Corporate funding for startups is rising globally as well, with sectors such as as cybersecurity and healthcare seeing the most activity.

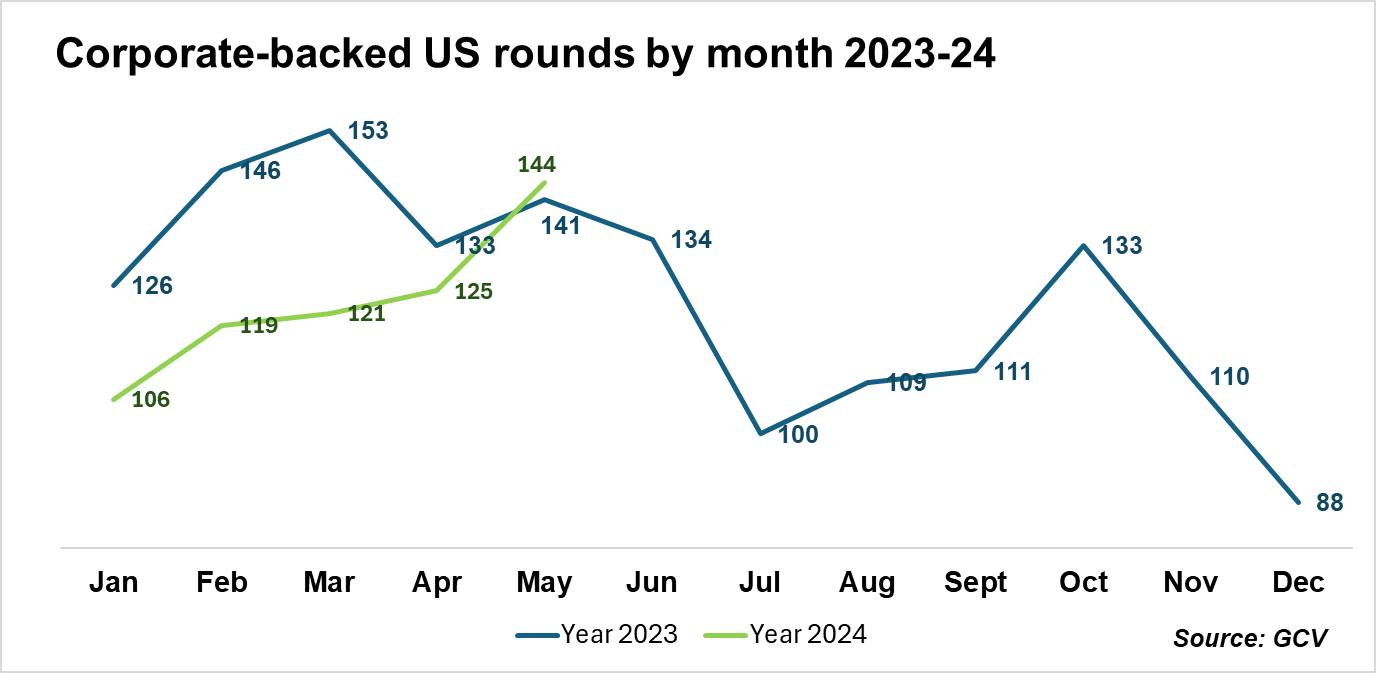

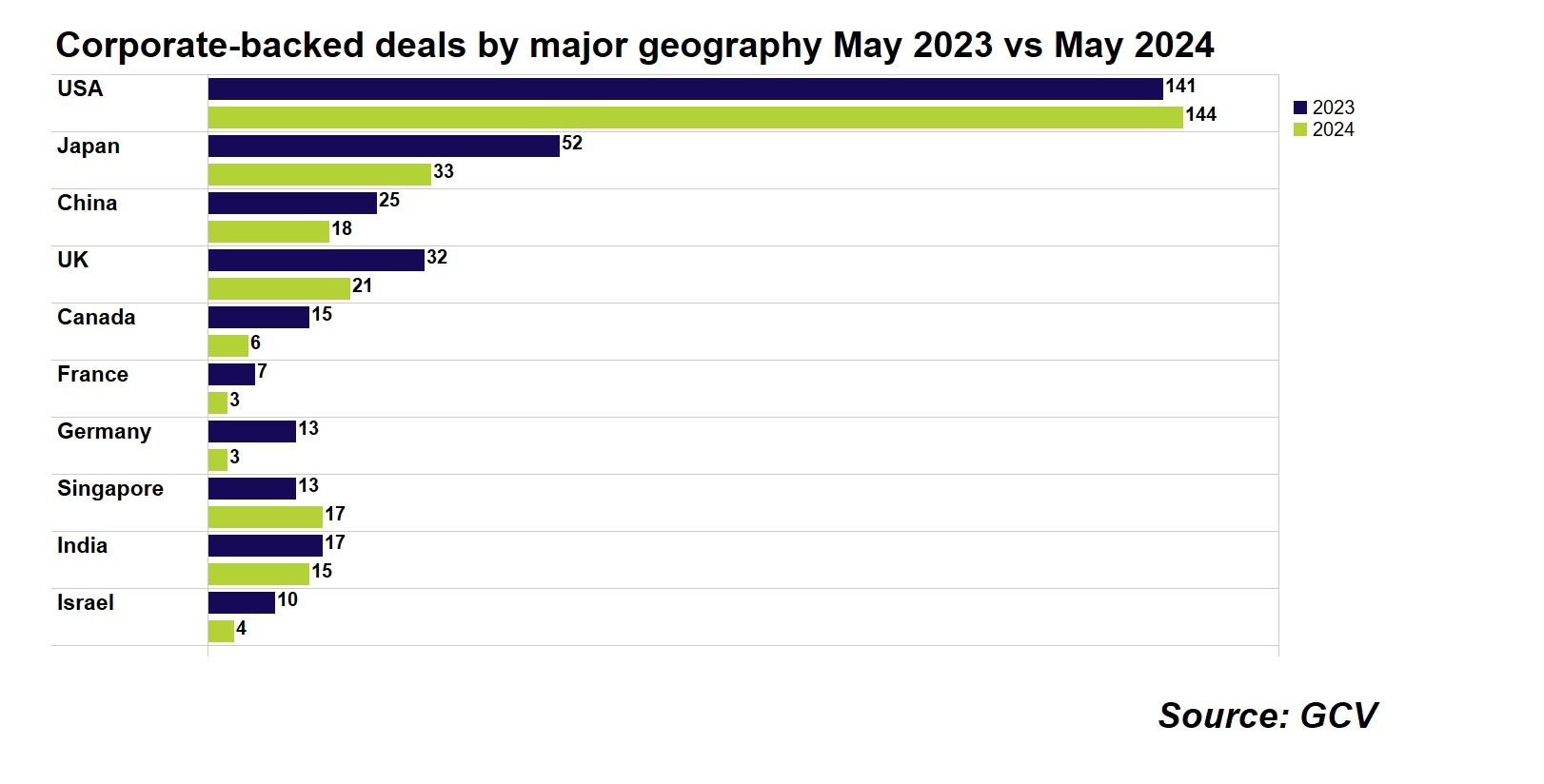

Corporate-backed startup funding deals rose in the US for the first time since April 2022. Our data showed that there were 144 deals May 2024 in the country, up from 141 in May 2023. This is only a small rise in deal numbers, but it is a notable change from the steep declines the US market has had over the past two years. US CVC deals were down 19% year-on-year in the first quarter of 2024, but the May numbers show there may be a change in sentiment.

Browse the full list of corporate backed deals.

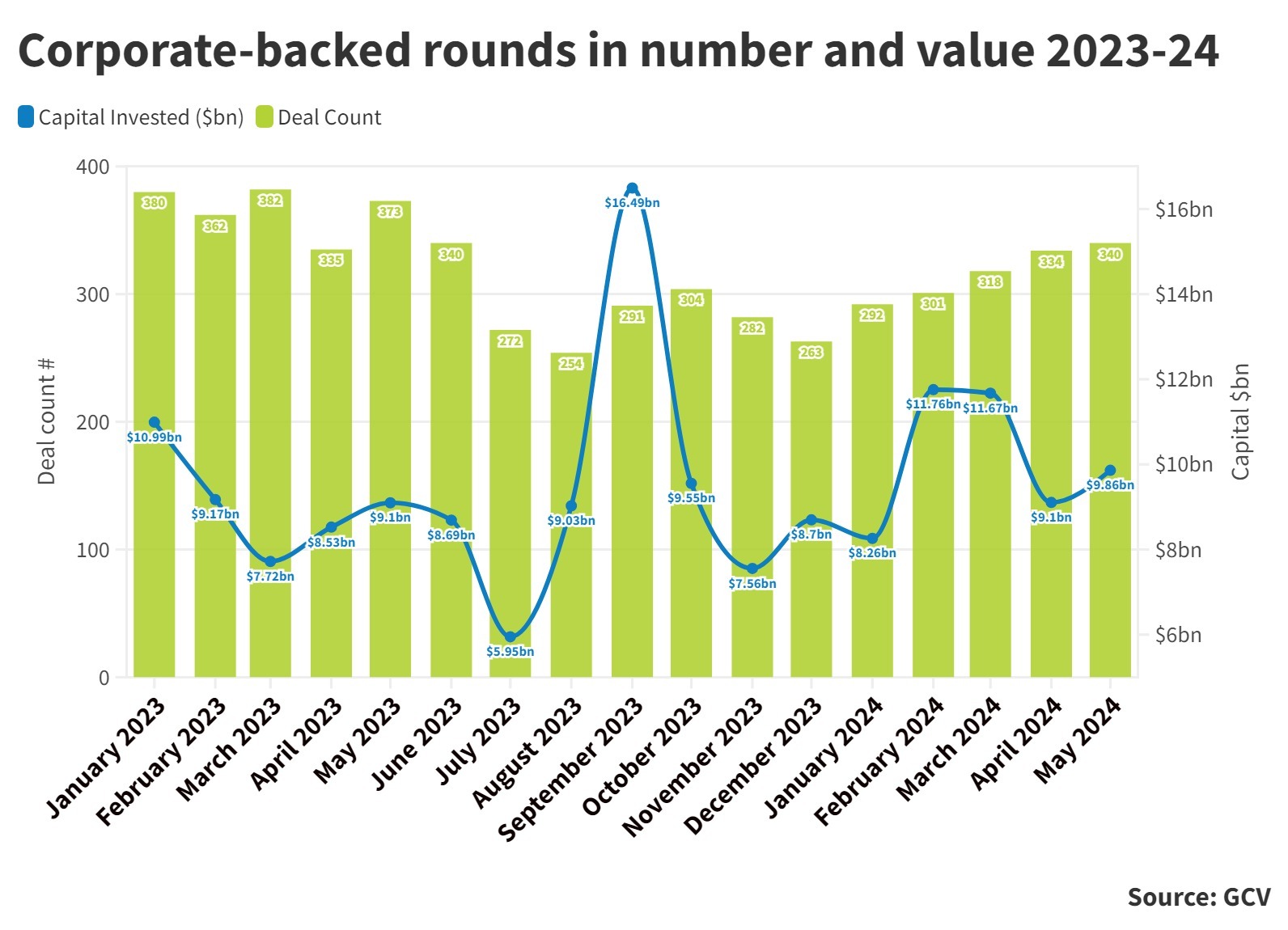

The number of corporate backed deals overall is slowly creeping upwards globally. The amount of funding rounds that included a corporate backer has been on the increase since the beginning of 2024, and as we edge towards the second half of the year, it looks like 2024 could be the year that the markets consolidate their recovery from the post-covid dip.

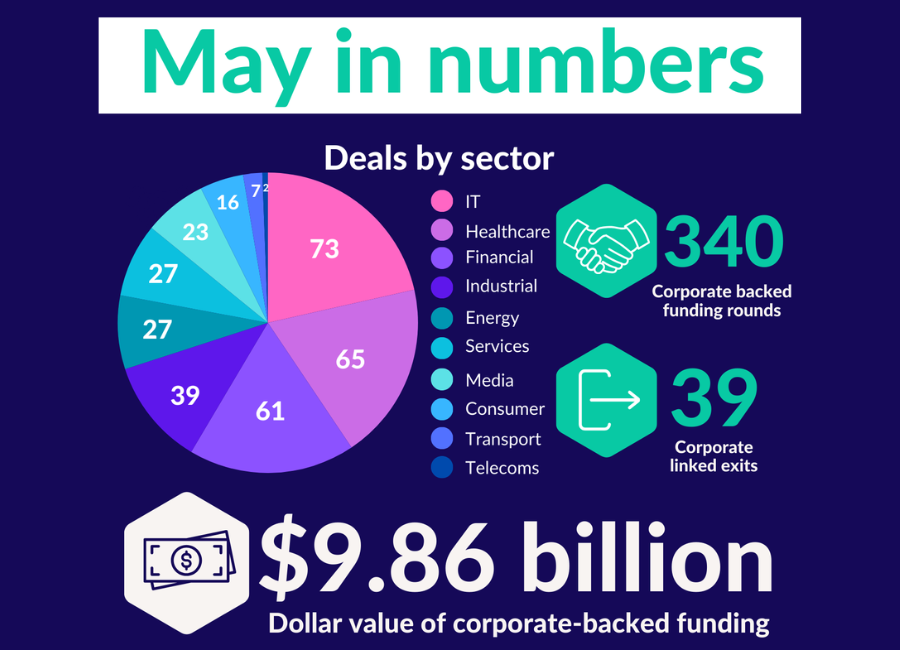

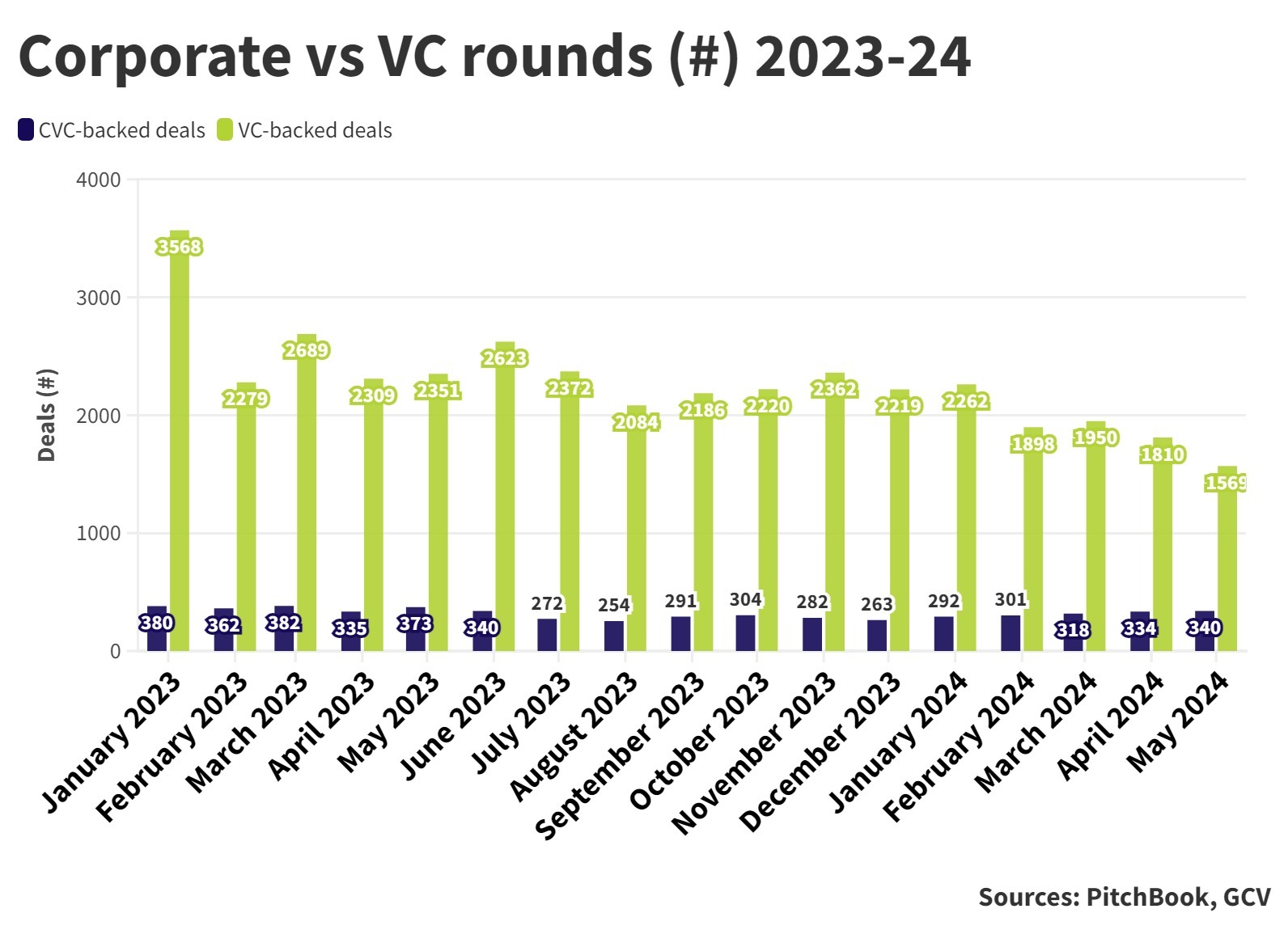

There were 340 corporate-backed funding rounds in May, still down 9% from the 373 of May last year. The total estimated dollar value, however, saw a slight 8% increase from $9.1bn to $9.86bn year-on-year.

The gradual rise in CVC investment activity is also in sharp contrast to the venture capital sector overall, which has continued to be on a downward trend since the beginning of 2024.

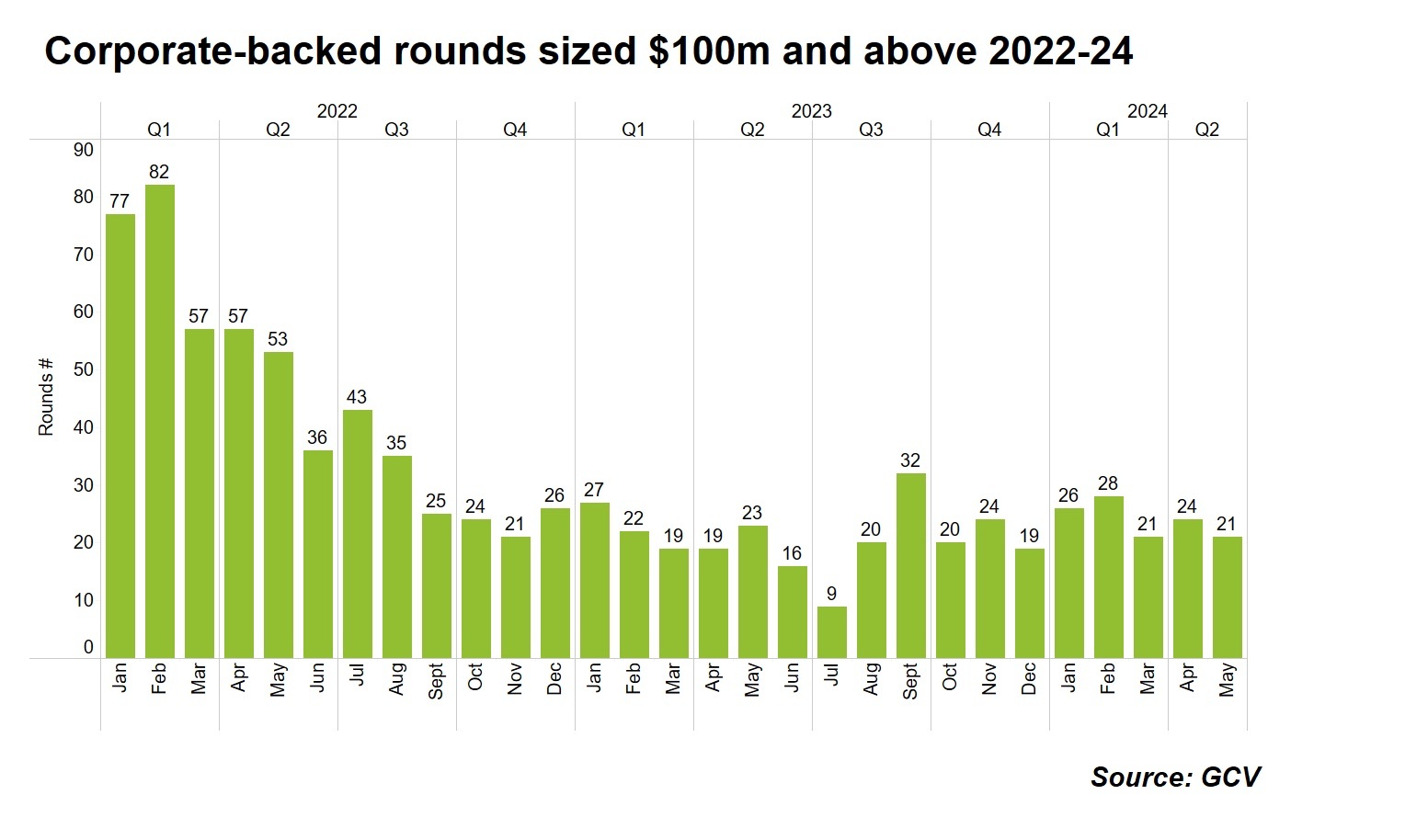

Corporates are still willing to bet big

Another feature over the past nine months has been a willingness by corporate investors to take part in large funding rounds. The number of corporate-backed rounds over $100m has been stable since the third quarter of last year.

May 2024 saw three individual rounds that hit the $1bn mark. UK company Wayve, a self-driving car technology developer, raised $1.05bn for its series C round, backed by Nvidia, Microsoft and Softbank. Wiz, a cloud security software startup raised $1bn in series E funding backed by Salesforce, and Scale AI, which is developing a data engine for training advanced AI models, raised $1bn in series F funding, backed by corporate giants Nvidia, Cisco, DFJ Growth, Intel, ServiceNow, AMD, Amazon and Meta.

Another notably large deal from May 2024 was a $220m seed round for French AI company H Company. H provides artificial intelligence models within the technology sector. Backers included Amazon, Samsung and UiPath as well as several other financial VCs and individuals. The company is working on automated systems that can perform tasks traditionally performed by human workers, according to TechCrunch.

India stabilises

India is another region where funding rounds appear to have stabilised. Last month, we noted an increase in deals within India. In May this year, the deals in India have kept steady, nearly matching the number of the same month last year.

The biggest corporate-backed deal in India was for Battery Smart, a lithium-ion battery provider for two and three-wheeled vehicles, which raised $45m in its series B round. The round was supported by Panasonic and SBI through the PC-SBI Kurashi Visionary Fund.

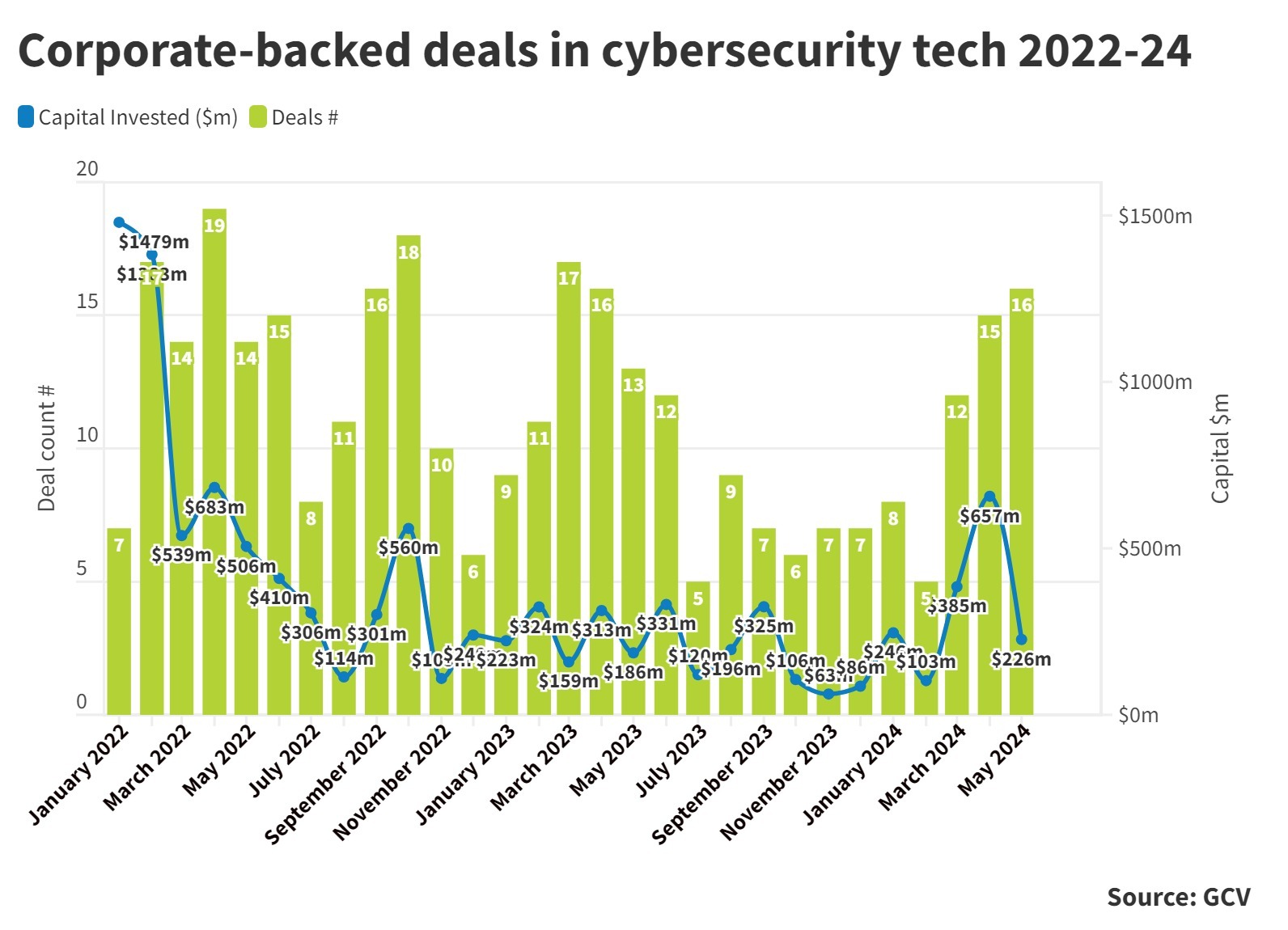

Cybersecurity deals on the rise

Large, high-profile and consequential cyber attacks are becoming a regular feature of the news cycle. Just this week, procedures at London hospitals ground to a halt due to a cyber attack on an NHS software provider. It makes sense that cybersecurity is in sharp focus for everyone from the typical consumer trying to make a payment, right up to venture capitalists. And our statistics from May 2024 showed an increase in corporate activity within the cybersecurity sector.

Corporate investors have always had an interest in cybersecurity, as corporates are often targeted in the most high profile events. However, this appears to have been a further uptick recently. Corporate-backed cybersecurity deals in May 2024 were up compared to the same month last year, and there has been a steady increase of such funding rounds within cybersecurity in the last three months.

Notable cybersecurity deals from May included TXOne Networks’ $51m series B extension, which was supported by electronics manufacturer Pegatron and semiconductor manufacturer Applied Materials among other investors. The US cybersecurity company StrongDM also raised a $34m series C round, backed by the likes of Capital One, Cisco and Alphabet, among others.

There was also a significant exit for a corporate-backed cybersecurity company this month. Private equity company Permira acquired a majority stake in biometric identification company Biocatch. Under the agreement, Biocatch was valued at $1.3bn. Investors in Biocatch include corporates Barclays, American Express and CreditEase.

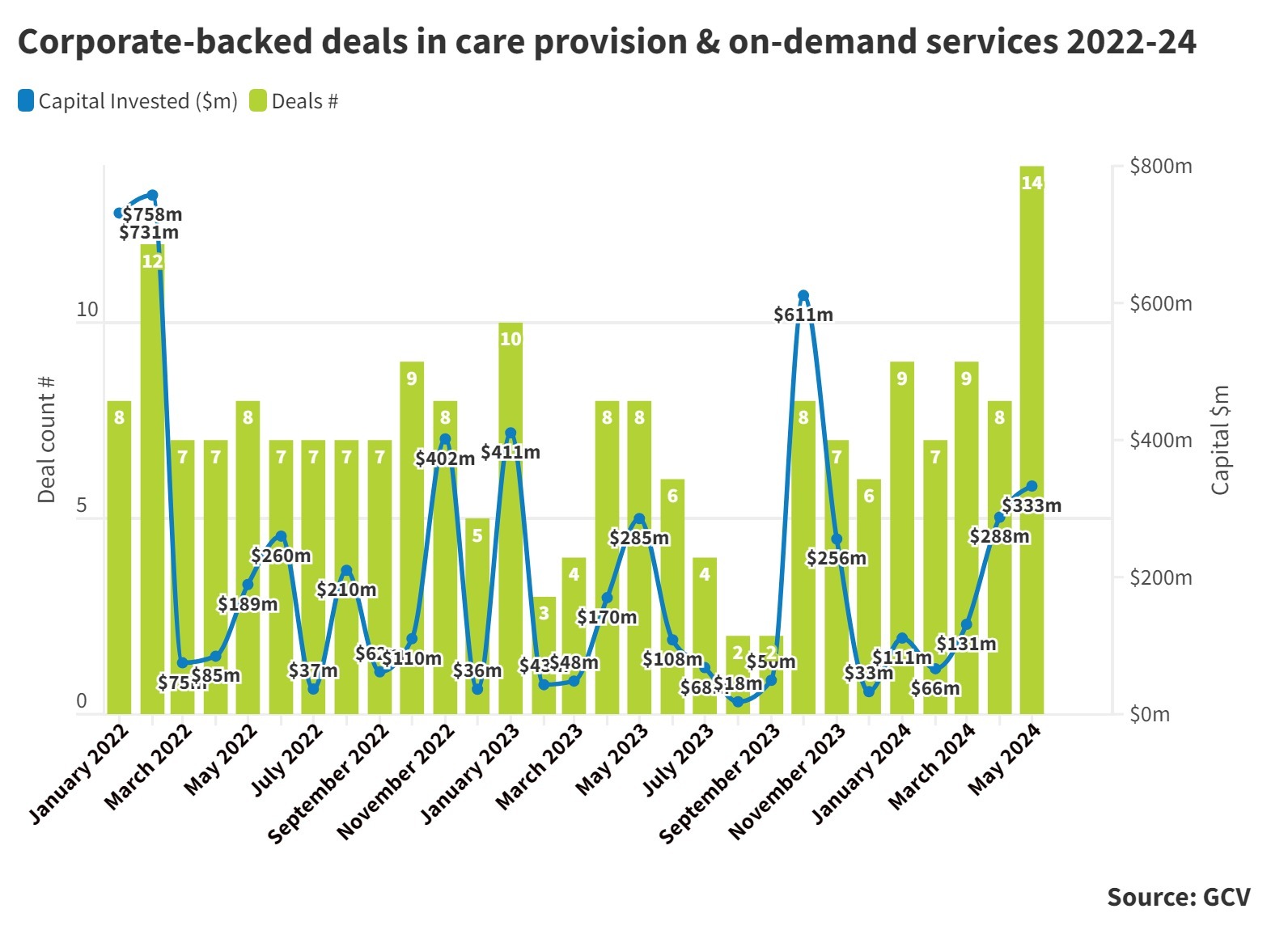

Care provision gets a boost from corporates

Pharmaceuticals has consistently been a popular area for corporate investors, but in May 2024 we have seen an increase in corporate-backed funding rounds in another healthcare-related sector: care provision and on-demand healthcare services. In May 2023, there were 8 corporate-backed funding rounds in this area, and that has increased to 14 in May 2024 – suggesting a 75% increase. Similarly, the total dollars tracked in rounds jumped from $189m in May last year to $333m this year.

One of the most notable rounds in this area was raised by Transcarent, a digital platform that assists and directs people navigating their health insurance benefits and recommends appropriate courses of action. The company announced a $126m series D funding round in May, backed by corporates Memorial Hermann Health System, MSD and Bayer, among others. Tuesday Health, an app that organises and monitors end of life care requirements also raised funding from healthcare giants Blue Cross Blue Shield and General Brigham.

Exits

Significant exits from May 2024 included MSD’s acquisition of EyeBio for $1.3bn. The US pharmaceuticals company had previously invested in the EyeBio, which develops ophthalmology biotechnology to protect, restore and improve vision in patients with sight-threatening eye diseases.

Elsewhere, biotechnology company Biogen agreed to buy Human Immunology Biosciences for up to $1.8 bn. Human Immunology Biosciences is developing therapeutics that assist those who have received a kidney transplant. Investors in the company included the German biotech company MorphoSys.