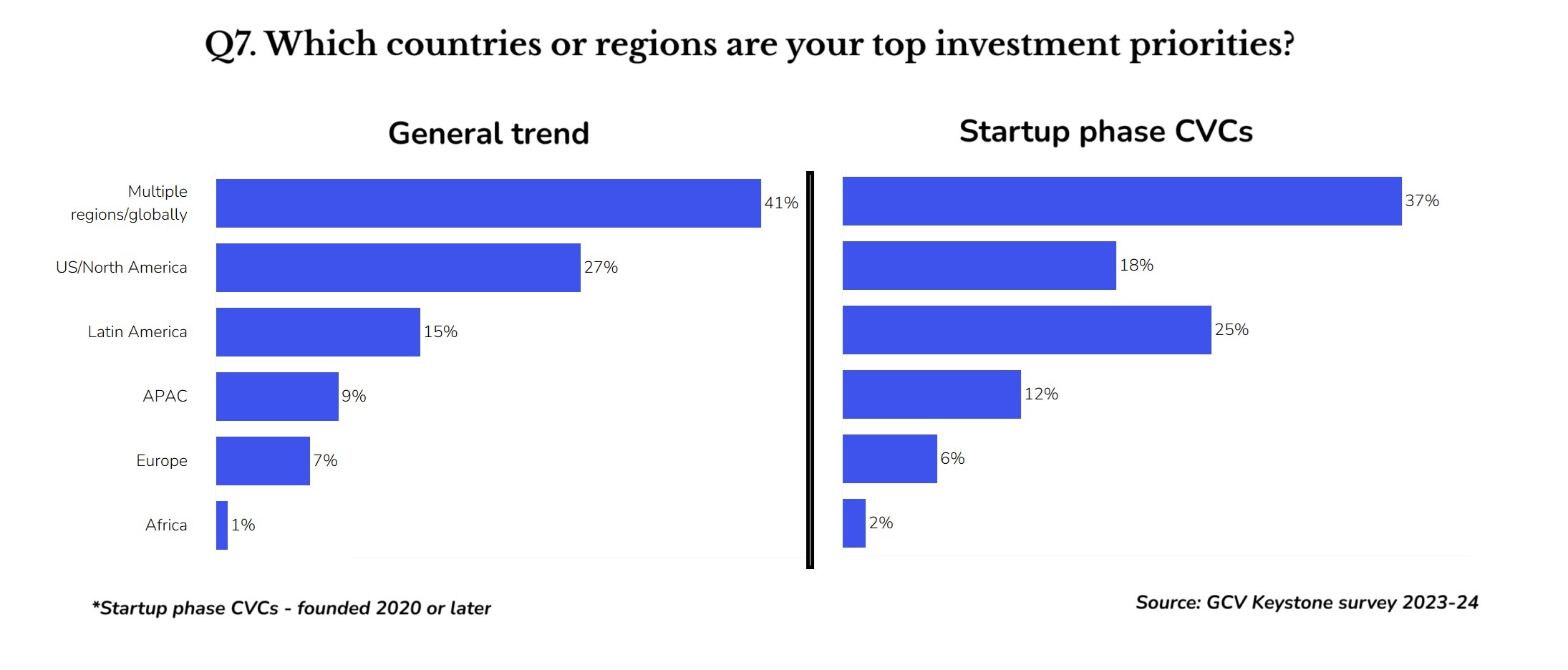

Newer CVC units are also more likely to be interested in investing in startups outside North America. Only 18% of the new startup-phase CVCs, those founded within the past four years, cited the region as a top investment priority, compared with 27% in the overall group.

This at least partially reflects the fact that countries such as Japan and Brazil have seen particularly strong growth in CVC activity in the past few years, and many of these units have a heavily domestic focus.

CVC investors overall appear to be increasingly interested in looking at a variety of markets. Sony Ventures, for example, recently launched an Africa investment fund. The investment arms of many large US corporations say they are interested in investing more in Europe.

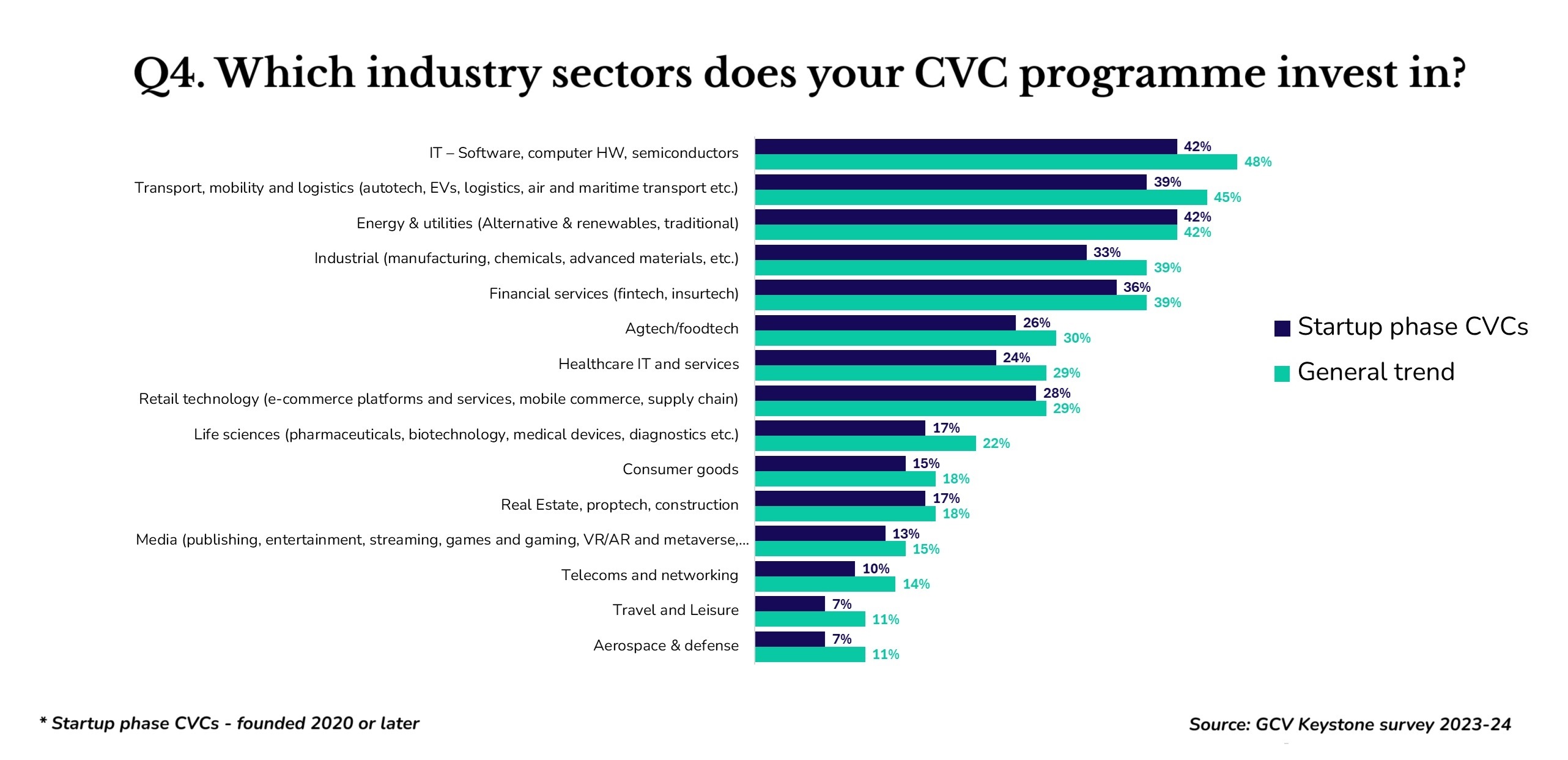

More look at energy

The newer crop of CVC investors were also more interested in energy investments than the general group. IT investments have typically been the focus for most CVC units, with nearly half of the general group selecting this as a key sector to invest in. Many older CVC units have grown out of a need for corporations to keep up with digitisation trends — and new information technologies such as artificial intelligence continue to be strong themes for them.

But for startup-phase CVCs, investments in energy were tied with IT as a top investment priority. This trend no doubt reflects the urgent need for every industry to decarbonise. It will be interesting to see if CVC units set up from the outset to solve a slightly different corporate need — lowering emissions versus catching up on IT developments — will invest and operate differently.

These are just a few of the insights that we have pulled from last year’s GCV Keystone benchmarking survey. We are currently collecting data for this year’s survey and would like to make sure this is as comprehensive as possible. Please help us by adding your CVC unit’s data to the study. All answers are anonymised and every respondent will receive a free, advance copy of the resulting survey results.

Maija Palmer

Maija Palmer is editor of Global Venturing and puts together the weekly email newsletter (sign up here for free).